Can You Write Off Real Estate Taxes

In the realm of personal finance and tax strategies, the question of whether real estate taxes can be written off often arises. Understanding the intricacies of tax laws and their potential benefits is crucial for homeowners and investors alike. This comprehensive article delves into the world of real estate taxes and explores the possibilities of tax deductions, providing an in-depth analysis and expert insights.

The Impact of Real Estate Taxes on Your Financial Landscape

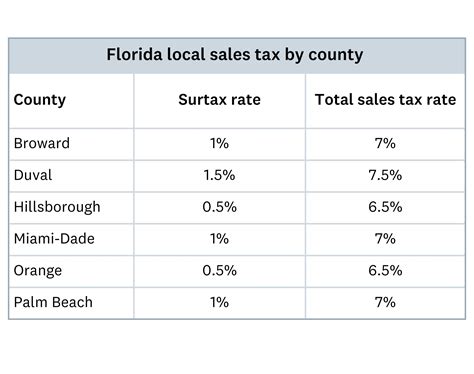

Real estate taxes, also known as property taxes, are an essential component of the financial obligations associated with owning property. These taxes are levied by local governments and are calculated based on the assessed value of the property. For many individuals, real estate taxes represent a significant portion of their annual tax burden.

The concept of writing off real estate taxes refers to the potential deduction of these tax expenses from one's taxable income. By exploring the intricacies of tax laws and regulations, it becomes evident that there are indeed strategies and provisions that allow taxpayers to reduce their tax liabilities through real estate-related deductions.

Understanding the Basics: What are Real Estate Taxes?

Real estate taxes are a form of ad valorem tax, which means they are imposed on the value of the property. These taxes are typically calculated based on the assessed value of the land, improvements (such as buildings), and any additional assessments or improvements made to the property. The assessment process varies across jurisdictions, but it generally involves a thorough evaluation of the property’s characteristics and market conditions.

The assessed value serves as the basis for determining the tax rate, which is typically expressed as a percentage. This rate is then applied to the assessed value to calculate the annual tax liability. Real estate taxes are often used by local governments to fund essential services such as education, infrastructure, and public safety.

For homeowners, real estate taxes can represent a substantial financial commitment. The amount of tax owed can vary significantly depending on factors such as property location, size, and improvements. Understanding the tax assessment process and the factors that influence the tax liability is crucial for effective financial planning and tax strategy development.

Exploring the Tax Deduction Opportunities for Real Estate Owners

When it comes to tax deductions, real estate owners have access to a range of opportunities that can help reduce their overall tax burden. One of the most well-known deductions in this realm is the mortgage interest deduction. Homeowners who have a mortgage on their property can deduct the interest paid on the loan from their taxable income.

This deduction is particularly beneficial for individuals in the early years of their mortgage, as a significant portion of the monthly payments during this period goes towards interest rather than principal. By deducting the mortgage interest, taxpayers can effectively lower their taxable income and potentially receive a substantial tax benefit.

In addition to the mortgage interest deduction, real estate owners may also be eligible for other deductions related to their property. These can include:

- Property Taxes: Many jurisdictions allow taxpayers to deduct the real estate taxes they pay from their federal income tax. This deduction is subject to certain limitations and qualifications, but it can provide significant savings for homeowners.

- Home Office Deduction: If a portion of your property is used exclusively for business purposes, you may be able to deduct a percentage of certain expenses, including real estate taxes, associated with that space. This deduction can be especially advantageous for entrepreneurs and small business owners.

- Rental Property Expenses: If you own rental properties, you can deduct a wide range of expenses, including real estate taxes, maintenance costs, and depreciation. These deductions can help offset the income generated from the rental activity, reducing the overall tax liability.

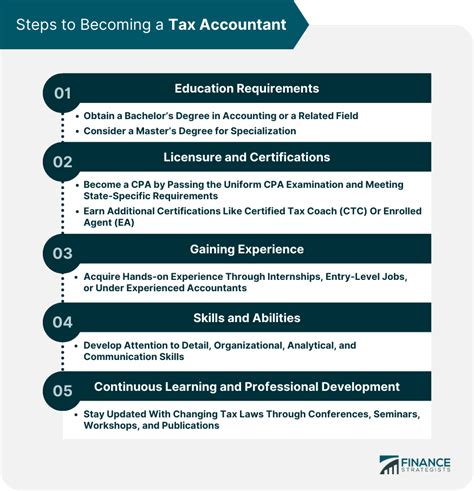

It is important to note that the eligibility and specific rules surrounding these deductions may vary depending on the taxpayer's circumstances and the jurisdiction in which they reside. Consulting with a tax professional or accountant is highly recommended to ensure compliance with applicable laws and to maximize the potential tax benefits.

Maximizing Tax Benefits: Strategies for Real Estate Investors

For real estate investors, understanding the tax implications of their investments is crucial for optimizing their financial strategies. Here are some key considerations and strategies to maximize tax benefits:

Depreciation Deductions

Depreciation is a powerful tool for real estate investors. By claiming depreciation deductions, investors can reduce their taxable income and potentially offset other income sources. Depreciation allows investors to recover the cost of their investment over time, even though the property may appreciate in value. There are different methods of depreciation, such as straight-line depreciation and accelerated depreciation, which can be chosen based on the investor’s specific circumstances.

| Depreciation Method | Description |

|---|---|

| Straight-Line Depreciation | This method allocates an equal amount of depreciation expense over the useful life of the property. |

| Accelerated Depreciation | Accelerated depreciation methods, such as the Modified Accelerated Cost Recovery System (MACRS), allow for faster depreciation and potentially greater tax benefits in the early years of ownership. |

Cost Segregation Studies

A cost segregation study is a valuable tool for real estate investors to identify and separate the various components of a property for tax purposes. By conducting a detailed analysis, investors can allocate a greater portion of the property’s cost to short-lived assets, such as landscaping, fixtures, and certain improvements. This allows for faster depreciation and potentially significant tax savings.

1031 Exchange

A 1031 exchange, also known as a like-kind exchange, is a powerful strategy for real estate investors to defer capital gains taxes. By exchanging one investment property for another of similar value, investors can avoid paying taxes on the realized gains. This strategy allows investors to reinvest their proceeds into new properties, growing their real estate portfolio tax-efficiently.

Pass-Through Entities and Tax Benefits

Real estate investors often utilize pass-through entities, such as partnerships or limited liability companies (LLCs), to structure their investments. These entities allow for the pass-through of income, losses, and deductions to the owners, who report these items on their individual tax returns. By utilizing pass-through entities, investors can potentially reduce their tax liability and take advantage of certain deductions and credits.

Navigating the Complexities: Real-Life Examples and Case Studies

To illustrate the impact and importance of real estate tax deductions, let’s explore some real-life examples and case studies.

Case Study 1: Homeowner Tax Savings

Meet Sarah, a homeowner who purchased a house in a desirable neighborhood two years ago. Sarah’s annual real estate tax bill amounts to $5,000. By claiming the property tax deduction on her federal income tax return, Sarah is able to reduce her taxable income by the full amount of the tax paid. This deduction not only lowers her tax liability but also provides her with a financial cushion, allowing her to allocate those savings towards other financial goals.

Case Study 2: Rental Property Investor Success

John, an experienced real estate investor, owns multiple rental properties. By strategically utilizing depreciation deductions and cost segregation studies, John has been able to significantly reduce his tax liability. Through careful analysis, he identified short-lived assets within his properties, such as certain fixtures and improvements, and allocated a greater portion of the property’s cost to these assets. This accelerated depreciation allowed him to claim substantial deductions in the early years of ownership, resulting in significant tax savings.

Case Study 3: Maximizing Deductions for Business Owners

Emily, a small business owner, operates her business from a dedicated home office space. By claiming the home office deduction, Emily is able to deduct a portion of her real estate taxes, mortgage interest, and other expenses related to her home office. This deduction not only reduces her taxable income but also provides her with a financial incentive to maintain and improve her business space. By maximizing her deductions, Emily is able to reinvest those savings into her business, fostering growth and sustainability.

The Future of Real Estate Tax Deductions: Trends and Implications

As tax laws and regulations evolve, it is essential to stay informed about potential changes and their implications for real estate taxpayers. Here are some key trends and considerations to keep in mind:

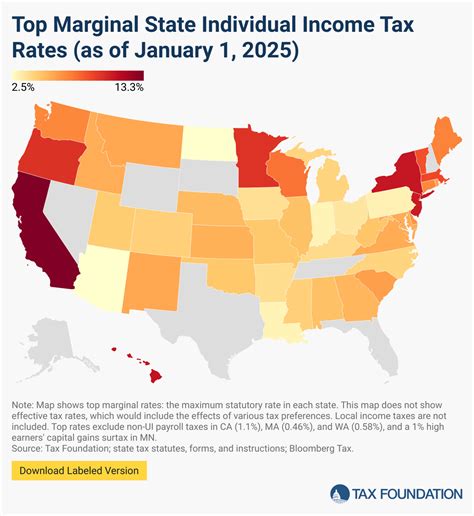

- Tax Reform and Potential Changes: Tax reform efforts at the federal and state levels can significantly impact the availability and extent of real estate tax deductions. Staying updated on proposed changes and their potential effects is crucial for effective tax planning.

- Alternative Valuation Methods: In some jurisdictions, alternative valuation methods, such as market-based approaches or income capitalization, are being considered or implemented for real estate tax assessments. Understanding these methods and their implications is essential for accurately assessing the impact on tax liabilities.

- Digitalization and Data Analytics: The real estate industry is increasingly adopting digital technologies and data analytics to enhance efficiency and transparency. These advancements can also impact tax assessment processes, as they enable more accurate and timely data collection and analysis. Taxpayers should stay informed about these technological advancements and their potential influence on tax assessments.

By staying informed about these trends and actively engaging with tax professionals, real estate taxpayers can ensure they are prepared for any changes and can effectively navigate the evolving tax landscape.

Conclusion

Real estate taxes represent a significant financial obligation for property owners, but understanding the tax deduction opportunities available can help alleviate this burden. From mortgage interest deductions to depreciation strategies, real estate owners and investors have a range of tools to reduce their tax liabilities. By staying informed, consulting with tax professionals, and strategically implementing tax-efficient strategies, individuals can maximize their tax benefits and achieve their financial goals.

Can I deduct real estate taxes if I own a second home or vacation property?

+Yes, you can deduct real estate taxes on a second home or vacation property as long as you meet certain requirements. If the property is used for personal purposes, you can deduct the taxes as an itemized deduction on your federal income tax return. However, if the property is used exclusively for rental purposes, you can deduct the taxes as a business expense.

Are there any limitations to the real estate tax deduction?

+Yes, there are limitations and restrictions on the real estate tax deduction. The Tax Cuts and Jobs Act (TCJA) of 2017 placed a cap on the amount of state and local taxes (including real estate taxes) that can be deducted. The cap is currently set at 10,000 (5,000 for married filing separately). Additionally, certain types of properties, such as investment properties or commercial real estate, may have different deduction rules and limitations.

How often do real estate tax rates change?

+Real estate tax rates can change annually or on a more frequent basis, depending on the jurisdiction. Local governments typically assess property values and determine tax rates based on factors such as budget needs, economic conditions, and market values. It is important for property owners to stay informed about any changes in tax rates to accurately calculate their tax liabilities.