Ca Alameda County Sales Tax

In the heart of California, where bustling cities meet a vibrant business landscape, the topic of sales tax is of utmost importance. Alameda County, with its diverse population and thriving economy, implements a sales tax that influences both local businesses and residents. Understanding the intricacies of this tax is essential for anyone navigating the financial landscape of this region. This article aims to provide an in-depth exploration of the Alameda County Sales Tax, covering its history, rates, implications, and future outlook.

Unraveling the Complexities of Alameda County Sales Tax

Alameda County, situated in the San Francisco Bay Area, is home to a dynamic economy, characterized by a diverse range of industries and a thriving consumer market. The sales tax imposed by the county plays a pivotal role in funding essential public services and infrastructure projects. Let’s delve into the key aspects that make up this critical component of the local economy.

Historical Context and Rate Variations

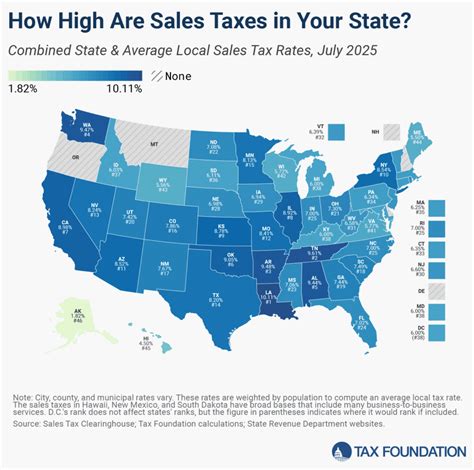

The history of sales tax in Alameda County dates back to the early 1930s, when the state of California first implemented a sales and use tax. Since then, the county has witnessed several rate adjustments, reflecting the evolving needs of its communities and the changing economic landscape. As of 2023, the sales tax rate in Alameda County stands at 9.25%, one of the highest in the state.

This rate is comprised of a 6% state base rate, a 1% local rate, and various additional district and city rates, which can vary depending on the specific location within the county. For instance, the city of Oakland imposes an additional 1% city tax, bringing the total sales tax rate to 10.25% within its boundaries.

| Tax Jurisdiction | Rate (%) |

|---|---|

| Alameda County | 9.25 |

| Oakland City | 10.25 |

| Berkeley City | 9.75 |

| Hayward City | 9.50 |

The Impact on Local Businesses and Residents

The high sales tax rate in Alameda County has a direct impact on both businesses and residents. For businesses, particularly those in the retail sector, the tax can affect their pricing strategies and overall profitability. Higher sales taxes can also influence consumer behavior, potentially driving shoppers to neighboring counties with lower tax rates.

For residents, the sales tax can significantly impact their disposable income and purchasing power. With a higher sales tax rate, residents may opt to make larger purchases online or in neighboring counties to avoid the additional tax burden. This can have a ripple effect on local businesses, especially those relying on foot traffic and in-person sales.

Future Outlook and Potential Changes

Looking ahead, the future of the Alameda County sales tax is a topic of much discussion and speculation. With the county’s diverse population and ever-changing economic landscape, there is a possibility of rate adjustments in the coming years. These adjustments could be influenced by factors such as economic growth, infrastructure needs, and the evolving political climate.

One potential scenario involves the implementation of a uniform sales tax rate across the county, simplifying the tax structure and reducing administrative burdens for businesses. However, such a change would require careful planning and consideration of the unique needs of each city and district within the county.

A Comprehensive Guide to Navigating the Alameda County Sales Tax Landscape

As we navigate the complex world of sales tax in Alameda County, it’s essential to have a comprehensive understanding of the implications and strategies involved. Whether you’re a business owner, consumer, or tax professional, here are some key considerations to keep in mind.

Strategies for Businesses

For businesses operating within Alameda County, here are some strategies to navigate the high sales tax environment:

- Price Adjustments: Consider adjusting your pricing strategy to absorb a portion of the sales tax, making your products more competitive and appealing to local consumers.

- Online Sales: Leverage online platforms to reach a wider audience, particularly those who may be hesitant to make in-store purchases due to the high tax rate.

- Tax Compliance: Ensure strict adherence to tax regulations to avoid penalties and maintain a positive relationship with the local tax authorities.

Tips for Consumers

As a resident of Alameda County, here are some tips to manage your finances effectively in the face of a high sales tax:

- Budgeting: Plan your purchases carefully, factoring in the sales tax to ensure you stay within your financial means.

- Comparison Shopping: Research prices online and in neighboring counties to find the best deals and potentially save on sales tax.

- Tax-Free Days: Stay informed about tax-free events or holidays, which can provide an opportunity to make larger purchases without the additional tax burden.

Tax Professional’s Perspective

Tax professionals play a crucial role in helping businesses and individuals navigate the complex world of sales tax. Here’s an insider perspective on the Alameda County sales tax landscape:

“As a tax professional, I often advise my clients to stay informed about the latest tax regulations and rate changes. In a high-tax environment like Alameda County, accurate record-keeping and timely tax filing are essential to avoid penalties and ensure compliance. Additionally, staying up-to-date with potential tax relief programs or incentives can provide a competitive edge for businesses.”

Frequently Asked Questions

What is the purpose of the Alameda County sales tax?

+

The sales tax in Alameda County is primarily used to fund essential public services, including education, healthcare, transportation, and infrastructure projects. It also contributes to the county’s general fund, which supports various administrative and operational costs.

How does the sales tax affect small businesses in the county?

+

Small businesses may face challenges due to the high sales tax rate, as it can impact their pricing strategies and competitiveness. However, they can mitigate these challenges by exploring online sales channels and implementing effective tax compliance measures.

Are there any tax relief programs available for businesses or residents in Alameda County?

+

Yes, the county offers various tax relief programs and incentives to support businesses and residents. These programs may include tax exemptions for certain industries, credits for job creation, and property tax relief for eligible homeowners. It’s advisable to consult with a tax professional to explore these options.