Nc Tax Refund Status

The North Carolina (NC) tax refund status is an important aspect of personal finance for many residents of the state. This article will provide an in-depth guide to understanding and tracking the status of your NC tax refund, offering valuable insights and tips to ensure a smooth and efficient process. From the initial filing to the final refund, we'll cover everything you need to know, including online tools, expected timelines, and what to do if there are delays or issues.

Understanding NC Tax Refunds

North Carolina offers tax refunds to residents who have overpaid their state taxes during the fiscal year. These refunds can provide a financial boost to individuals and families, especially during tax season. However, the process of claiming and receiving these refunds can sometimes be complex and time-consuming. Understanding the key aspects of NC tax refunds is crucial for a stress-free experience.

Eligibility and Calculation

To be eligible for an NC tax refund, individuals must have paid more in state taxes than they owe. This overpayment can occur due to various reasons, such as tax withholding on wages, estimated tax payments, or adjustments made during the tax filing process. The amount of the refund depends on the taxpayer's specific financial situation and the tax laws in effect during the relevant tax year.

North Carolina utilizes a progressive tax system, meaning that higher incomes are taxed at higher rates. The state has multiple tax brackets, and the refund amount is calculated based on the taxpayer's income, deductions, and credits. It's essential to understand these brackets and how they impact your refund to ensure accurate calculations.

Filing Options and Timelines

Taxpayers in North Carolina have the option to file their taxes either electronically or via paper forms. Electronic filing is generally faster and more efficient, with refunds often processed within a few weeks. Paper filings, on the other hand, may take significantly longer due to manual processing.

| Filing Method | Estimated Processing Time |

|---|---|

| Electronic Filing | 2-4 weeks |

| Paper Filing | 6-12 weeks |

It's important to note that these timelines are estimates and can vary based on factors such as the complexity of the tax return, errors or discrepancies in the filing, and the overall volume of tax returns being processed by the North Carolina Department of Revenue (NCDOR) during peak tax season.

Tracking Your NC Tax Refund Status

Knowing how to track the status of your NC tax refund is essential to staying informed and addressing any potential issues promptly. The NCDOR provides several tools and resources to help taxpayers monitor the progress of their refund.

Online Tools and Resources

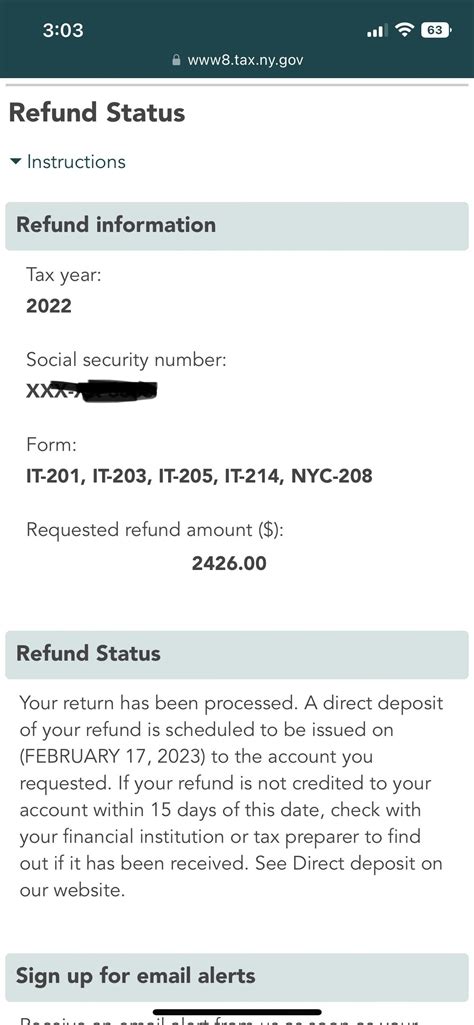

The NCDOR's website offers an online Where's My Refund tool, which allows taxpayers to check the status of their refund 24/7. This tool provides real-time updates on the progress of the refund and is a convenient way to stay informed without having to contact the NCDOR directly.

To use this tool, taxpayers will need to provide their Social Security Number, filing status (single, married filing jointly, etc.), and the exact amount of their refund. This information is crucial for security purposes and to ensure that only authorized individuals can access refund status information.

Additionally, the NCDOR provides a Taxpayer Assistance Center where taxpayers can find answers to frequently asked questions, access tax forms and publications, and seek help with various tax-related matters. This resource is particularly useful for taxpayers who prefer self-service options and want to resolve simple queries independently.

Refund Status Updates and Notifications

The NCDOR understands the importance of keeping taxpayers informed about the status of their refunds. As such, they provide regular updates through the Where's My Refund tool, which displays the current stage of the refund processing. These updates include messages such as "Return Received," "Refund Approved," and "Refund Sent," giving taxpayers a clear indication of where their refund is in the process.

Furthermore, the NCDOR may send email notifications or text alerts to taxpayers who have provided their contact information. These notifications serve as additional reminders and updates on the status of the refund, ensuring that taxpayers don't miss any important information.

Addressing Delays and Issues

Despite the best efforts of the NCDOR, tax refund processing can sometimes encounter delays or issues. Understanding the potential causes and knowing how to address them is crucial for a smooth refund experience.

Common Causes of Delays

There are several reasons why a tax refund might be delayed. Some common causes include errors or discrepancies in the tax return, missing or incomplete information, identity verification issues, or even technical glitches on the NCDOR's end.

For instance, if a taxpayer claims deductions or credits without providing the necessary documentation, the NCDOR may need to verify the information, which can lead to delays. Similarly, if there's a mismatch between the taxpayer's Social Security Number and the information on file with the IRS, this could trigger a review process, prolonging the refund timeline.

Steps to Take When Experiencing Delays

If your NC tax refund is taking longer than expected, there are a few steps you can take to investigate the issue and potentially expedite the process.

- Check the Where's My Refund Tool: Start by checking the Where's My Refund tool on the NCDOR's website. This tool provides the most up-to-date information on your refund status and can give you insights into potential delays. Look for specific messages that indicate the reason for the holdup, such as "Return Under Review" or "Additional Information Needed."

- Review Your Tax Return: If the tool indicates that your return is under review or that additional information is required, carefully review your tax return for any errors or omissions. Ensure that all information is accurate and complete, and consider providing any missing documentation as soon as possible.

- Contact the NCDOR: If you've reviewed your return and believe it to be accurate, or if you have questions about the status update provided by the tool, it's time to contact the NCDOR. They have a dedicated taxpayer assistance line where you can speak to a representative who can provide more detailed information about your refund and guide you through any necessary steps to resolve the issue.

- Keep Detailed Records: It's essential to keep detailed records of all communications with the NCDOR, including dates, times, and the names of any representatives you speak with. These records can be invaluable if you need to escalate the issue or seek further assistance.

Future Implications and Best Practices

Understanding the NC tax refund process and potential issues can help taxpayers plan and prepare for future tax seasons. By adopting best practices and staying informed, taxpayers can ensure a smoother and more efficient experience.

Planning for Future Tax Seasons

To ensure a stress-free tax season in the future, consider the following best practices:

- File Electronically: Electronic filing is generally faster and more efficient than paper filing. It reduces the chances of errors and allows the NCDOR to process your return more quickly.

- Accurate and Complete Information: Double-check your tax return for accuracy and completeness before filing. Ensure that all necessary forms and documentation are included to avoid delays due to missing information.

- Consider Early Filing: Filing your taxes early in the tax season can help reduce the chances of delays caused by high volumes of returns. It also allows you to receive your refund sooner, providing a timely financial boost.

- Keep Track of Deductions and Credits: Keep detailed records of all deductions and credits you claim on your tax return. This will help you prepare accurate returns in the future and provide documentation if your return is selected for review.

Staying Informed and Engaged

Staying informed about tax laws, changes, and updates is crucial for effective tax planning. The NCDOR provides various resources to help taxpayers stay up-to-date, including:

- Tax News and Updates: The NCDOR's website features a section dedicated to tax news and updates, where taxpayers can find information on recent changes to tax laws, important deadlines, and other relevant tax-related news.

- Taxpayer Assistance Center: As mentioned earlier, the Taxpayer Assistance Center is a valuable resource for taxpayers seeking self-service options. It provides access to tax forms, publications, and answers to frequently asked questions.

- Social Media and Email Updates: The NCDOR utilizes social media platforms and email subscriptions to provide taxpayers with timely updates and important reminders. Following their official social media accounts and subscribing to their email updates can ensure you stay informed.

Conclusion: Navigating the NC Tax Refund Journey

Understanding the NC tax refund process and having the tools to track its status are essential for a seamless experience. By staying informed, adopting best practices, and knowing how to address potential issues, taxpayers can navigate the tax refund journey with confidence. Remember, the NCDOR is committed to providing efficient and transparent tax services, and by leveraging the resources available, taxpayers can make the most of their refund experience.

Frequently Asked Questions

How long does it typically take to receive an NC tax refund?

+

The time it takes to receive an NC tax refund can vary. Electronic filings are generally processed within 2-4 weeks, while paper filings can take 6-12 weeks. However, these are estimates, and actual processing times may differ based on various factors.

What should I do if my NC tax refund is delayed?

+

If your NC tax refund is delayed, start by checking the Where’s My Refund tool on the NCDOR website. This tool provides real-time updates on your refund status. If your refund is taking longer than expected, review your tax return for errors or missing information. If necessary, contact the NCDOR for further assistance.

How can I track the status of my NC tax refund?

+

You can track the status of your NC tax refund using the Where’s My Refund tool on the NCDOR website. This tool requires your Social Security Number, filing status, and the exact amount of your refund. It provides real-time updates on the progress of your refund.

What are some common reasons for NC tax refund delays?

+

Common reasons for NC tax refund delays include errors or discrepancies in the tax return, missing or incomplete information, identity verification issues, and technical glitches on the NCDOR’s end. These issues can trigger additional reviews or verification processes, prolonging the refund timeline.

How can I plan for a smoother NC tax refund process in the future?

+

To plan for a smoother NC tax refund process in the future, consider filing electronically, ensuring accurate and complete information on your tax return, filing early in the tax season, and keeping detailed records of all deductions and credits claimed. Staying informed about tax laws and updates is also crucial.