Pre Tax Commuter Benefit

The Pre-Tax Commuter Benefit is an innovative and advantageous program that has gained significant traction in the realm of employee benefits, offering a practical solution to a common challenge faced by commuters. This benefit, often overlooked by employees, holds immense value in terms of financial savings and convenience, making it a powerful tool for both employers and employees alike. In this comprehensive guide, we will delve into the intricacies of the Pre-Tax Commuter Benefit, exploring its definition, advantages, eligibility criteria, implementation strategies, and its potential impact on the overall employee experience.

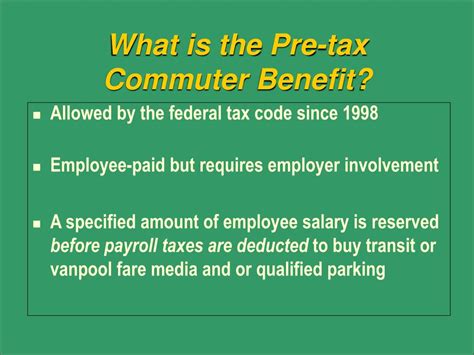

Understanding the Pre-Tax Commuter Benefit

The Pre-Tax Commuter Benefit, also known as a Commuter Transit Benefit or Commute Benefit, is a tax-advantaged program offered by employers to assist employees in covering their commuting costs. This benefit allows employees to set aside a portion of their pre-tax income to pay for eligible commuting expenses, thereby reducing their taxable income and saving money on their daily commutes. It is a voluntary benefit that employers can choose to offer as part of their compensation and benefits package, providing a significant incentive for employees who commute regularly.

Eligibility and Participation

Eligibility for the Pre-Tax Commuter Benefit is typically determined by the employer’s policies and the specific regulations governing such programs in the relevant jurisdiction. In the United States, for instance, the Internal Revenue Service (IRS) sets guidelines for this benefit, specifying that employees must be eligible to participate in their employer’s Flexible Spending Account (FSA) or Health Savings Account (HSA) to qualify for the Commuter Benefit.

Participation in the Pre-Tax Commuter Benefit is often open to all full-time and part-time employees, including those working remotely. However, certain eligibility criteria may vary based on the employer's discretion and the nature of the commuting expenses being covered. For example, some employers may restrict the benefit to employees who commute a certain distance or who use specific modes of transportation.

How it Works

The mechanics of the Pre-Tax Commuter Benefit are relatively straightforward. Employees who opt into the program can designate a portion of their pre-tax earnings to be set aside for commuting expenses. This amount is then deducted from their gross income before calculating federal, state, and local taxes, effectively reducing their taxable income. The designated funds can be used to cover a wide range of commuting expenses, including public transportation fares, parking fees, vanpooling costs, and even qualified bicycle commuting expenses.

The benefit is typically administered through a third-party benefits provider or the employer's payroll system. Employees can choose to contribute a fixed amount or a percentage of their earnings each pay period, with the designated funds being automatically deducted and allocated towards their commuting expenses. The specific process may vary depending on the employer's setup and the chosen benefits provider.

Advantages for Employees

- Tax Savings: One of the most significant advantages of the Pre-Tax Commuter Benefit is the tax savings it offers. By setting aside pre-tax income for commuting expenses, employees can reduce their taxable income, resulting in lower federal, state, and local taxes. This can lead to substantial savings, especially for employees with lengthy commutes or those who rely on costly modes of transportation.

- Cost-Effective Commuting: With the Pre-Tax Commuter Benefit, employees can cover their commuting expenses more cost-effectively. The benefit essentially provides a discount on commuting costs, making it more affordable for employees to get to and from work. This is particularly beneficial for those who live in areas with high transportation costs or who face long commutes.

- Financial Planning: The benefit allows employees to budget for their commuting expenses more effectively. By setting aside a specific amount for commuting, employees can plan their finances better, ensuring they have sufficient funds to cover their travel costs throughout the year.

- Flexibility: The Pre-Tax Commuter Benefit offers flexibility in terms of transportation choices. Employees can choose from various commuting options, such as public transit, ridesharing, or even biking, and still benefit from the tax advantages. This flexibility encourages employees to explore more sustainable and cost-effective commuting methods.

Advantages for Employers

- Attracting and Retaining Talent: Offering the Pre-Tax Commuter Benefit can be a powerful tool for employers to attract and retain top talent. In today’s competitive job market, providing comprehensive and attractive benefits packages is essential. The Commuter Benefit signals an employer’s commitment to employee well-being and financial health, making it a desirable perk for prospective employees.

- Reduced Administrative Burden: For employers, implementing the Pre-Tax Commuter Benefit can simplify payroll and tax administration. By partnering with a benefits provider or using an integrated payroll system, employers can streamline the process of administering the benefit, reducing the time and resources required for managing employee commuting expenses.

- Enhanced Employee Satisfaction: By offering this benefit, employers demonstrate their understanding of the challenges associated with commuting and their willingness to support employees in this aspect of their lives. This can lead to increased employee satisfaction, morale, and engagement, ultimately contributing to a more positive and productive work environment.

Implementing the Pre-Tax Commuter Benefit

Step-by-Step Guide

- Research and Planning: Before implementing the Pre-Tax Commuter Benefit, employers should conduct thorough research to understand the relevant regulations and best practices. This includes consulting with legal and tax advisors to ensure compliance with local, state, and federal laws. Additionally, employers should assess their employee population to gauge interest and potential participation in the benefit.

- Choose a Benefits Provider: Employers can opt to work with a third-party benefits provider or utilize their existing payroll system to administer the benefit. Benefits providers often offer a range of services, including enrollment management, expense tracking, and reporting, making the process more streamlined for both employers and employees.

- Develop a Communication Strategy: Effective communication is key to successful implementation. Employers should create a comprehensive communication plan to educate employees about the benefit, its advantages, and the enrollment process. This can include email campaigns, intranet posts, and in-person workshops or presentations.

- Set Up Enrollment Process: Determine the enrollment period and ensure that employees have ample time to review and enroll in the benefit. Develop clear and concise enrollment materials, including instructions and eligibility criteria. Consider offering multiple enrollment options, such as online, paper, or in-person enrollment, to accommodate different preferences and needs.

- Integration with Payroll: If using a third-party benefits provider, employers should work closely with their payroll team to integrate the benefit into the payroll system. This ensures that designated funds are accurately deducted from employees’ paychecks and allocated towards their commuting expenses.

- Ongoing Administration: Once the benefit is implemented, employers should establish a system for ongoing administration. This includes regular communication with employees, providing updates on benefit usage, and addressing any questions or concerns. Additionally, employers should monitor participation rates and analyze usage data to evaluate the success and impact of the benefit.

Maximizing the Impact of the Pre-Tax Commuter Benefit

To fully realize the potential of the Pre-Tax Commuter Benefit, employers can take additional steps to maximize its impact on employee satisfaction and engagement.

- Promote Sustainable Commuting: Encourage employees to explore sustainable commuting options, such as carpooling, vanpooling, or biking. Employers can provide resources and incentives to support these initiatives, including access to bike storage facilities, discounts on public transit passes, or even organizing company-wide carpooling initiatives.

- Offer Flexible Work Arrangements: Consider implementing flexible work arrangements, such as remote work options or flexible scheduling, to reduce the need for lengthy commutes. This not only saves employees time and money but also contributes to a more balanced work-life integration.

- Provide Commuting Resources: Share resources and information with employees to help them make informed commuting choices. This can include providing maps of public transit routes, sharing tips for efficient commuting, or even partnering with local transportation authorities to offer discounted passes or subscriptions.

- Recognize and Reward Participation: Recognize and appreciate employees who actively participate in the Pre-Tax Commuter Benefit. This can be done through public acknowledgment, incentives, or even friendly competitions to encourage wider adoption of the benefit.

Future Implications and Trends

As the landscape of employee benefits continues to evolve, the Pre-Tax Commuter Benefit is likely to play an increasingly significant role in attracting and retaining talent. With rising transportation costs and the growing emphasis on sustainability, employers who offer this benefit are well-positioned to meet the needs and expectations of their employees.

Looking ahead, we can anticipate several trends and developments related to the Pre-Tax Commuter Benefit:

- Integration with Sustainable Initiatives: Employers are increasingly recognizing the importance of sustainability in their operations. As such, we can expect to see the Pre-Tax Commuter Benefit integrated with broader sustainable initiatives, such as eco-friendly commuting incentives or initiatives to reduce carbon footprints.

- Enhanced Technology Integration: Technology will continue to play a pivotal role in the administration and utilization of the Pre-Tax Commuter Benefit. Employers may leverage digital platforms and mobile apps to streamline enrollment, expense tracking, and reimbursement processes, making the benefit more accessible and user-friendly.

- Expanded Eligibility Criteria: To accommodate a diverse workforce, employers may expand the eligibility criteria for the Pre-Tax Commuter Benefit. This could include extending the benefit to contractors, gig workers, or even employees working outside the traditional office setting, such as remote workers or those with flexible schedules.

- Increased Personalization: As employers strive to meet the unique needs of their workforce, we can expect to see more personalized approaches to the Pre-Tax Commuter Benefit. This may involve offering customized commuting packages based on individual preferences or providing flexible spending options to accommodate different commuting needs.

Conclusion

The Pre-Tax Commuter Benefit is a powerful tool that offers a win-win solution for both employers and employees. By providing tax advantages and cost savings on commuting expenses, this benefit enhances employee satisfaction, financial well-being, and overall engagement. Employers, in turn, benefit from improved talent attraction and retention, reduced administrative burdens, and a more positive work environment.

As we navigate the ever-changing landscape of employee benefits, the Pre-Tax Commuter Benefit stands out as a practical and valuable offering. By implementing this benefit effectively and maximizing its impact, employers can position themselves as forward-thinking and employee-centric organizations, setting the stage for long-term success and a thriving workforce.

What are the tax savings associated with the Pre-Tax Commuter Benefit?

+The tax savings depend on an individual’s tax bracket and commuting expenses. By setting aside pre-tax income for commuting, employees can reduce their taxable income, resulting in lower federal, state, and local taxes. The exact savings vary based on personal circumstances.

Are there any limitations on the types of commuting expenses covered by the Pre-Tax Commuter Benefit?

+Yes, the benefit typically covers expenses such as public transportation fares, parking fees, vanpooling costs, and qualified bicycle commuting expenses. However, the specific eligible expenses may vary depending on the employer’s policies and the relevant regulations.

How do employees enroll in the Pre-Tax Commuter Benefit?

+Employees typically enroll in the benefit during an open enrollment period, which is determined by the employer. The enrollment process may vary but often involves completing an enrollment form or accessing an online portal to designate the amount or percentage of their earnings to be set aside for commuting expenses.

Can the Pre-Tax Commuter Benefit be used for all modes of transportation?

+The benefit generally covers a wide range of commuting options, including public transit, ridesharing, and biking. However, certain modes of transportation, such as personal vehicle commuting, may not be eligible. Employers may have specific guidelines or restrictions based on their policies and the regulations in their jurisdiction.

How often can employees change their Pre-Tax Commuter Benefit contributions?

+The frequency of contribution changes depends on the employer’s policies and the benefits provider. In most cases, employees can make changes during a designated open enrollment period or in response to certain life events, such as a change in commuting distance or transportation mode.