Lost Federal Tax Id Number

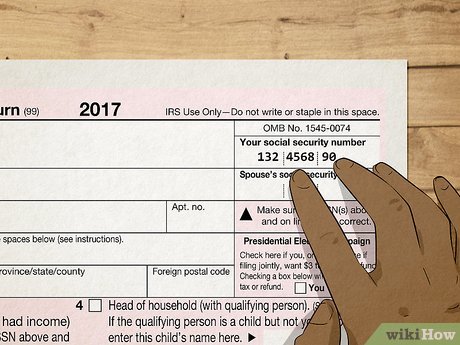

Losing your Federal Tax ID number can be a stressful situation, especially when it comes to managing your business or personal finances. The Federal Tax ID, also known as an Employer Identification Number (EIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes. It is crucial for various financial activities, including opening business bank accounts, hiring employees, and filing tax returns. If you've misplaced or forgotten your Federal Tax ID, don't panic; there are steps you can take to retrieve or reapply for this important identifier.

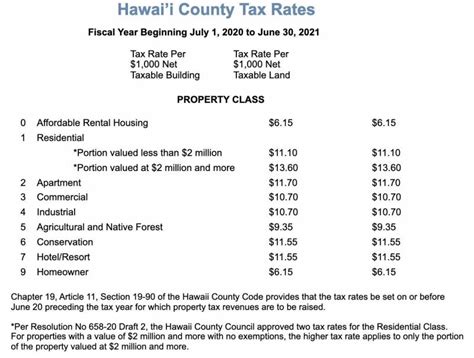

Understanding the Federal Tax ID Number

The Federal Tax ID number serves as a unique identifier for businesses and certain entities in the United States. It is similar to a Social Security Number (SSN) for individuals, but it is used for business-related activities and tax purposes. The number is essential for various financial transactions and is often required when dealing with government agencies, banks, and other institutions.

An EIN is typically assigned to:

- Businesses: Sole proprietorships, partnerships, corporations, and limited liability companies (LLCs) often need an EIN to operate legally and file taxes.

- Non-profit Organizations: Charitable organizations, churches, and other non-profit entities require an EIN for tax-exempt status and fundraising activities.

- Trusts and Estates: These entities often need an EIN for tax reporting and management purposes.

- Certain Individuals: In some cases, individuals may need an EIN, such as when they are required to withhold taxes on payments made to non-residents or when they have employees working for them.

Where to Find Your Federal Tax ID Number

If you're unsure where to locate your Federal Tax ID, here are some common places to check:

- IRS Notice or Letter: The IRS often includes your EIN on official correspondence.

- Business Documents: Look for your EIN on business licenses, tax returns, or bank statements associated with your business.

- Accounting Software: If you use accounting software for your business, it may store your EIN in its records.

- Tax Preparation Software: Software used for filing taxes may have your EIN saved in its system.

- Employment Records: If you've hired employees, your EIN should be on payroll records or employee tax forms.

Retrieving a Lost Federal Tax ID Number

If you've lost or forgotten your Federal Tax ID, there are several methods you can use to retrieve it. The IRS provides various tools and resources to help you locate your EIN, depending on the circumstances.

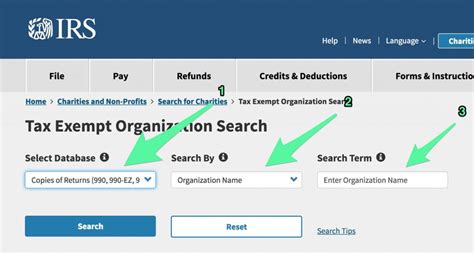

Online Tools

The IRS offers an online EIN Select Check tool that allows you to verify the validity of an EIN and retrieve your own EIN if you have certain information available. To use this tool, you'll need the following:

- Business Name: The legal name of your business as registered with the IRS.

- Business Address: The address associated with your business at the time of EIN issuance.

- Responsible Party's First Name: The first name of the person listed as the responsible party for the EIN application.

- Responsible Party's Last Name: The last name of the responsible party.

- Responsible Party's Social Security Number: The SSN of the responsible party.

With this information, you can use the EIN Select Check tool to retrieve your Federal Tax ID. However, keep in mind that this tool may not work for all entities, such as non-profits or government agencies.

Contacting the IRS

If you're unable to retrieve your EIN online or if you need further assistance, you can contact the IRS directly. The IRS provides various channels for EIN-related inquiries:

- Phone: Call the IRS Business & Specialty Tax Line at 1-800-829-4933 (available Monday to Friday, 7:00 AM to 7:00 PM local time). Have your business information ready when calling.

- Mail: Send a written request to the IRS with details about your business and the reason for your EIN inquiry. Include your business name, address, and any relevant details. Mail your request to:

| Internal Revenue Service | Attn: EIN Operation |

| Cincinnati Service Center | Stop 5733 |

| 1200 Main Street | Cincinnati, OH 45249-5733 |

Using Third-Party Services

Some third-party services offer EIN lookup or retrieval services. These services typically require you to provide specific details about your business, and they may charge a fee for their assistance. While these services can be convenient, it's important to ensure that they are reputable and secure before sharing any sensitive information.

Reapplying for a New Federal Tax ID Number

If you've tried all methods to retrieve your lost Federal Tax ID and are still unable to locate it, you may need to reapply for a new EIN. Reapplying for an EIN is a straightforward process, but it's essential to ensure that you meet the requirements and provide accurate information to avoid delays or issues.

Online Application

The IRS provides an Online EIN Application that allows you to apply for a new EIN quickly and securely. To use this application, you'll need the following information:

- Business Information: Details about your business, including its legal name, address, and type (sole proprietorship, partnership, corporation, etc.).

- Responsible Party's Information: Personal details of the responsible party, such as name, address, and Social Security Number.

- Reason for Application: You'll need to select the reason for applying for a new EIN, such as starting a new business or replacing a lost EIN.

Once you've gathered the necessary information, you can access the Online EIN Application through the IRS website. The application process is user-friendly and typically takes less than 15 minutes to complete. After submission, you'll receive your new EIN immediately via email or fax, depending on your preference.

Paper Application

If you prefer not to apply online or if you encounter technical issues, you can use the Form SS-4 to apply for a new EIN by mail. This form is available on the IRS website, and you can fill it out manually or use tax preparation software to complete it electronically. Once completed, mail the form to the IRS address mentioned earlier in this article.

Important Considerations

When reapplying for a new Federal Tax ID, it's crucial to remember the following:

- Business Entity Changes: If your business structure or ownership has changed since your original EIN application, you may need to apply for a new EIN to reflect these changes.

- Banking and Financial Accounts: If you've lost your EIN, you may need to update your banking and financial accounts with your new EIN to avoid potential issues with transactions and reporting.

- Tax Returns and Filings: When you receive your new EIN, ensure that you use it for all future tax returns and filings to avoid confusion and potential penalties.

Preventing Loss of Your Federal Tax ID

While it's important to know how to retrieve or reapply for a lost Federal Tax ID, it's even better to take preventive measures to ensure you don't lose it in the first place. Here are some tips to help you keep your EIN secure and easily accessible:

- Record Keeping: Maintain accurate and organized records of your business documents, including your EIN. Store them in a secure location, such as a digital cloud storage service or a physical file cabinet.

- Backup Copies: Create multiple copies of your EIN documentation and store them in different locations. This way, if one copy is lost or damaged, you still have access to others.

- Digital Storage: Consider using digital tools to store and manage your EIN and other important business documents. Many accounting and business management software platforms offer secure storage and easy access to essential documents.

- Business Partner Awareness: If you have business partners or employees who handle financial matters, ensure they are aware of the importance of your EIN and its proper use and storage.

- Regular Review: Periodically review your business records, including your EIN documentation, to ensure they are up-to-date and accurate. This practice can help you identify any potential issues early on.

Conclusion

Losing your Federal Tax ID number can be a challenging situation, but with the right tools and resources, you can easily retrieve or reapply for it. Whether you choose to use online tools, contact the IRS directly, or utilize third-party services, the key is to act promptly and provide accurate information. By following the steps outlined in this article, you can ensure that your business or entity remains compliant with tax regulations and continues to operate smoothly.

Frequently Asked Questions

Can I use my Social Security Number instead of a Federal Tax ID for business purposes?

+

Using your Social Security Number for business purposes is generally not recommended. The Federal Tax ID is designed specifically for businesses and entities to maintain a clear separation between personal and business finances. Using your SSN for business activities can lead to complications and potential tax issues.

What happens if I lose my Federal Tax ID and don’t retrieve or reapply for it?

+

Failing to retrieve or reapply for a lost Federal Tax ID can lead to significant complications. You may encounter difficulties when opening business bank accounts, hiring employees, or filing tax returns. Additionally, your business operations may be disrupted, and you may face legal and financial penalties for non-compliance with tax regulations.

How long does it take to receive a new Federal Tax ID after reapplying online or by mail?

+

When reapplying for a new Federal Tax ID online, you typically receive your EIN immediately via email or fax, depending on your preference. If you apply by mail, the process may take longer, and you should allow for processing time of several weeks.

Can I change my Federal Tax ID if my business structure or ownership changes?

+

Yes, if there are changes to your business structure or ownership, you may need to apply for a new Federal Tax ID. The EIN is associated with specific business details, so changes in structure or ownership may require a new EIN to ensure compliance with tax regulations.

Is it possible to retrieve a lost Federal Tax ID for a business that has been dissolved or closed?

+

Retrieving a lost Federal Tax ID for a dissolved or closed business can be challenging. It’s best to consult with a tax professional or the IRS directly to determine the appropriate steps in such cases. They can guide you on the specific requirements and processes involved.