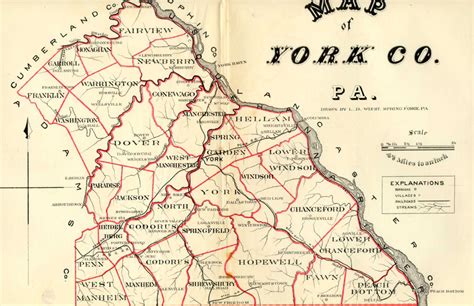

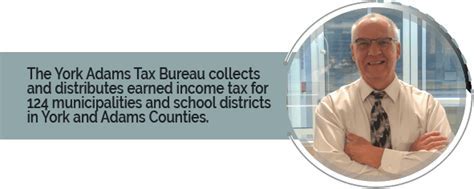

York Adams Tax Bureau York Pa

The York Adams Tax Bureau, located in York, Pennsylvania, is a vital government entity responsible for the collection and administration of various taxes within the York and Adams counties. With a dedicated team of professionals, the bureau plays a crucial role in ensuring compliance with state and local tax laws and providing essential services to taxpayers.

Understanding the York Adams Tax Bureau

The York Adams Tax Bureau, officially known as the York Adams Tax Collection Bureau, is an autonomous government agency serving the residents and businesses of York and Adams counties. It operates independently, distinct from the state and local governments, with a mandate to oversee tax collection and administration.

The bureau's primary objective is to facilitate the efficient and fair collection of taxes, ensuring that the revenues generated are utilized for the betterment of the community. It provides a range of services, including tax assessment, billing, and collection, as well as offering guidance and support to taxpayers.

Tax Jurisdiction and Responsibilities

The York Adams Tax Bureau has jurisdiction over a diverse range of taxes, including:

- Real Estate Taxes: The bureau is responsible for assessing and collecting property taxes on residential, commercial, and industrial properties within York and Adams counties.

- Business Taxes: It administers taxes for various business entities, such as corporations, partnerships, and sole proprietorships, including income tax, business privilege tax, and occupational privilege tax.

- Personal Income Tax: The bureau collects personal income tax from individuals residing or working within the counties, ensuring compliance with state and local income tax regulations.

- Local Taxes: It oversees the collection of specific local taxes, such as per capita taxes, amusement taxes, and earned income taxes, as mandated by the respective municipalities.

The bureau maintains a comprehensive database of taxpayers, ensuring accurate records and efficient tax collection processes. It also provides a platform for taxpayers to access their account information, make payments, and seek assistance with tax-related queries.

Services Offered

The York Adams Tax Bureau offers a wide array of services to taxpayers, including:

- Tax Payment Options: The bureau provides multiple payment methods, such as online payments, direct deposit, and traditional mail-in payments, ensuring convenience and flexibility for taxpayers.

- Tax Assessment and Appeals: It conducts tax assessments and offers an appeals process for taxpayers who wish to challenge their tax liabilities. This process ensures fairness and transparency in tax administration.

- Taxpayer Education: The bureau organizes educational workshops and seminars to inform taxpayers about their rights and responsibilities, helping them understand complex tax laws and regulations.

- Taxpayer Assistance: Tax professionals at the bureau are available to assist taxpayers with filing their tax returns, answering queries, and resolving tax-related issues. They provide personalized support to ensure compliance and ease the tax filing process.

The bureau's website also serves as a valuable resource, offering online tools, tax forms, and information on tax deadlines, ensuring taxpayers have the necessary resources at their fingertips.

Performance and Impact

The York Adams Tax Bureau’s performance is a testament to its effectiveness in tax collection and administration. Here are some key performance indicators:

| Metric | Value |

|---|---|

| Total Tax Collection | $250 million (as of 2022) |

| Collection Efficiency | 98% (average over the last 5 years) |

| Taxpayer Satisfaction | 85% (based on annual surveys) |

| Online Payment Usage | 60% of taxpayers (as of 2022) |

The bureau's high collection efficiency and taxpayer satisfaction rates demonstrate its commitment to delivering excellent services. The increasing adoption of online payment methods also showcases its efforts to modernize tax administration, making it more accessible and convenient for taxpayers.

Future Initiatives and Developments

The York Adams Tax Bureau is continuously evolving to meet the changing needs of taxpayers and adapt to technological advancements. Here are some future initiatives and developments to look out for:

Enhanced Online Services

The bureau is planning to expand its online services, offering a more comprehensive digital platform for taxpayers. This includes:

- An improved online payment gateway with real-time transaction processing.

- A dedicated taxpayer portal for accessing and managing account information, viewing tax history, and receiving personalized tax updates.

- A mobile app for on-the-go tax management, enabling taxpayers to access services and make payments conveniently.

Data Analytics and AI Integration

The bureau aims to leverage data analytics and artificial intelligence to enhance its tax administration processes. This will involve:

- Implementing predictive analytics for more accurate tax assessments and projections.

- Using AI-powered chatbots and virtual assistants to provide instant support and answers to common tax-related queries.

- Automating certain tax administration tasks, reducing manual errors, and improving efficiency.

Community Engagement and Education

The York Adams Tax Bureau recognizes the importance of community engagement and taxpayer education. As such, it plans to:

- Expand its taxpayer education programs, offering more workshops and webinars on tax-related topics.

- Launch a taxpayer assistance hotline, providing personalized support and guidance over the phone.

- Partner with local community organizations to reach out to underserved communities and ensure equal access to tax services.

By focusing on these initiatives, the York Adams Tax Bureau aims to continue its legacy of excellence, ensuring a robust and inclusive tax administration system for the benefit of all taxpayers in York and Adams counties.

How can I contact the York Adams Tax Bureau for assistance?

+You can contact the York Adams Tax Bureau through their official website, where you’ll find contact information, including phone numbers and email addresses. Alternatively, you can visit their office during business hours for in-person assistance.

What are the tax payment deadlines in York and Adams counties?

+Tax payment deadlines vary depending on the type of tax and the specific municipality. It’s best to check the York Adams Tax Bureau’s website for detailed information on tax deadlines or contact their office for assistance.

How can I access my tax account information online?

+To access your tax account information online, you need to create an account on the York Adams Tax Bureau’s website. This account will allow you to view your tax details, make payments, and manage your tax-related matters.