Nc Vehicle Property Tax

North Carolina's vehicle property tax system is an essential component of the state's revenue stream, playing a crucial role in funding various public services and infrastructure projects. Understanding how this tax works, its implications for vehicle owners, and its broader impact on the state's economy is essential for all residents. This comprehensive guide aims to provide an in-depth analysis of the NC Vehicle Property Tax, offering valuable insights for both new and experienced vehicle owners.

Understanding the NC Vehicle Property Tax

The Vehicle Property Tax in North Carolina is an annual assessment on registered vehicles, designed to contribute to the maintenance and improvement of the state’s roads, bridges, and public transportation systems. It is a critical source of revenue for local governments, ensuring the smooth functioning of essential services and community development projects.

Tax Assessment Process

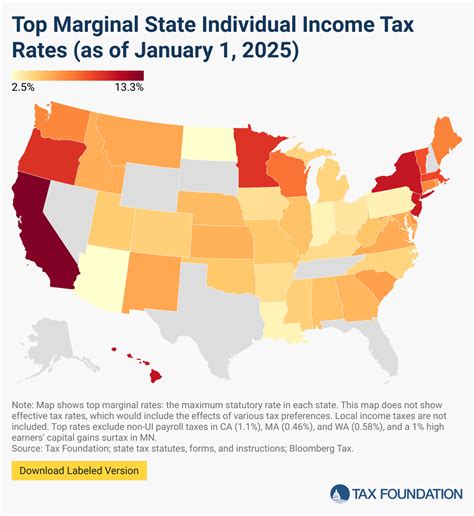

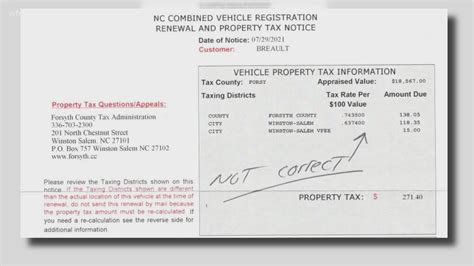

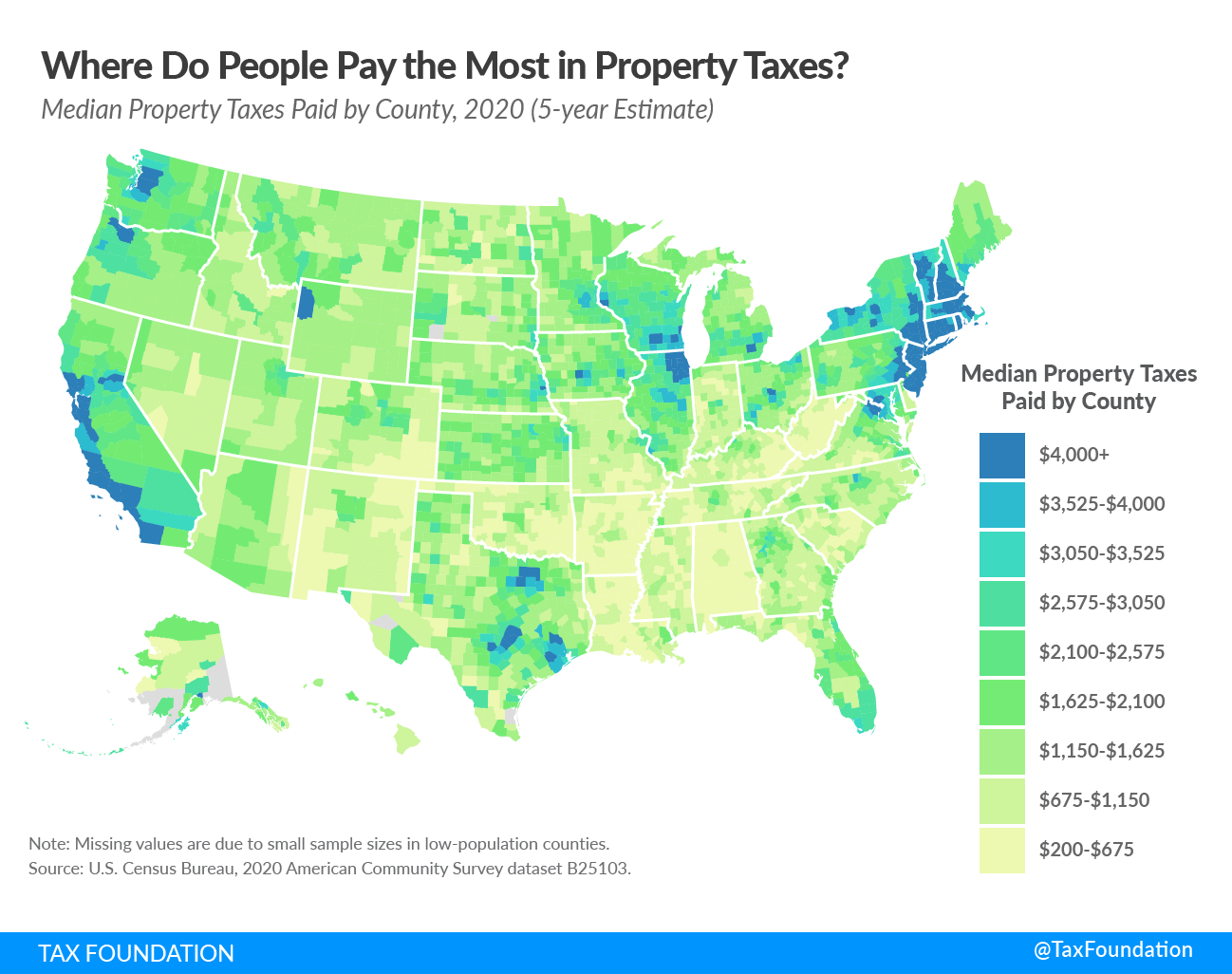

The tax assessment process in North Carolina is based on the vehicle’s value and the applicable tax rate in the vehicle owner’s county of residence. The vehicle’s value is determined by the North Carolina Department of Motor Vehicles (NCDMV) using a depreciation schedule, which accounts for the vehicle’s age, make, model, and condition.

The tax rate, on the other hand, is set by local governments and can vary significantly from one county to another. This rate is typically expressed as a percentage of the vehicle's value, and it is used to calculate the final tax amount.

For instance, if a vehicle is valued at $20,000 and the tax rate in the owner's county is 1%, the annual vehicle property tax would amount to $200.

Tax Due Dates and Payment Options

Vehicle property taxes in North Carolina are due annually, typically by January 1st. However, the exact due date may vary slightly depending on the county. It’s essential for vehicle owners to be aware of their specific due dates to avoid late fees and penalties.

The state offers several payment options, including online payments through the NCDMV website, payment by phone, and traditional mail-in payments. Some counties also accept payments in person at local tax offices.

Vehicle owners are encouraged to explore the payment methods offered by their county to find the most convenient and cost-effective option.

Tax Exemptions and Special Considerations

North Carolina offers several tax exemptions and special considerations to certain vehicle types and owners. These exemptions are designed to alleviate the tax burden on specific groups and promote the use of environmentally friendly vehicles.

- Disabled Veterans: Vehicles owned by disabled veterans are exempt from property tax, provided they meet specific criteria set by the NCDMV.

- Electric Vehicles (EVs): EVs benefit from a partial tax exemption for the first five years after registration. This exemption is intended to encourage the adoption of eco-friendly transportation options.

- Senior Citizens: Senior citizens may be eligible for a reduced tax rate on their vehicles, depending on their age and income.

It's crucial for vehicle owners to understand these exemptions and their eligibility criteria to take full advantage of these benefits.

The Impact of Vehicle Property Tax on Vehicle Owners

While the NC Vehicle Property Tax is an essential source of revenue for the state, it can also represent a significant financial burden for vehicle owners, especially those with multiple vehicles or high-value vehicles.

Financial Considerations

The financial impact of vehicle property tax is directly tied to the value of the vehicle and the tax rate in the owner’s county. As such, owners of expensive vehicles or those living in counties with high tax rates may face substantial tax liabilities.

For instance, an owner of a $100,000 vehicle in a county with a 1.5% tax rate would owe $1,500 in vehicle property tax annually.

Vehicle owners should carefully consider the financial implications of vehicle property tax when purchasing a new vehicle or moving to a new county.

Administrative Responsibilities

Vehicle property tax also entails administrative responsibilities for vehicle owners. These include ensuring timely payments, maintaining accurate vehicle registration information, and being aware of any changes to tax rates or exemptions.

Failing to meet these responsibilities can result in penalties, late fees, and, in extreme cases, vehicle registration revocation.

Vehicle Property Tax and the North Carolina Economy

The NC Vehicle Property Tax is a crucial component of the state’s economy, providing a stable source of revenue for local governments and contributing to the state’s overall economic health.

Revenue Generation

Vehicle property tax generates significant revenue for local governments, which use these funds to support essential public services such as education, public safety, and infrastructure development.

For instance, the City of Charlotte collected over $100 million in vehicle property tax revenue in the 2022 fiscal year, contributing to the city's budget for various public projects and services.

Economic Impact

The economic impact of vehicle property tax extends beyond revenue generation. It also influences consumer behavior, vehicle sales, and the overall health of the automotive industry in North Carolina.

High vehicle property tax rates can discourage vehicle purchases, especially among younger buyers or those on a tight budget. On the other hand, tax exemptions and incentives can stimulate the market, encouraging the adoption of newer, more efficient vehicles.

Additionally, the tax revenue generated supports local businesses and job creation, as it funds infrastructure projects and community development initiatives.

Future Implications

Looking ahead, the NC Vehicle Property Tax is likely to remain a critical component of the state’s revenue system. However, there are ongoing discussions and proposals to reform the tax system, with a focus on fairness, simplicity, and economic efficiency.

Proposed reforms include standardizing tax rates across counties, increasing tax exemptions for certain vehicle types, and implementing a vehicle mileage tax to account for vehicle usage and reduce the tax burden on vehicle owners.

These reforms aim to make the tax system more equitable, encourage sustainable transportation options, and better align tax revenue with road usage.

Conclusion

The NC Vehicle Property Tax is a complex yet essential aspect of vehicle ownership in North Carolina. Understanding the tax system, its implications, and its broader impact on the state’s economy is crucial for all vehicle owners.

By staying informed and proactive, vehicle owners can navigate the tax system effectively, take advantage of available exemptions and incentives, and contribute to the state's economic health and community development.

How often must I pay the NC Vehicle Property Tax?

+The NC Vehicle Property Tax is an annual tax, typically due by January 1st each year. However, it’s essential to check with your local county tax office for the exact due date, as it may vary slightly.

Are there any penalties for late payment of the vehicle property tax?

+Yes, late payment of the vehicle property tax can result in penalties and interest charges. The exact amount of these penalties varies by county, so it’s crucial to make timely payments to avoid additional costs.

How can I check my vehicle’s assessed value for tax purposes?

+You can check your vehicle’s assessed value by contacting the North Carolina Department of Motor Vehicles (NCDMV) or your local county tax office. They can provide you with the necessary information about your vehicle’s value and the applicable tax rate.

Are there any online resources to help me calculate my vehicle property tax?

+Yes, the NCDMV website offers an online calculator that allows you to estimate your vehicle property tax based on your vehicle’s value and the tax rate in your county. This can be a helpful tool for budgeting and financial planning.

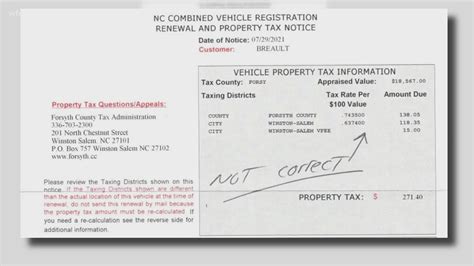

Can I appeal my vehicle’s assessed value if I believe it is incorrect?

+Yes, if you believe your vehicle’s assessed value is incorrect, you have the right to appeal. The process for doing so varies by county, so it’s essential to contact your local tax office to understand the specific procedures and requirements for an appeal.