Personal Property Tax Receipt

Personal property tax is an essential aspect of property ownership, and understanding the process and implications of this tax is crucial for every property owner. In this comprehensive guide, we will delve into the world of personal property tax, exploring its intricacies, legal aspects, and the practical steps involved in obtaining a tax receipt. By the end of this article, you will have a clear understanding of the role of personal property tax and the significance of the tax receipt, ensuring you can navigate this process with confidence.

Understanding Personal Property Tax

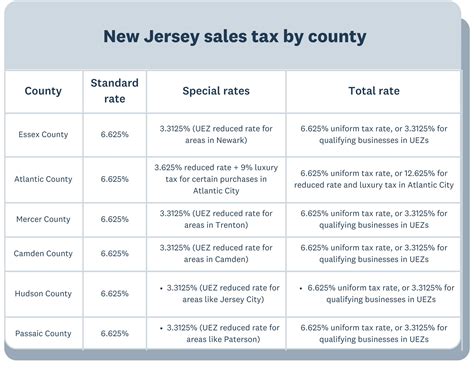

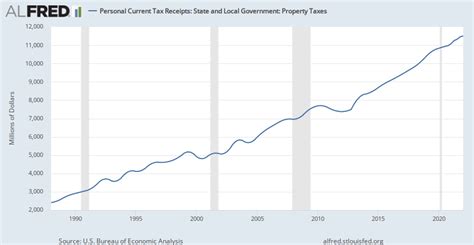

Personal property tax, often referred to as PP tax, is a levy imposed by local governments on the value of tangible assets owned by individuals or businesses. These assets can include vehicles, boats, aircraft, and even certain types of business equipment. The tax is typically calculated based on the assessed value of the property and is an important source of revenue for municipalities.

While the specific rules and rates may vary from one jurisdiction to another, the underlying principle remains consistent: personal property tax ensures that property owners contribute to the maintenance and development of the community's infrastructure and services. This tax helps fund essential public services such as education, healthcare, public safety, and infrastructure maintenance.

The Legal Framework

Personal property tax is governed by a complex web of laws and regulations. These laws define the types of property subject to taxation, the assessment process, and the rights and obligations of property owners. Understanding the legal framework is crucial for navigating the tax system effectively.

In most jurisdictions, personal property tax is administered by local tax authorities, often under the supervision of a county or municipal government. These authorities are responsible for assessing the value of personal property, determining the applicable tax rate, and collecting the tax revenue.

Assessment and Valuation

The assessment process is a critical component of personal property tax. Assessors, who are often employed by the local tax authority, are tasked with evaluating the value of personal property. They may use various methods, including market value, cost replacement, or income-based approaches, to determine the fair market value of the property.

Once the assessment is complete, property owners are informed of the assessed value and the corresponding tax liability. At this stage, property owners have the right to review the assessment and, if necessary, appeal the valuation if they believe it is inaccurate or unfair.

Tax Rates and Due Dates

Tax rates for personal property can vary significantly depending on the jurisdiction. Some areas may have a flat rate, while others may apply different rates based on the type of property or its intended use. For instance, vehicles may be taxed at a different rate than recreational property.

Additionally, personal property tax often has specific due dates. Failure to pay the tax by the deadline can result in penalties, interest charges, and even the seizure of the property. It is crucial for property owners to stay informed about the tax due dates and make timely payments to avoid any legal consequences.

The Importance of a Personal Property Tax Receipt

Obtaining a personal property tax receipt is a critical step in the tax payment process. This receipt serves as official proof that the tax has been paid and is an essential document for several reasons.

Legal Compliance and Record-Keeping

A tax receipt is a legal document that demonstrates compliance with the tax laws. It provides evidence that the property owner has fulfilled their tax obligations and can be used to resolve any disputes or audits related to personal property tax.

Furthermore, tax receipts are crucial for record-keeping purposes. Property owners should maintain a comprehensive collection of tax receipts to demonstrate their tax history. These records can be invaluable in case of a tax audit or when selling the property, as they provide a clear history of tax payments.

Proof of Ownership

In certain situations, a personal property tax receipt can serve as proof of ownership. For example, when registering a vehicle, the tax receipt may be required as evidence that the owner has paid the necessary taxes on the vehicle. This is particularly important for second-hand vehicle purchases, where the receipt can confirm the legitimacy of the transaction.

Vehicle Registration and Licensing

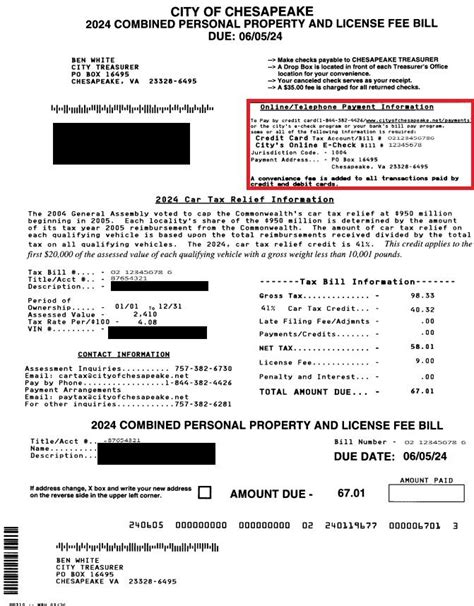

Personal property tax receipts are often a prerequisite for vehicle registration and licensing. Many jurisdictions require vehicle owners to present a valid tax receipt when applying for a new registration or license plate. Failure to provide this document can result in delays or even denial of the registration process.

Obtaining a Personal Property Tax Receipt

The process of obtaining a personal property tax receipt can vary depending on the jurisdiction and the type of property involved. However, there are some general steps that property owners can follow to ensure a smooth and timely receipt acquisition.

Step 1: Understand Your Tax Obligations

The first step is to familiarize yourself with the tax laws and regulations in your jurisdiction. This includes understanding the types of personal property subject to taxation, the assessment process, and the applicable tax rates. Being well-informed will help you navigate the tax system efficiently.

Step 2: Determine Your Tax Liability

Once you have a clear understanding of the tax laws, calculate your tax liability. This involves multiplying the assessed value of your personal property by the applicable tax rate. Ensure you have accurate and up-to-date information on the assessed value, as it may change annually.

Step 3: Make Timely Tax Payments

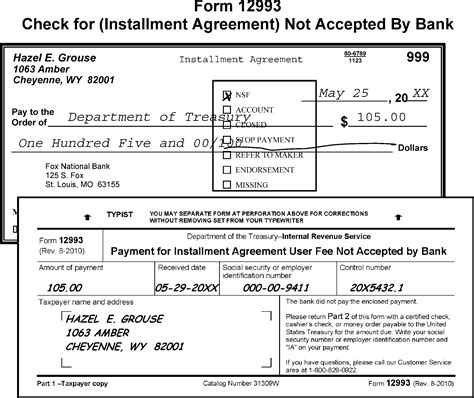

Paying your personal property tax on time is crucial to avoid penalties and interest charges. Most jurisdictions offer multiple payment methods, including online payments, mail-in payments, or in-person payments at designated tax offices. Choose the method that is most convenient for you and ensure you meet the payment deadline.

Step 4: Request a Tax Receipt

After making your tax payment, you can request a tax receipt. This can be done online, through the mail, or in person at the tax office. When requesting the receipt, ensure you provide all the necessary details, such as your property’s identification number, the tax year, and any other specific information required by your jurisdiction.

Step 5: Verify and Store Your Receipt

Upon receiving your tax receipt, carefully review it to ensure it accurately reflects your payment details. Check the tax amount, the property description, and any other relevant information. If there are any discrepancies, contact the tax authority immediately to resolve the issue.

Once the receipt is verified, store it in a safe and accessible location. Consider creating a digital copy for easy retrieval and backup. Having multiple copies of your tax receipts can be beneficial in case of loss or damage to the original document.

Personal Property Tax Receipt: A Practical Guide

Now that we’ve explored the importance and acquisition process of personal property tax receipts, let’s delve into some practical considerations and best practices to ensure a seamless experience.

Online Payment and Receipt Options

Many tax authorities offer online payment platforms, providing a convenient and efficient way to pay your personal property tax. These platforms often generate electronic tax receipts, which can be downloaded, printed, or stored digitally. Online payments are typically secure and provide a faster turnaround time compared to traditional mail-in payments.

Payment Plans and Installments

For property owners facing financial challenges, some jurisdictions offer payment plans or installment options. These arrangements allow property owners to spread out their tax payments over a specified period, making it more manageable to meet their tax obligations. Contact your local tax authority to inquire about available payment plans and the eligibility criteria.

Electronic Filing and Receipt Management

In today’s digital age, electronic filing and receipt management systems can greatly simplify the tax process. Many tax authorities provide online portals where property owners can register their personal property, file tax returns, and manage their tax payments and receipts. These systems often offer features such as automatic reminders, receipt storage, and easy access to tax history.

Appealing Assessments and Tax Disputes

If you believe your personal property has been assessed unfairly or if you have a dispute regarding your tax liability, it is important to know your rights. Most jurisdictions have established appeal processes, allowing property owners to challenge assessments and seek a fair resolution. Familiarize yourself with the appeal process in your area and seek professional advice if needed.

Stay Informed: Tax Updates and Changes

Tax laws and regulations are subject to change, and it is crucial to stay informed about any updates or amendments. Local tax authorities often publish tax guides, newsletters, or websites that provide the latest information on tax rates, due dates, and any changes to the tax system. Regularly checking these resources will help you stay compliant and avoid any unexpected surprises.

Conclusion: Empowering Property Owners

Personal property tax is an integral part of property ownership, and understanding its intricacies is essential for every responsible property owner. By navigating the tax system with knowledge and confidence, you can ensure compliance, avoid legal issues, and effectively manage your tax obligations.

The personal property tax receipt serves as a vital document, offering proof of compliance, facilitating vehicle registration, and providing a record of your tax history. By following the steps outlined in this guide and staying informed about the tax laws, you can obtain your tax receipt seamlessly and ensure a positive experience throughout the process.

Remember, being a proactive and informed property owner not only ensures compliance with the law but also contributes to the overall well-being of your community. So, stay informed, manage your tax obligations diligently, and make the most of the resources available to you.

How often do I need to pay personal property tax, and when are the due dates?

+The frequency of personal property tax payments and the due dates can vary depending on your jurisdiction. Some areas may require annual payments, while others may have semi-annual or even quarterly due dates. It is essential to consult your local tax authority’s guidelines or visit their official website to find the specific due dates for your region. Staying informed about these deadlines is crucial to avoid late payment penalties.

Can I appeal my personal property tax assessment if I believe it is inaccurate or unfair?

+Yes, most jurisdictions provide a process for property owners to appeal their tax assessments. If you believe your personal property has been unfairly valued, you have the right to challenge the assessment. The appeal process typically involves submitting a formal request to the tax authority, providing evidence to support your claim, and potentially attending a hearing. Familiarize yourself with the appeal procedures in your area to ensure a successful challenge.

What happens if I fail to pay my personal property tax on time?

+Failure to pay personal property tax by the due date can result in significant penalties and interest charges. The specific consequences may vary depending on your jurisdiction, but they often include late payment fees, additional interest on the outstanding amount, and, in some cases, legal action or the seizure of your personal property. It is crucial to prioritize timely tax payments to avoid these penalties and maintain good standing with the tax authority.

Can I obtain a personal property tax receipt online, or do I need to visit a tax office in person?

+Many tax authorities now offer online services, including the option to pay personal property tax and obtain a receipt electronically. This provides a convenient and efficient way to manage your tax obligations without the need to visit a physical tax office. However, it is essential to check with your local tax authority to confirm the availability of online services and the specific requirements for obtaining a tax receipt.