Miami Dade Property Taxes

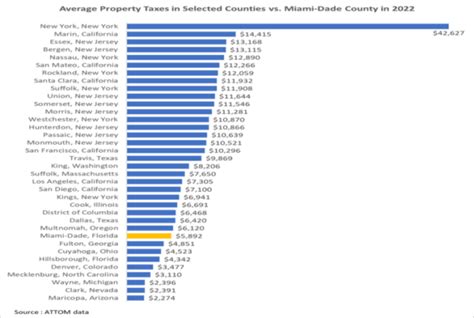

Property taxes in Miami-Dade County, Florida, are an important aspect of local governance and community development. These taxes contribute significantly to the county's budget, funding various essential services and infrastructure projects. Understanding the intricacies of property taxes in this region is crucial for both residents and investors alike.

The Basics of Miami-Dade Property Taxes

In Miami-Dade County, property taxes are levied on real estate properties, including land, buildings, and improvements. The tax rate is determined annually by the Miami-Dade Board of County Commissioners, who set the millage rate based on the county's budgetary needs and revenue requirements.

The tax assessment process begins with the Miami-Dade Property Appraiser's office, which determines the taxable value of each property. This value is based on the property's assessed value, which considers factors such as location, size, improvements, and recent sales data of similar properties. The taxable value may differ from the property's market value due to various exemptions and assessments.

Taxable Value Calculation

The formula for calculating the taxable value is as follows:

Taxable Value = Assessed Value - Exemptions + Assessments

Where:

- Assessed Value: The estimated fair market value of the property.

- Exemptions: Certain properties may be eligible for exemptions, reducing the taxable value. These include homestead exemptions for primary residences, senior citizen exemptions, and disability exemptions.

- Assessments: Additional charges or increases applied to the property's assessed value, such as special assessments for specific community projects or bond issues.

Once the taxable value is determined, it is multiplied by the millage rate to calculate the property tax liability.

| Tax Year | Millage Rate |

|---|---|

| 2023 | 11.4985 |

| 2022 | 11.5792 |

| 2021 | 11.5665 |

The millage rate comprises various components, including the countywide millage, municipal millage (for incorporated cities), school district millage, and special district millage (for entities like water management districts or fire districts). These rates are subject to change annually based on the budgetary requirements of each entity.

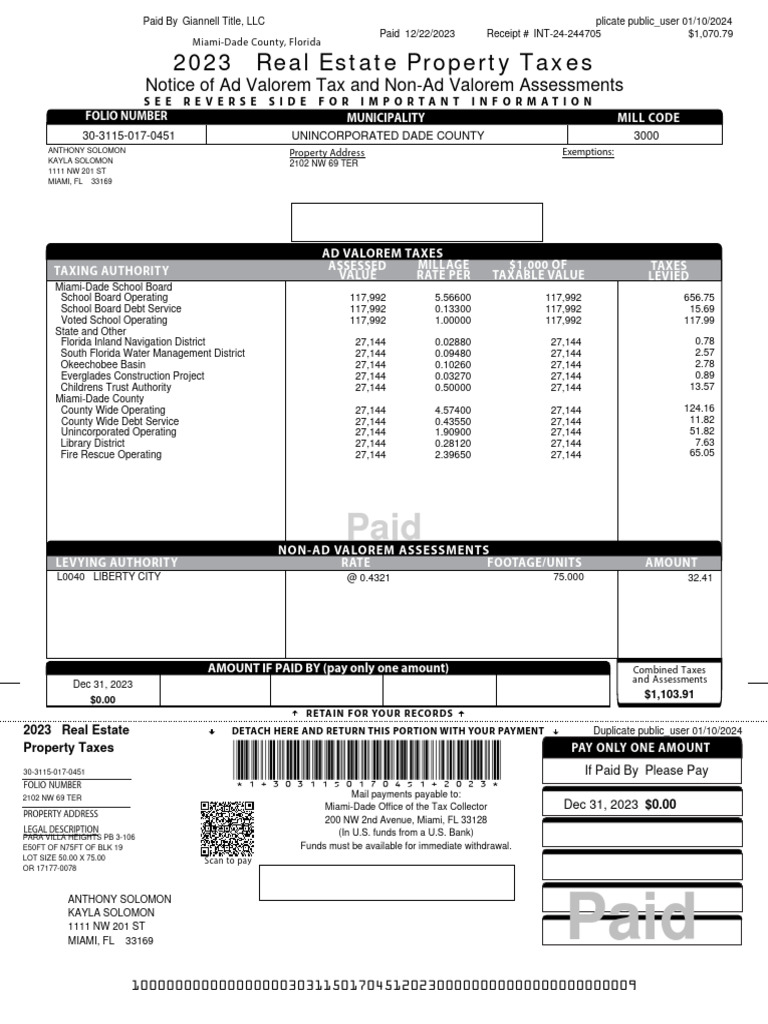

Property Tax Bill and Due Dates

Property owners in Miami-Dade County receive their tax bills from the Miami-Dade Tax Collector's office. The bills are typically mailed out in November, and the payment deadline is typically in early March. However, it's essential to check the specific due dates each year, as they may vary slightly.

Property taxes in Miami-Dade County are paid in two installments. The first installment is due in November and covers the tax liability for the first half of the tax year. The second installment is due in March and covers the remaining tax liability. Failure to pay by the due dates may result in penalties and interest charges.

Property Tax Exemptions and Assessments

Miami-Dade County offers various exemptions to eligible property owners, which can significantly reduce their tax liability. Some of the commonly availed exemptions include:

Homestead Exemption

The homestead exemption is a significant benefit for Miami-Dade County residents who own their primary residences. This exemption reduces the assessed value of the property by up to $50,000, resulting in lower property taxes. To qualify, the property must be the owner's permanent residence, and they must apply for the exemption annually.

Senior Citizen Exemption

Senior citizens aged 65 and above may be eligible for an additional exemption on their property taxes. This exemption is based on the property's assessed value and the applicant's income level. The amount of the exemption varies depending on the applicant's circumstances.

Disability Exemption

Individuals with permanent disabilities may qualify for a disability exemption, which reduces their property taxes. The exemption amount depends on the applicant's disability and other factors. It's important to note that this exemption is not available for second homes or investment properties.

Special Assessments

In addition to exemptions, property owners may also encounter special assessments. These assessments are typically levied to fund specific projects or improvements within a community. Examples include street lighting assessments, drainage assessments, or community development district assessments. Special assessments are usually included in the property tax bill and are payable along with the regular property taxes.

The Impact of Property Taxes on the Community

Property taxes play a vital role in funding essential services and infrastructure projects in Miami-Dade County. These taxes contribute to:

- Public safety services, including police, fire, and emergency medical response.

- Education, supporting local schools and providing resources for students.

- Road maintenance and construction, ensuring safe and efficient transportation.

- Environmental initiatives, such as water conservation and park maintenance.

- Community development projects, enhancing the overall quality of life in the county.

Balancing Tax Burden and Community Development

While property taxes are essential for funding community needs, the county also recognizes the importance of keeping the tax burden reasonable. The Miami-Dade Board of County Commissioners strives to maintain a balance between tax rates and community development. Regular reviews and adjustments to the millage rate aim to ensure that property owners are not overly burdened while still providing sufficient funding for vital services.

Tips for Property Tax Management

Navigating property taxes can be complex, but there are strategies to manage and optimize your tax liability:

- Stay Informed: Keep up-to-date with tax rates, due dates, and any changes in the assessment process. The Miami-Dade County website provides valuable resources and updates regarding property taxes.

- Apply for Exemptions: If you are eligible for exemptions, such as the homestead exemption, ensure you apply annually. These exemptions can significantly reduce your tax burden.

- Understand Assessments: If you receive a special assessment, understand its purpose and how it benefits your community. Special assessments are often necessary for specific projects that enhance the overall well-being of the neighborhood.

- Review Your Bill: Carefully review your property tax bill each year. Ensure that the assessed value, exemptions, and assessments are accurate. If you identify any discrepancies, contact the Miami-Dade Property Appraiser's office for clarification.

- Plan Your Payments: Consider setting aside funds throughout the year to cover your property tax liability. This can help you budget effectively and avoid late payment penalties.

Frequently Asked Questions

How are property taxes calculated in Miami-Dade County?

+Property taxes are calculated based on the property’s taxable value, which is determined by the Miami-Dade Property Appraiser’s office. The taxable value is derived by subtracting any eligible exemptions from the assessed value and adding any applicable assessments. This taxable value is then multiplied by the millage rate set by the county commissioners to arrive at the tax liability.

What is the millage rate for property taxes in Miami-Dade County in 2023?

+The millage rate for 2023 is 11.4985. This rate is subject to change annually based on the county’s budgetary requirements.

When are property tax bills mailed out in Miami-Dade County?

+Property tax bills are typically mailed out in November each year. However, it’s advisable to check the official Miami-Dade County website for the exact due dates, as they may vary slightly from year to year.

Are there any exemptions available for property taxes in Miami-Dade County?

+Yes, Miami-Dade County offers various exemptions to eligible property owners. These include homestead exemptions for primary residences, senior citizen exemptions, and disability exemptions. These exemptions can significantly reduce the taxable value of the property and, consequently, the property tax liability.

What are special assessments, and how do they impact property taxes?

+Special assessments are additional charges or increases applied to a property’s assessed value to fund specific community projects or improvements. These assessments are typically included in the property tax bill and are payable along with the regular property taxes. They are often levied to finance initiatives such as street lighting, drainage improvements, or community development projects.