Tax Unrealized Capital Gains

In the complex world of taxation, the concept of "unrealized capital gains" often emerges as a crucial yet perplexing aspect, especially for investors and financial experts. This term refers to the potential increase in the value of an asset that has yet to be sold or "realized." As such, it carries significant implications for tax strategies and financial planning. In this comprehensive article, we delve deep into the intricacies of tax unrealized capital gains, shedding light on its definition, tax implications, strategies for managing it, and the latest developments in this area.

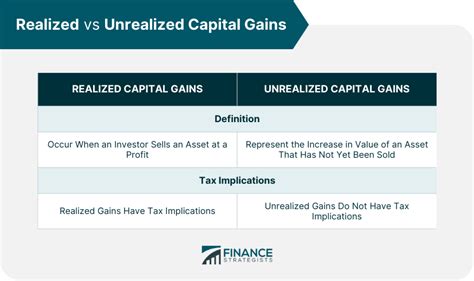

Understanding Unrealized Capital Gains

An unrealized capital gain represents the increase in value of an asset since its acquisition, which remains untapped until the asset is sold. This could include various assets like stocks, bonds, real estate, or even collectibles. The term “unrealized” implies that the gain is only on paper and hasn’t been converted into cash or other liquid assets. It’s an important concept to grasp, as it forms the basis for capital gains tax, a significant source of revenue for governments worldwide.

Calculation of Unrealized Capital Gains

Calculating unrealized capital gains is straightforward. It’s the difference between the current market value of the asset and its acquisition cost (also known as the basis). For instance, if you purchased a stock for 50,000 and its current market value is 70,000, your unrealized capital gain is $20,000. This calculation provides a snapshot of the potential profit an investor stands to make if they were to sell the asset at its current market price.

| Asset Type | Acquisition Cost | Current Market Value | Unrealized Capital Gain |

|---|---|---|---|

| Stock | $50,000 | $70,000 | $20,000 |

| Real Estate | $300,000 | $350,000 | $50,000 |

| Collectible (Artwork) | $15,000 | $22,000 | $7,000 |

Tax Implications of Unrealized Capital Gains

The tax implications of unrealized capital gains are a critical aspect of financial planning. Many countries levy taxes on capital gains, including those that are unrealized. This taxation strategy aims to capture the increase in asset value, even if the investor hasn’t cashed out. Here’s a deeper look at how this works.

Tax Treatment of Unrealized Capital Gains

The tax treatment of unrealized capital gains can vary based on jurisdiction and the type of asset. Generally, tax authorities do not tax unrealized capital gains directly. Instead, they tax the realized capital gain when an asset is sold or “disposed of” through other means. This means that if an investor holds an asset with an unrealized capital gain and doesn’t sell it, they don’t incur a tax liability for that gain. However, this scenario can change if certain events occur.

- Forced Sale: If an asset is involuntarily converted, such as through theft, casualty loss, or condemnation, the unrealized capital gain may be realized and subject to tax.

- Gifts and Transfers: When an asset is gifted or transferred, the recipient's basis is typically the fair market value at the time of the gift or transfer. This can result in an immediate tax liability for the recipient if they were to sell the asset.

- Death: Upon an investor's death, the unrealized capital gains may be realized for tax purposes. This is often referred to as a "step-up in basis," where the asset's basis is adjusted to its fair market value at the time of death.

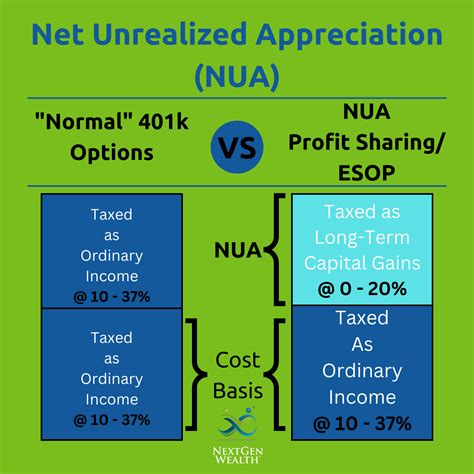

Capital Gains Tax Rates

Capital gains tax rates can vary widely depending on the jurisdiction and the type of asset. In many countries, capital gains are taxed at a lower rate than ordinary income. This is often referred to as a preferential tax rate for capital gains. For instance, in the United States, capital gains tax rates range from 0% to 20%, depending on the taxpayer’s income level and the holding period of the asset. Short-term capital gains (assets held for less than a year) are typically taxed at ordinary income tax rates, while long-term capital gains (assets held for more than a year) benefit from the preferential rates.

| Jurisdiction | Short-Term Capital Gains Tax Rate | Long-Term Capital Gains Tax Rate |

|---|---|---|

| United States | Up to 37% (same as ordinary income tax rate) | 0% - 20% |

| United Kingdom | Up to 45% (same as ordinary income tax rate) | 10% - 20% |

| Canada | Up to 33% (same as ordinary income tax rate) | 0% - 29.67% |

Strategies for Managing Unrealized Capital Gains

Given the potential tax implications of unrealized capital gains, investors often employ various strategies to manage them effectively. These strategies aim to minimize tax liabilities while optimizing investment returns. Here are some common approaches.

Harvesting Losses

Loss harvesting is a strategy where investors sell assets at a loss to offset their capital gains. This strategy can be particularly beneficial for investors with substantial unrealized capital gains. By selling assets at a loss, they can offset the capital gains realized from the sale of other assets, reducing their overall tax liability. However, it’s important to note that tax laws often have rules to prevent abuse of this strategy, such as the wash sale rule in the United States, which disallows loss harvesting if an identical or substantially identical asset is purchased within a certain period.

Tax-Loss Selling

Tax-loss selling is another strategy where investors sell assets at a loss to reduce their tax liability. This strategy is often used at the end of the tax year to offset realized capital gains. By doing so, investors can reduce their taxable income and, consequently, their tax liability. It’s a strategic move that requires careful planning and understanding of tax laws to avoid potential pitfalls.

Capital Gains Tax Planning

Effective capital gains tax planning involves a holistic approach to investment and tax strategies. This can include strategies like asset allocation, portfolio rebalancing, and tax-efficient investing. For instance, investors can consider holding assets for longer periods to benefit from long-term capital gains tax rates or invest in assets that are exempt from capital gains tax. It’s crucial to consult with a financial advisor or tax professional to develop a personalized tax plan that aligns with your investment goals and risk tolerance.

The Future of Tax Unrealized Capital Gains

The landscape of tax unrealized capital gains is ever-evolving, influenced by economic trends, government policies, and legal reforms. As governments seek to optimize tax revenues and adapt to changing economic conditions, the tax treatment of unrealized capital gains may undergo transformations. Here are some potential future developments.

Potential Changes in Tax Laws

Governments may introduce new laws or amend existing ones to adapt to the evolving economic landscape. For instance, there have been discussions about introducing a wealth tax or mark-to-market rules for certain assets, which could impact the tax treatment of unrealized capital gains. These changes could significantly alter tax planning strategies, prompting investors to adapt their approaches accordingly.

Impact of Economic Trends

Economic trends, such as inflation or market downturns, can influence the value of assets and, consequently, the amount of unrealized capital gains. In times of economic uncertainty, investors may opt to hold onto assets, hoping for a market recovery. Conversely, during economic booms, they may be more inclined to sell, realizing their gains and potentially facing higher tax liabilities. Understanding these trends and their potential impact on asset values is crucial for effective tax planning.

Digital Asset Taxation

The rise of digital assets, such as cryptocurrencies, has presented new challenges for tax authorities. These assets often have significant unrealized capital gains, but their taxation is complex and varies across jurisdictions. As the use of digital assets grows, governments are likely to introduce more comprehensive regulations and tax frameworks to address this evolving landscape. Investors in digital assets should stay informed about these developments to ensure compliance and effective tax planning.

Conclusion

The concept of tax unrealized capital gains is a critical aspect of financial planning and investment strategies. Understanding the tax implications of unrealized capital gains, the strategies to manage them, and the potential future developments in this area is essential for investors and financial professionals. By staying informed and proactive, investors can navigate the complexities of tax unrealized capital gains, optimize their tax liabilities, and achieve their financial goals.

How do unrealized capital gains differ from realized capital gains?

+Unrealized capital gains represent the potential increase in the value of an asset that has yet to be sold, while realized capital gains are the actual profits made when an asset is sold. Unrealized gains are not taxed directly, but they can impact future tax liabilities if the asset is sold or certain events occur, such as a forced sale or death of the investor.

Are unrealized capital gains always subject to tax?

+No, unrealized capital gains are not directly taxed. However, they can trigger tax liabilities if the asset is sold or certain events occur, such as a forced sale or death of the investor. It’s important to understand the tax laws applicable to your jurisdiction and asset type to effectively manage your tax liability.

What are some strategies to manage unrealized capital gains effectively?

+Strategies to manage unrealized capital gains include harvesting losses, tax-loss selling, and effective capital gains tax planning. These strategies aim to minimize tax liabilities while optimizing investment returns. It’s crucial to consult with a financial advisor or tax professional to develop a personalized tax plan that aligns with your investment goals and risk tolerance.

How might future developments impact the tax treatment of unrealized capital gains?

+Future developments, such as changes in tax laws, economic trends, and the rise of digital assets, can significantly impact the tax treatment of unrealized capital gains. Governments may introduce new laws or amend existing ones to adapt to the evolving economic landscape. Investors should stay informed about these developments to ensure compliance and effective tax planning.