Denver Tax Rate

When it comes to understanding the financial landscape of any city, tax rates play a crucial role. For individuals and businesses in Denver, Colorado, having a clear understanding of the tax structure is essential for making informed financial decisions. This comprehensive guide will delve into the intricacies of the Denver tax rate, covering everything from the types of taxes levied to their impact on the local economy.

Unraveling the Denver Tax System

The tax system in Denver, like any other metropolitan area, is a complex network of various taxes designed to fund public services and infrastructure. From sales tax to property tax, each component contributes to the city’s financial health and sustainability.

Sales Tax in Denver

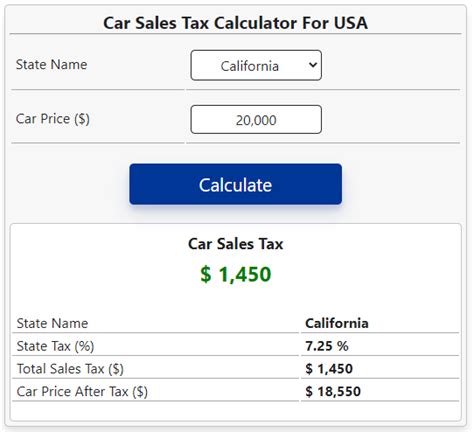

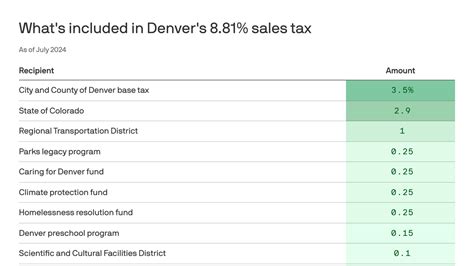

Sales tax is a prominent component of Denver’s tax landscape. It is levied on various goods and services sold within the city limits. The current Denver sales tax rate stands at 8.31%, which includes both the state and local sales tax. This rate is applied to most retail transactions, with certain exemptions for essential items like groceries and prescription drugs.

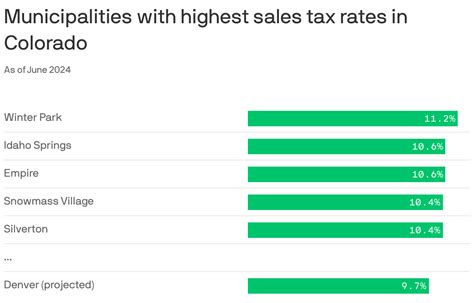

However, it's important to note that sales tax rates can vary within Denver. Different districts and special tax areas may have slightly higher or lower rates. For instance, the Denver Downtown Partnership area has a dedicated sales tax rate of 4.62%, generating funds for specific urban development projects.

Additionally, sales tax in Denver extends beyond the traditional retail sector. It also applies to services like restaurant meals, hotel accommodations, and even some professional services. This comprehensive approach ensures that a wide range of economic activities contribute to the city's revenue stream.

| Sales Tax Rate | Description |

|---|---|

| 8.31% | Combined State and Local Sales Tax |

| 4.62% | Denver Downtown Partnership Sales Tax |

Property Tax in Denver

Property tax is another significant component of Denver’s tax system. It is levied on real estate properties, including both residential and commercial properties. The Denver property tax rate varies depending on the property’s assessed value and its classification (residential, commercial, or industrial). On average, the rate ranges from 60 to 70 mills, which equates to approximately 0.6 to 0.7% of the property’s assessed value.

The property tax in Denver is used to fund essential public services such as education, public safety, and infrastructure maintenance. It is a vital source of revenue for the city and plays a critical role in sustaining the local community.

Interestingly, Denver also offers various property tax incentives and abatement programs to encourage economic development and revitalization in specific areas. These initiatives aim to attract new businesses and promote investment in targeted neighborhoods.

| Property Tax Rate | Description |

|---|---|

| 60-70 mills | Average Property Tax Rate (0.6-0.7%) |

Income Tax in Denver

Denver, being a part of Colorado, does not have a local income tax. Instead, the state of Colorado levies an income tax on individuals and businesses. The Colorado income tax rate is 4.55%, which is applicable to all taxpayers in the state, including those residing in Denver.

While Denver does not have its own income tax, the city benefits from the state's income tax revenue, which contributes to funding various state-wide initiatives and programs.

| Income Tax Rate | Description |

|---|---|

| 4.55% | Colorado State Income Tax Rate |

Other Taxes in Denver

In addition to the aforementioned taxes, Denver also imposes various other taxes to support specific initiatives and services. These include:

- Use Tax: Applied to goods and services purchased from out-of-state vendors for use in Denver.

- Accommodations Tax: Imposed on hotel stays, with revenue often dedicated to tourism promotion.

- Vehicle Registration Tax: A tax on vehicle ownership, contributing to transportation infrastructure.

- Marijuana Excise Tax: Tax on the sale of marijuana products, with proceeds supporting various programs.

Impact of Denver’s Tax Structure

The tax structure in Denver plays a pivotal role in shaping the city’s economic landscape. Here’s a deeper analysis of its impact:

Economic Development and Growth

Denver’s tax system, particularly the sales and property taxes, provides a steady revenue stream for the city. This revenue is instrumental in funding infrastructure projects, such as road improvements, public transportation enhancements, and the development of recreational spaces. These initiatives not only improve the quality of life for residents but also attract businesses and talent, fostering economic growth.

Furthermore, the tax incentives and abatement programs targeted at specific areas have the potential to rejuvenate underdeveloped neighborhoods, making them more attractive for investment and contributing to a more balanced economic landscape.

Funding Public Services

Tax revenue is the lifeblood of public services in Denver. It ensures that residents have access to high-quality education, efficient public safety measures, and well-maintained public spaces. The sales tax, for instance, plays a significant role in funding schools, libraries, and community centers, directly impacting the daily lives of Denver’s citizens.

Business Climate and Investment

For businesses, Denver’s tax structure offers a mix of advantages and considerations. While the sales tax rate may impact pricing strategies, the city’s overall business-friendly environment, coupled with targeted tax incentives, can make it an attractive location for startups and established enterprises alike. The absence of a local income tax can also be seen as a positive factor, as it simplifies tax obligations for businesses operating across the state.

Future Outlook and Potential Changes

As with any tax system, Denver’s structure is subject to potential changes and adjustments. The city’s leaders and policymakers continually evaluate the tax landscape to ensure it remains equitable, sustainable, and aligned with the needs of the community.

Looking ahead, there may be discussions surrounding tax reform to address evolving economic challenges and opportunities. This could involve adjustments to tax rates, the introduction of new taxes to fund specific initiatives, or the refinement of existing tax incentives to better support economic development goals.

Additionally, with the ongoing advancement of technology and digital commerce, Denver, like many other cities, may explore innovative ways to capture revenue from online sales and services, ensuring that the tax system remains adaptable to the changing nature of the economy.

Conclusion

Understanding the Denver tax rate is not merely an academic exercise; it is a vital component of financial literacy for both residents and businesses operating in the city. By delving into the intricacies of the tax system, individuals and enterprises can make informed decisions, optimize their tax obligations, and contribute effectively to the vibrant economy of Denver.

As Denver continues to thrive and evolve, its tax structure will play a pivotal role in shaping the city's future. Stay informed, engage with the community, and be a part of the dialogue surrounding taxes and their impact on the city's growth and prosperity.

What are the potential tax benefits for new businesses in Denver?

+New businesses in Denver can explore various tax incentives and abatements offered by the city. These initiatives aim to encourage economic development and investment, particularly in targeted areas. By taking advantage of these programs, businesses can potentially reduce their tax burden and contribute to the city’s growth.

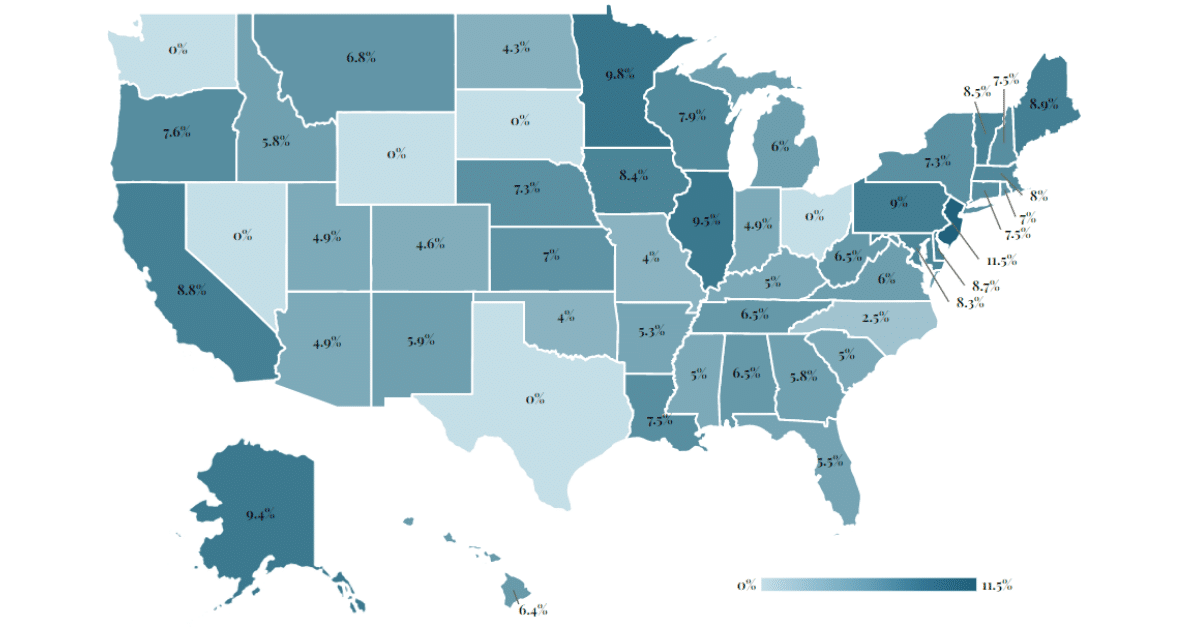

How does Denver’s tax structure compare to other major cities in the U.S.?

+Denver’s tax structure, particularly its sales and property tax rates, is relatively competitive when compared to other major U.S. cities. However, it’s important to note that tax rates can vary significantly across different cities and states, and a comprehensive analysis should consider a range of factors beyond just tax rates.

Are there any tax breaks for homeowners in Denver?

+Yes, Denver offers various tax breaks and incentives for homeowners. These can include property tax abatements, especially for homeowners in certain targeted areas, as well as programs aimed at encouraging homeownership and community development.