Hawaii Tax Refund Status

If you're a resident of Hawaii or a visitor to the beautiful islands, you may be interested in learning about the tax refund process and how to check the status of your refund. Hawaii, known for its stunning natural beauty and vibrant culture, offers a unique tax system that can leave many wondering about their refund status. This comprehensive guide will provide you with all the necessary information, from the moment you file your tax return to the moment you receive your refund.

Understanding the Hawaii Tax System

Hawaii operates under a progressive tax system, meaning the tax rate increases as your income rises. This system ensures that those with higher incomes contribute a larger share to the state’s revenue. The state income tax is levied on wages, salaries, tips, bonuses, commissions, and other forms of compensation. It’s important to note that Hawaii does not impose a sales tax, making it one of the few states without this type of tax.

The tax rates in Hawaii are divided into eight brackets, ranging from 1.4% to 11%. These brackets are adjusted annually to account for inflation. For example, for the tax year 2023, the tax rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $2,800 | 1.4% |

| $2,801 - $4,200 | 3.2% |

| $4,201 - $6,800 | 4.4% |

| $6,801 - $11,000 | 5.6% |

| $11,001 - $20,000 | 6.4% |

| $20,001 - $40,000 | 7.25% |

| $40,001 - $200,000 | 8.25% |

| $200,001 and above | 11% |

It's crucial to understand that Hawaii's tax system also includes a General Excise Tax (GET) and a Use Tax, which apply to most goods and services purchased within the state. The GET is imposed on the privilege of doing business in Hawaii and is typically passed on to consumers through the prices of goods and services. The Use Tax, on the other hand, is similar to a sales tax and applies to goods purchased from out-of-state vendors for use or consumption in Hawaii.

Filing Your Hawaii Tax Return

The process of filing your Hawaii tax return is straightforward and can be done electronically or by mail. The deadline for filing your state income tax return is typically April 20th each year, but it’s essential to check for any changes or extensions, especially during unique circumstances like a global pandemic.

To file your tax return, you'll need to gather all the necessary documents, including W-2 forms, 1099 forms, and any other income-related documents. You can use tax preparation software or engage the services of a tax professional to ensure your return is accurate and complete. When filing, you have the option to choose between a standard deduction or itemized deductions, depending on which provides you with the most favorable tax outcome.

If you're a non-resident of Hawaii with income sources within the state, you'll still need to file a Hawaii tax return. The state has specific guidelines and forms for non-residents to ensure they meet their tax obligations accurately.

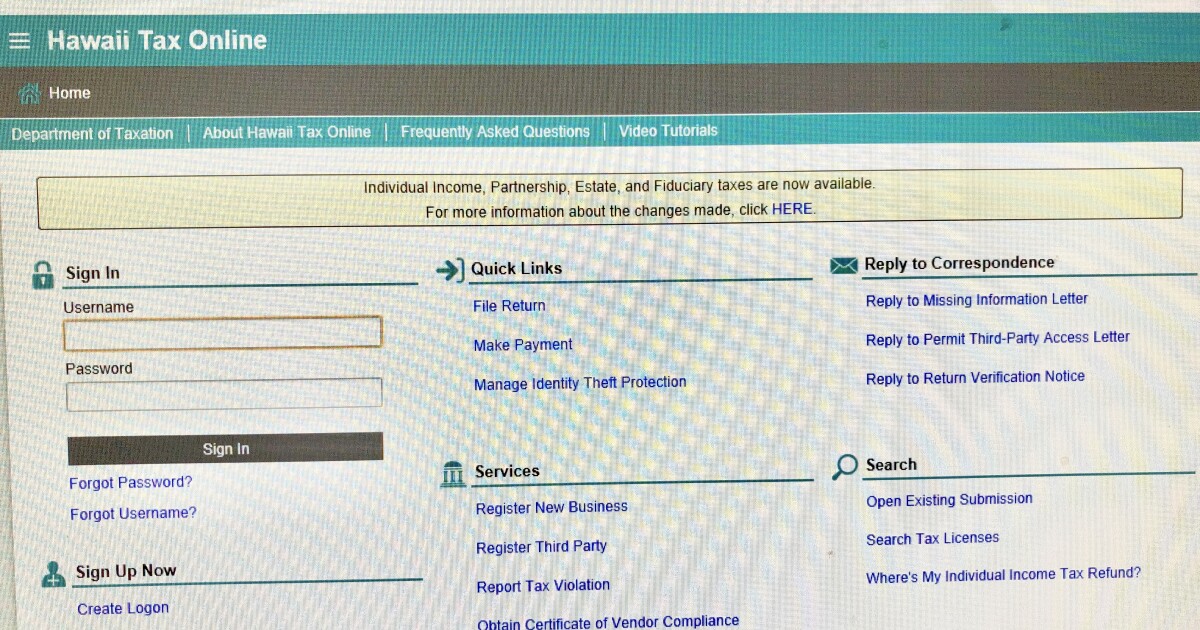

Checking Your Hawaii Tax Refund Status

After filing your Hawaii tax return, you’ll likely be eager to know when to expect your refund. The Hawaii Department of Taxation provides an online tool for taxpayers to check the status of their refund. This tool is user-friendly and accessible to all taxpayers, making it easy to track the progress of your refund.

Using the Online Refund Status Tool

To utilize the online refund status tool, you’ll need the following information:

- Your Social Security Number or Individual Taxpayer Identification Number (ITIN)

- Your exact refund amount (to the dollar)

- The filing status and exemption information you used on your return

With this information at hand, you can access the Hawaii Tax Refund Status Tool and input the required details. The tool will provide you with real-time information about the status of your refund, including whether it has been approved, is in process, or has been issued.

In some cases, you may encounter a delay in receiving your refund. This could be due to several reasons, such as missing or incorrect information on your tax return, a discrepancy in your documentation, or a simple backlog in processing. If you encounter a delay, it's recommended to contact the Hawaii Department of Taxation to discuss your specific situation and potential solutions.

Alternative Methods to Check Refund Status

If you prefer not to use the online tool or are unable to access it, there are alternative methods to check your Hawaii tax refund status. You can contact the Hawaii Department of Taxation directly by phone or mail. Their contact information is as follows:

Phone: 808-587-4242 (for O‘ahu) or 800-222-3229 (toll-free for neighbor islands)

Mail: Hawaii Department of Taxation, PO Box 259, Honolulu, HI 96809

When contacting the department, be prepared to provide your personal information and details about your tax return. This will help the customer service representatives assist you more efficiently.

What to Do if Your Refund is Delayed or Discrepancy Arises

In certain situations, you may experience a delay in receiving your Hawaii tax refund or discover a discrepancy in the amount you expected. If this occurs, it’s important to take the following steps:

- Review your tax return carefully to identify any errors or omissions. Ensure that all the information you provided is accurate and complete.

- If you identify an error, amend your tax return using the appropriate forms. You can find these forms on the Hawaii Department of Taxation's website or by contacting the department.

- If you believe there is a discrepancy with the processing of your return, contact the department and provide them with the details of your situation. They will investigate and provide you with an update on the status of your refund.

- Keep records of all communications with the department, including dates, times, and reference numbers. This will help you track your case and provide evidence if needed.

It's crucial to remain patient and understanding during the process, as the department works to resolve any issues efficiently. In most cases, delays are temporary and can be resolved with proper communication and documentation.

Maximizing Your Hawaii Tax Refund

While checking the status of your refund is essential, it’s equally important to ensure you’re maximizing your refund by taking advantage of all the deductions and credits available to you. Hawaii offers various tax credits and deductions to help reduce your tax liability and increase your refund.

Common Deductions and Credits in Hawaii

Some of the common deductions and credits available in Hawaii include:

- Standard Deduction: All taxpayers are entitled to a standard deduction, which reduces the amount of taxable income. The standard deduction amount varies based on your filing status.

- Personal Exemptions: Hawaii allows personal exemptions for yourself, your spouse, and your dependents. These exemptions further reduce your taxable income.

- Mortgage Interest Deduction: If you own a home in Hawaii and have a mortgage, you can deduct the interest you pay on your mortgage loan.

- Charitable Contributions: Donations made to qualified charities can be deducted from your taxable income.

- Education Credits: Hawaii offers tax credits for qualifying education expenses, such as tuition and fees for higher education.

- Child and Dependent Care Credit: If you incur expenses for childcare or dependent care while you work, you may be eligible for this credit.

It's important to consult a tax professional or use reputable tax preparation software to ensure you're taking advantage of all the deductions and credits you're entitled to. These can significantly impact your tax liability and increase your refund.

The Impact of Economic Stimulus on Hawaii Tax Refunds

In recent years, economic stimulus measures have had an impact on tax refunds across the United States, including Hawaii. These measures, such as stimulus checks and enhanced unemployment benefits, can affect your tax refund, either positively or negatively.

Stimulus Checks and Hawaii Tax Refunds

During the COVID-19 pandemic, the federal government issued economic impact payments, commonly known as stimulus checks, to eligible individuals. These payments were intended to provide financial relief during a challenging economic period. If you received a stimulus check, it’s important to understand how it may affect your Hawaii tax refund.

In most cases, stimulus checks are not taxable income and do not need to be reported on your Hawaii tax return. However, if you received a stimulus check but did not meet the eligibility criteria, you may need to repay all or a portion of the payment. This could impact your tax refund, reducing the amount you receive.

It's crucial to review the eligibility requirements and ensure you meet the criteria before accepting a stimulus check. If you have any doubts or concerns, consult a tax professional for guidance.

Unemployment Benefits and Hawaii Tax Refunds

Unemployment benefits can also impact your Hawaii tax refund. If you received unemployment compensation during the tax year, you’ll need to report this income on your Hawaii tax return. Unemployment benefits are taxable, and you’ll receive a Form 1099-G from the state, detailing the amount you received.

It's important to note that the tax treatment of unemployment benefits can vary depending on your personal circumstances and the total amount of your taxable income. In some cases, you may be eligible for certain deductions or credits that can offset the tax liability on your unemployment benefits. Consult a tax professional to understand your specific situation.

Future Implications and Tax Planning

Understanding the current tax system and how to maximize your refund is essential, but it’s equally important to stay informed about future tax changes and plan accordingly. Hawaii, like many other states, may introduce new tax laws, deductions, or credits that could impact your tax liability and refund.

Potential Future Tax Changes in Hawaii

Hawaii has a history of implementing tax reforms and adjustments to ensure the state’s revenue aligns with its economic needs. While it’s challenging to predict future tax changes, staying informed about potential reforms is crucial for effective tax planning.

Some potential future tax changes in Hawaii could include adjustments to tax brackets, the introduction of new tax credits or deductions, or changes to the GET and Use Tax rates. It's essential to keep an eye on news and updates from the Hawaii Department of Taxation and consult tax professionals to stay ahead of any potential changes.

Tax Planning Strategies for Hawaii Residents

To ensure you’re making the most of your tax situation, consider implementing the following tax planning strategies:

- Stay Informed: Keep yourself updated on the latest tax laws, changes, and reforms in Hawaii. This will help you take advantage of new deductions or credits and plan your finances accordingly.

- Review Your Withholdings: Regularly review your tax withholdings to ensure they align with your expected tax liability. This can help prevent surprises at tax time and ensure you're not overpaying or underpaying your taxes.

- Explore Investment Opportunities: Hawaii offers various investment options, such as real estate or business ventures, that can provide tax benefits. Consult a financial advisor or tax professional to explore these opportunities and their potential tax implications.

- Utilize Tax-Advantaged Accounts: Take advantage of tax-advantaged accounts like IRAs or 401(k)s to reduce your taxable income and save for your future. These accounts offer tax benefits and can help grow your savings over time.

- Consider Tax-Efficient Retirement Plans: If you're approaching retirement, explore tax-efficient retirement plans like Roth IRAs or deferred compensation plans. These plans can provide tax benefits during your retirement years.

By implementing these strategies and staying proactive in your tax planning, you can maximize your tax refunds and ensure your finances are well-managed.

Conclusion

Hawaii’s tax system, while unique, offers a range of opportunities for taxpayers to reduce their tax liability and maximize their refunds. By understanding the tax brackets, deductions, and credits available, you can make informed decisions about your tax returns and plan your finances effectively. Checking the status of your Hawaii tax refund is made easy through the online tool provided by the Hawaii Department of Taxation, ensuring transparency and efficiency in the process.

As you navigate the tax landscape in Hawaii, remember to stay informed, utilize available resources, and seek professional advice when needed. Whether you're a resident or a visitor, Hawaii's tax system should not be a cause for concern, but rather an opportunity to optimize your financial situation and enjoy all that the beautiful islands have to offer.

What is the deadline for filing my Hawaii tax return?

+The deadline for filing your Hawaii state income tax return is typically April 20th each year. However, it’s important to check for any changes or extensions, especially during unique circumstances like a global pandemic.

How do I check the status of my Hawaii tax refund?

+You can check the status of your Hawaii tax refund using the online refund status tool provided by the Hawaii Department of Taxation. You’ll need your Social Security Number or ITIN, exact refund amount, and filing status information.

What should I do if my Hawaii tax refund is delayed?

+If your Hawaii tax refund is delayed, review your tax return for any errors or omissions. If you find an error, amend your return. If you believe there’s a processing issue, contact the Hawaii Department of Taxation for assistance.

Are stimulus checks taxable in Hawaii?

+In most cases, stimulus checks are not taxable income in Hawaii and do not need to be reported on your tax return. However, if you received a stimulus check but did not meet the eligibility criteria, you may need to repay all or a portion of the payment.