What Happens If I Miss Tax Deadline

The tax deadline is a critical date for taxpayers and businesses alike, as it marks the end of the financial year and the time to settle any outstanding tax liabilities with the relevant tax authorities. However, life can be unpredictable, and sometimes, despite our best intentions, we may find ourselves facing the prospect of missing this crucial deadline. So, what are the implications and consequences of missing the tax deadline, and what steps can be taken to mitigate any potential issues? Let's delve into the world of tax obligations and explore the ins and outs of this scenario.

Understanding the Tax Deadline and Its Significance

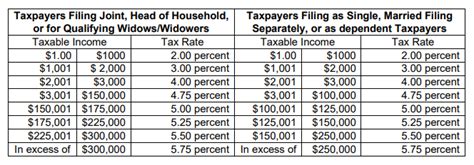

The tax deadline is a designated date set by the government or tax authorities for individuals and businesses to file their tax returns and make any necessary payments. This deadline varies across jurisdictions and can be influenced by factors such as the fiscal year-end, the complexity of the tax system, and the efficiency of the tax administration. In many countries, the tax deadline is a key event in the financial calendar, often accompanied by a flurry of activity as taxpayers rush to meet the requirements.

For instance, in the United States, the federal tax deadline for individual tax returns is typically April 15th, while corporate tax returns are due on March 15th for S corporations and March 16th for C corporations. These deadlines can be extended under certain circumstances, but the general rule is that taxpayers should aim to meet these dates to avoid any potential penalties.

Consequences of Missing the Tax Deadline

Missing the tax deadline can lead to a range of consequences, some more severe than others. It’s important to understand that the impact can vary depending on factors such as the jurisdiction, the amount of tax owed, and the reason for the missed deadline.

Late Filing Penalties

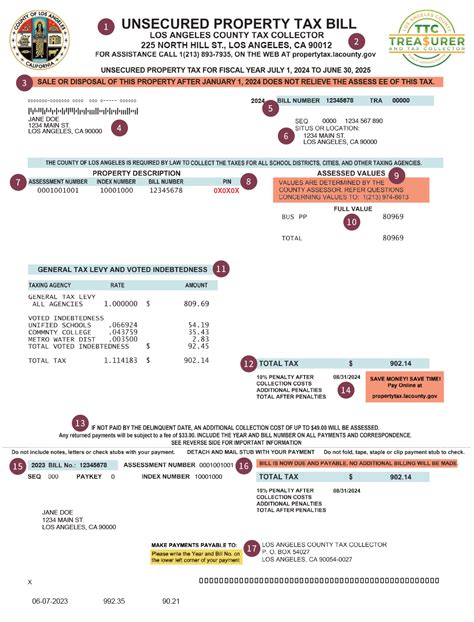

One of the most immediate consequences of missing the tax deadline is the imposition of late filing penalties. These penalties are designed to encourage taxpayers to meet their obligations in a timely manner and to deter any deliberate avoidance of the tax system. The specific penalties can vary, but they often include a monetary fine and, in some cases, additional interest charges on the outstanding tax amount.

For example, in the UK, the late filing penalty for Self Assessment tax returns is typically £100 if the return is up to three months late. If the return remains outstanding after three months, further penalties can be applied, which can quickly escalate. In the US, the late filing penalty for individual tax returns is generally 5% of the unpaid tax amount for each month or part of a month the return is late, up to a maximum of 25%.

Interest on Unpaid Tax

In addition to late filing penalties, taxpayers who miss the deadline and have an outstanding tax liability may also be charged interest on the unpaid amount. This interest is typically calculated daily and can quickly accumulate, adding to the overall cost of the late payment.

Consider the case of Australia, where the Australian Taxation Office (ATO) charges interest on unpaid tax at a rate that is indexed to the Reserve Bank of Australia's cash rate. This interest rate can change periodically and is applied from the due date of the tax liability until the date of payment.

Potential Criminal Charges

In some cases, missing the tax deadline can lead to more severe consequences, including potential criminal charges. This is particularly true if the missed deadline is coupled with other factors such as deliberate tax evasion, fraud, or a pattern of non-compliance.

In the US, for instance, the Internal Revenue Service (IRS) can pursue criminal charges against individuals who willfully fail to file tax returns or pay taxes. These charges can result in significant fines and even imprisonment. Similarly, in the UK, the HM Revenue and Customs (HMRC) has the power to investigate and prosecute individuals for tax evasion, which can lead to serious penalties.

Impact on Credit Rating

For individuals and businesses, missing the tax deadline can also have indirect consequences, such as a negative impact on their credit rating. Tax authorities often share information with credit bureaus, and a history of late payments or non-compliance can be reflected in an individual’s or business’s credit report.

This can make it more difficult to obtain loans, mortgages, or other forms of credit in the future, as lenders may perceive the individual or business as a higher risk due to their tax-related issues.

Strategies to Avoid Missing the Tax Deadline

Given the potential consequences, it’s clear that avoiding missing the tax deadline is in the best interest of taxpayers. Here are some strategies and best practices to help ensure compliance and avoid any unnecessary penalties.

Plan and Prepare in Advance

One of the most effective ways to avoid missing the tax deadline is to plan and prepare well in advance. This involves understanding the specific tax requirements, gathering all necessary documentation, and estimating the tax liability as early as possible.

For businesses, this may involve implementing robust financial management systems and processes to ensure accurate record-keeping and timely reporting. For individuals, it may mean seeking professional advice and support to navigate the tax system effectively.

Utilize Tax Software and Online Tools

In today’s digital age, there are numerous tax software and online tools available that can simplify the tax filing process and help ensure accuracy. These tools can guide users through the process, provide estimates of tax liabilities, and even generate the necessary tax forms.

By leveraging these technologies, taxpayers can reduce the risk of errors and ensure that their tax obligations are met in a timely manner. Many of these tools also offer features such as deadline reminders and the ability to store and access tax-related information securely.

Seek Professional Assistance

For complex tax situations or for those who lack the time or expertise to navigate the tax system, seeking professional assistance can be a valuable strategy. Tax professionals, such as accountants or tax consultants, can provide specialized knowledge and guidance to ensure compliance.

They can assist with tax planning, help identify potential deductions or credits, and ensure that all necessary tax forms are completed accurately and submitted on time. This can be particularly beneficial for businesses or individuals with more intricate tax situations.

Understand Extension Options

In some cases, taxpayers may find themselves unable to meet the tax deadline despite their best efforts. In such situations, it’s important to understand the extension options available and the procedures for requesting an extension.

Many jurisdictions offer the option to request an extension of the tax filing deadline. However, it's crucial to note that an extension to file does not necessarily mean an extension to pay. Taxpayers may still be required to make estimated tax payments by the original deadline to avoid penalties.

Navigating the Consequences of a Missed Deadline

If, despite your best efforts, you find yourself facing the reality of a missed tax deadline, it’s important to take immediate action to mitigate the consequences.

File as Soon as Possible

The first step is to file the tax return as soon as possible. While this won’t erase the consequences of missing the deadline, it demonstrates a willingness to comply and can help reduce further penalties or interest charges.

Tax authorities often appreciate prompt action and may be more lenient with taxpayers who take responsibility and file their returns promptly, even if they are late.

Pay Any Outstanding Tax

In addition to filing the tax return, it’s crucial to pay any outstanding tax liability as soon as you can. This will help minimize the interest charges and late payment penalties that may be accruing.

If you are unable to pay the full amount immediately, consider contacting the tax authorities to discuss potential payment plans or options. They may be able to offer a structured payment arrangement that suits your financial situation.

Seek Professional Advice

If you are facing significant penalties or potential legal consequences due to a missed tax deadline, it’s advisable to seek professional legal or tax advice. A qualified professional can provide guidance on your specific situation and help you navigate any complex issues.

They can also assist with negotiating with the tax authorities, representing you in any legal proceedings, and ensuring that you are taking all necessary steps to resolve the situation.

Future Implications and Lessons Learned

Missing the tax deadline can be a stressful and costly experience, but it also presents an opportunity for taxpayers to learn and improve their tax compliance practices.

Improved Tax Planning

One of the key lessons to take away from a missed tax deadline is the importance of effective tax planning. This involves not only understanding the tax requirements and deadlines but also anticipating potential changes in tax laws or regulations that may impact your tax obligations.

By staying informed and proactive, taxpayers can ensure that they are prepared for any changes and can adjust their financial strategies accordingly.

Enhanced Record-Keeping

Another critical aspect of tax compliance is maintaining accurate and organized financial records. This includes keeping track of income, expenses, deductions, and any other relevant information that may be required for tax purposes.

By implementing robust record-keeping systems and processes, taxpayers can ensure that they have the necessary documentation to support their tax filings and reduce the risk of errors or omissions.

The Value of Professional Guidance

For many taxpayers, especially those with complex financial situations or a history of non-compliance, seeking professional guidance can be a valuable investment. Tax professionals can provide specialized knowledge and support to ensure that tax obligations are met accurately and on time.

They can also offer ongoing advice and assistance with tax planning, helping taxpayers stay informed and compliant with the ever-evolving tax landscape.

Conclusion

Missing the tax deadline can lead to a range of consequences, from late filing penalties and interest charges to potential criminal charges and a negative impact on credit rating. However, by understanding the potential implications and taking proactive steps to avoid missing the deadline, taxpayers can minimize the risk of these consequences.

For those who find themselves in the unfortunate situation of missing the tax deadline, prompt action, such as filing the return and paying any outstanding tax, can help mitigate the penalties and interest charges. Seeking professional advice and learning from the experience can also help taxpayers improve their tax compliance practices and ensure a smoother tax journey in the future.

Remember, tax compliance is a shared responsibility, and by understanding the rules and taking the necessary steps, taxpayers can contribute to a fair and efficient tax system.

Can I still file my tax return after the deadline has passed?

+Yes, you can still file your tax return after the deadline, but it’s important to act promptly. Filing late can result in penalties and interest charges, so it’s best to file as soon as possible to minimize these consequences.

What happens if I can’t afford to pay the full amount of tax owed by the deadline?

+If you are unable to pay the full amount by the deadline, it’s recommended to contact the tax authorities to discuss potential payment plans or options. They may be able to work with you to set up a structured payment arrangement that suits your financial situation.

Are there any exceptions to the tax deadline for specific circumstances?

+Yes, there may be exceptions or special circumstances that allow for an extension of the tax filing deadline. However, it’s important to understand the specific requirements and procedures for requesting an extension in your jurisdiction. Additionally, an extension to file does not necessarily mean an extension to pay.

How can I reduce the risk of missing the tax deadline in the future?

+To reduce the risk of missing the tax deadline in the future, it’s beneficial to plan and prepare in advance, utilize tax software and online tools, and seek professional assistance if needed. Understanding the tax requirements, gathering necessary documentation, and staying informed about any changes can help ensure compliance.

Can I appeal the penalties and interest charges if I missed the tax deadline due to extenuating circumstances?

+In certain cases, it may be possible to appeal the penalties and interest charges if you can provide evidence of extenuating circumstances that prevented you from meeting the tax deadline. However, it’s important to consult with a tax professional or the relevant tax authorities to understand the specific requirements and procedures for appealing penalties.