Columbus Property Tax

The topic of property taxes is a critical aspect of homeownership and one that is often closely examined by potential buyers and investors. This article aims to provide an in-depth analysis of property taxes in the Columbus area, offering a comprehensive guide to understanding this essential financial obligation. We will delve into the factors that influence property tax rates, the assessment process, and the implications for homeowners and the local economy.

Unraveling the Complexity of Columbus Property Taxes

Property taxes in Columbus, Ohio, like in many other jurisdictions, are a key revenue source for local governments and are used to fund essential services and infrastructure projects. The Franklin County Auditor's Office plays a pivotal role in the property tax assessment and collection process, ensuring fairness and accuracy in the system.

The property tax structure in Columbus is designed to be equitable, taking into account the value of the property and the services provided to the area. This means that homeowners contribute to the community's growth and maintenance in proportion to the benefits they receive. However, the process can be complex, and understanding the various factors that influence property taxes is essential for homeowners and potential buyers.

Factors Influencing Property Tax Rates

Several key factors come into play when determining property tax rates in Columbus. These include:

- Property Value: The assessed value of a property is a primary determinant of the tax bill. This value is typically determined by a professional appraiser who considers factors such as the property's size, location, amenities, and recent sales of comparable properties.

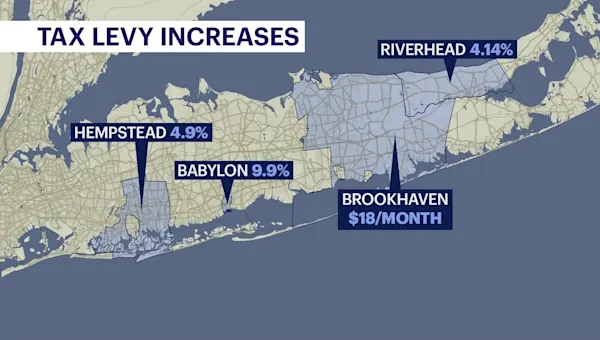

- Tax Rates: The tax rate, also known as the millage rate, is set by local government bodies, such as city councils and school boards. These rates can vary significantly between different areas within Columbus, depending on the services and facilities provided.

- Assessments and Reassessments: Properties are typically reassessed periodically to ensure that the tax burden is distributed fairly. These reassessments take into account changes in the property's value due to improvements, renovations, or general market fluctuations.

- Exemptions and Deductions : Certain properties or individuals may be eligible for exemptions or deductions, which can reduce the taxable value of the property. Common exemptions include those for senior citizens, veterans, and agricultural lands.

Understanding these factors is crucial for homeowners, as it allows them to anticipate potential changes in their tax obligations and plan their finances accordingly. For instance, a homeowner who plans significant renovations should be aware of the potential impact on their property's assessed value and, consequently, their tax bill.

The Assessment Process: A Step-by-Step Guide

The property tax assessment process in Columbus is a meticulous procedure aimed at ensuring fairness and accuracy. Here's a simplified breakdown of the key steps:

- Data Collection: The Franklin County Auditor's Office gathers data on all properties within its jurisdiction. This includes details such as the property's physical characteristics, recent sales, and any improvements or alterations.

- Appraisal: Professional appraisers conduct thorough assessments of each property, considering its unique features and comparing it to similar properties in the area. This step ensures that the assessed value is accurate and fair.

- Notices and Appeals: Once the assessments are complete, homeowners receive a notice of their property's assessed value and the corresponding tax obligation. If a homeowner disagrees with the assessment, they have the right to appeal the decision.

- Tax Calculation: The assessed value is multiplied by the applicable tax rate to determine the property tax liability. This rate is set by local authorities and may vary depending on the property's location and the services it receives.

- Collection: Property taxes are typically collected twice a year, with payments due in January and June. Homeowners have the option to pay in full or in installments, and late payments may incur penalties.

Transparency and accessibility are key tenets of the assessment process. Homeowners have the right to request a review of their property's assessment and can access detailed information about the process through the Franklin County Auditor's Office website and local government resources.

The Impact on Homeowners and the Local Economy

Property taxes have a significant influence on both homeowners and the local economy. For homeowners, property taxes are a substantial annual expense that must be budgeted for. They can also impact the affordability of homeownership, particularly for those on fixed incomes or with limited financial resources.

From an economic perspective, property taxes play a vital role in funding essential services and infrastructure. They support schools, emergency services, road maintenance, and other public facilities. A well-managed property tax system ensures that these services are adequately funded, contributing to the overall well-being and development of the community.

However, it's important to note that high property taxes can also have negative consequences. They can discourage investment in certain areas, impact business growth, and even lead to population shifts. Balancing the need for revenue with the affordability and competitiveness of the local economy is a delicate task for local government bodies.

Future Implications and Trends

Looking ahead, several factors are likely to influence property taxes in Columbus. These include:

- Population Growth and Development: As Columbus continues to grow and develop, new construction and increased demand for housing may lead to rising property values. This, in turn, could result in higher property tax revenues for the city.

- Economic Cycles: Economic downturns can impact property values and, consequently, tax revenues. Local governments must carefully manage their budgets during these periods to ensure essential services are not compromised.

- Policy Changes: Shifts in local government policies, such as changes to tax rates or assessment practices, can have a significant impact on property tax obligations. Homeowners should stay informed about these potential changes to plan effectively.

- Technological Advancements: The use of technology in the assessment process, such as digital mapping and data analysis tools, can improve accuracy and efficiency. This can lead to more equitable assessments and a better understanding of property values.

Staying informed about these trends and their potential impact is crucial for both homeowners and investors. It allows for better financial planning and ensures that individuals and businesses can make informed decisions about their real estate holdings.

Frequently Asked Questions (FAQ)

How often are properties reassessed in Columbus, Ohio?

+

In Columbus, Ohio, property reassessments typically occur every three years. However, certain circumstances, such as significant improvements or changes to the property, may trigger an earlier reassessment. It’s important for homeowners to be aware of these potential triggers to ensure they are prepared for any changes in their tax obligations.

Are there any tax relief programs available for senior citizens in Columbus?

+

Yes, Columbus offers a Senior Citizen Property Tax Relief Program to eligible residents aged 65 and older. This program provides a reduction in property taxes based on income and property value. To qualify, seniors must meet certain income and residency requirements. It’s advisable for eligible seniors to explore this program to ease their tax burden.

Can I appeal my property tax assessment in Columbus if I disagree with the value assigned to my property?

+

Absolutely! Homeowners in Columbus have the right to appeal their property tax assessments if they believe the assigned value is inaccurate or unfair. The Franklin County Auditor’s Office provides a detailed appeals process, which includes submitting documentation and evidence to support your case. It’s important to carefully review the process and prepare your appeal with the necessary information.

How does the Columbus property tax system impact the local economy and business growth?

+

The property tax system in Columbus plays a crucial role in funding essential services and infrastructure, which are vital for the local economy and business growth. However, high property taxes can also be a deterrent for businesses and investors, potentially impacting the city’s competitiveness. Balancing the need for revenue with the affordability of doing business is a key challenge for local government.

What happens if I fail to pay my property taxes in Columbus?

+

Late payment of property taxes in Columbus can result in penalties and interest charges. If the taxes remain unpaid, the local government has the authority to place a lien on the property, which could lead to foreclosure in extreme cases. It’s important for homeowners to prioritize their property tax obligations to avoid these negative consequences.