Office Of Tax And Revenue Dc

The Office of Tax and Revenue (OTR) in Washington, D.C., plays a vital role in the city's financial infrastructure, ensuring the smooth operation of tax collection and revenue management. With a dedicated team of professionals, OTR is responsible for administering a wide range of tax programs and services that contribute significantly to the city's fiscal health.

In this comprehensive article, we will delve into the various aspects of the Office of Tax and Revenue, exploring its functions, services, and impact on the District of Columbia's economy. By understanding the intricate workings of this essential government agency, we can gain valuable insights into the city's fiscal management strategies and the role it plays in the lives of its residents and businesses.

Understanding the Office of Tax and Revenue (OTR)

The Office of Tax and Revenue is a division of the District of Columbia’s government, tasked with the critical responsibility of managing the city’s tax system. Established to streamline and regulate tax collection processes, OTR acts as the primary custodian of the District’s revenue streams, overseeing a diverse range of taxes and ensuring compliance with relevant laws and regulations.

At the heart of OTR's mission is the principle of equitable taxation, aiming to provide a fair and transparent tax system for all District residents and businesses. By implementing effective tax policies and practices, OTR strives to create a stable and sustainable revenue base, supporting the city's development and growth.

Key Functions of the Office of Tax and Revenue

The Office of Tax and Revenue’s functions are diverse and far-reaching, encompassing a wide array of responsibilities to support the city’s financial well-being.

- Real Property Tax Administration: OTR is responsible for assessing and collecting real property taxes, ensuring that property owners contribute their fair share to the city's revenue. This includes maintaining accurate property records, conducting assessments, and managing the billing and collection processes.

- Business and Professional Tax Services: The agency provides a range of services to support businesses and professionals in their tax obligations. This includes administering taxes such as the District's Income Tax, Sales and Use Tax, and Excise Taxes, as well as offering guidance and resources to help businesses comply with tax regulations.

- Personal Income Tax Management: OTR handles the collection and management of personal income taxes for District residents. This involves processing tax returns, calculating tax liabilities, and ensuring timely refunds or payments.

- Special Tax Programs: OTR also administers various special tax programs, such as the Citywide Tax Collection Program, which consolidates the collection of various taxes into a single process, simplifying the experience for taxpayers.

- Taxpayer Assistance and Education: The agency offers valuable resources and support to taxpayers, providing guidance on tax filing, payment options, and resolving any issues or disputes. OTR's goal is to ensure that taxpayers understand their obligations and have access to the necessary tools to comply with tax laws.

Through these functions, the Office of Tax and Revenue plays a pivotal role in maintaining the District's financial stability and supporting the city's economic growth. By effectively managing tax collection and revenue, OTR contributes to the overall prosperity and development of Washington, D.C.

Tax Programs and Services Offered by OTR

The Office of Tax and Revenue offers a comprehensive suite of tax programs and services designed to meet the diverse needs of District taxpayers. These programs aim to simplify the tax process, provide assistance, and promote compliance, ensuring a fair and efficient tax system for all residents and businesses.

Real Property Tax Services

OTR administers the District’s Real Property Tax program, which includes assessing property values, calculating tax liabilities, and collecting property taxes. Here are some key aspects of this program:

- Assessment and Appeal Process: OTR conducts periodic assessments of real property to determine fair market value. Taxpayers have the right to appeal their assessments if they believe the value is inaccurate. The agency provides detailed guidelines and resources to facilitate the appeal process.

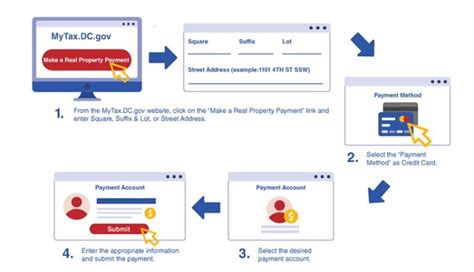

- Payment Options: OTR offers a range of payment methods, including online payments, direct debit, and in-person payments at designated locations. Taxpayers can also opt for installment plans or apply for hardship relief if they are facing financial difficulties.

- Exemptions and Credits: The agency provides various exemptions and credits to eligible taxpayers, such as the Homestead Deduction, which reduces the taxable value of a primary residence, and the Senior Citizen and Disabled Tax Relief Program, which offers tax relief to qualifying homeowners.

Business and Professional Tax Services

OTR supports businesses and professionals with a range of tax programs and services, including:

- Income Tax for Businesses: OTR administers the District's Corporate Income Tax, which applies to businesses operating within the District. The agency provides resources and guidance to help businesses understand their tax obligations and file their returns accurately.

- Sales and Use Tax: OTR collects Sales and Use Tax on the sale of goods and certain services within the District. The agency ensures compliance by registering businesses, collecting taxes, and providing resources to help businesses understand their responsibilities.

- Excise Taxes: OTR administers various excise taxes, including the Gasoline Excise Tax, Tobacco Excise Tax, and Alcoholic Beverage Excise Tax. These taxes are levied on specific goods and services, and the agency ensures proper collection and compliance.

- Business Registration and Licensing: OTR assists businesses with the registration and licensing process, ensuring they meet all necessary requirements. This includes obtaining business licenses, occupational permits, and other relevant certifications.

Personal Income Tax Services

OTR manages the District’s Personal Income Tax program, which includes filing and processing individual tax returns. Key aspects of this program include:

- Filing Requirements: District residents with income above a certain threshold are required to file personal income tax returns annually. OTR provides resources and guidance to help taxpayers understand their filing obligations and complete their returns accurately.

- Refund Processing: OTR processes tax refunds for eligible taxpayers. The agency aims to issue refunds promptly, ensuring that taxpayers receive their refunds within a reasonable timeframe.

- Payment Options: OTR offers various payment methods for taxpayers to settle their tax liabilities, including online payments, direct debit, and payment plans for those facing financial difficulties.

Special Tax Programs

OTR administers several special tax programs to simplify the tax process and provide relief to certain taxpayers. These programs include:

- Citywide Tax Collection Program: This program consolidates the collection of various taxes, such as property taxes, business taxes, and personal income taxes, into a single process. It streamlines the tax payment experience for taxpayers, making it more efficient and convenient.

- Tax Amnesty Programs: OTR periodically offers tax amnesty programs, providing taxpayers with an opportunity to resolve past-due tax liabilities without penalties or interest. These programs encourage voluntary compliance and help taxpayers get back on track with their tax obligations.

- Tax Relief Programs: OTR administers various tax relief programs to assist taxpayers facing financial hardships. These programs may include property tax relief for low-income seniors and disabled residents, as well as tax relief for victims of natural disasters or other qualifying events.

Impact of the Office of Tax and Revenue on the District’s Economy

The Office of Tax and Revenue plays a pivotal role in shaping the economic landscape of Washington, D.C. Its effective management of tax collection and revenue distribution has a profound impact on the city’s fiscal health and overall economic growth.

Revenue Generation and Economic Development

OTR’s primary function of collecting taxes contributes significantly to the District’s revenue stream, providing the financial resources necessary for the city’s operations and development. The taxes collected by OTR fund critical public services, infrastructure projects, and social programs, ensuring the well-being and prosperity of District residents.

By efficiently managing the tax system, OTR enables the District to invest in economic development initiatives, attract businesses, and create job opportunities. The stable revenue base generated by OTR's activities provides a foundation for sustainable growth and long-term prosperity.

Promoting Fair and Equitable Taxation

OTR’s commitment to equitable taxation ensures that the tax burden is distributed fairly among residents and businesses. The agency’s efforts to administer taxes efficiently and transparently help maintain public trust and confidence in the tax system.

Through its taxpayer assistance programs and education initiatives, OTR empowers residents and businesses to understand their tax obligations and comply with the law. This fosters a culture of voluntary compliance, reducing the need for enforcement actions and promoting a more harmonious relationship between taxpayers and the government.

Supporting Small Businesses and Economic Growth

OTR’s focus on providing support and resources to small businesses is instrumental in fostering economic growth within the District. By offering guidance on tax obligations, registration processes, and compliance requirements, OTR helps small businesses navigate the complex tax landscape, allowing them to focus on their core operations and contribute to the local economy.

Additionally, OTR's special tax programs, such as tax relief initiatives and simplified tax collection processes, provide much-needed support to small businesses, especially during challenging economic times. These programs help alleviate financial burdens and encourage entrepreneurship, further boosting the District's economic vitality.

Future Outlook and Continuous Improvement

The Office of Tax and Revenue remains committed to continuous improvement and adaptation to meet the evolving needs of District taxpayers. As the city’s economic landscape changes, OTR is dedicated to enhancing its services, streamlining processes, and leveraging technology to provide a seamless tax experience.

Digital Transformation and Tax Administration

OTR recognizes the importance of digital transformation in modern tax administration. The agency is actively working to enhance its online platforms, making it easier for taxpayers to access information, file returns, and make payments electronically. This digital shift not only improves efficiency but also reduces the burden on taxpayers, especially those with limited access to traditional tax preparation services.

By investing in digital infrastructure, OTR aims to provide a user-friendly and secure online environment, ensuring taxpayers can complete their tax obligations with ease and convenience. This digital transformation also enables the agency to gather valuable data and insights, facilitating more effective policy decisions and improvements to the tax system.

Taxpayer Engagement and Education

OTR understands the significance of taxpayer engagement and education in promoting voluntary compliance and a positive tax experience. The agency continues to develop and enhance its outreach programs, offering workshops, seminars, and online resources to help taxpayers understand their rights and responsibilities.

Through these initiatives, OTR aims to build a more informed and engaged taxpayer community, reducing the incidence of non-compliance and fostering a culture of responsible tax citizenship. By empowering taxpayers with knowledge and resources, OTR strengthens the foundation of a fair and sustainable tax system.

Collaborative Partnerships and Community Support

OTR recognizes the value of collaborative partnerships and community support in achieving its mission. The agency actively engages with community organizations, business associations, and taxpayer advocacy groups to gather feedback, address concerns, and improve its services.

By working together with stakeholders, OTR can better understand the unique challenges and needs of different taxpayer groups, allowing for more targeted and effective solutions. This collaborative approach also helps foster a sense of community ownership and involvement in the tax process, strengthening the overall tax system's resilience and adaptability.

Conclusion

The Office of Tax and Revenue in Washington, D.C., is an essential pillar of the city’s financial infrastructure, playing a critical role in maintaining fiscal stability and supporting economic growth. Through its dedicated efforts in tax administration, taxpayer assistance, and community engagement, OTR ensures a fair and efficient tax system that benefits all District residents and businesses.

As the city continues to evolve and adapt to changing economic landscapes, OTR remains committed to continuous improvement, leveraging technology, and fostering collaboration to provide the best possible tax experience. By effectively managing the city's tax system, OTR contributes to the District's long-term prosperity and the well-being of its residents.

How can I contact the Office of Tax and Revenue for assistance?

+You can reach out to the Office of Tax and Revenue through their official website, which provides contact information and resources. You can also contact them via phone or visit their offices during business hours. OTR aims to provide timely assistance and support to taxpayers.

What are the deadlines for filing taxes in Washington, D.C.?

+Tax filing deadlines vary depending on the type of tax and the taxpayer’s circumstances. For personal income taxes, the deadline is typically April 15th, but it may be extended in certain cases. Business tax deadlines may also vary. It’s essential to refer to the OTR’s website for specific deadlines and any applicable extensions.

Are there any tax relief programs available for low-income residents?

+Yes, the Office of Tax and Revenue offers various tax relief programs to assist low-income residents. These programs may include property tax relief, income tax credits, and other forms of financial support. OTR’s website provides detailed information on eligibility criteria and application processes for these programs.

How does OTR handle tax disputes or appeals?

+OTR has established processes for taxpayers to dispute or appeal tax assessments, penalties, or other tax-related issues. These processes typically involve filing a formal appeal, providing evidence, and participating in hearings or mediations. OTR aims to provide a fair and impartial resolution to such disputes.

What resources does OTR offer for small businesses regarding tax compliance?

+OTR provides a wealth of resources and guidance specifically tailored for small businesses. These resources include online guides, workshops, and one-on-one assistance to help small businesses understand their tax obligations, register for taxes, and comply with relevant regulations. OTR’s website is a valuable starting point for small business owners seeking tax-related information.