Oklahoma Car Sales Tax

In the Sooner State, Oklahoma, understanding the intricacies of car sales tax is essential for both buyers and sellers. With a unique tax structure, Oklahoma offers a distinct experience when it comes to automotive transactions. This article aims to delve into the specifics of Oklahoma's car sales tax, providing an in-depth analysis and practical insights for those navigating the state's automotive market.

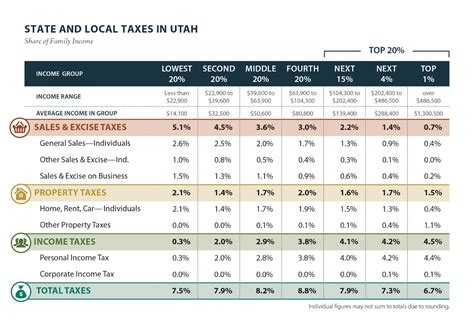

Oklahoma’s Car Sales Tax: An Overview

Oklahoma imposes a sales tax on the purchase of vehicles, which contributes significantly to the state’s revenue. The tax is applied to the total purchase price of the vehicle, including any additional fees and charges. It’s important to note that this tax is separate from the title and registration fees that are also required when buying a vehicle in Oklahoma.

The state sales tax rate for vehicles in Oklahoma is currently set at 4.5%, which is applied uniformly across the state. However, it's crucial to consider that many cities and counties in Oklahoma also impose their own additional sales tax rates, known as local option taxes. These local taxes can vary significantly, with some areas adding an extra 1% to 2% on top of the state rate. Therefore, the total sales tax on a vehicle purchase can range from 4.5% to 6.5%, depending on the location of the dealership.

For instance, if you're purchasing a car in Oklahoma City, which has a local option tax of 1%, you'll be subject to a total sales tax of 5.5% on your vehicle purchase. On the other hand, if you're in a county with no additional local tax, the sales tax remains at the state rate of 4.5%.

Calculating the Sales Tax

To calculate the sales tax on a vehicle purchase in Oklahoma, you can use the following formula:

Sales Tax = Purchase Price x (State Tax Rate + Local Tax Rate)

Let's consider an example. If you're buying a car priced at $25,000 in a county with a 1% local option tax, the calculation would be as follows:

Sales Tax = $25,000 x (0.045 + 0.01) = $1,312.50

So, in this scenario, the sales tax on the vehicle would amount to $1,312.50.

| Purchase Price | State Tax Rate | Local Tax Rate | Total Sales Tax |

|---|---|---|---|

| $20,000 | 4.5% | 1% | $950 |

| $30,000 | 4.5% | 1.5% | $1,575 |

| $45,000 | 4.5% | 2% | $2,362.50 |

![Oklahoma (Ok) Vehicle Sales Tax & Fees [+ Calculator] - Find The Best Car Price % % % Oklahoma (Ok) Vehicle Sales Tax & Fees [+ Calculator] - Find The Best Car Price % % %](https://nacdashboard.nara.gov/assets/img/oklahoma-ok-vehicle-sales-tax-and-fees-calculator-find-the-best-car-price.jpeg)

Exemptions and Special Considerations

While the general sales tax applies to most vehicle purchases in Oklahoma, there are certain exemptions and special considerations to be aware of:

- Trade-Ins: If you're trading in your old vehicle as part of the purchase, the sales tax is calculated based on the difference between the trade-in value and the new vehicle's price. So, if your trade-in value is $5,000 and the new vehicle costs $25,000, the sales tax is applied to the $20,000 difference.

- Military Personnel: Active-duty military personnel stationed in Oklahoma may be eligible for a sales tax exemption. However, this exemption typically requires specific documentation and is not automatically applied.

- Out-of-State Purchases: If you purchase a vehicle out of state and bring it into Oklahoma, you may be subject to a use tax to ensure you pay the equivalent of the Oklahoma sales tax. The use tax is calculated similarly to the sales tax, but it's applied to the purchase price, not the difference as in the case of trade-ins.

The Impact of Sales Tax on Car Buying in Oklahoma

The sales tax on vehicle purchases in Oklahoma can significantly impact the overall cost of buying a car. For buyers, it’s essential to factor in the sales tax when budgeting for a new vehicle. Dealers should also ensure they provide transparent information about the sales tax to their customers to maintain trust and avoid any surprises during the transaction.

Additionally, the variation in local option taxes across Oklahoma means that car buyers may strategically consider their purchase location to minimize their sales tax burden. However, it's important to balance this consideration with other factors, such as the convenience of the dealership and the overall price of the vehicle.

Tips for Minimizing Sales Tax

If you’re looking to reduce the impact of sales tax on your vehicle purchase, here are a few strategies to consider:

- Research Local Tax Rates: Before finalizing your purchase, research the local tax rate in the area where you plan to buy. This can help you choose a location with a lower tax rate, potentially saving you a significant amount.

- Consider Trade-Ins: Trading in your old vehicle can reduce the sales tax amount, as it's calculated based on the difference in value. Ensure you get a fair trade-in value to maximize your savings.

- Explore Military Exemptions: If you're an active-duty military member, research the requirements for the sales tax exemption and gather the necessary documentation. This can be a significant savings opportunity.

- Negotiate the Price: While the sales tax is a fixed percentage, negotiating a lower purchase price can indirectly reduce the overall tax amount. Dealers may be more open to negotiation if you're aware of the local tax rates and can demonstrate the impact on your total cost.

Future Implications and Changes

The sales tax structure in Oklahoma is subject to potential changes and updates. While the state sales tax rate has remained stable, local option taxes can fluctuate as counties and cities adjust their tax policies. It’s crucial for both buyers and sellers to stay informed about any changes to local tax rates to ensure accurate budgeting and pricing.

Additionally, there have been ongoing discussions and proposals for tax reforms in Oklahoma, including potential changes to the sales tax structure. While it's difficult to predict the future of these reforms, staying aware of any proposed changes can help stakeholders prepare for potential adjustments to the tax landscape.

For buyers, staying informed about these potential changes can impact their timing of purchases, while sellers should be prepared to adapt their pricing strategies to remain competitive.

Conclusion

Navigating the car sales tax landscape in Oklahoma requires a keen understanding of the state’s unique tax structure. From the state sales tax rate to the varying local option taxes, buyers and sellers must be well-informed to make the most of their automotive transactions. By staying aware of the tax rates, researching local options, and employing strategic purchasing tactics, Oklahomans can ensure they’re getting the best value when buying or selling vehicles.

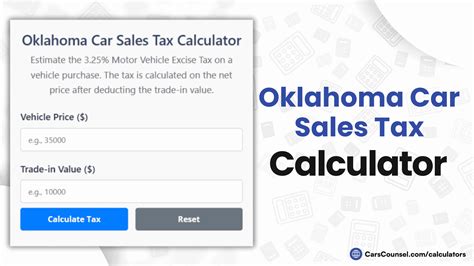

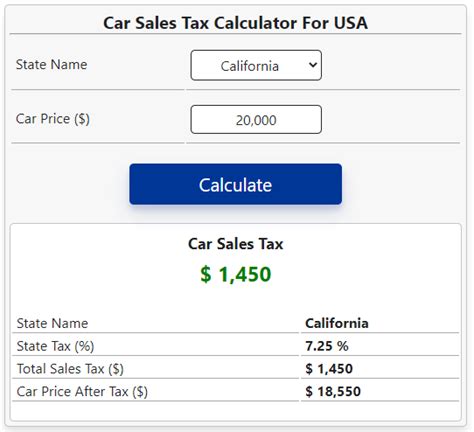

Are there any online resources to help calculate the total sales tax on a vehicle purchase in Oklahoma?

+

Yes, there are online sales tax calculators available that can help you estimate the total sales tax on your vehicle purchase. These calculators typically require you to input the purchase price, the state tax rate, and any local tax rates. However, it’s important to note that these calculators provide estimates and may not account for specific exemptions or local variations.

Can I negotiate the sales tax on my vehicle purchase?

+

The sales tax is a mandatory tax set by the state and local governments, so you cannot directly negotiate it. However, you can negotiate the purchase price of the vehicle, which indirectly affects the sales tax amount. By negotiating a lower price, you can reduce the overall sales tax liability.

Are there any online resources to help calculate the total sales tax on a vehicle purchase in Oklahoma?

+

Yes, there are online sales tax calculators available that can help you estimate the total sales tax on your vehicle purchase. These calculators typically require you to input the purchase price, the state tax rate, and any local tax rates. However, it’s important to note that these calculators provide estimates and may not account for specific exemptions or local variations.