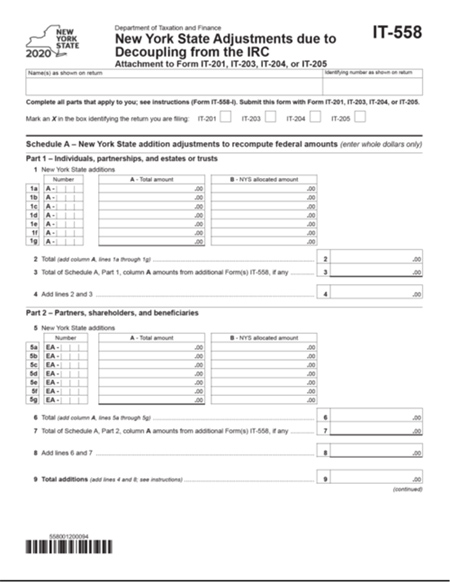

New York State Tax Return Status

New York State tax returns are an important aspect of financial compliance for residents and businesses operating within the state. Every year, millions of individuals and entities navigate the process of filing their taxes, and it's crucial to understand the status of one's return to ensure timely submission and avoid any potential penalties.

Understanding the New York State Tax Return Process

The New York State Department of Taxation and Finance is responsible for collecting and processing tax returns. They offer a range of filing options, including online submission through their secure website, paper filing, and e-filing for businesses. The process typically involves gathering relevant financial documents, calculating taxable income, and determining the amount owed or the refund due.

It's essential to note that the tax return status can vary depending on the type of return (individual, business, or trust) and the method of filing. Additionally, factors such as the complexity of the return, the accuracy of the information provided, and the volume of returns received by the department can impact the processing time.

Key Factors Affecting Return Status

- Return Complexity: Simple returns with straightforward income and deductions are typically processed faster. More complex returns with business income, investments, or multiple sources of income may take longer.

- Accuracy of Information: Inaccurate or incomplete information can lead to delays in processing. The department may need to contact the filer to request additional documents or clarifications.

- Peak Filing Seasons: During the traditional tax filing season (January to April), the department receives a high volume of returns. This can result in longer processing times as they manage the influx of submissions.

- Electronic vs. Paper Filing: Electronic filing generally offers faster processing times compared to paper returns. Online submissions are often prioritized and processed more efficiently.

| Filing Method | Average Processing Time |

|---|---|

| Online Filing (Individual) | 3-4 weeks |

| Paper Filing (Individual) | 6-8 weeks |

| Business Returns (E-filing) | 2-3 weeks |

| Paper Business Returns | 8-12 weeks |

It's important to note that these processing times are approximate and can vary based on the factors mentioned earlier. The New York State Department of Taxation and Finance aims to provide accurate and timely services, but delays can occur, especially during peak seasons.

Checking the Status of Your New York State Tax Return

To stay informed about the status of your tax return, the department offers several convenient options for tracking your submission.

Online Status Check

The most efficient way to check your New York State tax return status is through the department’s official website. By creating an account and logging in, you can access the “Where’s My Refund?” tool, which provides real-time updates on the progress of your return. This tool offers a secure and convenient way to track your refund or any other processing updates.

Telephone Inquiry

If you prefer a more traditional method, you can contact the department’s customer service hotline. Their representatives are available to assist with status inquiries and provide guidance on any issues related to your tax return. However, keep in mind that calling during peak seasons may result in longer wait times.

Mail Correspondence

For those who prefer written communication, the department accepts inquiries through regular mail. Sending a letter to the appropriate address with your personal details and tax return information can help you receive an update on your return’s status. However, this method is generally slower compared to online or telephone inquiries.

Common Issues and Their Resolutions

While the vast majority of tax returns are processed without any issues, there are some common challenges that filers may encounter. Understanding these issues and their potential resolutions can help streamline the process and ensure a smooth experience.

Return Errors and Corrections

Errors in tax returns are not uncommon and can occur due to various reasons, such as incorrect calculations, missing information, or data entry mistakes. If the department identifies an error in your return, they will contact you to request corrections or additional documentation. It’s crucial to respond promptly to these requests to avoid delays in processing.

Missing or Incomplete Information

In some cases, the department may require additional information or supporting documents to process your return. This can include proof of income, deductions, or other relevant financial details. Providing the requested information promptly can help expedite the process and ensure a timely resolution.

Refund Delays and Adjustments

Refund delays can occur for several reasons, including errors in the return, additional review by the department, or discrepancies in the information provided. In such cases, the department will communicate the reason for the delay and provide an estimated timeframe for processing. It’s important to remain patient and avoid contacting the department repeatedly, as this may further delay the resolution.

Tax Debt and Payment Plans

If you owe taxes to the state and are unable to pay the full amount, the department offers various payment plan options. These plans allow you to pay your tax debt in installments over a specified period. It’s crucial to communicate your financial situation to the department and work with them to establish a suitable payment plan.

Conclusion: Navigating the New York State Tax Return Process

Filing and managing your New York State tax return can be a complex process, but with the right tools and knowledge, it becomes more manageable. Understanding the various factors that affect return status, utilizing the available tracking options, and being proactive in resolving any issues can help ensure a smoother experience.

By staying informed and utilizing the resources provided by the New York State Department of Taxation and Finance, you can navigate the tax return process with confidence. Remember to plan ahead, gather your financial documents, and seek assistance when needed. With a well-prepared return and timely submission, you can avoid potential penalties and ensure compliance with state tax laws.

How long does it typically take to receive my New York State tax refund?

+The average processing time for a New York State tax refund is approximately 4-6 weeks from the date of filing. However, it’s important to note that this timeframe can vary based on the complexity of your return, any errors or issues identified, and the overall volume of returns received by the department.

What should I do if I haven’t received my refund within the expected timeframe?

+If you haven’t received your refund within the expected timeframe, it’s recommended to first check the status of your return using the online tool or by contacting the department’s customer service hotline. They can provide you with an update on the progress of your refund and inform you of any potential delays or issues.

Can I track my refund status if I filed a paper return?

+Yes, you can still track the status of your refund even if you filed a paper return. While the processing time for paper returns may be longer, you can utilize the same online status check tool or contact the department’s customer service to receive updates on your refund’s progress.

What happens if I need to make corrections to my tax return after filing?

+If you discover an error or need to make corrections to your tax return after filing, you can file an amended return. The process for amending a return varies depending on the type of return (individual, business, etc.) and the nature of the corrections. It’s important to follow the department’s guidelines and submit the necessary forms and documentation to process the amendments.

How can I stay updated on the latest tax laws and regulations in New York State?

+To stay informed about the latest tax laws and regulations in New York State, you can visit the official website of the Department of Taxation and Finance. They provide comprehensive resources, including publications, guidelines, and updates on tax-related matters. Additionally, you can subscribe to their email updates or follow their social media channels for timely notifications.