Oregon State Tax Forms

When it comes to managing your tax obligations in Oregon, understanding the state's tax forms is crucial. Oregon's tax system is unique and offers various avenues for individuals and businesses to fulfill their tax responsibilities. This comprehensive guide will delve into the world of Oregon state tax forms, providing you with an in-depth analysis and practical insights.

Navigating Oregon’s Tax Landscape

Oregon, known for its stunning natural beauty and progressive policies, maintains a distinct tax structure. The state’s tax forms are designed to cater to the diverse needs of taxpayers, whether they are residents, businesses, or entities with specific tax requirements. Let’s explore the key aspects of Oregon’s tax forms and how they impact taxpayers.

Resident Individual Tax Forms

For Oregon residents, the journey into the world of state taxes often begins with Form OR-40, the Individual Income Tax Return. This form is the primary avenue for reporting income, claiming deductions, and calculating the state income tax liability. It is essential to understand the intricacies of this form, especially when it comes to declaring various sources of income, such as wages, investments, and business profits.

Additionally, Oregon offers specific deductions and credits to its residents, including the Oregon Heritage Tax Credit, which provides incentives for preserving and supporting Oregon's cultural heritage. Such credits can significantly impact a taxpayer's overall liability and must be claimed accurately.

For those with complex financial situations or business ownership, Schedule A and Schedule B come into play. These schedules allow taxpayers to itemize deductions, including expenses related to business operations, medical costs, and charitable contributions. Properly navigating these schedules is crucial for optimizing tax benefits.

| Form Name | Description |

|---|---|

| OR-40 | Individual Income Tax Return, reporting income and calculating tax liability. |

| Schedule A | Itemized deductions for expenses like medical costs and charitable donations. |

| Schedule B | Business income and expense reporting for sole proprietors and partnerships. |

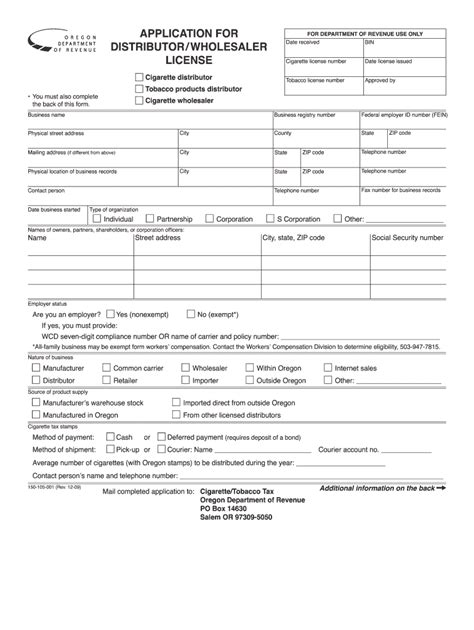

Business Tax Forms and Obligations

Oregon’s business landscape is diverse, ranging from small startups to large corporations. The state’s tax forms cater to this diversity, providing tailored solutions for different business entities.

For corporations, Form OR-20, the Corporate Excise Tax Return, is a crucial document. It is used to report corporate income, determine tax liability, and fulfill the state's corporate tax obligations. Additionally, corporations may need to file Form OR-20S if they are classified as S Corporations, which have unique tax implications.

Partnerships, on the other hand, utilize Form OR-20P to report partnership income and allocate it to individual partners. This form is essential for partnerships to comply with Oregon's tax regulations and ensure accurate reporting of business profits.

Small businesses and sole proprietors often rely on Form OR-240, the Business/Farm/Rental Income Tax Return. This form simplifies tax reporting for smaller entities, allowing them to declare income, claim deductions, and calculate their tax liability in a straightforward manner.

| Form Name | Business Type |

|---|---|

| OR-20 | Corporations |

| OR-20S | S Corporations |

| OR-20P | Partnerships |

| OR-240 | Small Businesses, Sole Proprietorships |

Other Specialized Tax Forms

Oregon’s tax system also accommodates specialized tax situations. For instance, Form OR-260 is designed for individuals and businesses engaged in timber operations, providing a dedicated avenue for reporting timber-related income and expenses.

Additionally, Oregon offers tax incentives for renewable energy projects. Form OR-280 is specifically tailored for these initiatives, allowing taxpayers to claim credits for investing in renewable energy technologies and supporting Oregon's sustainability goals.

For taxpayers with significant income from outside Oregon, Form OR-40N comes into play. This form is used to report nonresident income and calculate the tax liability for individuals with Oregon-sourced income.

| Form Name | Specialized Purpose |

|---|---|

| OR-260 | Timber Operations Income and Expenses |

| OR-280 | Renewable Energy Tax Credits |

| OR-40N | Nonresident Income Reporting |

The Importance of Accurate Filing

Oregon’s tax forms are designed with precision and efficiency in mind. Accurate filing is not just a legal obligation but also a strategic move to ensure compliance, optimize tax benefits, and avoid potential penalties. Here are some key considerations when dealing with Oregon state tax forms:

- Understand the specific requirements of each form and the data it captures.

- Keep detailed records of income, expenses, and deductions to facilitate accurate reporting.

- Utilize online filing options, which often provide real-time updates and may offer faster processing.

- Consider using tax preparation software or seeking professional assistance, especially for complex tax situations.

Future of Oregon’s Tax System

Oregon’s tax landscape is dynamic, and the state continues to evolve its tax system to meet the needs of its residents and businesses. Here are some potential future developments:

- Expansion of renewable energy incentives to further support sustainable initiatives.

- Digitalization of tax processes, including enhanced online filing systems and real-time data integration.

- Potential reforms to simplify tax forms and make them more user-friendly, especially for small businesses.

- Integration of artificial intelligence for tax compliance and fraud detection.

As Oregon adapts to technological advancements and changing economic landscapes, its tax system will likely undergo transformations to remain efficient and effective. Staying informed about these developments is crucial for taxpayers to navigate the evolving tax environment.

Conclusion

Oregon’s tax forms are a critical component of the state’s financial ecosystem, offering a tailored approach to tax obligations for residents and businesses. By understanding the specific forms, their purposes, and the data they require, taxpayers can ensure compliance, optimize tax benefits, and contribute to Oregon’s economic vitality.

When is the deadline for filing Oregon state taxes?

+The deadline for filing Oregon state taxes is typically April 15th, aligning with the federal tax deadline. However, it’s important to note that this date may vary for certain taxpayers, such as those who need an extension or have specific tax situations. Always check the official Oregon Department of Revenue website for the most up-to-date information on tax deadlines.

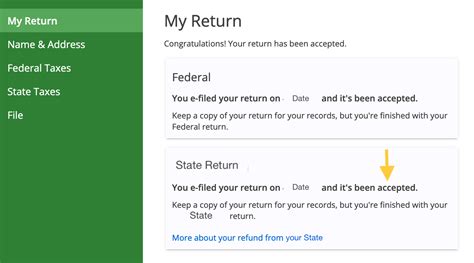

Can I e-file my Oregon state tax return?

+Yes, Oregon offers electronic filing (e-filing) for state tax returns. E-filing is a convenient and secure way to submit your tax information directly to the Oregon Department of Revenue. It often provides faster processing and can reduce the likelihood of errors compared to traditional paper filing. Visit the official website for more information on e-filing options and requirements.

Are there any tax incentives for businesses in Oregon?

+Oregon provides a range of tax incentives for businesses, including tax credits for job creation, research and development, and renewable energy projects. Additionally, certain industries, such as film production and data centers, may qualify for specific tax benefits. It’s important to research and understand the eligibility criteria for these incentives, as they can significantly impact a business’s tax liability and overall financial strategy.