Does Alabama Tax Social Security

The taxation of social security benefits in the state of Alabama is a topic of interest for many residents and retirees alike. In this comprehensive article, we will delve into the specifics of how Alabama handles the taxation of social security income, providing an in-depth analysis of the state's policies and the potential implications for individuals.

Understanding Alabama’s Social Security Tax Policies

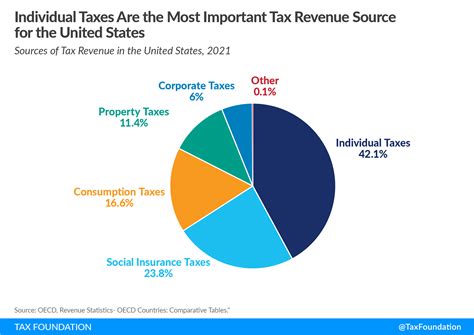

Alabama, like many other states, has specific guidelines when it comes to taxing social security benefits. While the federal government imposes certain rules regarding the taxation of social security, individual states have the autonomy to make their own decisions regarding the matter. This results in a diverse landscape of tax policies across the United States.

In the case of Alabama, the state's tax treatment of social security benefits is quite straightforward. Alabama is one of the states that does not tax social security income. This means that individuals who receive social security benefits in Alabama are not required to pay state taxes on those benefits.

The decision to exempt social security benefits from taxation is based on the understanding that these benefits are often a crucial source of income for retirees and individuals with disabilities. By not taxing these benefits, Alabama aims to alleviate the financial burden on those who rely on social security for their livelihood.

Alabama’s Tax-Free Social Security Benefits

Alabama’s tax exemption for social security benefits applies to all forms of social security income, including:

- Retirement benefits for individuals and spouses.

- Disability benefits for those who qualify.

- Survivor benefits for dependents of deceased workers.

- Supplemental Security Income (SSI) for low-income individuals.

This broad coverage ensures that individuals across various circumstances are not subject to state taxes on their social security benefits.

| Social Security Benefit Type | Alabama Tax Treatment |

|---|---|

| Retirement Benefits | Tax-free |

| Disability Benefits | Exempt from state taxes |

| Survivor Benefits | Not taxable at the state level |

| Supplemental Security Income (SSI) | Excluded from Alabama's tax calculations |

The Impact on Alabama Residents

Alabama’s decision to exempt social security benefits from taxation has a significant impact on the state’s residents, especially those who rely heavily on these benefits. Let’s explore some of the key implications:

Financial Security for Retirees

For retirees living in Alabama, the tax-free status of social security benefits is a major advantage. It means that their retirement income, which often consists primarily of social security, is not subject to state-level taxation. This can lead to a more comfortable retirement lifestyle as retirees have a greater proportion of their income available to cover living expenses and discretionary spending.

Consider the case of Mr. Johnson, a retiree who moved to Alabama after a long career in another state. Mr. Johnson's primary source of income is his social security benefits, which he receives monthly. Thanks to Alabama's tax policies, he can enjoy the full amount of his benefits without worrying about state taxes eating into his retirement funds.

Attracting Retirees to Alabama

Alabama’s tax exemption for social security benefits is not only beneficial for current residents but also plays a role in attracting retirees from other states. Retirees often consider tax implications when deciding on their retirement destination, and Alabama’s favorable tax treatment can be a significant draw.

Imagine a couple, the Smiths, who are approaching retirement and are considering various states for their golden years. After learning about Alabama's tax-free social security policy, they realize that they could stretch their retirement savings further in Alabama compared to states that tax social security benefits. This realization may lead them to choose Alabama as their retirement home.

Economic Impact on the State

Alabama’s decision to exempt social security benefits from taxation also has broader economic implications. By attracting retirees who may have substantial savings and assets, the state can benefit from increased economic activity. Retirees often contribute to local economies through their spending on housing, healthcare, recreation, and other goods and services.

Furthermore, the absence of a tax on social security benefits can encourage individuals to stay in Alabama as they age, rather than moving to other states with potentially more favorable tax policies. This retention of residents can lead to a more stable and thriving local economy.

Comparative Analysis: Alabama vs. Other States

To gain a deeper understanding of Alabama’s tax policies regarding social security, let’s compare it with a few other states:

Alabama vs. California

California, in contrast to Alabama, does tax social security benefits. This means that residents of California who receive social security income may have to pay state taxes on those benefits. While the exact tax rates and thresholds vary, this can lead to a higher overall tax burden for retirees in California compared to Alabama.

Alabama vs. Florida

Florida, like Alabama, is another state that does not tax social security benefits. This makes Florida and Alabama attractive destinations for retirees seeking tax-friendly environments. However, it’s worth noting that Florida offers additional tax advantages, such as no state income tax on any source of income, which can make it even more appealing to certain retirees.

Alabama vs. New York

New York, on the other hand, has a more complex tax system when it comes to social security benefits. While some social security income is exempt from state taxes, there are certain thresholds and limitations. New York’s tax policy may require retirees to carefully assess their income to determine the tax implications.

| State | Social Security Tax Policy |

|---|---|

| Alabama | Tax-free social security benefits |

| California | Taxes social security benefits |

| Florida | Exempts social security benefits from taxation |

| New York | Complex tax system with partial exemption |

Future Implications and Considerations

As we look ahead, it’s important to consider the potential future implications of Alabama’s tax policies regarding social security. While the current tax-free status is beneficial for retirees, there are ongoing discussions and considerations at the state level that could impact these policies in the future.

Potential Policy Changes

State governments often review and assess their tax policies to ensure they align with the needs and priorities of their residents. While Alabama’s current policy of exempting social security benefits from taxation is advantageous for retirees, there is always a possibility of future policy changes.

For instance, if the state faces budgetary constraints or seeks to generate additional revenue, it may consider taxing social security benefits to some extent. This could take the form of introducing a flat tax rate or implementing thresholds and exclusions, similar to the approach seen in states like New York.

Impact on Retirement Planning

Retirees and individuals planning for retirement should be aware of the potential for policy changes. While Alabama’s current tax-free policy is a significant advantage, it’s prudent to stay informed about any developments in state tax laws. This ensures that retirement plans can be adjusted accordingly, taking into account the most up-to-date tax information.

It's also essential to consider the broader financial landscape when making retirement decisions. Factors such as cost of living, healthcare costs, and overall economic stability should be weighed alongside tax policies to make well-informed choices.

Advocacy and Awareness

For those who wish to maintain or improve the tax-free status of social security benefits in Alabama, advocacy and awareness play a crucial role. Engaging with local representatives, participating in town hall meetings, and staying informed about proposed tax legislation can all contribute to shaping the future of Alabama’s tax policies.

Additionally, spreading awareness about the benefits of Alabama's current tax policy can encourage more retirees to consider the state as a retirement destination, further strengthening the local economy and community.

Conclusion

In conclusion, Alabama’s decision to exempt social security benefits from taxation is a significant advantage for retirees and individuals who rely on these benefits. The tax-free status provides financial security and peace of mind, allowing individuals to enjoy their retirement income without the added burden of state taxes.

While Alabama's current policy is favorable, it's important to remain vigilant about potential future changes. Staying informed and engaged in the discussion surrounding tax policies can help ensure that Alabama continues to be a retirement-friendly state, offering a high quality of life and financial stability to its residents.

Is Alabama the only state that doesn’t tax social security benefits?

+No, Alabama is not the only state with a tax-free policy for social security benefits. Several other states, including Florida, Hawaii, and Nevada, also do not tax these benefits. However, tax policies can vary widely from state to state, so it’s essential to research each state’s specific tax laws.

Are there any income thresholds for Alabama’s tax exemption on social security benefits?

+No, Alabama does not impose income thresholds or limitations on its tax exemption for social security benefits. This means that regardless of the amount of social security income an individual receives, it is exempt from state taxes in Alabama.

How does Alabama’s tax policy compare to other states in the region?

+Alabama’s tax policy regarding social security benefits is relatively favorable compared to some neighboring states. For example, Georgia and Tennessee do tax social security benefits, while Alabama does not. However, it’s important to consider the overall tax landscape and other factors when comparing states for retirement.

Can I still claim tax deductions or credits if my social security benefits are tax-free in Alabama?

+Yes, even though social security benefits are tax-free in Alabama, you may still be eligible for certain tax deductions or credits. It’s important to consult with a tax professional or refer to the Alabama Department of Revenue’s guidelines to understand which deductions or credits you may qualify for based on your overall financial situation.

Are there any plans to change Alabama’s tax policy on social security benefits in the future?

+As of my last update, there were no specific plans to change Alabama’s tax policy regarding social security benefits. However, state tax policies are subject to change, and it’s always a good idea to stay informed about any proposed tax legislation that could impact your financial situation.