Mi Sales Tax

Welcome to an in-depth exploration of the Mi Sales Tax, a crucial aspect of doing business in the vibrant state of Michigan. This article aims to provide a comprehensive guide, delving into the intricacies of this tax system, its impact on businesses, and its role in shaping the state's economy. By the end of this article, you'll have a thorough understanding of Mi Sales Tax, its importance, and how it affects various industries.

Understanding Mi Sales Tax: An Overview

The Mi Sales Tax, officially known as the Michigan Sales and Use Tax, is a consumption tax levied on the sale of tangible personal property and certain services within the state of Michigan. It is a fundamental component of the state’s revenue generation, contributing significantly to the funding of essential public services and infrastructure development.

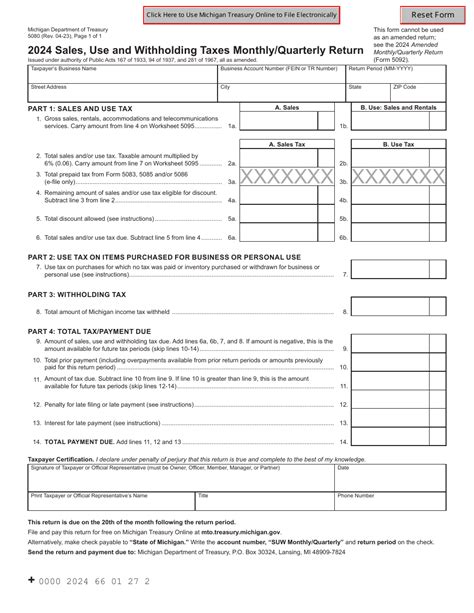

Implemented and regulated by the Michigan Department of Treasury, the sales tax is applied at both the state and local levels, with specific rates varying across different jurisdictions. This complexity arises from the fact that Michigan allows local governments to impose additional sales taxes, creating a unique and diverse tax landscape throughout the state.

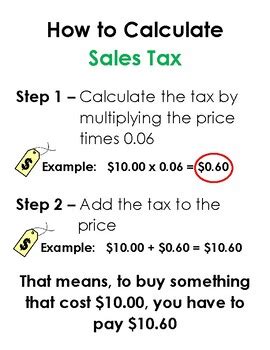

As of [Date], the statewide sales tax rate in Michigan stands at 6%, which is applicable to most retail sales, rentals, and leases of tangible personal property. However, it's important to note that certain items, such as food, prescription drugs, and select services, are exempt from this tax. Additionally, there are local sales tax rates that can increase the overall tax burden, ranging from 0% to 2% depending on the county and municipality.

Key Characteristics of Mi Sales Tax

The Mi Sales Tax exhibits several key characteristics that set it apart from other state tax systems:

- Broad Base, Low Rate: Michigan’s sales tax has a broad base, meaning it applies to a wide range of goods and services, which helps maintain a relatively low tax rate compared to other states.

- Local Variation: The allowance for local governments to impose additional sales taxes creates a diverse tax environment, with rates varying significantly across the state.

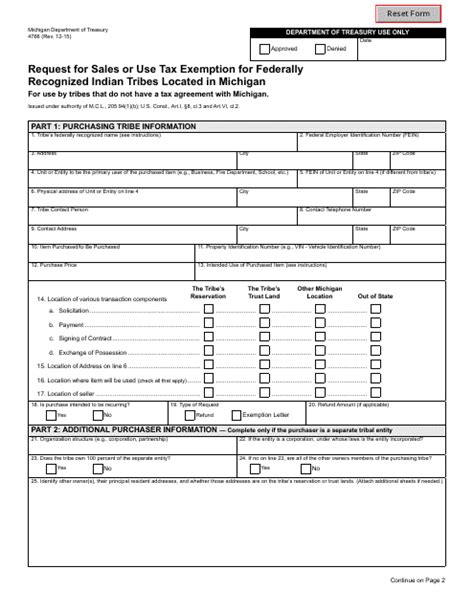

- Exemptions: Certain items and services are exempt from sales tax, including essential items like groceries and medical supplies, to alleviate the tax burden on low-income households.

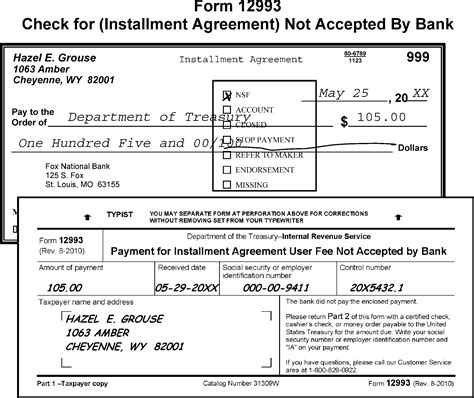

- Use Tax: Michigan also enforces a use tax, which applies to purchases made outside the state but used within Michigan, ensuring that all consumers contribute to the state’s revenue regardless of where they make their purchases.

| Tax Type | Description |

|---|---|

| Sales Tax | Tax on retail sales, rentals, and leases of tangible personal property. |

| Use Tax | Tax on purchases made outside Michigan but used within the state. |

Impact on Businesses and Consumers

The Mi Sales Tax has a profound impact on both businesses and consumers within the state, influencing their financial strategies and purchasing behaviors.

Businesses

For businesses operating in Michigan, the sales tax is a crucial consideration in their financial planning and operational strategies. Here’s how it affects them:

- Revenue Generation: The sales tax is a significant source of revenue for businesses, particularly those with a strong retail presence. It contributes to their overall profitability and can influence their pricing strategies.

- Compliance: Businesses must adhere to strict compliance requirements, including proper tax registration, accurate tax collection, and timely tax remittance. Non-compliance can lead to penalties and legal repercussions.

- Competitive Advantage: Businesses can strategically utilize the sales tax to their advantage, offering tax-free promotions or positioning themselves as tax-efficient alternatives to competitors.

- Tax Software: To streamline compliance, many businesses invest in specialized tax software that automates tax calculation, collection, and reporting processes.

Consumers

Consumers in Michigan are directly impacted by the sales tax through their purchasing decisions and overall financial planning. Consider the following aspects:

- Cost of Living: The sales tax adds to the cost of living in Michigan, impacting consumers’ purchasing power and budget planning. It is particularly relevant for low-income households, as sales tax on essential items can significantly affect their financial stability.

- Shopping Strategies: Consumers often employ various shopping strategies to mitigate the impact of sales tax, such as waiting for tax-free periods, shopping online from out-of-state retailers, or taking advantage of sales and discounts.

- Consumer Awareness: Educated consumers are more likely to be aware of the sales tax rates in their area, influencing their purchasing decisions and preferences for certain retailers or products.

Industry-Specific Considerations

The Mi Sales Tax has unique implications for different industries, shaping their business models and operational strategies. Let’s explore some industry-specific considerations:

Retail and E-commerce

The retail sector, including both traditional brick-and-mortar stores and e-commerce platforms, is directly impacted by the sales tax. Here’s how it affects these industries:

- Online Sales: E-commerce businesses must navigate the complexities of sales tax compliance, especially when shipping products to multiple jurisdictions within Michigan. They often utilize tax software and tools to ensure accurate tax collection and compliance.

- Retail Strategy: Retailers may employ various strategies to enhance their competitiveness, such as offering tax-free promotions, providing convenient in-store pickup options, or partnering with local delivery services to reduce shipping costs.

- Customer Experience: Retailers must provide clear and transparent pricing, including sales tax, to enhance the customer experience and build trust.

Manufacturing and Wholesale

The manufacturing and wholesale industries in Michigan also face unique challenges and opportunities related to the sales tax. Consider the following:

- Exemptions: Certain manufacturing and wholesale activities may be exempt from sales tax, depending on the specific products and services offered. This can provide a significant competitive advantage and impact pricing strategies.

- Supply Chain: Manufacturers and wholesalers must navigate the sales tax implications throughout their supply chain, from raw material procurement to product distribution. This includes considering tax rates at various stages of production and transportation.

- Compliance Complexity: With the potential for multiple tax jurisdictions and varying rates, compliance can be complex for these industries. Specialized tax software and expert consultation may be necessary to ensure accuracy and avoid penalties.

Service-Based Industries

Service-based industries, such as healthcare, education, and professional services, have their own unique considerations when it comes to the Mi Sales Tax:

- Taxability: The taxability of services varies depending on the specific service provided. Some services, such as healthcare and education, are often exempt from sales tax, while others, like professional services, may be subject to tax.

- Pricing Strategies: Service-based businesses must carefully consider the impact of sales tax on their pricing strategies. They may need to adjust their pricing models to remain competitive and ensure client satisfaction.

- Compliance and Reporting: Accurate tax compliance and reporting are essential for these industries. They must stay updated on any changes to tax laws and regulations to avoid compliance issues.

Mi Sales Tax: Future Implications and Potential Reforms

The Mi Sales Tax is a dynamic component of Michigan’s tax system, subject to potential reforms and adjustments to meet the evolving needs of the state and its residents. Here, we explore some future implications and potential reforms that could shape the sales tax landscape in Michigan.

Potential Reforms

There have been ongoing discussions and proposals for sales tax reforms in Michigan, aimed at addressing various concerns and improving the tax system’s effectiveness and fairness. Some potential reforms include:

- Simplification: Simplifying the sales tax structure by reducing the number of tax rates and streamlining the tax collection process could enhance compliance and reduce administrative burdens for businesses.

- Online Sales Tax: With the growth of e-commerce, there is a push to enforce online sales tax collection, ensuring that all retailers, regardless of their physical presence, contribute to the state’s revenue.

- Exemption Review: Reviewing and potentially revising the list of exempt items and services could generate additional revenue for the state while ensuring fairness across industries.

- Local Tax Autonomy: Granting local governments more autonomy in setting sales tax rates could allow for more tailored tax policies that reflect the unique needs and characteristics of different regions.

Future Implications

The future of the Mi Sales Tax holds both opportunities and challenges. Here are some key implications to consider:

- Economic Growth: A well-designed and efficiently administered sales tax system can contribute to Michigan’s economic growth by generating revenue for essential public services and infrastructure development.

- Fairness and Equity: Reforms aimed at ensuring fairness and equity in the sales tax system, such as simplifying rates and addressing tax loopholes, can enhance public trust and support for the tax.

- E-commerce Impact: As e-commerce continues to grow, the sales tax system will need to adapt to effectively tax online sales and prevent revenue leakage.

- Compliance and Technology: Advances in tax software and technology can enhance compliance and reduce the administrative burden for businesses, improving the overall efficiency of the sales tax system.

Conclusion

The Mi Sales Tax is a vital component of Michigan’s tax system, impacting businesses, consumers, and the state’s economy as a whole. Its unique characteristics, including local variation and exemptions, shape the financial strategies and operational approaches of various industries. As Michigan continues to evolve and adapt to changing economic landscapes, the sales tax will likely undergo reforms to ensure its effectiveness, fairness, and sustainability.

Stay tuned for further updates and insights on the Mi Sales Tax and its role in shaping Michigan's future.

¿Cómo afecta el Mi Sales Tax a las pequeñas empresas en Michigan?

+

El Mi Sales Tax tiene un impacto significativo en las pequeñas empresas en Michigan. Estas empresas deben cumplir con las obligaciones de registro, recaudación y remisión del impuesto de ventas, lo que puede suponer una carga administrativa adicional. Además, las pequeñas empresas pueden utilizar estrategias fiscales para mitigar el impacto del impuesto de ventas, como ofrecer promociones sin impuestos o buscar oportunidades de crecimiento en nichos de mercado específicos.

¿Qué impacto tiene el Mi Sales Tax en la economía de Michigan?

+

El Mi Sales Tax es una fuente importante de ingresos para el estado de Michigan, contribuyendo a la financiación de servicios públicos esenciales y al desarrollo de la infraestructura. Sin embargo, también puede afectar la competitividad de las empresas locales y el poder adquisitivo de los consumidores, especialmente en las áreas con tasas de impuesto de ventas más altas.

¿Existen excepciones en el Mi Sales Tax para ciertos productos o servicios?

+

Sí, hay varias excepciones en el Mi Sales Tax. Algunos productos y servicios, como alimentos básicos, medicamentos recetados y ciertos servicios, están exentos del impuesto de ventas. Estas excepciones están diseñadas para aliviar la carga fiscal sobre los consumidores, especialmente aquellos con menos recursos económicos.