Use Taxs In A Contect

Taxes are an integral part of any economy and have a significant impact on individuals, businesses, and governments. Understanding the context of taxes and their role in society is crucial for making informed decisions and navigating the complex world of fiscal policies. In this article, we will delve into the various aspects of taxes, exploring their purpose, implications, and the ways they shape our financial landscape.

The Significance of Taxes in Modern Society

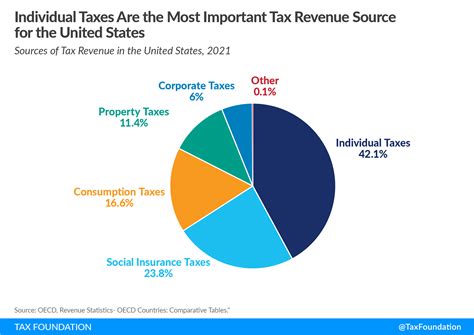

Taxes serve as the primary source of revenue for governments, enabling them to fund essential public services and infrastructure. From healthcare and education to national defense and social welfare programs, taxes play a vital role in sustaining a functional and prosperous society.

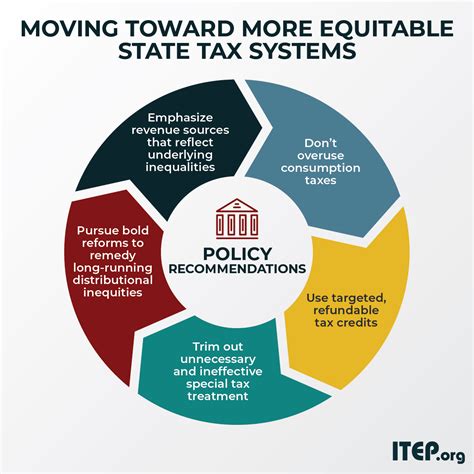

Moreover, taxes contribute to economic stability and fairness. Progressive tax systems, for instance, aim to redistribute wealth by imposing higher tax rates on higher income earners, promoting social equality and reducing income disparities.

Key Functions of Taxes

Taxes serve multiple purposes, including:

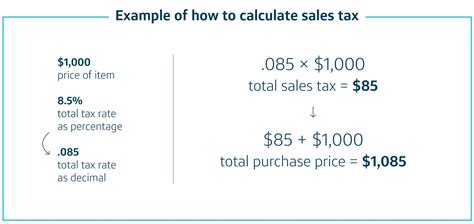

- Revenue Generation: Governments collect taxes to fund public expenditures, ensuring the smooth operation of various sectors and services.

- Economic Policy: Taxes can be used as a tool to influence economic behavior, encourage investment, and stimulate growth.

- Social Welfare: Through taxes, governments can finance social safety nets, providing support to vulnerable populations and promoting social cohesion.

- Environmental Sustainability: Certain taxes, such as carbon taxes, are implemented to address environmental concerns and encourage sustainable practices.

However, it is important to note that the tax system is not without its complexities and challenges. Navigating the intricate web of tax laws, regulations, and compliance requirements can be daunting for individuals and businesses alike.

The Complexity of Tax Systems

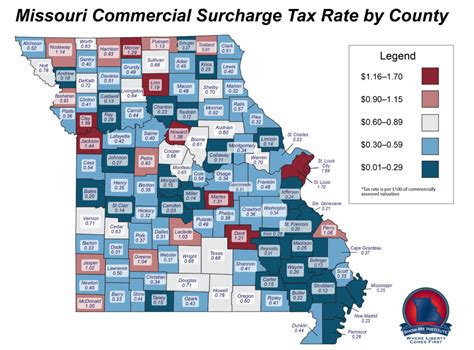

Tax systems around the world vary greatly, with each country adopting unique approaches and structures. These variations can make it challenging for individuals and businesses operating across borders to navigate the tax landscape effectively.

Consider, for example, the differences in tax rates and regulations between the United States and European Union countries. The United States has a federal income tax system with progressive tax brackets, while European countries often have a more nuanced approach, incorporating various deductions, credits, and exemptions.

Challenges in Tax Compliance

The complexity of tax systems gives rise to a range of compliance challenges:

- Interpretation of Tax Laws: Ambiguities in tax regulations can lead to misinterpretations and potential non-compliance issues.

- International Tax Implications: Businesses operating globally must navigate multiple tax jurisdictions, each with its own set of rules and requirements.

- Tax Planning and Optimization: Individuals and businesses seek ways to minimize their tax liabilities within legal boundaries, often requiring expert advice and strategic planning.

To address these challenges, governments and tax authorities continuously work towards simplifying tax systems, enhancing transparency, and providing accessible resources for taxpayers.

The Role of Technology in Tax Administration

Advancements in technology have revolutionized the way taxes are administered and complied with. Electronic filing systems, online tax portals, and digital tax records have streamlined the tax process, making it more efficient and convenient for taxpayers.

For instance, many countries now offer e-filing platforms, allowing individuals and businesses to submit their tax returns electronically. This not only reduces paperwork but also minimizes errors and accelerates the processing of tax returns.

Benefits of Digital Tax Solutions

The integration of technology in tax administration brings several advantages:

- Efficiency: Digital tax solutions automate various tasks, reducing the time and effort required for compliance.

- Accuracy: Online platforms and software minimize the risk of human errors, leading to more accurate tax calculations and reporting.

- Accessibility: Taxpayers can access their tax information and submit returns remotely, enhancing convenience and flexibility.

- Data Analytics: Tax authorities can leverage advanced analytics to identify trends, detect potential fraud, and improve tax policy decision-making.

As technology continues to evolve, the tax landscape is expected to become even more digitalized, further simplifying the tax process and enhancing transparency.

Future Implications and Innovations in Taxation

The world of taxation is constantly evolving, driven by changing economic landscapes, societal needs, and technological advancements. As we look towards the future, several key trends and innovations are shaping the tax landscape.

One notable development is the rise of digital currencies and blockchain technology. The emergence of cryptocurrencies like Bitcoin has prompted discussions around tax implications and the need for updated regulations. Governments are exploring ways to integrate these digital assets into existing tax frameworks while addressing potential risks and challenges.

Tax Innovations and their Impact

Here are some key innovations and their potential implications:

| Innovation | Impact |

|---|---|

| Digital Tax Platforms | Enhanced compliance, improved taxpayer experience, and reduced administrative burden. |

| Tax Analytics | Improved tax policy formulation, enhanced fraud detection, and better resource allocation. |

| Blockchain Integration | Streamlined tax reporting for digital assets, increased transparency, and reduced tax evasion risks. |

| Artificial Intelligence | Automated tax advisory services, improved tax planning, and personalized tax strategies. |

These innovations not only improve the efficiency and effectiveness of tax systems but also contribute to a more equitable and sustainable tax environment.

How do taxes impact economic growth and investment decisions?

+Tax policies can influence economic growth and investment by providing incentives or disincentives. Lower tax rates on capital gains or business profits, for example, can encourage investment and stimulate economic activity. Conversely, higher tax rates may deter investment and impact economic growth.

What are the potential challenges of implementing a digital tax system?

+Implementing a digital tax system may pose challenges such as ensuring data security, addressing digital divides, and providing adequate support for taxpayers who may have limited digital literacy. Additionally, the rapid pace of technological change requires constant updates and adaptations to tax regulations.

How can taxpayers stay updated with tax regulations and changes?

+Taxpayers can stay informed by regularly checking official government websites, subscribing to tax newsletters or alerts, and seeking guidance from tax professionals or accounting firms. Staying updated is crucial to ensure compliance and take advantage of any new tax benefits or incentives.