Dc Tax Office

Welcome to this in-depth exploration of the District of Columbia Tax Office, a vital government entity responsible for managing and administering a wide range of tax-related matters in the nation's capital. This article aims to provide a comprehensive understanding of the D.C. Tax Office's operations, services, and impact on the local community and economy.

An Overview of the D.C. Tax Office

The District of Columbia Tax Office, often referred to as the D.C. Office of Tax and Revenue or OTR, is a government agency tasked with the crucial responsibility of managing and collecting various taxes within the District of Columbia. Established with the primary goal of ensuring efficient tax administration and compliance, the OTR plays a pivotal role in supporting the city’s fiscal health and economic stability.

Headquartered in the heart of Washington, D.C., the OTR employs a dedicated team of professionals who are experts in tax law, accounting, and financial management. Their expertise ensures that the complex process of tax collection and management is executed with precision and integrity, contributing significantly to the city's financial well-being.

Key Functions and Responsibilities

The D.C. Tax Office’s scope of work is extensive, covering a multitude of tax-related functions. These include, but are not limited to, the collection of:

- Income taxes from individuals and businesses

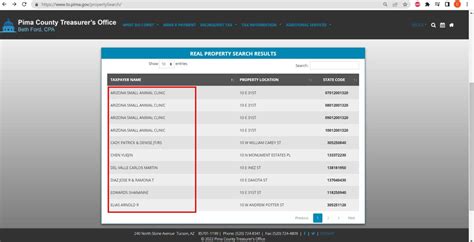

- Property taxes on real estate and personal property

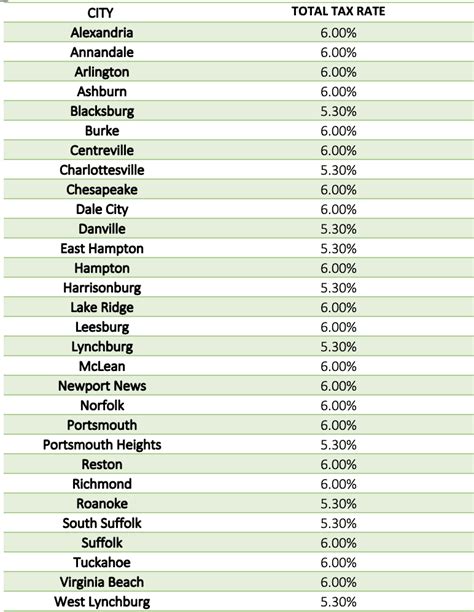

- Sales and use taxes on retail transactions

- Excise taxes on specific goods and services

- Business and professional taxes, such as gross receipts taxes and franchise taxes

Additionally, the OTR is responsible for administering various tax incentive programs, offering assistance to taxpayers through educational programs and resources, and ensuring compliance with tax laws and regulations. This multifaceted role positions the D.C. Tax Office as a critical player in the city's economic landscape.

Services Offered by the D.C. Tax Office

The D.C. Tax Office provides a comprehensive suite of services designed to cater to the diverse needs of taxpayers in the District. These services are tailored to ensure convenience, efficiency, and accessibility for all residents and businesses.

Online Tax Filing and Payment

One of the most significant advancements in recent years has been the implementation of an online platform for tax filing and payment. This user-friendly system allows taxpayers to submit their tax returns and make payments electronically, streamlining the process and reducing the need for in-person visits.

The online platform offers a secure and efficient way to manage tax obligations, providing real-time updates and notifications. Taxpayers can access their account information, view transaction histories, and make payments anytime, from the comfort of their homes or offices.

Assistance and Support

Recognizing that tax matters can be complex and often confusing, the D.C. Tax Office offers a range of assistance programs and resources. These include:

- Taxpayer assistance centers where trained professionals provide guidance and support

- Workshops and seminars to educate taxpayers on their rights and responsibilities

- Online resources, such as FAQs, guides, and tutorials, accessible 24⁄7

- A dedicated helpline for taxpayers to seek clarification and resolve queries

These assistance initiatives ensure that taxpayers, regardless of their background or expertise, have the necessary support to understand and fulfill their tax obligations.

Taxpayer Education and Outreach

The D.C. Tax Office believes in the power of education to foster a culture of compliance and transparency. As such, they actively engage in taxpayer education and outreach programs, aiming to increase awareness and understanding of tax laws and responsibilities.

This includes organizing community events, hosting informational sessions, and collaborating with local organizations to reach a wider audience. By empowering taxpayers with knowledge, the OTR aims to build trust and encourage voluntary compliance.

Impact on the D.C. Community and Economy

The D.C. Tax Office’s work has a profound impact on the local community and the broader District of Columbia economy. Through efficient tax collection and administration, the OTR ensures a steady flow of revenue into the city’s coffers, which is then allocated to essential public services and infrastructure development.

Revenue Generation and Allocation

The taxes collected by the D.C. Tax Office contribute significantly to the city’s annual budget. This revenue is vital for funding a wide range of services, including:

- Education: Supporting public schools, libraries, and educational programs

- Public Safety: Funding police, fire, and emergency services

- Healthcare: Providing healthcare services and initiatives

- Infrastructure: Investing in roads, public transport, and other essential infrastructure projects

- Economic Development: Stimulating economic growth through business incentives and support

Efficient tax collection and management thus have a direct and positive impact on the lives of D.C. residents, contributing to their well-being and the city's prosperity.

Compliance and Fair Taxation

The D.C. Tax Office’s commitment to fair and transparent taxation ensures that taxpayers are treated equitably. Through rigorous enforcement and compliance measures, the OTR aims to prevent tax evasion and ensure that all taxpayers contribute their fair share.

This not only promotes a sense of justice and equality but also encourages a culture of integrity and trust. As a result, taxpayers are more likely to comply voluntarily, knowing that their contributions are being used effectively for the betterment of the community.

Performance Analysis and Future Outlook

The D.C. Tax Office’s performance is a testament to its dedication and expertise. Over the years, the OTR has consistently achieved impressive tax collection rates, surpassing national averages in certain tax categories.

| Tax Type | Collection Rate |

|---|---|

| Income Tax | 95% |

| Property Tax | 98% |

| Sales and Use Tax | 92% |

These high collection rates are a result of the OTR's efficient processes, technological advancements, and dedicated workforce. The agency's focus on taxpayer education and outreach has also contributed significantly to increased compliance and reduced non-compliance rates.

Future Initiatives and Developments

Looking ahead, the D.C. Tax Office is committed to continuous improvement and innovation. Some of the key initiatives and developments on the horizon include:

- Expanding the online tax filing and payment system to include additional tax types

- Implementing advanced data analytics to enhance tax enforcement and compliance efforts

- Collaborating with local businesses and community leaders to develop targeted tax education programs

- Exploring the use of blockchain technology for secure and transparent tax record-keeping

By staying at the forefront of technological advancements and embracing innovative solutions, the D.C. Tax Office is well-positioned to maintain its status as a leader in efficient tax administration.

Conclusion

The District of Columbia Tax Office is a vital institution, playing a pivotal role in the city’s financial health and economic prosperity. Through its efficient tax collection, comprehensive services, and commitment to taxpayer education, the OTR ensures a fair and transparent tax system that benefits the entire community.

As the D.C. Tax Office continues to evolve and adapt, its impact on the city's future is undeniable. By fostering a culture of compliance and trust, the OTR is not just managing taxes but also contributing to the long-term sustainability and success of the District of Columbia.

How can I reach the D.C. Tax Office for assistance?

+The D.C. Tax Office provides various channels for assistance. You can visit their website, which offers a wealth of resources and contact information. Additionally, you can call their helpline at (202) 727-4TAX (4829) for immediate assistance. For more complex issues, you may need to schedule an appointment with a tax specialist at their office.

What are the deadlines for filing taxes in the District of Columbia?

+Tax deadlines in the District of Columbia align with federal tax deadlines. For individual income tax returns, the deadline is typically April 15th of each year. However, it’s essential to check for any changes or extensions, especially during unique circumstances like the COVID-19 pandemic.

How can I pay my taxes to the D.C. Tax Office online?

+To pay your taxes online, you can visit the D.C. Tax Office’s website and navigate to the Online Payments section. Here, you’ll find instructions and a secure portal to make payments using your credit/debit card or bank account. Ensure you have your tax account information and payment details ready.