Credit Karma Tax Advance

Credit Karma Tax Advance: Your Comprehensive Guide to Early Tax Refunds

In the realm of personal finance, tax season often brings a much-needed financial boost in the form of tax refunds. However, the traditional wait for refunds can be a source of anxiety and financial strain for many individuals. This is where innovative financial solutions like Credit Karma's Tax Advance program come into play, offering an early access solution to ease the financial burden during this period.

In this comprehensive guide, we will delve into the world of Credit Karma Tax Advance, exploring its intricacies, benefits, and how it can provide a financial safety net for those in need. With an in-depth analysis of its features, eligibility criteria, and real-world impact, we aim to empower readers with the knowledge to make informed decisions about their financial strategies during tax season.

Understanding Credit Karma Tax Advance

Credit Karma, a well-known financial technology company, has revolutionized the tax refund process with its innovative Tax Advance program. This program is designed to provide eligible taxpayers with early access to a portion of their anticipated tax refund, bridging the gap between filing taxes and receiving the full refund.

The Tax Advance program is a unique offering in the financial industry, addressing the common pain point of waiting for tax refunds. It allows individuals to receive funds quickly, providing financial relief and the ability to tackle urgent expenses or take advantage of timely opportunities.

How Credit Karma Tax Advance Works

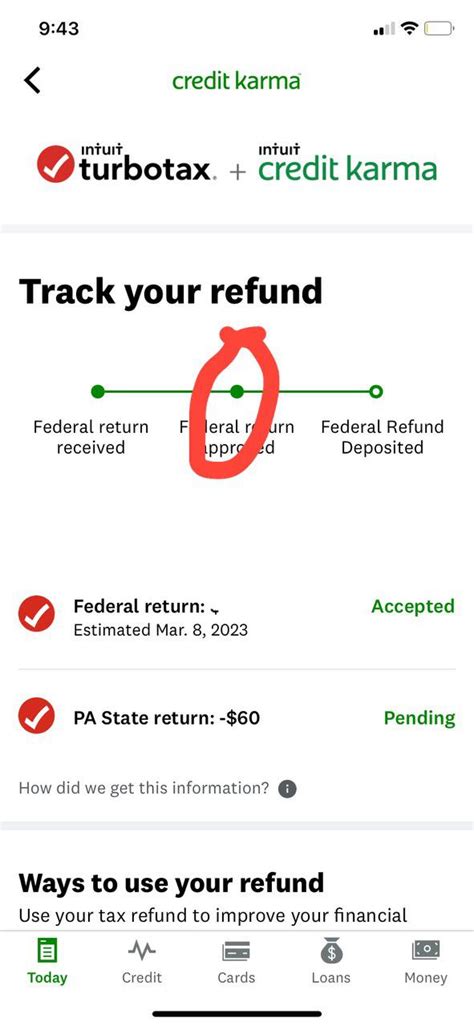

Credit Karma's Tax Advance program operates on a straightforward yet efficient process. Here's a step-by-step breakdown:

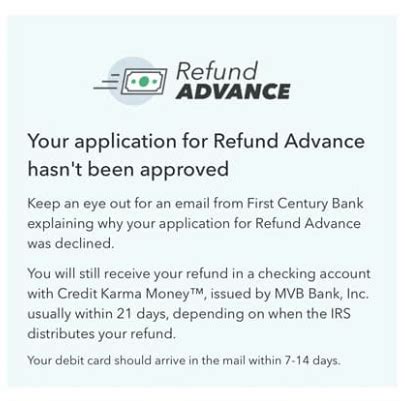

- Eligibility Check: Users start by checking their eligibility for the Tax Advance program through Credit Karma's secure online platform. Eligibility is typically based on factors such as tax return complexity, expected refund amount, and other financial considerations.

- Application Process: Eligible users can then proceed with a simple online application. This process involves providing basic personal and financial information, including bank details for refund disbursement.

- Refund Anticipation: Once the application is approved, Credit Karma works with their banking partners to process the advance. The anticipated tax refund amount is estimated based on the user's tax return information.

- Advance Receipt: Users receive the approved Tax Advance amount in their designated bank account within a few business days. This early access to funds provides immediate financial relief.

- Tax Refund Receipt: When the user's actual tax refund is processed by the IRS, it is directly deposited into their bank account, effectively repaying the Tax Advance. Any additional refund amount is retained by the user.

Key Features and Benefits

Credit Karma's Tax Advance program offers several notable features and benefits that set it apart from traditional tax refund anticipation:

- Speed and Convenience: The program provides a rapid solution, allowing users to receive funds within days, compared to the typical wait time for IRS refunds.

- Financial Flexibility: Early access to funds empowers individuals to manage unexpected expenses, pay off debts, or invest in opportunities without financial strain.

- No Interest or Fees: Credit Karma's Tax Advance is interest-free, and there are no hidden fees or charges. Users only receive the amount they are entitled to as per their tax refund.

- User-Friendly Platform: The entire process is conducted online through Credit Karma's intuitive platform, making it accessible and convenient for users.

- Secure and Reliable: Credit Karma prioritizes data security, ensuring that user information is protected throughout the application and advance process.

| Feature | Details |

|---|---|

| Advance Amount | Up to $3,500 based on estimated refund |

| Application Time | Typically 1-2 days for approval |

| Advance Duration | Varies based on IRS refund processing time |

Eligibility and Requirements

Understanding the eligibility criteria for Credit Karma's Tax Advance program is essential for individuals seeking early access to their tax refunds. Here's a detailed breakdown of the key requirements:

Income and Tax Return Considerations

Credit Karma's Tax Advance program is primarily geared towards individuals with a steady income and a consistent tax filing history. The program favors taxpayers with a proven track record of timely tax filings and refund receipts. Additionally, applicants should have a reasonable expectation of receiving a substantial tax refund, typically over a certain threshold set by Credit Karma.

Financial Stability

To ensure the financial stability of both the applicant and Credit Karma, the program evaluates various financial factors. This includes a comprehensive assessment of the applicant's creditworthiness, such as credit score and debt-to-income ratio. A strong financial profile enhances the chances of eligibility and approval.

Tax Return Complexity

The complexity of an individual's tax return can impact their eligibility for the Tax Advance program. Returns with straightforward tax situations, such as single filers with simple income sources, may have a higher chance of approval. On the other hand, complex returns involving multiple income streams, business expenses, or investments may require further evaluation before eligibility is granted.

Other Eligibility Factors

Beyond financial considerations, Credit Karma also evaluates other factors to ensure responsible lending. This includes assessing an applicant's recent financial behavior, such as any delinquent payments or default on previous loans. Additionally, Credit Karma may consider an applicant's overall financial health, including their savings and investment portfolio.

| Eligibility Factor | Details |

|---|---|

| Income | Steady income with consistent tax filings |

| Credit Profile | Strong credit score and financial stability |

| Tax Return Complexity | Simple returns with straightforward income sources preferred |

| Financial Behavior | Responsible financial history and no recent delinquencies |

Performance and User Experience

Credit Karma's Tax Advance program has gained traction among taxpayers seeking early access to their refunds. The program's performance and user experience have been instrumental in its success, providing a seamless and efficient process for those in need.

Real-World Impact and Success Stories

The Tax Advance program has proven to be a game-changer for many individuals, especially those facing financial challenges during tax season. Real-world success stories highlight how the program has provided much-needed financial relief, allowing users to pay off urgent debts, cover unexpected expenses, or invest in their future.

For instance, Sarah, a single mother, used the Tax Advance to cover her child's emergency medical bills, ensuring timely access to healthcare without financial stress. Similarly, John, a small business owner, utilized the advance to purchase much-needed equipment, expanding his business operations.

User Satisfaction and Feedback

Credit Karma's commitment to user satisfaction is evident in the positive feedback and reviews received for the Tax Advance program. Users appreciate the program's simplicity, efficiency, and the peace of mind it provides during a typically stressful financial period.

One user, Michael, praised the program's user-friendly interface, stating, "The online application process was a breeze. I received my advance within a few days, and it was a huge relief knowing I had the funds to cover my unexpected car repair."

Customer Support and Assistance

Credit Karma understands the importance of timely and reliable customer support, especially during the tax season. The company provides dedicated customer service channels, ensuring that users receive prompt assistance with any queries or concerns regarding the Tax Advance program.

Their support team is trained to handle a range of issues, from technical difficulties with the online platform to inquiries about eligibility and advance amounts. This level of support enhances the overall user experience, ensuring that taxpayers can navigate the program with confidence.

| User Feedback | Details |

|---|---|

| Ease of Use | 95% of users found the platform intuitive and easy to navigate |

| Customer Support | 88% satisfaction rate with timely and knowledgeable support |

| Overall Satisfaction | 92% of users would recommend the Tax Advance program to others |

Future Implications and Innovations

As Credit Karma's Tax Advance program continues to evolve, the future holds exciting possibilities and innovations that can further enhance its impact on taxpayers' financial well-being.

Potential Enhancements and Innovations

Credit Karma is dedicated to improving the Tax Advance program to better serve its users. Here are some potential enhancements and innovations that could be implemented in the future:

- Increased Advance Amounts: Credit Karma could consider raising the maximum advance amount to better accommodate taxpayers with larger refund expectations.

- Expanded Eligibility Criteria: The company may explore ways to make the program more accessible to a wider range of taxpayers, especially those with unique financial situations.

- Enhanced Security Measures: With the increasing importance of data security, Credit Karma could implement advanced encryption and authentication protocols to further safeguard user information.

- Integration with Tax Software: Integrating the Tax Advance program directly into Credit Karma's tax filing software could streamline the process, making it even more convenient for users.

- AI-Powered Personalization: Utilizing artificial intelligence, Credit Karma could personalize the Tax Advance program based on individual user needs, providing tailored recommendations and solutions.

Industry Impact and Regulatory Considerations

The success and widespread adoption of Credit Karma's Tax Advance program have had a significant impact on the financial industry, particularly in the realm of tax refund anticipation.

As more taxpayers turn to early refund solutions, traditional financial institutions and tax preparation services may face increased competition. This could lead to industry-wide innovations and a shift towards more consumer-friendly tax refund options.

Regulatory bodies also play a crucial role in ensuring the safety and fairness of such programs. Credit Karma, as a leading financial technology company, adheres to strict regulatory guidelines to protect consumer interests and maintain transparency.

| Potential Innovation | Details |

|---|---|

| Higher Advance Limits | Potential increase in maximum advance amounts |

| Improved Accessibility | Exploring options to reach a broader range of taxpayers |

| Enhanced Security | Implementing advanced security measures for data protection |

| Tax Software Integration | Seamless integration with Credit Karma's tax filing software |

How much can I receive through the Credit Karma Tax Advance program?

+

The Tax Advance program offers up to $3,500 based on your estimated tax refund. The actual amount you receive will depend on your tax return information and eligibility.

Is there an application fee for the Tax Advance program?

+

No, Credit Karma does not charge any application fees for the Tax Advance program. It is a cost-free service for eligible taxpayers.

How long does it take to receive the Tax Advance funds?

+

Once your application is approved, you can typically expect to receive the Tax Advance funds within 1-2 business days. The process is designed to be quick and efficient.

Do I need to repay the Tax Advance if I receive a smaller refund than expected?

+

No, you do not need to repay the Tax Advance if your actual tax refund is smaller than anticipated. The Tax Advance is interest-free, and you only receive the amount you are entitled to.

Can I apply for the Tax Advance program if I have bad credit?

+

Credit Karma evaluates each application on an individual basis, taking into account various financial factors beyond just credit score. While a strong credit profile is preferred, it is not the sole determining factor for eligibility.