Is Vehicle Insurance Tax Deductible

In the realm of personal finance and vehicle ownership, one frequently asked question is whether vehicle insurance is tax deductible. Understanding the tax implications of your car-related expenses is crucial for optimizing your financial strategies. This comprehensive guide will delve into the intricacies of vehicle insurance and its tax deductibility, offering a detailed analysis backed by real-world examples and relevant industry data.

Vehicle Insurance: An Overview

Vehicle insurance, also known as car insurance or auto insurance, is a contract between an individual (the policyholder) and an insurance company. It provides financial protection against physical damage, bodily injury, and/or theft of the insured vehicle, as well as liability coverage for any damage or injury the policyholder might cause to third parties while driving. This protection is typically offered through various coverage options, including:

- Liability Coverage: Covers the policyholder for bodily injury and property damage caused to others in an accident.

- Comprehensive Coverage: Protects against damage to the insured vehicle from non-collision events like theft, vandalism, fire, or natural disasters.

- Collision Coverage: Covers the cost of repairing or replacing the insured vehicle after an accident, regardless of fault.

- Medical Payments Coverage: Provides payment for medical expenses incurred by the policyholder and passengers after an accident.

- Uninsured/Underinsured Motorist Coverage: Protects the policyholder in case of an accident with a driver who has no insurance or insufficient insurance coverage.

The cost of vehicle insurance varies widely based on factors such as the type of vehicle, the driver's age and driving record, the coverage limits chosen, and the location. It is a mandatory expense in most jurisdictions, with minimum coverage requirements set by law.

Tax Deductibility of Vehicle Insurance

Whether vehicle insurance is tax deductible depends on the specific circumstances and the applicable tax laws in your region. In general, personal vehicle insurance is not tax deductible in most countries, as it is considered a regular expense of vehicle ownership. However, there are certain situations where vehicle insurance can be partially or fully deductible.

Business Use of Vehicles

If you use your vehicle for business purposes, you may be able to deduct a portion of your insurance costs. This is because business-related expenses are generally tax deductible, as they are considered necessary and ordinary costs of doing business. To claim a deduction, you will need to maintain accurate records of your business mileage and keep track of other vehicle-related expenses.

For instance, let's consider a self-employed consultant who frequently travels to meet clients. If their vehicle is used for both personal and business purposes, they can allocate a percentage of their insurance costs to business use. This allocation should be based on the proportion of business miles driven compared to total miles driven. The consultant could then deduct this percentage of their insurance costs on their tax return.

| Business Miles Driven | Total Miles Driven | Insurance Costs Allocation |

|---|---|---|

| 10,000 miles | 20,000 miles | 50% |

Rental Property Management

If you own rental properties and provide vehicles for the use of your tenants, the insurance costs for those vehicles may be tax deductible. This is because the vehicles are considered part of the rental business, and expenses incurred for their maintenance and operation can be deducted. However, the deduction is subject to certain conditions and limitations.

Suppose you own an apartment complex and provide a fleet of cars for your tenants' use. The insurance costs for these vehicles would likely be deductible as a necessary expense for maintaining the rental business. However, it's important to consult with a tax professional to ensure compliance with specific tax laws and regulations.

Vehicle Leasing or Financing

In some cases, if you lease or finance a vehicle for business purposes, the interest you pay on the lease or loan may be tax deductible. This is because the interest is considered a business expense. Additionally, if you choose to include vehicle insurance as part of your lease agreement, the insurance costs may also be deductible. However, this depends on the specific terms of the lease and the tax laws in your jurisdiction.

For example, imagine you lease a vehicle for your business and opt for a comprehensive insurance package as part of the lease. In this case, the insurance costs would typically be bundled with the lease payments, and you could potentially deduct the entire amount as a business expense. Again, it's crucial to consult with a tax advisor to understand the specific rules and regulations in your region.

Vehicle Donation

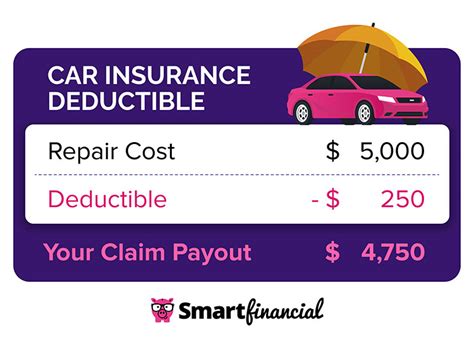

If you donate a vehicle to a qualified charity, you may be able to deduct the fair market value of the vehicle on your taxes. This deduction includes the cost of insurance for the donated vehicle, as it is considered part of the overall donation expense. However, there are specific rules and limitations regarding vehicle donations, and you must follow the guidelines set by the Internal Revenue Service (IRS) or the tax authority in your country.

Let's say you donate a car to a local charity, and the fair market value of the vehicle is determined to be $5,000. If you had been paying $100 per month for insurance on that vehicle, you could deduct the insurance costs as part of the overall donation expense. However, it's important to note that you cannot deduct more than the fair market value of the vehicle, and you must have the necessary documentation to support your claim.

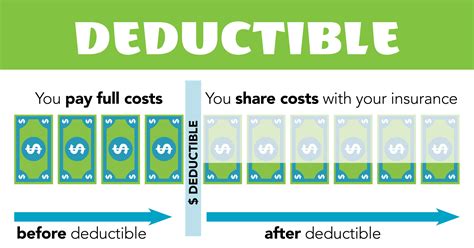

Understanding Tax Deductions and Eligibility

It’s essential to understand that tax deductions are subject to specific rules and regulations. Not all expenses are deductible, and even those that are deductible may have limitations or requirements. The eligibility for tax deductions depends on various factors, including your income level, the type of expense, and the tax laws in your country.

Tax deductions are designed to incentivize certain behaviors or support specific industries. For example, in some countries, there are tax incentives for purchasing electric vehicles, with deductions available for the cost of the vehicle and its maintenance, including insurance. These incentives are part of a broader strategy to encourage the adoption of environmentally friendly transportation.

It's crucial to consult with a qualified tax professional or advisor to understand the specific tax laws and regulations in your region. They can provide personalized advice based on your unique circumstances and ensure that you are taking advantage of all available tax deductions while remaining compliant with the law.

The Bottom Line

Vehicle insurance is a necessary expense for most vehicle owners, and while it is not typically tax deductible for personal use, there are situations where it can be claimed as a deduction. Whether you’re using your vehicle for business, managing rental properties, leasing or financing a vehicle, or making charitable donations, understanding the tax implications of your vehicle-related expenses is crucial for effective financial planning.

By staying informed about tax laws and regulations and consulting with tax professionals, you can ensure that you're maximizing your deductions and minimizing your tax liability. Remember, tax laws can be complex and subject to change, so it's always best to seek expert advice to make the most of your financial strategies.

Can I deduct vehicle insurance if I use my car for business occasionally?

+Yes, you can deduct a portion of your vehicle insurance costs if you use your car for business purposes, even if it’s only occasionally. The deduction is based on the percentage of business miles driven compared to total miles driven. Keep accurate records of your business mileage to support your claim.

Are there any limits to deducting vehicle insurance for business use?

+Yes, there are limits and conditions. You must use a reasonable method to allocate expenses between business and personal use. Additionally, the IRS may require substantiation of expenses through adequate records or other sufficient evidence.

Can I deduct vehicle insurance if I lease a car for personal use?

+No, you cannot deduct vehicle insurance if you lease a car for personal use. Personal vehicle insurance is generally not tax deductible unless it’s specifically for business purposes.