Marion County Real Estate Taxes

Welcome to a comprehensive guide on Marion County's real estate taxes, an essential aspect of property ownership in this vibrant region. Understanding the intricacies of real estate taxes is crucial for homeowners and investors alike, as it directly impacts their financial planning and overall property management strategies. In this expert-driven analysis, we will delve into the specifics of Marion County's tax system, exploring the assessment process, tax rates, exemptions, and more. By the end of this article, you'll have a thorough understanding of how real estate taxes work in Marion County and the key considerations to make when managing your property's tax obligations.

The Fundamentals of Marion County Real Estate Taxes

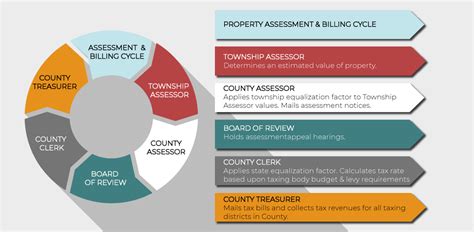

Marion County, known for its vibrant communities and thriving real estate market, employs a well-defined tax system to support its local infrastructure and services. Real estate taxes in this county are calculated based on the assessed value of a property, which is determined by the Marion County Property Appraiser’s Office. This office plays a pivotal role in ensuring fair and accurate assessments, thereby maintaining the integrity of the tax system.

The Assessment Process: A Comprehensive Overview

The assessment process in Marion County is a meticulous procedure that involves several key steps. Firstly, the Property Appraiser’s Office conducts a physical inspection of each property to determine its physical characteristics, such as size, condition, and any recent improvements. This data is then used to calculate the property’s just value, which represents the likely sale price in an open market.

Once the just value is established, it is subject to a limitation factor, which is set by the state. This factor helps ensure that property values do not increase disproportionately from year to year. The limited value, as a result, often differs from the just value, especially in a rapidly appreciating market like Marion County.

After the limited value is determined, it is further adjusted based on the Save Our Homes (SOH) benefit, which provides a homestead exemption for primary residences. This benefit, unique to Florida, helps homeowners keep their property taxes in check, even as property values rise.

| Assessment Term | Description |

|---|---|

| Just Value | The estimated sale price of a property in an open market. |

| Limited Value | The value used for tax purposes, subject to state-mandated limitations. |

| Save Our Homes (SOH) Benefit | A homestead exemption that limits annual increases in assessed value for primary residences. |

Tax Rates and Exemptions: Understanding the Details

Marion County’s tax rates are set annually by the Board of County Commissioners and other taxing authorities, including local municipalities, school districts, and special districts. These rates are expressed in mills, with one mill representing 1 of tax for every 1,000 of a property’s assessed value.

For example, if the total millage rate for a property is 10 mills and the property's assessed value is $200,000, the annual real estate tax would be calculated as follows:

Assessed Value: $200,000

Millage Rate: 10 mills

Annual Tax: $200,000 x 0.010 = $2,000

It's important to note that Marion County offers various exemptions that can reduce the taxable value of a property. These include:

- Homestead Exemption: This exemption, as mentioned earlier, is provided through the Save Our Homes program and is available to homeowners who use the property as their primary residence.

- Senior Exemption: Property owners who are 65 or older and meet certain income requirements may qualify for an additional exemption.

- Military Exemption: Active-duty military personnel and veterans may be eligible for exemptions based on their service status and disability rating.

- Widow/Widower Exemption: Spouses of deceased veterans or first responders may qualify for this exemption.

Each of these exemptions has specific criteria and documentation requirements, which can be obtained from the Marion County Property Appraiser's Office.

Managing Your Real Estate Taxes in Marion County

Effectively managing your real estate taxes in Marion County involves a combination of understanding the assessment process, staying informed about tax rates and exemptions, and timely payment of your tax obligations.

Staying Informed: A Key to Tax Management

Staying up-to-date with changes in tax rates and understanding the impact of exemptions on your property’s taxable value are crucial aspects of tax management. The Marion County Property Appraiser’s Office provides a wealth of resources, including online tools and publications, to help property owners understand their tax obligations.

Regularly checking your property's assessment details, such as the just value, limited value, and any applicable exemptions, is essential. This information is available on the Property Appraiser's website and can be accessed using your property's unique identification number.

Timely Payment and Available Options

Real estate taxes in Marion County are due annually, typically with two installments due in March and November. However, taxpayers have the flexibility to pay their taxes in full by the first installment due date or choose to pay in installments. Late payments are subject to interest and penalties, so it’s important to stay on top of your payment schedule.

Marion County offers a variety of payment methods, including online payments through the Property Appraiser's website, by phone, or at local payment centers. Additionally, taxpayers can opt for automatic payments, ensuring their taxes are paid on time without the need for manual reminders.

Challenging Your Assessment: The Appeals Process

In the event that you believe your property’s assessment is inaccurate or unfair, Marion County provides an appeals process. The first step is to contact the Property Appraiser’s Office to discuss your concerns and potentially resolve the issue informally. If a resolution cannot be reached, you can file a formal petition with the Value Adjustment Board (VAB).

The VAB is an independent board that hears appeals from property owners who believe their assessments are too high, their property was improperly classified, or they did not receive an exemption for which they are eligible. The board's decisions are final and binding, and their hearings are open to the public.

Future Implications and Considerations

As Marion County continues to grow and its real estate market evolves, it’s important for property owners to stay informed about potential changes to the tax system. While the current system provides a stable framework for property taxation, it is subject to change based on economic conditions, legislative decisions, and local initiatives.

For instance, the Save Our Homes benefit, while providing significant relief to homeowners, also limits the revenue available for local services. This can lead to discussions about potential changes to the benefit or other tax structures to ensure the sustainability of these services.

Additionally, as Marion County attracts more residents and businesses, the demand for infrastructure and services increases. This could result in proposals for additional tax measures to fund these needs, which property owners should be aware of and actively engage with.

The Impact of Real Estate Trends

Marion County’s real estate market, like any other, is subject to market fluctuations and trends. As property values rise, particularly in popular neighborhoods or with certain property types, the impact on tax assessments and obligations can be significant.

For instance, if a neighborhood experiences rapid appreciation, the limited value of properties in that area may increase substantially, leading to higher tax obligations for homeowners. Similarly, investors who own multiple properties may need to carefully manage their tax obligations, especially if they are not eligible for the Save Our Homes benefit.

Staying abreast of real estate trends and their potential impact on tax assessments is crucial for effective financial planning and property management.

Long-Term Planning and Strategies

For property owners looking to the future, effective tax management often involves long-term planning and strategic decision-making. This can include considerations such as:

- Understanding the impact of potential changes to tax laws and rates on your property's value and cash flow.

- Exploring investment strategies that maximize tax benefits, such as utilizing available exemptions or considering the tax implications of different property types.

- Planning for major improvements or renovations, and understanding how these changes may impact your property's assessment and subsequent tax obligations.

Working with tax professionals or financial advisors who specialize in real estate can provide valuable insights and strategies to optimize your tax position while meeting your long-term financial goals.

Conclusion

Understanding and effectively managing real estate taxes in Marion County is an essential part of responsible property ownership. By familiarizing yourself with the assessment process, tax rates, and available exemptions, you can make informed decisions about your property’s tax obligations. Stay engaged with local government initiatives and market trends to ensure your tax strategy remains aligned with your financial goals and the evolving landscape of Marion County’s real estate market.

Frequently Asked Questions

What is the typical tax rate for real estate in Marion County?

+The tax rate can vary annually and is determined by the Board of County Commissioners and other taxing authorities. It is expressed in mills, with one mill representing 1 of tax for every 1,000 of a property’s assessed value. As of the latest information, the total millage rate is approximately 10 mills.

How can I check my property’s assessed value and applicable exemptions?

+You can access this information on the Marion County Property Appraiser’s website using your property’s unique identification number. This online tool provides detailed information about your property’s assessment, including its just value, limited value, and any applicable exemptions.

Are there any tax benefits for homeowners in Marion County?

+Yes, Marion County offers several tax benefits, including the Save Our Homes (SOH) program, which provides a homestead exemption for primary residences. Additionally, there are exemptions for seniors, military personnel, and widows/widowers.

How can I appeal my property’s assessment if I believe it is incorrect?

+You can start by contacting the Property Appraiser’s Office to discuss your concerns and potentially resolve the issue informally. If a resolution cannot be reached, you can file a formal petition with the Value Adjustment Board (VAB). The VAB hears appeals and makes final, binding decisions on assessment disputes.

What payment options are available for real estate taxes in Marion County?

+Marion County offers various payment methods, including online payments through the Property Appraiser’s website, by phone, or at local payment centers. Taxpayers can also opt for automatic payments and have the flexibility to pay in installments or in full by the first installment due date.