Tax Changes

The world of taxation is ever-evolving, with governments and regulatory bodies introducing new measures, amendments, and reforms to adapt to changing economic landscapes and societal needs. Tax changes, though often complex and intricate, are vital to the functioning of modern economies, impacting individuals, businesses, and the overall fiscal health of nations. This comprehensive article aims to delve into the recent tax changes, their implications, and the strategies to navigate this dynamic environment.

Unraveling the Latest Tax Amendments

In recent times, tax systems globally have undergone significant transformations to address various economic challenges and promote sustainable growth. These changes are diverse, ranging from adjustments in income tax brackets to the introduction of new environmental levies and the reform of corporate tax structures.

Income Tax Reforms: A Focus on Equity and Efficiency

Many countries have been reevaluating their income tax systems to promote fairness and stimulate economic growth. One notable trend is the expansion of tax brackets, particularly at the higher income levels, to ensure that those with greater earning capacity contribute proportionally more to the public purse. For instance, the United States recently introduced a new top income tax bracket of 37% for individuals earning over $539,900 annually.

Additionally, some nations have been adjusting tax rates for middle-income earners to provide relief and boost disposable incomes. For example, the United Kingdom reduced its basic rate of income tax from 20% to 19% in 2023, benefiting millions of taxpayers. Such measures aim to stimulate consumer spending and support economic recovery.

Corporate Tax: Balancing Revenue and Competitiveness

Corporate tax reforms have been a key focus area, especially with the rise of multinational corporations and the need to ensure they pay their fair share. Several countries have been implementing measures to prevent profit shifting and tax avoidance, often through the introduction of minimum tax rates. The OECD’s (Organisation for Economic Co-operation and Development) pillar one and pillar two proposals are notable examples, aiming to establish a more stable and equitable international tax system.

Furthermore, some nations have been reducing their corporate tax rates to attract foreign investment and promote domestic business growth. For instance, Ireland has maintained its 12.5% corporate tax rate, one of the lowest in the European Union, which has contributed to its success as a hub for multinational corporations.

Environmental Taxes: Promoting Sustainability

In response to the global climate crisis, many governments have been introducing or increasing environmental taxes. These levies aim to discourage environmentally harmful activities and encourage the adoption of sustainable practices. For instance, several European countries have implemented carbon taxes, such as Sweden’s carbon dioxide tax, which stands at €120 per ton of CO2 emitted.

Additionally, some jurisdictions have introduced or increased taxes on single-use plastics, such as Canada's proposed plastic tax, set to come into effect in 2023, which aims to encourage a shift towards reusable and recyclable materials.

Navigating the Tax Landscape: Strategies and Considerations

With the ever-changing tax environment, individuals and businesses must adapt their strategies to ensure compliance and optimize their financial positions.

Individual Tax Planning: Maximizing Benefits and Compliance

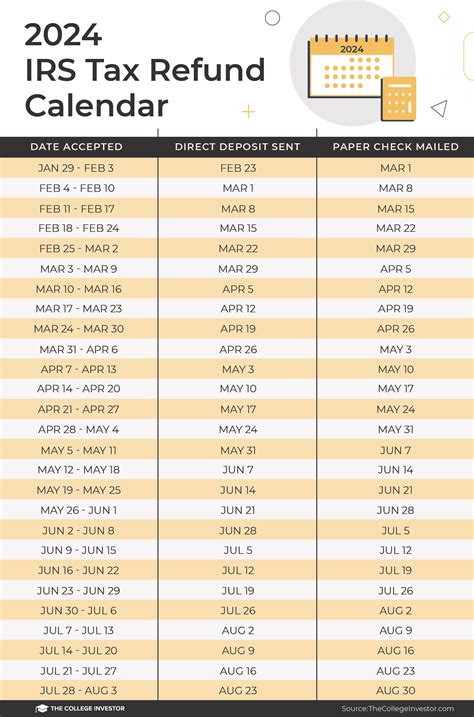

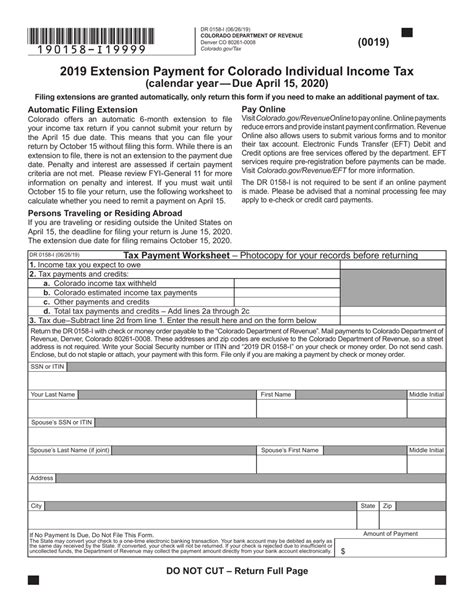

For individuals, staying informed about tax changes is crucial. Keeping abreast of income tax bracket adjustments, new tax credits and deductions, and changes in filing requirements can help maximize refunds and minimize liabilities. For instance, understanding the eligibility criteria for tax credits, such as the United States’ Child Tax Credit or the United Kingdom’s Marriage Allowance, can significantly impact an individual’s tax position.

Additionally, individuals can explore tax-efficient savings and investment options, such as pension contributions or Individual Savings Accounts (ISAs) in the UK, which offer tax benefits and can boost long-term financial security.

Business Tax Strategies: Navigating Complexity for Success

Businesses face a more intricate landscape, with tax considerations often influencing strategic decisions. Staying updated on corporate tax rates, tax incentives for research and development, and changes in transfer pricing rules is essential for effective tax planning.

Moreover, businesses should consider the impact of tax changes on their international operations. For instance, the OECD's BEPS (Base Erosion and Profit Shifting) project has led to significant changes in transfer pricing regulations, affecting how multinational corporations structure their global operations.

Adapting to tax changes also involves exploring tax-efficient business structures, such as Limited Liability Companies (LLCs) or Sole Proprietorships, which offer different tax advantages and liabilities.

The Role of Tax Professionals: Expert Guidance in a Complex Environment

With the increasing complexity of tax systems, the role of tax professionals, such as accountants and tax advisors, has become even more critical. These experts can provide valuable insights and guidance on navigating tax changes, ensuring compliance, and optimizing tax positions.

Tax professionals can assist individuals in understanding the implications of tax changes on their financial planning, retirement strategies, and estate planning. For businesses, they can offer strategic advice on tax-efficient structures, transfer pricing, and international tax considerations.

The Future of Taxation: Trends and Implications

Looking ahead, several key trends are likely to shape the future of taxation. The rise of digital economies and the increasing use of technology are expected to lead to more efficient tax collection systems and the potential for new taxes on digital services and transactions.

Furthermore, the global push for sustainability is likely to result in the continued expansion of environmental taxes and the exploration of new levies, such as carbon border adjustment mechanisms, to ensure a level playing field for businesses operating in different jurisdictions.

Additionally, with the ongoing debate on wealth inequality, there may be further adjustments to tax systems to promote fairness, such as the introduction of wealth taxes or the expansion of inheritance tax regimes.

The evolving nature of tax systems underscores the importance of staying informed and adaptable. By understanding the latest tax changes and their implications, individuals and businesses can make informed decisions and ensure they are well-positioned to navigate this complex landscape.

How often do tax laws change, and what triggers these changes?

+Tax laws can change annually or even more frequently, often driven by changing economic conditions, government policy shifts, or the need to address specific societal issues. For instance, during economic downturns, governments may adjust tax rates to stimulate spending, while environmental concerns can lead to the introduction of new green taxes.

What are the potential consequences of non-compliance with tax changes?

+Non-compliance with tax changes can lead to significant penalties, interest charges, and, in severe cases, criminal prosecution. It is essential to stay informed and seek professional advice to ensure compliance with the latest tax regulations.

How can businesses stay updated on international tax changes and their implications?

+Businesses operating internationally should invest in robust tax compliance systems and consider partnering with global tax advisory firms. These firms can provide real-time updates and strategic advice on navigating the complexities of international tax landscapes.