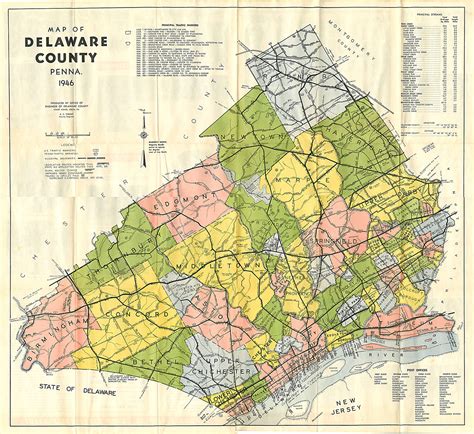

Delaware County Tax Records

In the realm of public records, tax information is a valuable resource for researchers, historians, and those interested in understanding the economic landscape of a region. This article delves into the Delaware County tax records, exploring their historical significance, accessibility, and the insights they provide about the county's financial history.

Unveiling Delaware County's Fiscal Past

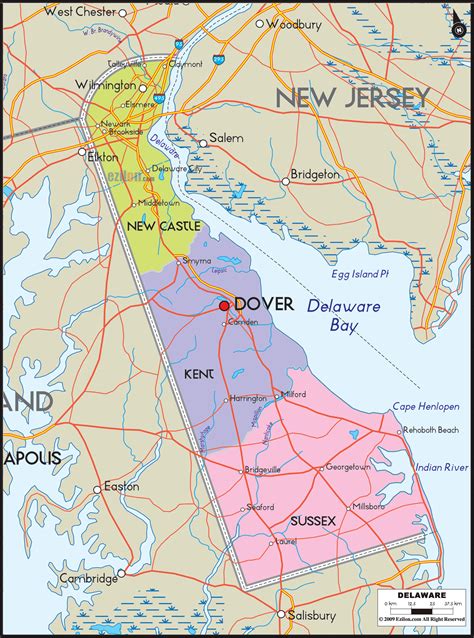

Delaware County, nestled in the heart of Pennsylvania, boasts a rich history that is intricately woven with its economic development. The tax records of this county serve as a window into the past, offering a glimpse of the financial contributions and obligations of its residents and businesses over the years.

These records, often meticulously maintained by the county's tax authorities, provide a comprehensive overview of property values, tax rates, and the economic climate of Delaware County. From assessing the growth and decline of property values to understanding the fiscal policies implemented by the county government, these records offer a unique perspective on the region's economic journey.

A Historical Overview

The Delaware County tax records date back to the late 18th century, a period marked by the county's establishment and the emergence of its earliest settlements. During this era, tax assessments were primarily focused on real estate, with properties being valued based on their size, location, and potential for agricultural or commercial use.

As the county evolved, so did its tax system. The 19th century saw the introduction of new tax categories, including personal property taxes and income taxes. These records reflect the changing economic landscape, with the rise of industrial activities and the emergence of new business sectors.

| Period | Tax Categories |

|---|---|

| 18th Century | Real Estate Taxes |

| 19th Century | Personal Property Taxes, Income Taxes |

| 20th Century | Business Taxes, Vehicle Taxes |

| 21st Century | Online Filing, Modernized Assessment Methods |

The 20th century brought further diversification, with the introduction of business taxes, vehicle taxes, and the gradual shift towards online tax filing and assessment methods. This evolution is a testament to the county's adaptability and its efforts to keep pace with modern financial practices.

Uncovering the Data: A Step-by-Step Guide

Accessing Delaware County tax records is a straightforward process, thanks to the county's commitment to transparency and digitization efforts. Here's a guide to navigating the process:

- Online Search: The Delaware County website provides an online search portal for tax records. Users can search by property address, owner name, or tax parcel number.

- Public Records Office: For those seeking a more comprehensive search or requiring assistance, the Delaware County Public Records Office is a valuable resource. Staff members are available to guide researchers and provide access to physical records and digital archives.

- Digitized Archives: A significant portion of the county's tax records has been digitized, making it easier to access and analyze data. These digital records are organized by year and category, allowing for efficient searches.

Analyzing the Data: Insights and Trends

The wealth of information contained within Delaware County tax records offers a multitude of insights for researchers and analysts.

- Property Value Trends: Analyzing historical tax assessments provides a clear picture of property value fluctuations over time. This data is invaluable for real estate professionals, historians, and urban planners, offering insights into the county's economic health and development patterns.

- Tax Policy Impact: By comparing tax records from different periods, researchers can assess the impact of tax policy changes. This analysis helps evaluate the effectiveness of various fiscal strategies implemented by the county government.

- Business Growth and Decline: Tax records that include business tax information can reveal trends in business activity. This data is crucial for economic development initiatives, allowing the county to identify sectors that are thriving or struggling and tailor support strategies accordingly.

The Future of Delaware County Tax Records

As Delaware County continues to embrace technological advancements, the future of its tax records looks increasingly digital and accessible. The county's ongoing efforts to modernize its record-keeping systems and provide online access are a testament to its commitment to transparency and efficiency.

With the digitization of records, researchers and the public can expect more streamlined access to historical tax data. This not only facilitates easier analysis but also opens up opportunities for citizen engagement and participation in understanding the county's financial history.

Additionally, the integration of modern assessment methods and online filing systems ensures that Delaware County's tax records remain up-to-date and reflective of the current economic landscape. This continuous updating process ensures the records' relevance and utility for years to come.

Conclusion: A Valuable Resource for All

Delaware County tax records are more than just numbers and data; they are a narrative of the county's economic journey. From its early days as a burgeoning settlement to its modern status as a thriving economic hub, these records tell a story of growth, adaptation, and financial resilience.

By exploring these records, researchers, historians, and the public can gain a deeper understanding of the county's past and present, and perhaps, make more informed decisions about its future. The accessibility and richness of these records ensure that Delaware County's fiscal history remains an open book for all to explore and learn from.

How far back do Delaware County tax records go?

+Delaware County tax records date back to the late 18th century, offering a comprehensive historical perspective.

What types of tax records are available for public access?

+The county provides access to real estate tax records, personal property tax records, and business tax records.

How can I search for specific tax records online?

+You can search by property address, owner name, or tax parcel number on the Delaware County website’s search portal.

Are there any restrictions on accessing Delaware County tax records?

+While the records are generally accessible to the public, certain sensitive information, such as individual tax returns, may be restricted for privacy reasons.