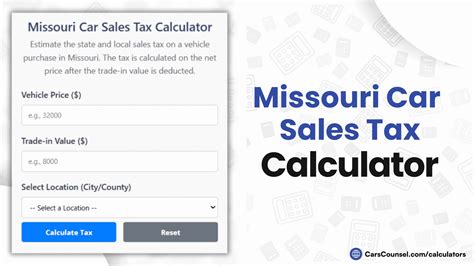

Calculate Missouri Sales Tax On Car

When purchasing a car in Missouri, it's important to understand the sales tax implications to ensure you're prepared for the additional costs. The sales tax in Missouri can vary depending on several factors, including the location of the dealership and the specific county in which the vehicle is registered. This guide will help you calculate the Missouri sales tax on a car purchase, providing you with a clear understanding of the process and the potential expenses involved.

Understanding Missouri Sales Tax

Missouri imposes a state sales tax rate of 4.225% on most tangible personal property, including vehicles. However, it’s essential to note that this state tax is just the base rate, and local municipalities and counties can add additional taxes, resulting in a higher overall sales tax rate.

The sales tax rate can vary significantly from one county to another, with some counties imposing a local option sales tax of up to 3.25%. This means that in certain areas, the total sales tax rate can reach as high as 7.475%. It's crucial to research the specific sales tax rate applicable to the county where you plan to register your vehicle.

For instance, in St. Louis County, the sales tax rate for vehicles is 7.225%, which includes the state tax of 4.225% and a local tax of 3%. In contrast, Boone County has a lower sales tax rate of 5.225%, consisting of the state tax and a local tax of 1%.

| County | Sales Tax Rate |

|---|---|

| St. Louis County | 7.225% |

| Boone County | 5.225% |

| Jackson County | 7.475% |

| Greene County | 7.025% |

Calculating Sales Tax on a Car Purchase

To calculate the sales tax on a car purchase in Missouri, you’ll need to follow these steps:

- Determine the County's Sales Tax Rate: Find out the specific sales tax rate applicable to the county where you plan to register the vehicle. You can usually find this information on the Missouri Department of Revenue website or by contacting your local Department of Motor Vehicles (DMV) office.

- Calculate the Base Tax: Multiply the purchase price of the car by the state sales tax rate of 4.225%. For example, if the car costs $25,000, the base tax would be $1,056.25 ($25,000 x 0.04225).

- Add the Local Tax: Determine the local tax rate for your chosen county and add it to the base tax. In our example, if the local tax rate is 3%, the local tax would be $750 ($25,000 x 0.03).

- Combine the Taxes: Add the base tax and the local tax together to find the total sales tax. Continuing with our example, the total sales tax would be $1,806.25 ($1,056.25 + $750).

So, for a car costing $25,000 in a county with a 3% local tax rate, the total sales tax would amount to $1,806.25.

Additional Fees and Considerations

Apart from the sales tax, there are a few other fees and considerations to keep in mind when purchasing a car in Missouri:

- Title Fees: There is a title fee of $10 for registering a vehicle in Missouri.

- Registration Fee: The registration fee varies depending on the vehicle's weight and type. For a typical passenger vehicle, the registration fee is around $14 for a two-year registration period.

- Documentation Fees: Dealers may charge a documentation fee, which covers the cost of processing the paperwork for your vehicle purchase. These fees can vary, so it's best to ask the dealer for specific details.

- Trade-In Allowance: If you're trading in your old vehicle, the dealership may offer a trade-in allowance, which can reduce the overall cost of your new car. Be sure to discuss this option with the dealer.

Tips for Saving on Sales Tax

While you can’t avoid paying sales tax on a car purchase in Missouri, there are a few strategies you can employ to potentially save some money:

- Research Different Counties: Compare the sales tax rates in different counties to find the most favorable rate for your purchase. This can be especially beneficial if you're flexible with your vehicle registration location.

- Consider Out-of-State Purchases: If you live near a state border, you may find lower sales tax rates in neighboring states. However, be aware of any potential registration or titling complications that may arise from an out-of-state purchase.

- Negotiate with Dealers: While the sales tax rate is set, you can still negotiate with dealers on the vehicle price itself. A lower purchase price can result in a reduced sales tax burden.

- Explore Financing Options: Some financing options, such as loans or leases, may offer benefits like waived or reduced sales tax. Research and compare different financing options to find the most cost-effective solution.

Conclusion

Calculating the Missouri sales tax on a car purchase involves understanding the state and local tax rates applicable to your chosen county. By following the steps outlined above and considering the additional fees and strategies for saving, you can ensure a more accurate financial plan for your vehicle purchase. Remember to research and compare different options to make the most informed decision for your specific situation.

How often do I need to renew my vehicle registration in Missouri?

+Vehicle registrations in Missouri are valid for two years. You’ll receive a renewal notice approximately 60 days before your registration expires. It’s important to renew your registration on time to avoid penalties.

Can I register my vehicle online in Missouri?

+Yes, Missouri offers online vehicle registration renewal through the Missouri Department of Revenue website. However, if you’re registering a new vehicle or have specific circumstances, you may need to visit a local DMV office.

Are there any tax deductions or incentives for purchasing an electric vehicle in Missouri?

+Missouri currently does not offer specific tax deductions or incentives for electric vehicle purchases. However, there may be federal tax credits available, so it’s worth researching those options.