Nj Inheritance Tax

Understanding New Jersey's inheritance tax is crucial for residents and those with connections to the state, as it can significantly impact the distribution of assets and estates. This article aims to provide a comprehensive guide to the intricacies of New Jersey's inheritance tax, covering everything from who is affected to how it is calculated and paid.

Navigating New Jersey's Inheritance Tax: A Comprehensive Guide

When it comes to estate planning and inheritance, New Jersey has its own set of rules and regulations, including an inheritance tax that is distinct from the federal estate tax. This tax is imposed on beneficiaries who receive assets from the estate of a deceased individual. While the tax may seem straightforward, there are various nuances and exemptions that can make it a complex topic to navigate. In this guide, we will delve into the specifics of New Jersey's inheritance tax, offering a clear understanding of its implications and providing practical advice for those affected.

Inheritance Tax vs. Estate Tax: What's the Difference?

Before we dive into the details of New Jersey's inheritance tax, it's essential to clarify the distinction between inheritance tax and estate tax. The federal government imposes an estate tax, which is levied on the entire value of an estate before it is distributed to beneficiaries. This tax is paid by the estate itself and is typically managed by the executor or personal representative. On the other hand, an inheritance tax is a state-level tax that is applied to the assets received by individual beneficiaries. Each state has its own set of rules and exemptions for inheritance tax, and New Jersey is one of the few states that still imposes this tax.

Who is Subject to New Jersey's Inheritance Tax?

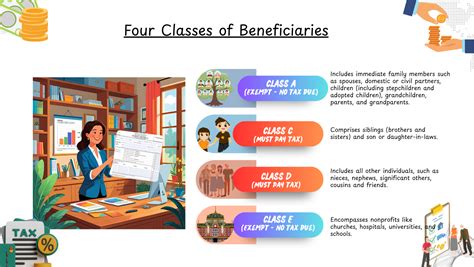

New Jersey's inheritance tax applies to beneficiaries who receive assets from the estate of a deceased resident of the state. It is important to note that the tax is based on the relationship between the beneficiary and the deceased individual, with different tax rates and exemptions depending on this relationship.

The following categories of beneficiaries are generally exempt from New Jersey's inheritance tax:

- Spouses: A surviving spouse is typically exempt from inheritance tax in New Jersey, regardless of the value of the assets received.

- Descendants: Direct descendants of the deceased, such as children, grandchildren, and great-grandchildren, are often exempt up to a certain threshold.

- Charitable Organizations: Gifts to qualified charitable organizations are usually exempt from inheritance tax.

However, for other beneficiaries, such as siblings, parents, nieces, nephews, and distant relatives, as well as friends and domestic partners, the inheritance tax may apply. The tax rates and exemptions vary based on the relationship and the value of the assets received.

Inheritance Tax Rates and Exemptions in New Jersey

New Jersey has a progressive inheritance tax system, which means the tax rate increases as the value of the assets received rises. The current tax rates for New Jersey's inheritance tax are as follows:

| Relationship to Deceased | Tax Rate |

|---|---|

| Spouse (not legally separated) | 0% |

| Children, grandchildren, and great-grandchildren | 0% up to $25,000; 11% above $25,000 |

| Parents, grandparents, siblings, nieces, nephews, and descendants of siblings | 11% up to $1,000; 15% above $1,000 |

| Unrelated beneficiaries | 16% on the entire amount |

It's worth noting that these rates are subject to change, so it's essential to refer to the most up-to-date tax information provided by the New Jersey Division of Taxation. Additionally, there may be certain exemptions and deductions available, such as the Family Exemption, which provides an additional exemption for certain family members.

Calculating and Paying New Jersey's Inheritance Tax

The calculation of New Jersey's inheritance tax involves determining the value of the assets received by each beneficiary and applying the appropriate tax rate based on their relationship to the deceased. It's crucial to accurately assess the value of the assets, including real estate, personal property, investments, and other financial assets.

Once the tax liability is calculated, it must be paid within eight months of the date of death. The payment can be made online through the New Jersey Division of Taxation website or by submitting a paper form along with a check or money order. Failure to pay the inheritance tax on time may result in penalties and interest charges.

Planning Strategies to Minimize New Jersey's Inheritance Tax

For those concerned about the impact of New Jersey's inheritance tax, there are several planning strategies that can help minimize the tax liability. These strategies may include:

- Gifting Assets: Transferring assets during the lifetime of the individual can reduce the value of the estate and potentially lower the inheritance tax burden.

- Utilizing Exemptions: Understanding and taking advantage of the available exemptions, such as the Family Exemption, can help reduce the taxable amount.

- Establishing Trusts: Certain types of trusts, such as bypass trusts or charitable remainder trusts, can be effective tools for reducing inheritance tax liability.

- Life Insurance: Life insurance proceeds are generally not subject to inheritance tax, so purchasing life insurance policies can provide a tax-efficient way to transfer assets to beneficiaries.

The Future of New Jersey's Inheritance Tax

The future of New Jersey's inheritance tax remains uncertain. While some states have abolished their inheritance tax, New Jersey has continued to maintain it, albeit with various amendments and exemptions over the years. The state's budget and political landscape can influence the future of this tax, so staying informed about any proposed changes is essential for effective estate planning.

Conclusion

Understanding New Jersey's inheritance tax is a crucial aspect of estate planning for residents and those with connections to the state. By being aware of the tax rates, exemptions, and planning strategies, individuals can navigate this complex tax landscape and ensure that their assets are distributed efficiently and in accordance with their wishes. Remember, seeking professional advice is always recommended to tailor your estate plan to your unique situation.

Frequently Asked Questions

Is there a threshold for inheritance tax in New Jersey?

+Yes, there is a threshold for inheritance tax in New Jersey. For direct descendants, such as children, grandchildren, and great-grandchildren, the first 25,000 is exempt from tax. For other beneficiaries, there is an exemption of 1,000.

What happens if I fail to pay the inheritance tax on time in New Jersey?

+Failure to pay the inheritance tax on time in New Jersey can result in penalties and interest charges. It is important to meet the deadline to avoid additional financial burdens.

Are there any ways to reduce inheritance tax liability in New Jersey?

+Yes, there are several strategies to reduce inheritance tax liability in New Jersey. These include gifting assets during one’s lifetime, utilizing available exemptions, establishing specific types of trusts, and considering life insurance policies.