Day Trading And Taxes

Day trading is an exciting and dynamic world where traders buy and sell financial instruments within the same trading day, aiming to capitalize on short-term price movements. However, with the potential for high rewards comes a unique set of tax obligations and considerations. This comprehensive guide delves into the intricate relationship between day trading and taxes, offering an in-depth analysis for those navigating this challenging and rewarding financial path.

The Complex World of Day Trading Taxes

Understanding the tax landscape of day trading is crucial for both seasoned traders and newcomers alike. Unlike traditional investments, day trading involves a high volume of transactions, often resulting in complex tax situations. Traders must be well-versed in the tax implications of their activities to ensure compliance and optimize their financial strategies.

Defining Day Trading for Tax Purposes

From a tax perspective, day trading is characterized by a pattern of frequent trades, typically involving the buying and selling of securities within the same trading day. This is distinct from long-term investing, where assets are held for extended periods. The Internal Revenue Service (IRS) has specific guidelines for classifying day traders, which can impact tax obligations.

For instance, the IRS considers a trader a pattern day trader if they execute four or more day trades within five business days and the number of day trades is more than six percent of the customer's total trades for that same five-day period. This classification carries specific margin requirements and tax implications.

| Day Trading Classification | Definition |

|---|---|

| Pattern Day Trader | Trader who executes four or more day trades within five business days and the number of day trades is more than six percent of the customer's total trades for that same five-day period. |

| Non-Pattern Day Trader | Trader who doesn't meet the criteria for a pattern day trader. They typically trade with a longer-term perspective and may hold positions overnight. |

Tax Forms and Reporting

Day traders must report their trading activities and related income on their tax returns. This involves filling out specific tax forms, such as Schedule D and Form 8949, to accurately report gains and losses from each trade. The complexity of these forms often requires the assistance of a tax professional.

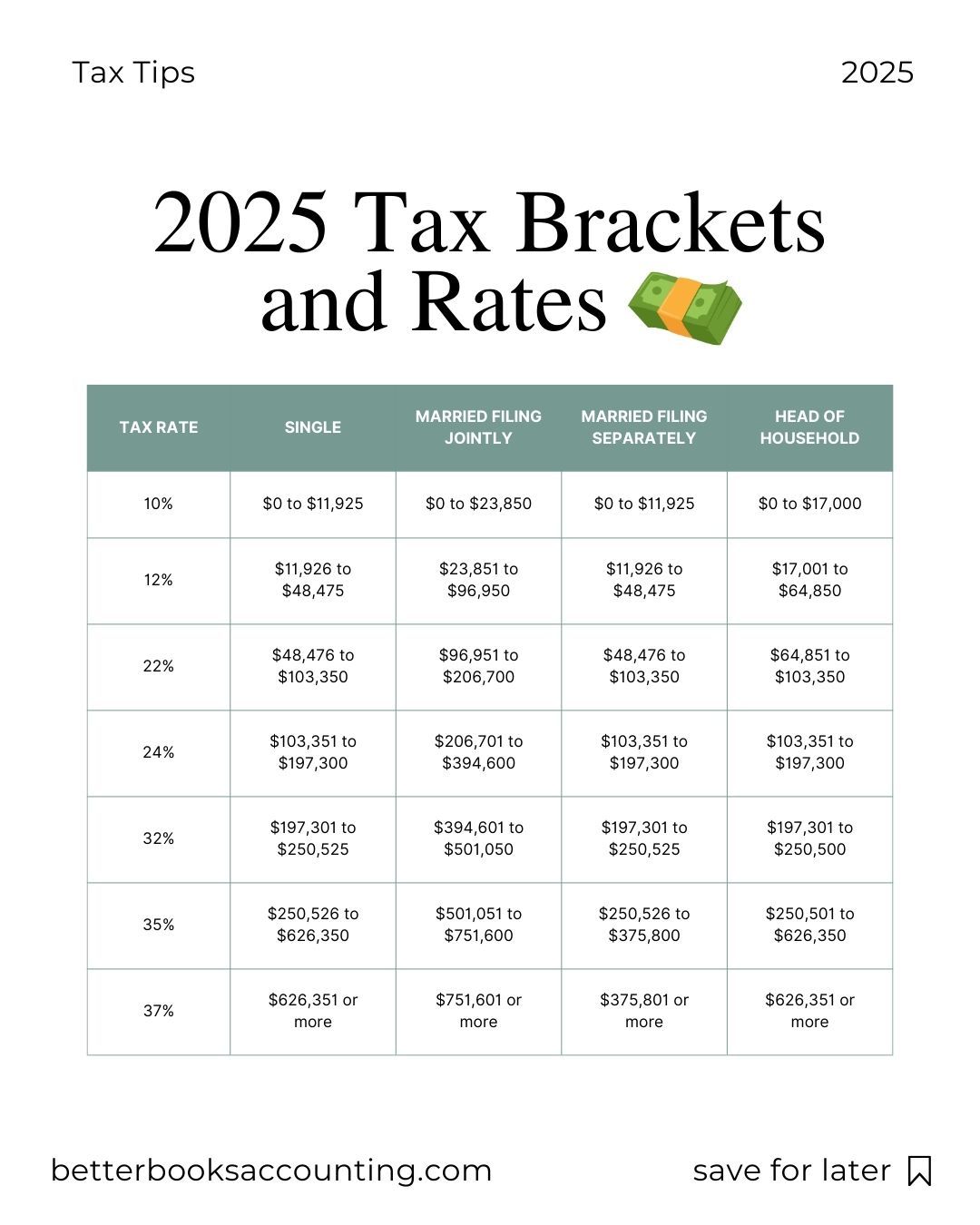

For example, traders must report short-term capital gains, which are taxed at ordinary income tax rates, and long-term capital gains, which are typically taxed at a lower rate. The distinction between these two types of gains can significantly impact a trader's tax liability.

Tax Strategies for Day Traders

Developing effective tax strategies is a key component of successful day trading. Traders can employ various techniques to optimize their tax positions and minimize their overall tax burden.

Tax Loss Harvesting

Tax loss harvesting is a strategy where traders sell securities at a loss to offset gains from other trades. This can be particularly beneficial for traders who have experienced significant losses in a particular year. By strategically selling losing positions, traders can reduce their taxable income and potentially lower their tax liability.

Tax-Efficient Brokerage Accounts

Choosing the right brokerage account can have tax advantages. Some brokerage firms offer tax-efficient accounts, such as Individual Retirement Accounts (IRAs) or Health Savings Accounts (HSAs), which can provide tax benefits on contributions and investment gains. Traders should consider the tax implications of their brokerage accounts when selecting a platform.

Capital Gains Tax Strategies

Capital gains taxes can significantly impact a day trader’s profits. Traders can employ strategies such as tax-loss carrying, where they can carry forward capital losses to offset future capital gains, or tax-loss selling, where they sell losing positions to reduce their tax liability in the current year. Understanding the rules and limitations of these strategies is essential for effective tax planning.

Utilizing Tax Software and Professionals

Given the complexity of day trading taxes, many traders turn to specialized tax software or engage the services of tax professionals. These tools and experts can help traders navigate the intricacies of tax reporting, ensure compliance, and identify potential tax savings opportunities.

The Impact of Trading Frequency on Taxes

The frequency of trades can significantly influence a day trader’s tax situation. Traders who execute a high volume of trades may face more complex tax reporting and potentially higher tax liabilities due to the increased likelihood of short-term capital gains.

Tracking and Reporting Trades

Day traders must meticulously track and record each trade, including the date, time, security, and price. This information is crucial for accurate tax reporting and can help traders identify potential tax advantages or disadvantages associated with specific trades.

For example, traders may want to consider the wash sale rule when planning their trades. If a trade results in a loss, traders must ensure they don't buy back the same security within 30 days, as this could limit their ability to claim the loss on their tax return.

Tax Consequences of Trading Volume

The volume of trades can affect a day trader’s tax obligations in several ways. High-volume traders may face increased scrutiny from tax authorities and may need to provide more detailed records to support their tax returns. Additionally, the frequency of trades can impact the calculation of capital gains taxes, potentially leading to higher tax liabilities.

| Trading Volume | Tax Implications |

|---|---|

| High-Volume Trading | Increased complexity in tax reporting, potential for higher tax liabilities due to short-term capital gains, and the need for detailed record-keeping. |

| Low-Volume Trading | Simplified tax reporting, potential for lower tax liabilities, and reduced need for extensive record-keeping. |

Day Trading and Tax Planning

Effective tax planning is a crucial aspect of day trading success. Traders should consider their tax strategies alongside their trading strategies to optimize their overall financial performance.

Long-Term vs. Short-Term Trading

The decision to engage in long-term or short-term trading can have significant tax implications. Short-term trades, held for a year or less, are subject to higher tax rates, while long-term trades, held for more than a year, benefit from potentially lower capital gains tax rates. Traders should carefully consider the tax advantages and disadvantages of each approach.

Tax-Efficient Trading Strategies

Traders can employ various strategies to make their trading more tax-efficient. This may include tax-loss harvesting, where they strategically sell losing positions, or tax-gain harvesting, where they sell profitable positions to realize gains and potentially reduce their tax liability. These strategies require careful planning and a deep understanding of tax rules.

Utilizing Tax-Advantaged Accounts

Day traders can take advantage of tax-advantaged accounts, such as IRAs or HSAs, to reduce their tax burden. Contributions to these accounts may be tax-deductible, and investment gains within the accounts may be tax-free or tax-deferred. Traders should explore these options to optimize their tax positions.

The Role of Brokers and Tax Reporting

Brokers play a crucial role in the tax landscape of day trading. They are responsible for providing traders with accurate tax documentation and ensuring compliance with tax regulations.

Brokers’ Tax Reporting Responsibilities

Brokers are required to provide traders with a Form 1099-B, which reports the proceeds from the sale of securities. This form is crucial for traders when filing their tax returns, as it provides the necessary information to calculate capital gains and losses.

Additionally, brokers must report any applicable fees, commissions, and other charges associated with the trades to ensure traders have a comprehensive view of their trading activities for tax purposes.

Choosing the Right Broker for Tax Reporting

Traders should carefully select a broker that meets their tax reporting needs. Some brokers offer more comprehensive tax reporting tools and resources, making it easier for traders to navigate the complex world of day trading taxes. Traders should consider the broker’s tax support services when making their selection.

Day Trading Taxes and International Traders

For international day traders, the tax landscape becomes even more complex. Traders must navigate the tax regulations of their home country and potentially those of the countries where their trades are executed.

Tax Treaties and International Trading

International traders should be aware of tax treaties between their home country and the countries where they trade. These treaties can impact the tax obligations and withholding taxes on their trades. Traders should consult with tax professionals to understand the specific implications of these treaties.

Withholding Taxes and International Trades

International trades may be subject to withholding taxes, which are taxes deducted at the source by the country where the trade is executed. Traders should be aware of these taxes and their potential impact on their overall tax liability. Proper planning and understanding of withholding tax rules are essential for international traders.

The Future of Day Trading Taxes

The world of day trading taxes is constantly evolving, and traders must stay abreast of changes in tax regulations and reporting requirements. The following are some potential future developments and their implications.

Regulatory Changes and Tax Compliance

Tax regulations can change over time, and day traders must be prepared to adapt to these changes. This may include new reporting requirements, altered tax rates, or shifts in the classification of day traders. Staying informed about these changes is crucial for maintaining tax compliance.

The Impact of Technology on Tax Reporting

Advancements in technology are likely to continue shaping the world of day trading taxes. Traders can expect more sophisticated tax software and tools to emerge, simplifying tax reporting and providing more accurate insights into their tax obligations. Staying updated with these technological advancements can benefit day traders in the long run.

The Role of Tax Professionals

As the world of day trading taxes becomes more complex, the role of tax professionals is likely to grow in importance. Traders may increasingly rely on tax advisors and accountants to navigate the intricate tax landscape, ensuring compliance and optimizing their tax positions. Engaging with tax professionals can provide traders with a competitive edge in this dynamic environment.

Conclusion

Day trading is an exhilarating journey, offering both rewards and challenges. Navigating the complex world of day trading taxes is a critical aspect of this journey. Traders must be well-informed, prepared, and proactive in their tax planning to ensure compliance and optimize their financial outcomes. By understanding the intricacies of day trading taxes and employing effective tax strategies, traders can thrive in this dynamic financial landscape.

How often should I report my day trading activities to the IRS?

+Day traders must report their trading activities annually on their tax returns. This typically involves filling out Schedule D and Form 8949, which detail gains and losses from each trade. Traders should consult with a tax professional to ensure they are meeting all reporting requirements.

Can I deduct trading expenses from my taxes as a day trader?

+Yes, day traders can deduct certain trading-related expenses from their taxes. These may include brokerage fees, software subscriptions, and other costs directly related to their trading activities. Traders should maintain records of these expenses and consult with a tax advisor to determine which expenses are deductible.

What is the difference between a day trader and a swing trader for tax purposes?

+For tax purposes, a day trader is classified as someone who executes a high volume of trades within a single trading day, often buying and selling securities quickly. In contrast, a swing trader typically holds positions for a few days or weeks, aiming to profit from short-term price movements. The tax implications and reporting requirements differ between these two trading styles.

How can I minimize my tax liability as a day trader?

+To minimize tax liability, day traders can employ various strategies such as tax-loss harvesting, utilizing tax-advantaged accounts, and strategically timing their trades. Additionally, consulting with a tax professional can help traders identify additional opportunities to optimize their tax positions and reduce their overall tax burden.