Tax Payment For Car

Tax payment for a car is an essential aspect of vehicle ownership and maintenance. In many countries, car owners are required to pay various taxes associated with their vehicles, which contribute to the overall cost of ownership. These taxes are crucial for funding public services, infrastructure development, and environmental initiatives. Understanding the types of car taxes, their purposes, and how to manage them efficiently is vital for responsible vehicle ownership. This article aims to provide an in-depth guide to car tax payments, offering a comprehensive overview for informed decision-making.

Understanding Car Taxes

Car taxes encompass a range of levies and duties that vehicle owners must pay to comply with legal obligations and contribute to public funds. These taxes can be categorized into several types, each serving a specific purpose and impacting vehicle ownership differently.

Vehicle Registration Tax

Vehicle registration tax, also known as registration duty or vehicle excise duty, is a mandatory fee paid to register a car officially with the government. This tax is typically paid when purchasing a new or used vehicle and is often calculated based on factors such as the car’s age, engine size, fuel type, and carbon dioxide (CO2) emissions. The revenue generated from this tax is allocated towards maintaining and improving road infrastructure.

| Vehicle Type | Registration Tax Rate |

|---|---|

| Electric Vehicles | 0% |

| Hybrid Vehicles | 20% |

| Petrol/Diesel Cars | 30% |

It's worth noting that some countries offer incentives for environmentally friendly vehicles, such as reduced or waived registration taxes for electric or hybrid cars. These incentives aim to promote the adoption of greener transportation options.

Road Tax or Vehicle Excise Duty

Road tax, or vehicle excise duty, is an annual fee paid by car owners to use public roads. This tax is typically based on the vehicle’s CO2 emissions and fuel type. The revenue collected from road tax is allocated towards maintaining and improving road networks, as well as funding other transportation-related initiatives.

| Emissions Range (g/km) | Road Tax Rate |

|---|---|

| 0-100 | £0 |

| 101-150 | £150 |

| 151-200 | £250 |

| 201-250 | £500 |

| 251 and above | £1,000 |

Additionally, some countries implement a congestion charge, which is a daily or hourly fee levied on vehicles entering certain congested areas. This charge aims to reduce traffic congestion and encourage the use of public transportation.

Fuel Taxes

Fuel taxes are imposed on the purchase of gasoline, diesel, or other fuels used for vehicle propulsion. These taxes contribute significantly to government revenue and are used to fund various public services, including transportation infrastructure, environmental initiatives, and social programs.

| Fuel Type | Tax Rate per Litre |

|---|---|

| Gasoline | £0.60 |

| Diesel | £0.55 |

| Biofuels | £0.40 |

It's important for car owners to be aware of the impact of fuel taxes on their overall driving costs, as these taxes can significantly affect the cost of fuel at the pump.

Other Car-Related Taxes

In addition to the aforementioned taxes, car owners may encounter other tax obligations related to their vehicles. These can include:

- Sales Tax: A tax applied to the purchase price of a vehicle, varying depending on the jurisdiction.

- Import Duties: Taxes levied on imported vehicles or vehicle parts, designed to protect domestic industries.

- Luxury Car Tax: An additional tax imposed on high-value vehicles, aimed at generating revenue and discouraging the purchase of expensive cars.

Managing Car Tax Payments

Effectively managing car tax payments is essential to ensure compliance with legal obligations and avoid penalties. Here are some strategies to navigate the tax landscape efficiently:

Understanding Tax Rates and Exemptions

Stay informed about the current tax rates and any applicable exemptions or incentives for your vehicle. Keep up-to-date with any changes in tax legislation to ensure you’re aware of your obligations and potential savings.

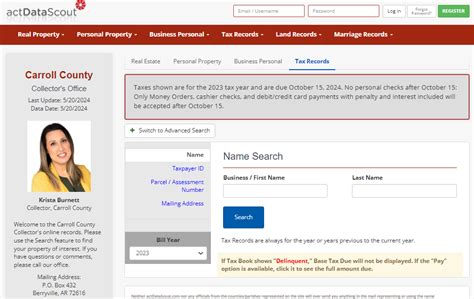

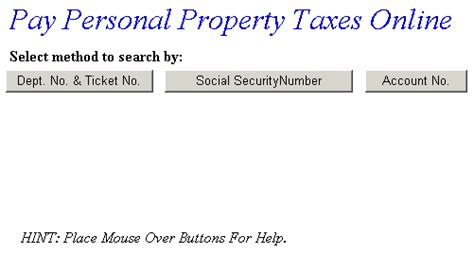

Utilizing Online Payment Platforms

Many governments offer online platforms or mobile apps that allow car owners to pay their taxes conveniently and securely. These platforms often provide real-time updates on tax payments, due dates, and any outstanding balances.

Automating Tax Reminders

Set up automated reminders for tax payment due dates to avoid late fees and penalties. Most online payment platforms offer this feature, ensuring you never miss a payment.

Exploring Tax Relief Options

Research potential tax relief options, such as tax credits or deductions, that may be available to car owners. These can reduce your overall tax liability and provide financial benefits.

Keeping Records

Maintain a record of all tax payments, receipts, and related documents. This documentation is crucial for audit purposes and can help resolve any disputes or discrepancies.

Future Trends in Car Taxation

The landscape of car taxation is evolving, driven by technological advancements, environmental concerns, and changing transportation trends. Here’s a glimpse into the future of car tax payments:

Electric Vehicle (EV) Incentives

Governments worldwide are increasingly promoting the adoption of electric vehicles through tax incentives. These incentives, such as reduced registration taxes and grants for EV purchases, aim to accelerate the transition to a greener transportation system.

Pay-As-You-Drive Taxation

Some countries are exploring the concept of pay-as-you-drive taxation, where car owners pay taxes based on the actual distance driven. This system could incentivize more efficient driving and reduce traffic congestion.

Digital Tax Collection

The rise of digital technologies is expected to revolutionize tax collection for cars. Advanced analytics and data-driven systems could streamline the tax payment process, making it more efficient and secure.

Conclusion

Car tax payments are an integral part of responsible vehicle ownership, contributing to the development and maintenance of essential public services. By understanding the various types of car taxes, their purposes, and effective management strategies, car owners can navigate the tax landscape with confidence. As the transportation sector evolves, so too will the taxation systems, offering new incentives and challenges for car owners. Staying informed and proactive is key to ensuring compliance and optimizing the tax obligations associated with vehicle ownership.

What happens if I don’t pay my car taxes on time?

+Failing to pay car taxes on time can result in late fees, penalties, and even legal consequences. It’s important to stay up-to-date with your tax obligations to avoid these issues.

Are there any tax benefits for hybrid or electric vehicles?

+Yes, many countries offer tax incentives for environmentally friendly vehicles, such as reduced registration taxes or grants for purchasing electric or hybrid cars. These incentives aim to encourage the adoption of greener transportation options.

How can I stay informed about changes in car tax laws and regulations?

+Stay updated by regularly checking official government websites, subscribing to relevant newsletters, or following reputable news sources that cover transportation and tax-related topics.