Fica Tax Meaning

In the world of international business and finance, understanding the intricacies of taxation is crucial, especially when dealing with cross-border transactions. The Fica Tax, a term that may be unfamiliar to many, holds significant importance in certain jurisdictions. Let's delve into the meaning and implications of this tax, shedding light on its role in the global financial landscape.

Unraveling the Fica Tax: A Comprehensive Guide

The Fica Tax, an acronym for Financial Contributions to Social Insurance, is a mandatory deduction from an individual’s income, primarily aimed at funding social security and welfare programs. It is a vital component of the tax system in various countries, playing a pivotal role in maintaining social safety nets and ensuring the financial sustainability of government-sponsored benefits.

This tax mechanism is designed to provide a safety net for citizens, covering a range of social services, including healthcare, retirement pensions, unemployment benefits, and disability support. By contributing to Fica, individuals and employers help to build a robust social security system, ensuring that all citizens have access to essential services, regardless of their financial situation.

The Mechanics of Fica Tax

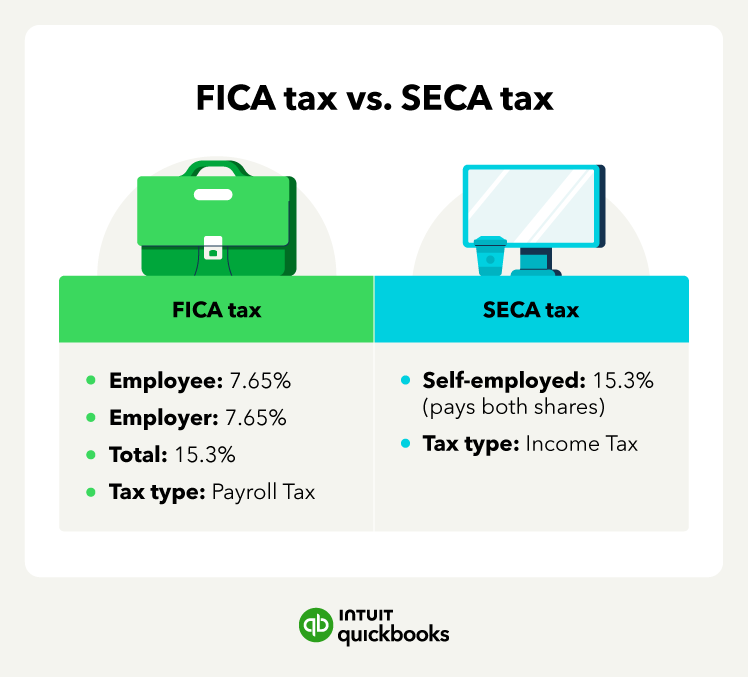

The Fica Tax operates as a payroll tax, meaning it is typically deducted from an individual’s salary or wages. Both the employee and the employer contribute to this tax, with the specific rates and structures varying across jurisdictions. These contributions are then allocated to different social insurance programs, each serving a unique purpose in supporting the well-being of citizens.

For instance, a portion of the Fica tax might be allocated to healthcare coverage, ensuring that individuals have access to medical services without incurring substantial out-of-pocket expenses. Another portion might be directed towards pension funds, building a financial safety net for individuals during their retirement years. The distribution of Fica contributions is carefully regulated, ensuring transparency and accountability in the management of these vital funds.

| Fica Tax Component | Purpose |

|---|---|

| Healthcare Contributions | Funding universal healthcare coverage |

| Pension Deductions | Building retirement funds for future financial security |

| Unemployment Benefits | Providing financial support during periods of job loss |

| Disability Support | Assisting individuals with disabilities in accessing essential services |

Implications for Businesses and Individuals

For businesses operating within jurisdictions that implement Fica Tax, understanding the mechanics and rates is essential. It directly impacts the cost of employment, as employers must contribute a significant portion of the tax. This, in turn, influences hiring decisions, salary structures, and overall business strategies.

From an individual's perspective, Fica Tax deductions can significantly reduce take-home pay. However, it is essential to recognize that these contributions are a necessary investment in one's future and the well-being of the community. By paying Fica, individuals gain access to a comprehensive social safety net, providing peace of mind and financial security in times of need.

The Role of Fica in Social Equity

The Fica Tax plays a critical role in promoting social equity. By ensuring that all individuals, regardless of their income level, have access to essential social services, Fica helps to reduce societal inequalities. It provides a level of financial security that can break the cycle of poverty and support upward mobility.

Furthermore, Fica Tax contributions can be seen as a form of social investment, where those who are financially stable contribute to the well-being of the less fortunate. This collective approach to social welfare fosters a sense of community and solidarity, strengthening the social fabric of the nation.

Challenges and Future Considerations

While the Fica Tax system has proven effective in providing social security, it is not without its challenges. One of the primary concerns is the sustainability of these programs, especially in the face of an aging population and changing economic landscapes. As the ratio of contributors to beneficiaries shifts, governments must carefully manage Fica funds to ensure their long-term viability.

Additionally, the complexity of the Fica Tax system can be a challenge for businesses and individuals alike. Navigating the various rates, thresholds, and exemptions can be daunting, requiring specialized knowledge and expertise. Simplifying the system and providing clear guidelines can help alleviate this burden, making it more accessible and understandable for all stakeholders.

Conclusion: A Vital Pillar of Social Security

The Fica Tax is more than just a financial obligation; it is a cornerstone of social security and welfare systems. By understanding its purpose, mechanics, and implications, individuals and businesses can navigate this complex landscape with greater clarity and confidence. Ultimately, the Fica Tax serves as a reminder of our collective responsibility to support one another and build a more equitable and sustainable future.

How does Fica Tax impact my take-home pay?

+Fica Tax deductions directly reduce your take-home pay. The amount deducted depends on your income level and the specific rates in your jurisdiction. While it may decrease your immediate disposable income, it is an investment in your future social security and the well-being of your community.

Are there any tax benefits associated with Fica contributions?

+Yes, Fica contributions are often tax-deductible, which means they can reduce your taxable income. This can lead to a lower tax burden, providing a financial incentive for individuals to contribute to social security programs.

What happens if I fail to pay Fica Tax?

+Failing to pay Fica Tax can result in penalties and legal consequences. It is a mandatory obligation, and non-compliance can lead to significant financial repercussions and legal issues. It is crucial to stay informed about your Fica responsibilities and ensure timely payments.