City Of West Haven Tax Collector

Welcome to the city of West Haven, a vibrant coastal community nestled along the shores of Connecticut. Amidst its rich history and bustling neighborhoods, the West Haven Tax Collector's office plays a pivotal role in ensuring the efficient administration of taxes and financial obligations. This article delves into the intricacies of the West Haven Tax Collector's operations, shedding light on its services, responsibilities, and the vital role it plays in maintaining the financial stability of the city.

Introduction to the West Haven Tax Collector’s Office

The West Haven Tax Collector’s Office is a dedicated entity within the city’s administrative framework, tasked with the crucial responsibility of managing and collecting various taxes and fees levied by the municipality. Headquartered at 355 Main Street, West Haven, CT 06516, this department serves as the primary point of contact for residents and businesses regarding tax-related matters.

Under the leadership of the esteemed Tax Collector, Sarah Johnson, the office prides itself on maintaining a high standard of service and efficiency. With a team of experienced professionals, the department strives to provide timely and accurate tax administration, ensuring a smooth financial relationship between the city and its stakeholders.

The West Haven Tax Collector's Office is responsible for a diverse range of tax-related functions, including but not limited to: property taxes, motor vehicle taxes, business taxes, and various other fees and assessments. Their comprehensive services aim to simplify the tax payment process for residents and businesses, fostering a culture of financial responsibility and compliance.

Services Offered by the West Haven Tax Collector

The West Haven Tax Collector’s Office offers a wide array of services tailored to meet the diverse needs of its constituents. Here’s an in-depth look at some of the key services provided by the department:

Property Tax Assessment and Collection

Property taxes form a significant portion of the city’s revenue stream, and the Tax Collector’s Office plays a crucial role in ensuring their timely and accurate collection. The department conducts annual assessments of all real estate properties within the city limits, determining the fair market value and subsequently calculating the applicable property tax.

Property owners in West Haven can access their tax information and make payments online through the West Haven Tax Portal. This user-friendly platform offers a convenient way to view tax bills, check payment history, and make secure payments using various methods such as credit cards, debit cards, and electronic checks. For those who prefer traditional methods, the office also accepts payments in person, by mail, or via drop boxes located at designated city halls.

| Property Tax Collection Dates | Due Dates |

|---|---|

| 1st Installment | August 1st - November 1st |

| 2nd Installment | February 1st - May 1st |

Motor Vehicle Taxes

West Haven residents are required to pay motor vehicle taxes annually, based on the assessed value of their registered vehicles. The Tax Collector’s Office handles the administration and collection of these taxes, ensuring that vehicle owners are compliant with state regulations.

Motor vehicle tax bills are typically mailed out in March, with a due date of May 1st. Payments can be made online, in person, or through the mail, and the office provides a convenient 10-month payment plan for those who wish to spread out their tax payments.

Business Taxes and Licenses

The Tax Collector’s Office is responsible for collecting business taxes and ensuring that all businesses operating within West Haven are properly licensed and compliant with local regulations. This includes the issuance of business licenses, collection of business privilege taxes, and the administration of various other business-related fees.

Businesses can apply for licenses and permits through the West Haven Business Portal, a centralized platform that streamlines the process and provides a single point of contact for all business-related matters. The Tax Collector's Office works closely with the city's Economic Development Office to promote a business-friendly environment and facilitate the growth of local enterprises.

Other Fees and Assessments

In addition to the aforementioned taxes, the Tax Collector’s Office is also responsible for collecting various other fees and assessments, such as:

- Trash Collection Fees: Residents are charged an annual fee for trash collection services, which is included in their property tax bill.

- Water and Sewer Fees: These fees are calculated based on water consumption and are billed separately from property taxes.

- Parking Permits: Residents and businesses can purchase parking permits through the Tax Collector's Office, providing access to designated parking areas.

- Special Assessments: In certain cases, the city may levy special assessments for infrastructure improvements or other specific projects. The Tax Collector's Office handles the administration and collection of these assessments.

Payment Options and Online Services

The West Haven Tax Collector’s Office recognizes the importance of providing convenient and secure payment options to its constituents. To accommodate various preferences and needs, the department offers a range of payment methods, both online and offline.

Online Payment Options

The West Haven Tax Portal serves as the primary online platform for tax-related transactions. Residents and businesses can access their accounts, view tax bills, and make payments using the following methods:

- Credit/Debit Cards: Major credit and debit cards are accepted for online payments, providing a quick and convenient option for tax payers.

- Electronic Checks: Residents can also pay their taxes using electronic checks, which offer a secure and cost-effective alternative to traditional paper checks.

- eBilling: This feature allows users to receive their tax bills electronically, eliminating the need for paper statements and reducing environmental impact.

- Auto-Pay: For those who prefer a hassle-free approach, the Auto-Pay feature enables automatic payments on due dates, ensuring timely payment without manual intervention.

In-Person and Mail-In Payments

For those who prefer traditional methods, the Tax Collector’s Office accepts payments in person at their Main Street location during regular business hours. Residents can also mail their payments to the following address:

West Haven Tax Collector's Office

355 Main Street

West Haven, CT 06516

Payments by mail should be accompanied by the remittance portion of the tax bill to ensure accurate processing.

Payment Plan Options

Recognizing that tax payments can be a financial burden for some residents, the Tax Collector’s Office offers flexible payment plan options for both property and motor vehicle taxes. These plans allow taxpayers to spread out their payments over a period of time, making it more manageable to meet their financial obligations.

The office typically offers a 10-month payment plan for property taxes and a similar plan for motor vehicle taxes. To enroll in a payment plan, residents need to contact the Tax Collector's Office directly to discuss their eligibility and the terms of the plan.

Tax Relief Programs and Exemptions

The West Haven Tax Collector’s Office is committed to providing support and relief to eligible residents through various tax relief programs and exemptions. These initiatives aim to ease the financial burden on certain segments of the population, promoting equity and financial stability within the community.

Senior Citizen Tax Relief Program

The Senior Citizen Tax Relief Program is designed to provide property tax relief to eligible senior citizens residing in West Haven. To qualify, individuals must meet the following criteria:

- Be 65 years of age or older

- Have a total household income of less than $35,000

- Own and occupy the property as their primary residence

Eligible seniors can receive a reduction in their property tax assessment, making it more affordable to maintain their homes. The Tax Collector's Office provides application forms and guidance to help seniors navigate the process and access the benefits they are entitled to.

Veterans’ Property Tax Relief Program

West Haven is proud to support its veterans through the Veterans’ Property Tax Relief Program. This program offers a reduction in property tax assessments for eligible veterans, recognizing their service and sacrifice.

To qualify, veterans must meet the following requirements:

- Have served in the U.S. Armed Forces during a period of declared war or conflict

- Own and occupy the property as their primary residence

- Have a total household income of less than $35,000

Eligible veterans can receive a substantial reduction in their property tax bill, providing much-needed financial relief. The Tax Collector's Office works closely with the city's Veterans Affairs Office to ensure that veterans are aware of this program and can easily access the benefits they deserve.

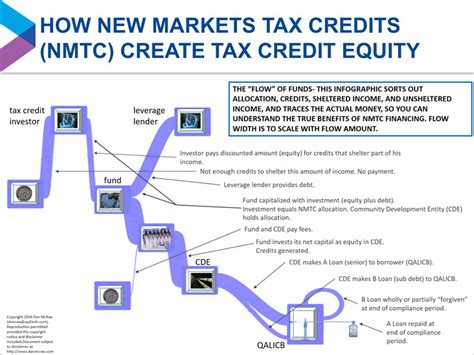

Other Tax Exemptions and Credits

In addition to the above programs, West Haven offers various other tax exemptions and credits to eligible residents and businesses. These include:

- Blind Persons Tax Exemption: Property tax exemption for legally blind residents.

- Farmland Preservation Tax Relief: Tax relief for agricultural lands, encouraging the preservation of farmland within the city.

- Home Improvement Tax Credit: A tax credit for eligible home improvement projects, promoting the rehabilitation of residential properties.

- Historic Preservation Tax Credit: Tax incentives for the preservation and restoration of historic properties.

The Tax Collector's Office provides detailed information and application guidelines for these programs, ensuring that residents and businesses can take advantage of the available tax benefits.

Future Initiatives and Technological Advancements

As technology continues to advance, the West Haven Tax Collector’s Office remains committed to embracing innovative solutions to enhance its services and improve the overall taxpayer experience. Here’s a glimpse into some of the future initiatives and technological advancements the department is exploring:

Digital Transformation

The Tax Collector’s Office is undergoing a digital transformation, leveraging technology to streamline processes and improve efficiency. This includes the development of a comprehensive digital platform that integrates various tax-related services, providing a one-stop solution for taxpayers.

The new platform will offer enhanced features such as:

- Taxpayer Profile Management: Residents and businesses will be able to create and manage their online profiles, providing a centralized hub for all their tax-related information.

- Document Upload and Storage: Users will be able to upload and store important tax documents, such as receipts, invoices, and proof of payments, ensuring easy access and organization.

- Real-Time Payment Tracking: The platform will provide real-time updates on payment status, allowing taxpayers to monitor the progress of their transactions and receive instant confirmation upon successful payment.

- AI-Powered Support: Artificial intelligence will be utilized to provide personalized assistance and answer frequently asked questions, enhancing the user experience and reducing response times.

Mobile App Development

Recognizing the growing preference for mobile interactions, the Tax Collector’s Office is exploring the development of a dedicated mobile app. This app will provide taxpayers with convenient access to their tax information, payment options, and other relevant services on the go.

Key features of the proposed mobile app include:

- Push Notifications: Users will receive timely notifications about upcoming tax deadlines, payment due dates, and important tax-related announcements.

- Location-Based Services: The app will utilize GPS technology to provide users with directions to the Tax Collector's Office and other relevant locations, making it easier to navigate and access services.

- QR Code Payments: A secure and innovative payment method, allowing taxpayers to scan QR codes to make payments quickly and easily.

Data Analytics and Insights

By leveraging advanced data analytics tools, the Tax Collector’s Office aims to gain deeper insights into taxpayer behavior and trends. This data-driven approach will enable the department to make informed decisions, optimize processes, and enhance the overall efficiency of tax administration.

Key areas of focus for data analytics include:

- Taxpayer Segmentation: Analyzing taxpayer data to identify patterns and trends, allowing for more targeted communication and tailored services.

- Payment Behavior Analysis: Studying payment patterns to identify areas for improvement and develop strategies to encourage timely payments and reduce delinquency.

- Performance Measurement: Tracking key performance indicators to assess the effectiveness of tax collection processes and identify areas for enhancement.

Community Engagement and Outreach

The West Haven Tax Collector’s Office understands the importance of building strong relationships with the community and fostering an environment of transparency and trust. To achieve this, the department actively engages with residents and businesses through various outreach initiatives and community events.

Community Outreach Programs

The Tax Collector’s Office regularly participates in community events and fairs, providing residents with an opportunity to meet the staff, ask questions, and gain a better understanding of the tax collection process. These events also serve as a platform to promote the various tax relief programs and services offered by the department.

Additionally, the office conducts regular outreach campaigns, distributing informational materials and hosting educational workshops to raise awareness about tax obligations, payment options, and available tax relief programs. These initiatives aim to empower residents with the knowledge and tools they need to navigate the tax system effectively.

Partnerships and Collaborations

The Tax Collector’s Office actively collaborates with other city departments and community organizations to enhance its services and promote financial literacy. By working together, these entities can provide a more comprehensive support system for residents, ensuring that tax-related matters are addressed efficiently and effectively.

Some of the key partnerships include:

- City Hall: Close collaboration with City Hall ensures a seamless flow of information and a unified approach to tax administration.

- Economic Development Office: Joint efforts with the Economic Development Office promote a business-friendly environment and facilitate the growth of local enterprises.

- Senior Centers: The Tax Collector's Office often partners with senior centers to provide tax assistance and outreach programs specifically tailored to the needs of senior citizens.

- Veterans Affairs Office: Working closely with the Veterans Affairs Office, the Tax Collector's Office ensures that veterans are aware of and can access the benefits they are entitled to, including tax relief programs.

Financial Literacy Initiatives

Recognizing the importance of financial literacy, the Tax Collector’s Office actively participates in and supports initiatives aimed at educating residents about financial management and tax obligations. These initiatives include:

- Workshops and Seminars: The office hosts regular workshops and seminars, covering topics such as tax planning, budgeting, and financial management. These events provide residents with practical knowledge and tools to make informed financial decisions.

- Online Resources: The West Haven Tax Portal offers a wealth of resources and educational materials, including tax guides, payment tips, and information on tax relief programs. These resources are easily accessible and provide valuable support to taxpayers.

- Community Partnerships: The Tax Collector's Office collaborates with local community organizations, schools, and financial institutions to promote financial literacy and provide residents with access to additional support and resources.

Frequently Asked Questions (FAQ)

What is the due date for property tax payments in West Haven?

+

Property tax payments in West Haven are due in two installments. The first installment is due on November 1st, and the second installment is due on May 1st. It’s important to make these payments on time to avoid late fees and penalties.