Www.fairfaxcounty/Taxes

In the realm of local government services, Fairfax County, located in the heart of Virginia, stands as a testament to efficient governance and community-centric initiatives. Among the myriad of responsibilities undertaken by this county government, the management of taxes is a critical function that directly impacts the lives of its residents. This article delves into the world of Fairfax County taxes, exploring the mechanisms, benefits, and implications of the tax system within this vibrant community.

Understanding Fairfax County Taxes

Fairfax County, much like other local governments, relies on a robust tax system to fund essential services and infrastructure projects. The county’s tax structure is designed to be equitable and sustainable, ensuring that residents contribute their fair share while also receiving the benefits of a well-managed community.

Real Estate Taxes

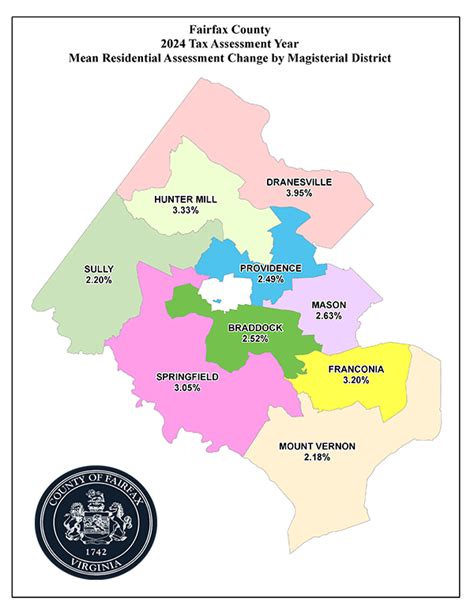

One of the primary sources of revenue for Fairfax County is real estate taxes. These taxes are levied on properties within the county, including residential, commercial, and industrial properties. The assessment process involves evaluating the property’s value, taking into account factors such as location, size, and recent improvements.

For instance, consider the case of a typical single-family home in Fairfax County. The county assessor would evaluate the home’s market value, considering its proximity to schools, parks, and other amenities. This value is then multiplied by the applicable tax rate to determine the annual tax liability for the property owner.

Fairfax County aims to maintain a competitive tax rate, ensuring that the burden on property owners is reasonable while still generating sufficient revenue. The revenue generated from real estate taxes is crucial for funding essential services such as education, public safety, and transportation infrastructure.

| Fiscal Year | Real Estate Tax Rate (per $100 of assessed value) |

|---|---|

| 2023 | $1.137 |

| 2022 | $1.137 |

| 2021 | $1.135 |

The table above provides a glimpse into the stability of Fairfax County's real estate tax rate over the past few years. This consistency is a testament to the county's commitment to fiscal responsibility and its understanding of the impact that tax rates can have on property owners.

Personal Property Taxes

In addition to real estate taxes, Fairfax County also collects personal property taxes. These taxes are levied on vehicles, boats, and other tangible personal property owned by individuals and businesses within the county. The assessment process for personal property taxes involves evaluating the fair market value of the property and applying the applicable tax rate.

For example, let’s consider a resident who owns a vehicle registered in Fairfax County. The county would assess the vehicle’s value based on factors such as its make, model, age, and condition. This assessed value is then multiplied by the personal property tax rate to determine the annual tax liability for the vehicle owner.

Fairfax County’s personal property tax rates are designed to be fair and progressive, taking into account the value of the property and the owner’s ability to pay. The revenue generated from personal property taxes contributes to the county’s overall tax base, allowing for the provision of high-quality public services and amenities.

| Vehicle Type | Tax Rate (per $100 of assessed value) |

|---|---|

| Automobiles | $3.50 |

| Motorcycles | $3.50 |

| Trucks & Trailers | $3.50 |

The table above provides a breakdown of Fairfax County's personal property tax rates for different vehicle types. These rates are consistent across the county, ensuring that all residents and businesses are treated equitably when it comes to taxation on their personal property.

Income Taxes

Fairfax County, unlike some other localities in Virginia, does not have the authority to impose an income tax. However, the county does play a crucial role in administering and collecting state income taxes on behalf of the Commonwealth of Virginia. Residents of Fairfax County are subject to Virginia’s income tax laws, which include both personal income tax and corporate income tax.

The revenue generated from state income taxes is allocated to various state-level programs and services, including education, healthcare, and infrastructure development. Fairfax County’s role in collecting these taxes ensures that residents contribute to the overall economic well-being of the state while also receiving the benefits of state-funded initiatives.

Tax Benefits and Incentives

Fairfax County recognizes the importance of providing tax benefits and incentives to attract and retain businesses, encourage economic growth, and support its residents. Here are some notable tax benefits offered by the county:

Business Tax Incentives

Fairfax County offers a range of tax incentives to attract and support businesses. These incentives include tax credits, tax abatements, and reduced tax rates for qualifying businesses. The county’s economic development efforts aim to create a favorable business environment, encouraging investment and job creation.

For instance, the Fairfax County Industrial Development Authority (IDA) provides tax-exempt financing for eligible projects. This initiative helps businesses access the capital they need to expand, modernize their operations, or relocate to the county. By offering these tax incentives, Fairfax County fosters economic growth and creates opportunities for both businesses and its residents.

Senior Citizen and Disabled Person Property Tax Relief

Fairfax County understands the financial challenges that seniors and individuals with disabilities may face. To provide relief, the county offers property tax exemptions and reductions for qualifying individuals. These tax benefits aim to ease the financial burden on those who have contributed significantly to the community over the years.

The Senior Citizen Real Estate Tax Deferral Program allows eligible seniors to defer a portion of their real estate taxes until the property is sold or transferred. This program ensures that seniors can continue to reside in their homes without the immediate concern of paying high property taxes. Similarly, the Disabled Persons Real Estate Tax Exemption Program provides a partial or full exemption from real estate taxes for eligible individuals with disabilities.

Homestead Exemptions

Fairfax County offers homestead exemptions to eligible homeowners. These exemptions reduce the assessed value of a homeowner’s primary residence, resulting in lower real estate taxes. The homestead exemption is particularly beneficial for homeowners who are facing financial challenges or have limited income.

By providing homestead exemptions, Fairfax County ensures that homeowners can continue to afford their homes and maintain their financial stability. This initiative promotes homeownership and contributes to the overall stability of the county’s housing market.

Tax Administration and Support

Fairfax County takes pride in its commitment to providing excellent tax administration services to its residents and businesses. The Fairfax County Tax Administration department is dedicated to ensuring transparency, fairness, and efficiency in the tax collection process.

Online Tax Payment and Services

Fairfax County understands the convenience and efficiency that online services bring to its residents. The county’s website offers a user-friendly platform for taxpayers to access a wide range of tax-related services and information. Residents can:

- Pay their real estate, personal property, and business taxes online securely.

- View and print tax bills, as well as tax payment histories.

- Update their contact information and make changes to their tax accounts.

- Access tax forms, guides, and resources to assist with tax filing.

The online platform ensures that taxpayers can manage their tax obligations from the comfort of their homes, saving time and reducing the need for in-person visits to county offices.

Taxpayer Assistance and Education

Fairfax County recognizes that taxes can be complex and sometimes confusing. To support its residents, the county offers a comprehensive taxpayer assistance program. This program includes:

- A dedicated Taxpayer Assistance Center where residents can receive personalized help with their tax inquiries.

- Tax workshops and seminars to educate residents on various tax-related topics, such as tax preparation, filing deadlines, and available tax benefits.

- Online resources and guides that provide step-by-step instructions and answers to frequently asked questions.

By providing taxpayer assistance and education, Fairfax County ensures that its residents are well-informed and empowered to navigate the tax system effectively.

Future Implications and Continuous Improvement

Fairfax County remains committed to continuously improving its tax system to meet the evolving needs of its residents and businesses. The county’s leadership understands that a well-managed tax system is crucial for the long-term sustainability and prosperity of the community.

As Fairfax County looks to the future, several key initiatives and considerations come into focus:

Tax Equity and Fairness

Ensuring tax equity and fairness remains a top priority for Fairfax County. The county aims to maintain a balanced tax system that treats all taxpayers equitably, regardless of their income, property value, or business size. Continuous reviews and assessments of the tax structure will help identify any potential disparities and ensure that the tax burden is distributed fairly across the community.

Tax Efficiency and Technology

Fairfax County recognizes the potential of technology to enhance tax administration processes. The county plans to invest in modernizing its tax systems and infrastructure, leveraging digital solutions to improve efficiency, accuracy, and transparency. By embracing technology, Fairfax County aims to reduce administrative costs, streamline tax collection, and provide a better experience for taxpayers.

One example of this is the implementation of an online tax assessment and appeal system. This system will allow taxpayers to submit appeals and receive decisions online, eliminating the need for in-person visits and reducing the administrative burden on both taxpayers and county staff.

Community Engagement and Feedback

Fairfax County values the input and feedback of its residents and businesses. The county actively seeks feedback through surveys, town hall meetings, and community forums to understand the perspectives and concerns of taxpayers. This feedback is integral to shaping future tax policies and initiatives, ensuring that they align with the needs and expectations of the community.

By engaging with the community, Fairfax County fosters a sense of ownership and involvement in the tax system. This collaborative approach helps build trust and ensures that the county’s tax policies are responsive to the diverse needs of its residents and businesses.

Sustainable Revenue Sources

As Fairfax County looks to the future, it recognizes the importance of diversifying its revenue sources. While real estate and personal property taxes remain critical components of the county’s tax base, exploring additional revenue streams will be essential for long-term financial stability. This may include considering new tax policies or exploring alternative funding mechanisms to support essential services and infrastructure projects.

Fairfax County’s commitment to fiscal responsibility and sustainability will guide its decisions on future revenue sources, ensuring that any new initiatives are implemented thoughtfully and with the best interests of the community in mind.

Conclusion

Fairfax County’s tax system is a vital component of its local government, playing a crucial role in funding essential services, supporting economic development, and promoting community well-being. Through a combination of real estate, personal property, and state income taxes, the county generates the revenue needed to maintain a high quality of life for its residents.

By offering tax benefits, providing efficient tax administration services, and continuously improving its tax system, Fairfax County demonstrates its commitment to serving its community. As the county moves forward, its focus on tax equity, technology, community engagement, and sustainable revenue sources will ensure that its tax system remains fair, efficient, and responsive to the needs of its residents and businesses.

How can I pay my Fairfax County taxes online?

+

To pay your Fairfax County taxes online, visit the county’s official website at https://www.fairfaxcounty.gov. Navigate to the “Taxes” section, where you will find options to pay your real estate, personal property, and business taxes securely. You can also view your tax bills and payment histories online.

What tax benefits are available for senior citizens in Fairfax County?

+

Fairfax County offers the Senior Citizen Real Estate Tax Deferral Program, which allows eligible seniors to defer a portion of their real estate taxes until the property is sold or transferred. Additionally, the Disabled Persons Real Estate Tax Exemption Program provides a partial or full exemption from real estate taxes for eligible individuals with disabilities.

Are there any tax incentives for businesses in Fairfax County?

+

Yes, Fairfax County offers a range of tax incentives to attract and support businesses. These incentives include tax credits, tax abatements, and reduced tax rates for qualifying businesses. The county’s economic development efforts aim to create a favorable business environment, encouraging investment and job creation.

How can I access taxpayer assistance and resources in Fairfax County?

+

Fairfax County provides a dedicated Taxpayer Assistance Center where residents can receive personalized help with their tax inquiries. Additionally, the county offers tax workshops and seminars, as well as online resources and guides to assist taxpayers. These resources aim to educate residents on various tax-related topics and provide step-by-step instructions for tax filing.