Tax Percentage In Sc

The tax landscape in South Carolina is a complex web of regulations and rates that impact both individuals and businesses. Understanding the tax structure is crucial for residents and businesses alike, as it influences financial planning, investment decisions, and overall economic growth. This article aims to provide a comprehensive overview of the tax system in South Carolina, delving into the various tax types, rates, and their implications.

The Tax Structure of South Carolina

South Carolina, like many states, has a diverse tax system that includes a mix of income, sales, property, and other taxes. The state government uses these tax revenues to fund essential services, infrastructure development, and public welfare programs. The tax structure in South Carolina is designed to balance the need for revenue generation with the goal of fostering economic growth and competitiveness.

Income Tax

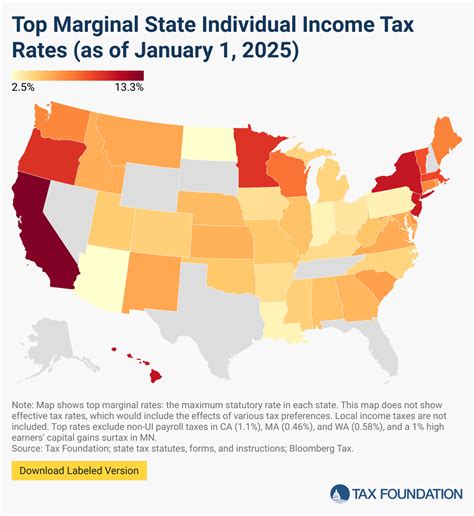

South Carolina imposes a progressive income tax on its residents and businesses. This means that as income increases, the tax rate also increases. The state’s income tax structure is designed to be fair and equitable, ensuring that higher-income earners contribute a larger share of their income to the state’s revenue.

For individuals, South Carolina has six income tax brackets ranging from 0% to 7%. The specific tax rates and the income thresholds for each bracket are as follows:

| Tax Rate | Income Range |

|---|---|

| 0% | Up to 2,960</td> </tr> <tr> <td>3%</td> <td>2,961 - 5,920</td> </tr> <tr> <td>4%</td> <td>5,921 - 9,867</td> </tr> <tr> <td>5%</td> <td>9,868 - 11,840</td> </tr> <tr> <td>6%</td> <td>11,841 - 16,640</td> </tr> <tr> <td>7%</td> <td>Above 16,640 |

It’s important to note that these rates are subject to change and should be verified with official sources for the most up-to-date information.

For businesses, the income tax rates vary depending on the legal structure of the entity. For instance, corporations are subject to a flat tax rate of 5%, while pass-through entities like partnerships and LLCs are taxed at the individual level, following the personal income tax brackets.

Sales and Use Tax

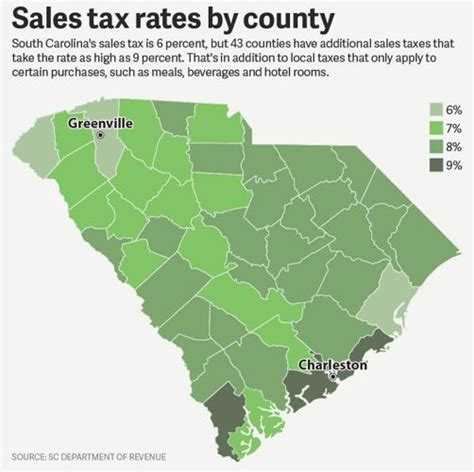

South Carolina imposes a sales and use tax on the sale of tangible personal property and certain services within the state. The base sales tax rate is 6%, which is one of the lowest in the country. However, this rate can vary across different counties and municipalities, as local governments have the authority to levy additional taxes.

For example, in the city of Charleston, the sales tax rate is 7% due to a 1% local option tax. These variations in sales tax rates can significantly impact businesses and consumers, especially those operating in multiple jurisdictions.

Additionally, South Carolina has specific regulations regarding the taxation of certain goods and services. For instance, groceries are exempt from sales tax, while prepared foods are taxable. Understanding these nuances is crucial for businesses to ensure compliance and for consumers to make informed purchasing decisions.

Property Tax

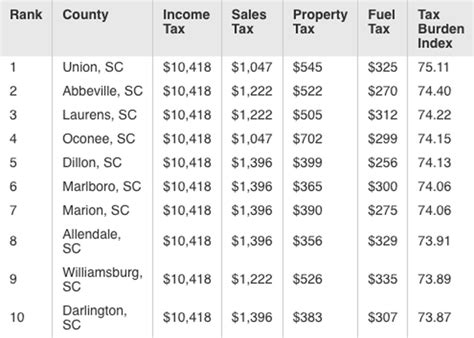

Property taxes are a significant source of revenue for local governments in South Carolina. The state’s property tax system is decentralized, meaning that each county sets its own property tax rates. This leads to a wide range of tax rates across the state.

The property tax is based on the assessed value of the property, which is determined by the county assessor’s office. The assessed value is then multiplied by the applicable millage rate (tax rate per 1,000 of assessed value) to calculate the property tax due. For instance, if a property is valued at 200,000 and the millage rate is 100 mills, the annual property tax would be $2,000.

The variation in property tax rates can have a significant impact on homeowners and businesses, influencing their financial planning and decision-making processes.

Tax Incentives and Exemptions

South Carolina offers various tax incentives and exemptions to promote economic development, attract businesses, and support specific industries. These incentives can take the form of tax credits, deductions, or exemptions and are designed to encourage investment, job creation, and innovation.

Economic Development Incentives

The state provides a range of incentives to encourage businesses to locate, expand, or invest in South Carolina. These incentives include:

- Job Tax Credits: Businesses that create new jobs or retain existing ones may be eligible for tax credits based on the number of jobs created and the wages paid.

- Investment Tax Credits: Incentives for businesses that make significant capital investments in the state, encouraging infrastructure development and job creation.

- Research and Development Tax Credits: Credits are available for businesses engaged in research and development activities, promoting innovation and technological advancement.

Industry-Specific Incentives

South Carolina offers targeted incentives to support specific industries, including:

- Manufacturing: The state provides various tax credits and exemptions to manufacturers, such as a partial sales tax exemption on manufacturing equipment and a credit for research and development expenses.

- Film and Media: The film industry is supported through tax incentives, including a 25% rebate on qualified production expenditures.

- Renewable Energy: Incentives are in place to encourage the development of renewable energy projects, such as solar and wind power.

Tax Exemptions for Individuals

South Carolina offers certain tax exemptions to individuals, including:

- Homestead Exemption: Eligible homeowners can apply for a homestead exemption, which reduces the assessed value of their primary residence for property tax purposes.

- Senior Citizen and Disability Exemptions: Certain senior citizens and individuals with disabilities may qualify for property tax exemptions or reductions.

- Military Exemptions: Active-duty military personnel and veterans may be eligible for property tax exemptions or reduced rates.

Tax Compliance and Enforcement

Ensuring tax compliance is a critical aspect of South Carolina’s tax system. The South Carolina Department of Revenue (SCDOR) is responsible for administering and enforcing the state’s tax laws. SCDOR has a range of tools and resources to ensure that taxpayers understand their obligations and comply with the law.

Taxpayers who fail to comply with their tax obligations may face penalties and interest charges. In severe cases, non-compliance can lead to legal action and criminal charges. It is essential for both individuals and businesses to stay informed about their tax responsibilities and seek professional advice when needed.

Online Filing and Payment Options

South Carolina offers convenient online filing and payment options for various taxes, including income tax, sales tax, and business taxes. The SCDOR’s website provides a user-friendly platform for taxpayers to register, file, and pay their taxes electronically. This streamlines the tax process and reduces the administrative burden on taxpayers and the state.

Taxpayer Assistance and Education

SCDOR recognizes the importance of taxpayer education and assistance in fostering compliance. The department provides a wealth of resources, including guides, tutorials, and webinars, to help taxpayers understand their tax obligations and navigate the tax system effectively. Taxpayers can also access support through a dedicated call center and in-person assistance at local SCDOR offices.

Impact on Economic Growth

The tax system in South Carolina plays a pivotal role in shaping the state’s economic landscape. The state’s competitive tax rates, especially in comparison to neighboring states, contribute to its attractiveness as a business destination. Low corporate income tax rates and targeted incentives encourage businesses to establish and expand their operations in South Carolina, creating jobs and driving economic growth.

Furthermore, the state’s focus on economic development and industry-specific incentives promotes innovation and diversification. By supporting industries like manufacturing, film, and renewable energy, South Carolina positions itself as a hub for cutting-edge businesses and sustainable development.

However, the impact of taxes on economic growth is a delicate balance. While low tax rates can attract businesses, they may also limit the state’s ability to invest in critical areas such as education, infrastructure, and social services. Finding the right equilibrium between tax incentives and revenue generation is essential for long-term economic sustainability.

Future Implications and Trends

As South Carolina continues to evolve economically, the state’s tax system will likely undergo changes and adaptations. Here are some key trends and implications to consider:

- Tax Reform and Simplification: There is ongoing discussion about tax reform in South Carolina, with a focus on simplifying the tax code and reducing complexity for taxpayers. This could involve consolidating tax brackets, revising tax rates, and streamlining tax administration processes.

- Digital Economy and Sales Tax: With the rise of e-commerce and digital platforms, South Carolina, like many states, is grappling with the challenge of taxing online sales. The state may need to adapt its sales tax regulations to ensure that online retailers contribute fairly to the tax base.

- Remote Work and Income Tax: The increasing trend of remote work, especially post-pandemic, raises questions about income tax jurisdiction. South Carolina may need to address the taxation of non-resident employees working remotely within the state to ensure compliance and fairness.

- Environmental Taxes: As environmental concerns gain prominence, South Carolina may explore the implementation of environmental taxes or incentives to promote sustainable practices and reduce carbon emissions.

- Tax Policy and Economic Recovery: In the aftermath of economic downturns, such as the COVID-19 pandemic, tax policy can play a crucial role in stimulating economic recovery. South Carolina may consider temporary tax measures to support businesses and individuals during challenging times.

What is the average property tax rate in South Carolina?

+

The average property tax rate in South Carolina varies widely across counties and municipalities. It typically ranges from 0.5% to 1.5% of the assessed property value. However, it’s important to note that specific rates can be significantly higher or lower in certain areas, so it’s essential to check the local millage rates for an accurate estimate.

Are there any sales tax holidays in South Carolina?

+

Yes, South Carolina does have sales tax holidays. These are designated periods during which certain items, such as school supplies, clothing, and energy-efficient appliances, are exempt from sales tax. These holidays are typically scheduled around back-to-school and energy-efficient product promotions.

How often are tax rates reviewed and updated in South Carolina?

+

Tax rates in South Carolina are subject to periodic review and updates. The state legislature reviews and approves tax rates and any changes to the tax code. While there is no set frequency for these updates, they typically occur as part of the annual budget process or in response to specific economic or policy considerations.