Property Tax Tarrant County

Welcome to our comprehensive guide on Property Tax Tarrant County. Property taxes are an essential aspect of homeownership, and understanding the process, rates, and assessment procedures is crucial for every resident of Tarrant County, Texas. In this article, we delve into the intricacies of property taxation in this vibrant county, offering a detailed analysis to help you navigate this complex yet vital financial obligation.

Understanding Property Taxes in Tarrant County

Property taxes in Tarrant County, like many other counties in Texas, serve as a significant source of revenue for local governments, school districts, and various special districts. These taxes contribute to funding essential public services and infrastructure projects that directly impact the quality of life for residents. It is important to note that the property tax system in Texas is unique compared to many other states, with its own set of rules and procedures.

The Tarrant Appraisal District (TAD) plays a pivotal role in the property tax process. This entity is responsible for appraising properties within the county, ensuring fair and accurate assessments. The appraisal process is an annual event, with the TAD determining the market value of each property, which forms the basis for calculating the property tax.

Tax Rates and Assessment Process

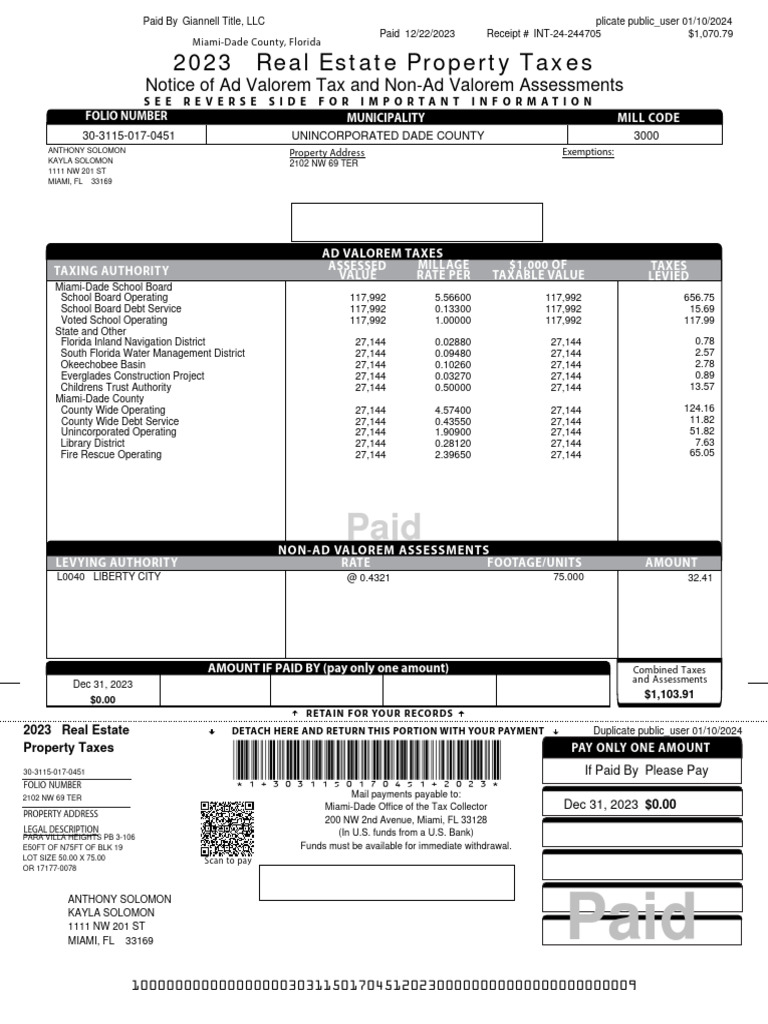

The property tax rate in Tarrant County is expressed as a percentage and is typically presented as a combination of rates from various taxing entities. These entities include the county government, cities, school districts, and special districts such as hospital districts or community college systems. Each of these entities has its own tax rate, which collectively make up the overall tax rate for a specific property.

For instance, a property located in Fort Worth might be subject to tax rates from the Tarrant County government, the City of Fort Worth, the Fort Worth Independent School District, and potentially other special districts that provide services to the area. The combined tax rate for this property will determine the total amount of property tax due.

| Taxing Entity | Tax Rate (per $100 of assessed value) |

|---|---|

| Tarrant County | 0.3777 |

| City of Fort Worth | 0.5522 |

| Fort Worth ISD | 1.4794 |

| Other Special Districts | Varies |

It's important to note that tax rates can vary significantly depending on the location of the property within the county. Properties in different cities or school districts may have different tax rates, even if they are in close proximity to each other.

Taxable Value and Assessment Dates

The taxable value of a property is determined by multiplying the appraised value set by the Tarrant Appraisal District (TAD) with the applicable tax rate. This value is then used to calculate the property tax bill. It's crucial to understand that the appraisal district's role is to determine the market value of the property, not the taxable value. The taxable value is calculated by the taxing entities based on the appraised value and the tax rate.

In Tarrant County, the appraisal process typically begins in January and February, with the TAD conducting appraisals and notifying property owners of any changes in the appraised value. Property owners then have the opportunity to review and potentially protest these appraisals. The deadline for filing protests is typically in late May or early June.

Once the protest period is over, the TAD finalizes the appraisal roll, which is a comprehensive list of all properties and their appraised values within the county. This roll is then used by taxing entities to calculate the tax rates and generate tax bills.

Property Tax Rates and Trends in Tarrant County

Property tax rates in Tarrant County have experienced fluctuations over the years, influenced by various factors such as economic conditions, public service demands, and changes in legislation. Understanding these trends is crucial for property owners to make informed decisions about their financial planning and investment strategies.

Historical Rate Analysis

A review of historical property tax rates in Tarrant County reveals a general upward trend over the past decade. While specific rates may vary across different taxing entities, the overall trend suggests an increase in property tax obligations for homeowners.

| Year | Overall Tax Rate (per $100 of assessed value) |

|---|---|

| 2015 | 2.3204 |

| 2016 | 2.3508 |

| 2017 | 2.3942 |

| 2018 | 2.4252 |

| 2019 | 2.4594 |

| 2020 | 2.4868 |

| 2021 | 2.5154 |

| 2022 | 2.5448 |

The data above presents the overall tax rate for Tarrant County, which is the combined rate of all taxing entities within the county. It's important to note that individual tax rates for specific entities may vary, and the overall rate is a cumulative representation of these individual rates.

Factors Influencing Tax Rate Changes

Several factors contribute to changes in property tax rates. These include:

- Economic Conditions: Economic downturns or recessions can lead to reduced property values, affecting the tax base and potentially resulting in higher tax rates to maintain revenue for essential services.

- Public Service Demands: Increases in demand for public services, such as education, infrastructure development, or public safety, often require additional funding, which can be reflected in higher tax rates.

- Legislative Changes: Changes in state or local laws, such as tax reform initiatives or adjustments to appraisal processes, can directly impact property tax rates and procedures.

- Special Projects: Funding for specific projects, such as bond initiatives for school renovations or infrastructure improvements, may require temporary increases in tax rates.

Comparison with Other Counties

Comparing Tarrant County's property tax rates with other counties in Texas provides valuable context. While rates can vary significantly across the state, Tarrant County's rates are generally competitive and in line with neighboring counties.

| County | Overall Tax Rate (per $100 of assessed value) |

|---|---|

| Tarrant County | 2.5448 |

| Dallas County | 2.4586 |

| Denton County | 2.5836 |

| Collin County | 2.6256 |

| Ellis County | 2.3822 |

The table above provides a snapshot of the overall tax rates for some of the neighboring counties in Texas. It's important to note that these rates may not be directly comparable due to variations in the composition of taxing entities and the services they provide.

Property Tax Assessment and Payment Process

The property tax assessment and payment process in Tarrant County involves several key steps, from receiving tax notices to understanding protest procedures and payment deadlines. Being familiar with this process is essential for property owners to ensure compliance and avoid penalties.

Receiving Tax Notices

Property owners in Tarrant County typically receive tax notices in the mail from their respective taxing entities. These notices provide details about the appraised value of the property, the taxable value, and the calculated tax amount. It's crucial to review these notices carefully and promptly to identify any discrepancies or errors.

Tax notices usually include important information such as the deadline for protests, payment due dates, and instructions on how to pay the taxes. Property owners should keep these notices for their records and refer to them throughout the tax year.

Protest Procedures

If a property owner believes that their property has been appraised incorrectly or that the tax rate is unfair, they have the right to protest. The Tarrant Appraisal Review Board (ARB) is responsible for hearing and resolving such protests. The protest process typically involves the following steps:

- Submit a written protest to the ARB within the designated deadline, usually a few months after the appraisal notice is received.

- Provide evidence and supporting documentation to support the protest, such as recent sales data, property condition reports, or expert appraisals.

- Attend a hearing before the ARB, where both the property owner and the appraisal district have an opportunity to present their cases.

- The ARB will review the evidence and make a decision, which may result in a change to the property's appraised value or the denial of the protest.

Payment Deadlines and Penalties

Property taxes in Tarrant County are due in two installments, with specific deadlines for each. The first installment is typically due in October, and the second installment is due in January. It's important to note that failing to pay taxes by the deadline can result in penalties and interest charges.

Penalties for late payment can vary depending on the taxing entity and the duration of the delay. Interest charges are also applied to the unpaid balance, further increasing the financial burden. Property owners should make every effort to pay their taxes on time to avoid these additional costs.

Payment Options

Tarrant County offers several convenient payment options for property taxes, including:

- Online Payment: Property owners can make secure online payments through the taxing entity's website. This option often provides real-time confirmation and a convenient payment history.

- Mail-In Payment: Property owners can mail their tax payments to the designated address, typically the tax office of the respective taxing entity. It's important to ensure the payment is postmarked by the due date to avoid late fees.

- In-Person Payment: Taxing entities often have physical offices where property owners can make payments in person. This option may be preferred by those who prefer a more personal interaction or need assistance with the payment process.

Impact of Property Taxes on Homeownership

Property taxes are a significant financial consideration for homeowners, influencing their overall cost of living and the long-term viability of homeownership. Understanding the impact of property taxes is crucial for both current and prospective homeowners in Tarrant County.

Budgeting and Financial Planning

Property taxes represent a substantial annual expense for homeowners. When planning their budgets, homeowners should allocate a significant portion to cover these taxes. Failure to budget adequately for property taxes can lead to financial strain and potential difficulties in meeting other financial obligations.

Homeowners should also consider the impact of property taxes on their overall financial goals, such as saving for retirement, funding education, or investing in other assets. Property taxes can reduce the disposable income available for these purposes, so careful financial planning is essential.

Home Value and Tax Implications

The relationship between home value and property taxes is complex. While higher home values can be a sign of a thriving real estate market and increased equity for homeowners, they also often result in higher property taxes. This is because property taxes are typically based on a percentage of the property's appraised value.

When home values increase, it can lead to a higher taxable value, which in turn increases the property tax bill. This can be a double-edged sword for homeowners, as they benefit from increased equity but also face higher tax obligations. It's important for homeowners to stay informed about local market trends and the potential impact on their property taxes.

Strategies for Managing Property Taxes

There are several strategies that homeowners can employ to manage their property tax obligations effectively:

- Review Appraisals: Property owners should carefully review their appraisal notices and ensure that the appraised value is accurate. If they believe the value is too high, they can protest the appraisal through the official channels.

- Take Advantage of Exemptions: Tarrant County offers various property tax exemptions, such as the homestead exemption, which can reduce the taxable value of a property. Homeowners should explore these options and apply for the exemptions they qualify for.

- Consider Tax-Efficient Remodeling: Certain home improvements, such as energy-efficient upgrades or accessibility modifications, may qualify for tax deductions or exemptions. Homeowners should consult with tax professionals or local authorities to understand these options.

- Explore Financing Options: Some homeowners may choose to finance their property taxes through specialized loans or tax anticipation notes. While these options may carry additional costs, they can provide flexibility for homeowners with cash flow constraints.

Future Outlook and Potential Reforms

The future of property taxes in Tarrant County is subject to various factors, including economic conditions, legislative changes, and public sentiment. While it's challenging to predict specific reforms or changes, several potential scenarios and their implications are worth exploring.

Economic Impact and Public Sentiment

The economic climate plays a significant role in shaping property tax policies. In times of economic prosperity, local governments may have more flexibility in managing tax rates and funding public services. Conversely, economic downturns can lead to increased pressure on property taxes as a revenue source.

Public sentiment also influences property tax policies. Residents' perceptions of the value they receive from their tax dollars, as well as their tolerance for tax increases, can impact the direction of tax reforms. Transparency in the tax process and effective communication from local governments can help shape public opinion and build support for necessary tax measures.

Potential Reforms and Initiatives

Several potential reforms and initiatives could shape the future of property taxes in Tarrant County:

- Tax Rate Caps: Implementing tax rate caps or limits on the rate of increase could provide relief for homeowners facing rising tax obligations. While this may restrict the revenue available for public services, it could also promote stability and predictability for taxpayers.

- Enhanced Exemptions: Expanding or enhancing existing property tax exemptions, such as the homestead exemption, could provide more significant relief for homeowners. This could involve increasing the exemption amount or broadening the criteria for eligibility.

- Alternative Funding Sources: Exploring alternative revenue streams, such as sales taxes or user fees, could reduce the reliance on property taxes. However, these alternatives may face their own challenges and limitations.

- Streamlined Appraisal Process: Improving the efficiency and accuracy of the appraisal process could lead to more equitable assessments and reduce the need for protests. This could involve investing in technology, training, and resources for the appraisal district.

Conclusion

Property taxes are a critical component of homeownership in Tarrant County, impacting the financial well-being of residents and the overall economic health of the community. Understanding the assessment process, tax rates, and available resources is essential for homeowners to navigate this complex yet vital obligation.

By staying informed about appraisal procedures, exploring protest options, and budgeting effectively, homeowners can manage their property tax obligations with confidence. The future of property taxes in Tarrant County is dynamic, and staying engaged in local politics and community discussions can ensure that the tax system remains fair, transparent, and responsive to the needs of its residents.

Frequently Asked Questions

What is the Tarrant Appraisal District (TAD)?

+