Taxes In Alabama

Taxes are an essential aspect of any economy, and understanding the tax landscape is crucial for individuals, businesses, and investors. Alabama, known for its diverse economy and southern hospitality, has a unique tax system that impacts its residents and contributes to the state's fiscal policies. Let's delve into the world of taxes in Alabama, exploring the various types, rates, and implications for those living and working within the state.

Unraveling Alabama's Tax System: A Comprehensive Guide

Alabama's tax structure is designed to fund public services, infrastructure development, and various state initiatives. The state relies on a combination of income taxes, sales taxes, property taxes, and other levies to generate revenue. Each of these tax categories plays a distinct role in Alabama's economy, impacting individuals and businesses differently.

Income Taxes: Navigating Alabama's Personal and Corporate Tax Landscape

Income taxes form a significant portion of Alabama's revenue stream. The state imposes a progressive income tax structure, meaning tax rates increase as taxable income rises. Alabama's personal income tax rates range from 2% to 5%, depending on the taxpayer's income bracket. For instance, a single filer with a taxable income of $20,000 would fall under the 2% tax bracket, while a joint filer with an income of $100,000 would be taxed at the higher 5% rate.

In addition to personal income taxes, Alabama also imposes corporate income taxes. The corporate tax rate in Alabama stands at 6.5%, applicable to the net income of corporations operating within the state. This rate is relatively competitive when compared to other states, making Alabama an attractive destination for businesses seeking to minimize their tax burden.

| Tax Category | Tax Rate |

|---|---|

| Personal Income Tax | 2% - 5% |

| Corporate Income Tax | 6.5% |

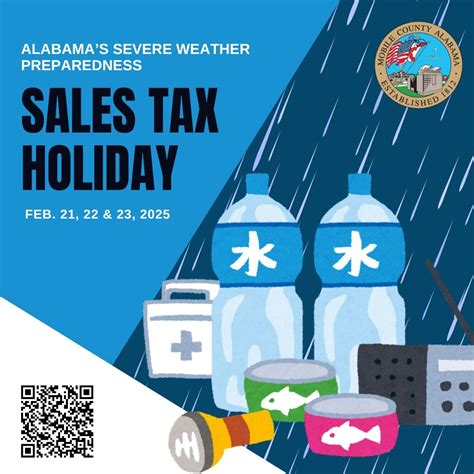

Sales and Use Taxes: Understanding the Alabama Consumer's Burden

Alabama levies sales and use taxes on the sale of goods and certain services within the state. The state's general sales tax rate is 4%, which applies to most tangible personal property and select services. However, local governments can also impose additional sales taxes, leading to varying rates across the state. For instance, the city of Birmingham has a 10% sales tax rate, including state and local taxes.

In addition to sales taxes, Alabama also imposes a use tax, which is essentially a sales tax on goods purchased outside the state but used or consumed within Alabama. This tax is designed to prevent residents from avoiding sales taxes by making purchases in other states with lower tax rates. The use tax rate mirrors the sales tax rate, ensuring consistency in taxation.

| Sales and Use Tax Rates | Alabama |

|---|---|

| State Sales Tax | 4% |

| Average Local Sales Tax | 2% |

| Use Tax Rate | 4% |

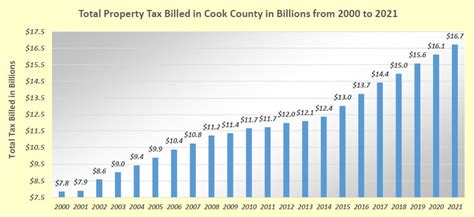

Property Taxes: Alabama's Approach to Real Estate Taxation

Property taxes are a critical component of Alabama's tax system, contributing to local government revenues. Alabama's property tax structure is primarily a local matter, with rates varying across counties and municipalities. The average effective property tax rate in Alabama is 0.55%, which is lower than the national average.

Property taxes in Alabama are assessed on the value of real estate, including land and improvements. The state's Department of Revenue provides guidelines for property tax assessment, ensuring uniformity across jurisdictions. However, it's important to note that individual counties and municipalities have the authority to set their own tax rates, leading to variations in the effective tax burden across the state.

| Property Tax Rates | Alabama |

|---|---|

| Average Effective Rate | 0.55% |

| Range of Rates Across Counties | 0.4% - 1.1% |

Other Taxes: Exploring Alabama's Diverse Revenue Streams

Beyond the core tax categories, Alabama also imposes various other taxes to generate revenue and support specific initiatives. These include:

- Motor Fuel Taxes: Alabama levies taxes on gasoline and diesel fuel, contributing to the state's infrastructure development.

- Inheritance and Estate Taxes: While Alabama does not impose an inheritance tax, it does have an estate tax that applies to estates exceeding a certain value.

- Severance Taxes: Taxes on the extraction of natural resources, such as coal and oil, contribute to Alabama's revenue stream.

- Lodging Taxes: Many counties and municipalities in Alabama impose additional taxes on hotel stays, supporting tourism-related initiatives.

The Impact of Alabama's Tax System: Analysis and Implications

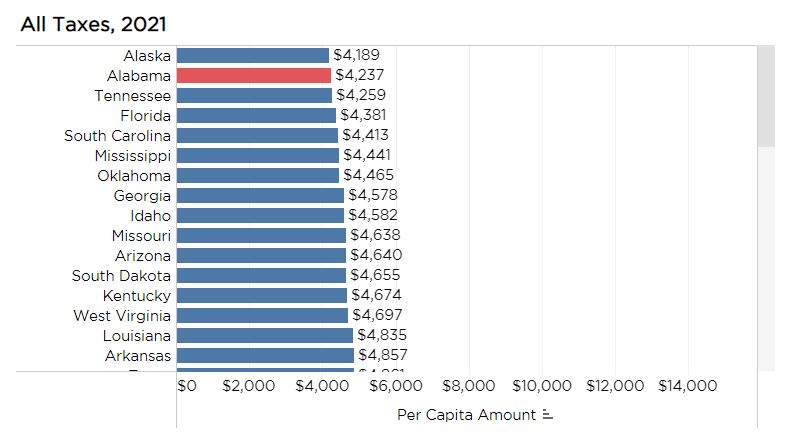

Alabama's tax system plays a pivotal role in shaping the state's economic landscape. The progressive income tax structure ensures that higher-income earners contribute a larger share to the state's revenue, promoting social equity. Meanwhile, the relatively low sales and property tax rates can make Alabama an attractive destination for consumers and investors.

However, it's important to consider the impact of local variations in tax rates. While the state's average effective property tax rate is lower than the national average, certain counties may have higher rates, impacting the affordability of real estate. Similarly, sales tax rates can vary significantly across the state, influencing consumer spending patterns and business location decisions.

For businesses, Alabama's corporate income tax rate is a competitive advantage, potentially reducing their tax burden. However, the state's sales and use taxes, along with other business-related taxes, should be carefully considered when evaluating the overall tax climate for businesses.

Conclusion: Navigating Alabama's Tax Landscape for Optimal Financial Outcomes

Understanding Alabama's tax system is crucial for individuals, businesses, and investors seeking to make informed financial decisions. The state's tax landscape is diverse, with income, sales, property, and various other taxes contributing to its fiscal policies. By navigating these taxes strategically, individuals and businesses can optimize their financial outcomes and contribute to Alabama's thriving economy.

What is the average income tax rate in Alabama for individuals?

+

The average income tax rate for individuals in Alabama is approximately 4%, but it can vary depending on income brackets.

Are there any tax incentives for businesses in Alabama?

+

Yes, Alabama offers various tax incentives for businesses, including tax credits for job creation, research and development, and more.

How does Alabama’s sales tax compare to other states?

+

Alabama’s sales tax rate is relatively competitive, with a state rate of 4%, which is lower than many other states.