What Is Ny Sales Tax

The New York sales tax is a consumption tax imposed on the sale of goods and certain services within the state of New York. It is an important revenue source for the state, contributing significantly to its overall tax income. The tax is administered by the New York State Department of Taxation and Finance, which ensures compliance and sets guidelines for businesses and consumers alike.

Understanding the Basics of New York Sales Tax

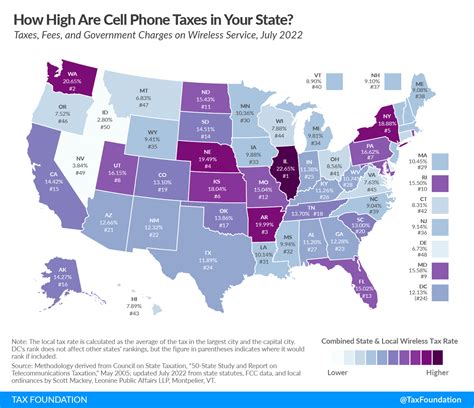

The sales tax in New York is applied to the purchase price of tangible personal property and certain services. It is a percentage of the purchase price, and the rate can vary depending on the location of the sale and the type of item or service being sold. The state of New York sets a base sales tax rate, but counties and municipalities can also add their own local sales taxes, resulting in a combined rate.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 4% |

| Local Sales Tax (Average) | 4.5% |

| Combined Rate (State + Local) | 8.5% |

As of 2023, the state of New York imposes a base sales tax rate of 4%. However, when combined with local sales taxes, which vary by county and city, the average rate increases to 8.5%. This means that on a $100 purchase, you would pay $8.50 in sales tax, bringing the total cost to $108.50.

Exemptions and Special Cases

Not all goods and services are subject to sales tax in New York. Some items are exempt, such as most groceries, prescription medications, and certain clothing items under a specific price threshold. Additionally, there are periodic tax-free shopping events, often targeting back-to-school or holiday shopping, where certain categories of goods are exempt from sales tax for a limited time.

Furthermore, there are special rules for certain industries. For instance, in the hospitality sector, sales tax is charged on the total bill, including room charges, meals, and services. In the construction industry, sales tax may apply to building materials and certain services related to construction or renovation.

Sales Tax Registration and Compliance

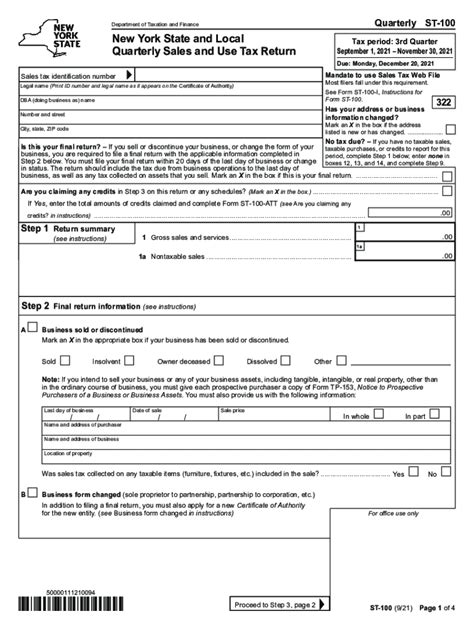

Businesses operating in New York or making sales into the state are generally required to register for a sales tax permit with the Department of Taxation and Finance. This registration ensures that businesses collect and remit the correct amount of sales tax on behalf of the state. Failure to register and comply with sales tax laws can result in penalties and interest charges.

Collection and Remittance

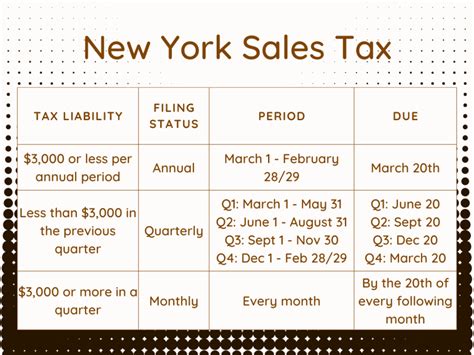

Businesses are responsible for collecting the appropriate sales tax at the point of sale. This tax is then held in trust by the business until it is remitted to the state. The frequency of remittance depends on the business’s sales volume and can range from monthly to annually. Late or incorrect remittances can lead to penalties.

Audits and Enforcement

The Department of Taxation and Finance has the authority to conduct audits on businesses to ensure compliance with sales tax laws. These audits can be complex and may require businesses to provide detailed records of sales, purchases, and tax collections. Non-compliance can result in legal consequences, including fines and, in extreme cases, criminal charges.

The Impact of Sales Tax on Businesses and Consumers

For businesses, the sales tax system in New York can be complex, especially for those with multiple locations or those selling online. Businesses must ensure they are aware of the tax rates applicable to their specific location and the products or services they sell. Missteps can lead to under- or over-collection of sales tax, both of which can have financial and legal repercussions.

Consumer Behavior and Pricing Strategies

Consumers, on the other hand, may strategically time their purchases to take advantage of tax-free periods or shop across state lines to avoid higher sales tax rates. This can impact local businesses, especially in border towns where consumers might opt to shop in neighboring states with lower tax rates. As a result, businesses often have to balance their pricing strategies to remain competitive while still meeting their tax obligations.

E-commerce and Sales Tax Challenges

The rise of e-commerce has presented unique challenges for sales tax collection. Online retailers, especially those selling to New York consumers, must navigate the complex web of tax rates and regulations. This often requires the use of specialized software to ensure accurate tax calculation and compliance.

Future Outlook and Potential Changes

As technology and consumer behavior evolve, the sales tax landscape in New York is likely to see further changes. The state may consider implementing new strategies, such as expanding the list of taxable services or simplifying the tax structure to ease the burden on businesses and consumers.

Additionally, with the ongoing debate around online sales tax collection, there is a possibility of new federal legislation that could significantly impact how sales tax is collected and remitted, particularly for e-commerce businesses.

Potential Benefits and Drawbacks

Simplifying the sales tax system could reduce compliance costs for businesses and provide a more consistent experience for consumers. However, any changes would need to balance the needs of different industries and regions within the state to ensure fairness.

Conclusion

The New York sales tax is a vital component of the state’s revenue system, providing funding for essential services and infrastructure. While it can be complex, understanding the tax rates and regulations is crucial for both businesses and consumers. Staying informed about any changes and ensuring compliance not only helps avoid legal issues but also contributes to the state’s overall financial health.

How often are sales tax rates updated in New York?

+

Sales tax rates are not updated frequently. However, local jurisdictions may adjust their rates from time to time. It is advisable to check with the New York Department of Taxation and Finance for the most current rates.

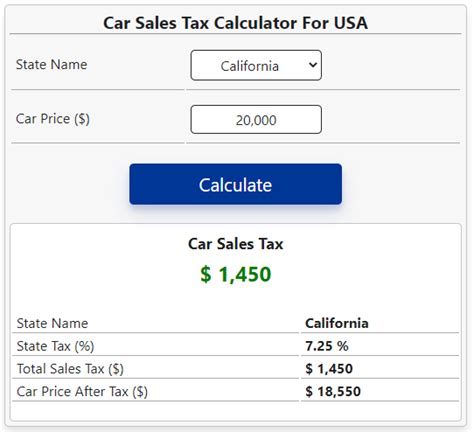

Are there any online tools to help calculate New York sales tax?

+

Yes, there are several online calculators and tools available, including those provided by tax software companies and some government websites. These tools can help you estimate the sales tax for a specific purchase based on your location.

Can I get a refund if I overpay sales tax?

+

Yes, if you believe you have overpaid sales tax, you can file for a refund with the New York Department of Taxation and Finance. You will need to provide supporting documentation to substantiate your claim.

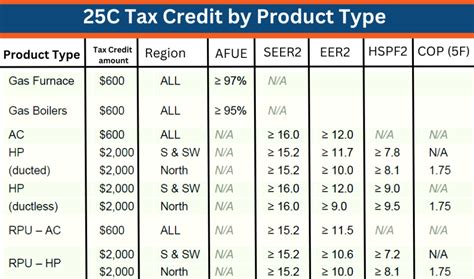

Are there any tax incentives for businesses in New York?

+

Yes, New York offers various tax incentives and credits to encourage business growth and investment. These can include tax credits for job creation, research and development, and certain types of investments. It is recommended to consult with a tax professional or the Department of Taxation and Finance for more information.