How To Obtain Tax Return Copy

Taxes are an essential part of our financial lives, and sometimes, we might need access to our previous tax returns for various reasons. Whether it's for loan applications, financial audits, or simply keeping records, obtaining a copy of your tax return is a straightforward process. This guide will walk you through the steps to retrieve your tax return information efficiently and securely.

Understanding the Process of Obtaining Tax Return Copies

The process of acquiring a copy of your tax return is facilitated by the Internal Revenue Service (IRS) and is accessible to all taxpayers. It is important to note that there are different methods to obtain your tax return information depending on whether you are requesting a copy of a previously filed tax return or seeking a transcript of your tax records.

Requesting a Copy of a Previously Filed Tax Return

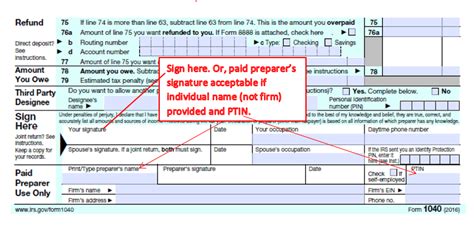

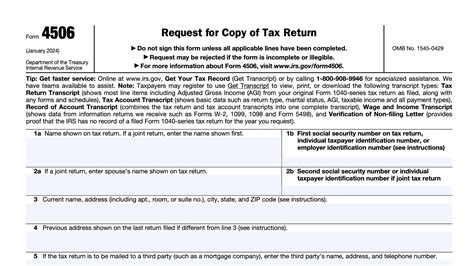

To request a copy of a previously filed tax return, you will need to complete and submit Form 4506, Request for Copy of Tax Return. This form is available on the IRS website and can be submitted by mail or fax. When filling out the form, ensure that you provide accurate and detailed information, including your full name, Social Security Number (SSN), and the specific tax year for which you are requesting the return.

Once your request is processed, the IRS will mail you a copy of your tax return. Please note that there is a fee associated with this service, and the processing time can vary depending on the IRS workload. It is advisable to allow sufficient time, especially if you are approaching tax season, as the IRS may experience higher volumes of requests during this period.

Obtaining a Transcript of Your Tax Records

If you only require certain information from your tax return, such as adjusted gross income or tax liability, you can request a transcript instead of a full tax return copy. The IRS offers several types of transcripts, including tax return transcripts, tax account transcripts, wage and income transcripts, and record of account transcripts.

To request a transcript, you can use the Get Transcript Online tool on the IRS website. This secure tool allows you to access your tax information quickly and easily. Alternatively, you can complete and submit Form 4506-T, Request for Transcript of Tax Return, by mail or fax. When using the online tool, you will need to create an account and verify your identity through a series of security questions.

The IRS also provides the option to request transcripts by phone. You can call the IRS at 800-908-9946 and follow the prompts to order your transcript. Keep in mind that transcripts are typically available within 10 business days after they are requested.

Additional Considerations for Tax Return Copies

It is important to note that the IRS generally retains tax returns for a period of seven years. Therefore, if you are requesting a copy of a tax return from a year that is older than seven years, the IRS may not have the records available. In such cases, you might need to contact the agency that received your tax information, such as your state tax authority, to obtain the necessary records.

Additionally, if you have recently filed your tax return and need a copy for immediate use, you can typically access it through your tax preparation software or online account. Many tax preparation services allow you to retrieve and download your filed tax return directly from their platform.

| Request Method | Description |

|---|---|

| Form 4506 | Used for requesting a full tax return copy by mail or fax. |

| Get Transcript Online | Secure online tool for accessing tax transcripts. |

| Form 4506-T | Form to request tax transcripts by mail or fax. |

| Phone Request | Option to call the IRS to order tax transcripts. |

Steps to Securely Obtain Your Tax Return Copy

Now that we have covered the different methods of obtaining tax return copies and transcripts, let's delve into the step-by-step process to ensure a smooth and secure experience.

Step 1: Determine Your Requirements

Before initiating the process, it is crucial to determine whether you need a full tax return copy or a transcript. Consider the specific information you require and the purpose for which you need the tax return. This will help you choose the most appropriate method and ensure you receive the necessary information promptly.

Step 2: Gather Necessary Information

To complete the request forms accurately, gather the following information:

- Your full name (as it appears on your tax return)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Tax year(s) for which you are requesting the return or transcript

- Your current mailing address

- A valid email address (if using online tools)

Step 3: Choose Your Request Method

As discussed earlier, you have several options for requesting tax return copies or transcripts. Consider your preference and the urgency of your request when selecting the method that best suits your needs. Remember that online tools generally provide faster access to your information.

Step 4: Complete the Request Form or Use Online Tools

If you opt to use Form 4506 or Form 4506-T, carefully fill out the required information. Ensure that your handwriting is legible, and double-check for any errors before submitting. If using the online tools, create an account and follow the step-by-step instructions provided by the IRS.

Step 5: Submit Your Request

Once you have completed the necessary forms or online process, submit your request according to the instructions provided. If using the mail or fax option, ensure that you include the correct mailing address or fax number as specified by the IRS.

Step 6: Track Your Request

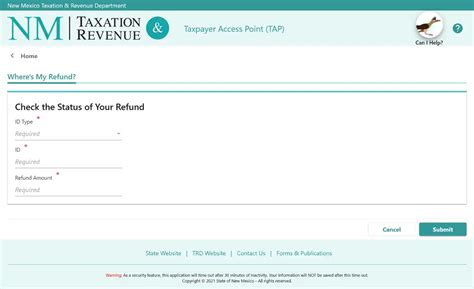

After submitting your request, you can track its progress. The IRS provides a Where's My Transcript tool on their website, which allows you to check the status of your transcript request. For Form 4506 requests, you can contact the IRS at 800-908-9946 to inquire about the status of your request.

Step 7: Receive and Review Your Tax Return Copy or Transcript

Once your request is processed, you will receive your tax return copy or transcript. Carefully review the information provided to ensure its accuracy. If you identify any discrepancies, contact the IRS immediately to address the issue.

Common Questions About Tax Return Copies

How long does it take to receive a tax return copy or transcript?

+The processing time for tax return copies and transcripts can vary. Generally, it takes around 10 business days to receive a transcript, while copies of tax returns may take slightly longer, depending on the IRS workload. It is advisable to plan ahead and allow sufficient time, especially during tax season.

Are there any fees associated with requesting tax return copies or transcripts?

+Yes, there is a fee of $43 (as of 2023) for each request for a tax return copy. Transcripts are free of charge. The fee covers the cost of processing and mailing the requested information.

Can I request a tax return copy or transcript for someone else, such as a family member or business partner?

+Yes, you can request tax return copies or transcripts on behalf of others. However, you must have the individual's written consent and provide additional documentation, such as a power of attorney or Form 2848, Power of Attorney and Declaration of Representative, signed by the taxpayer.

What if I need a tax return from a year older than seven years?

+If you need a tax return from a year that is older than seven years, the IRS may not have the records available. In such cases, you can contact the state tax authority or the agency that received your tax information to inquire about obtaining the necessary records.

Can I request a tax return copy or transcript online without creating an account?

+No, the Get Transcript Online tool requires you to create an account and verify your identity through a series of security questions. This measure ensures the security and confidentiality of your tax information.

Obtaining a copy of your tax return or a transcript of your tax records is a straightforward process facilitated by the IRS. By following the steps outlined above and being mindful of the different methods available, you can access your tax information securely and efficiently. Remember to plan ahead, especially during tax season, to ensure a smooth experience.