Utah State Income Tax Rate

Utah, known for its stunning natural landscapes and thriving economy, imposes a state income tax on its residents and businesses. The Utah State Income Tax Rate plays a crucial role in funding various public services and initiatives, impacting both individuals and businesses across the state. Understanding this tax structure is essential for residents, investors, and businesses considering their financial strategies and contributions to the local economy.

Overview of Utah’s State Income Tax System

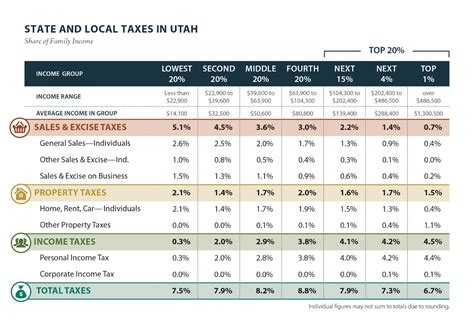

Utah operates on a progressive income tax system, which means that the state income tax rate increases as an individual’s or business’s taxable income rises. This approach ensures that those with higher incomes contribute a greater proportion of their earnings to the state’s revenue. The state’s tax structure is designed to promote fairness and support essential public services, such as education, healthcare, infrastructure development, and more.

As of my last update in January 2023, the Utah State Income Tax Rates are as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 4.85% | First $2,500 of taxable income |

| 5.30% | $2,500.01 - $5,500 |

| 5.40% | $5,500.01 - $8,000 |

| 5.50% | $8,000.01 - $12,500 |

| 5.70% | $12,500.01 and above |

These tax rates are applicable to both individuals and businesses operating in Utah. It's important to note that the tax rates and brackets may be subject to changes and updates by the Utah State Legislature, so staying informed about the latest tax laws is essential for accurate financial planning.

Impact on Individuals and Businesses

The Utah State Income Tax Rate has a significant impact on both individuals and businesses within the state. For individuals, the progressive tax system means that higher-income earners contribute a larger portion of their income to state revenue. This structure aims to maintain a balance between individual financial responsibilities and the funding of essential public services.

Businesses, too, are subject to the state income tax, with the rate varying based on the business's taxable income. This tax contributes to the overall economic health of the state, providing resources for infrastructure, education, and other vital sectors. Additionally, Utah offers various incentives and tax credits to businesses, encouraging economic growth and job creation.

Comparison with Other States

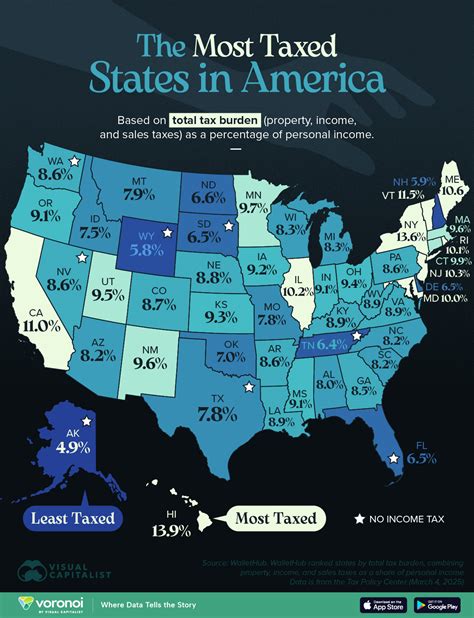

When compared to other states, Utah’s state income tax rate is relatively moderate. Many states have higher tax rates, especially for higher-income brackets. This competitiveness can make Utah an attractive destination for businesses and individuals seeking a balanced approach to taxation and a thriving economic environment.

For example, California, with its high cost of living, has a top state income tax rate of 13.3%, which is significantly higher than Utah's top rate of 5.7%. Similarly, New York State's top income tax rate is 8.82%, making Utah's tax structure more favorable for high-income earners.

Tax Credits and Incentives

Utah offers a range of tax credits and incentives to individuals and businesses, aiming to promote economic growth, support specific industries, and encourage community development. These credits and incentives can significantly reduce an individual’s or business’s tax liability, making Utah an attractive location for investment and entrepreneurship.

Business Tax Incentives

Utah provides various tax incentives for businesses, including tax credits for research and development, job creation, and investment in certain industries. For instance, the state offers a Research Tax Credit, allowing businesses to claim a credit of up to 15% of qualified research expenses. This credit aims to foster innovation and technological advancement within the state.

Additionally, Utah's Capital Investment Tax Credit provides a credit of up to 10% of eligible capital investment costs for businesses expanding or relocating to the state. This incentive encourages businesses to invest in Utah's economy and create job opportunities.

Individual Tax Credits

Individuals in Utah can also benefit from tax credits, such as the Child and Dependent Care Tax Credit, which helps offset the cost of childcare. This credit is particularly beneficial for working parents, allowing them to claim a percentage of their childcare expenses as a tax credit.

Furthermore, Utah offers a Credit for College Tuition and Fees, providing a credit for qualified education expenses. This credit aims to make higher education more accessible and affordable for Utah residents.

Tax Filing and Compliance

Tax filing and compliance in Utah are relatively straightforward processes. The Utah State Tax Commission provides comprehensive resources and guidance for individuals and businesses to ensure accurate and timely tax filing. The commission offers online filing options, making the process more convenient and efficient.

Tax Deadlines and Extensions

The standard tax filing deadline in Utah is April 15th, aligning with the federal tax deadline. However, the state offers extension options for those who require additional time to file their tax returns. It’s essential to note that while an extension provides more time to file, it does not extend the deadline for paying any taxes owed.

Electronic Filing and Payment Options

Utah encourages electronic filing and payment of taxes, providing a secure and efficient system for taxpayers. The state’s online tax filing platform, MyTax, allows individuals and businesses to file their tax returns and make payments conveniently. This platform also provides real-time updates and notifications, ensuring taxpayers stay informed about their tax obligations.

Future Outlook and Tax Policy Changes

The Utah State Income Tax Rate is subject to periodic reviews and potential changes by the state legislature. These changes may be influenced by economic conditions, budget considerations, and the state’s overall financial needs. It’s crucial for taxpayers to stay informed about any proposed or enacted tax law changes to effectively plan their financial strategies.

Potential Tax Reform Proposals

In recent years, there have been discussions and proposals for tax reform in Utah, including ideas such as flattening the tax rate or implementing a sales tax increase to fund specific initiatives. These proposals aim to address various economic and social issues while maintaining a balanced approach to taxation.

As of my last update, there were no major tax reform proposals actively being considered. However, it's important for taxpayers to engage with their local representatives and stay updated on any potential changes that may impact their financial planning.

Conclusion

The Utah State Income Tax Rate plays a vital role in funding public services and contributing to the state’s economic health. The progressive tax system ensures fairness, while tax credits and incentives promote economic growth and community development. Understanding the tax structure and staying informed about potential changes is essential for individuals and businesses operating in Utah.

As Utah continues to thrive and evolve, its tax policies will likely adapt to meet the changing needs of its residents and businesses. By staying engaged and informed, taxpayers can actively participate in shaping the state's financial landscape and contribute to its overall success.

What is the current top state income tax rate in Utah?

+As of my last update, the top state income tax rate in Utah is 5.7% for taxable income above $12,500.

Are there any tax incentives for businesses in Utah?

+Yes, Utah offers various tax incentives for businesses, including tax credits for research and development, job creation, and capital investment.

When is the tax filing deadline in Utah?

+The standard tax filing deadline in Utah is April 15th, aligning with the federal tax deadline. However, extensions are available for those who need additional time to file.

How can I stay updated on Utah’s tax policies and changes?

+You can stay informed by regularly visiting the Utah State Tax Commission’s website, following local news outlets, and engaging with tax professionals who can provide insights and updates on tax policy changes.