Illinois Estate Tax Calculator

When it comes to estate planning, understanding the tax implications is crucial, especially for those with assets and property in Illinois. The Illinois Estate Tax Calculator is a valuable tool that helps individuals and families navigate the complex world of estate taxes in the state. This comprehensive guide aims to provide an in-depth analysis of the Illinois estate tax system, offering insights and practical tips for effective tax planning.

The Illinois Estate Tax: An Overview

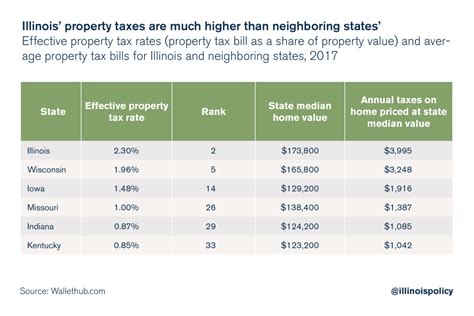

Illinois, like many other states, imposes an estate tax on the transfer of certain assets upon an individual’s death. This tax is separate from the federal estate tax and is levied on the state level. Understanding the intricacies of the Illinois estate tax is essential for residents and individuals with ties to the state who wish to minimize their tax liability and ensure a smooth transition of their assets.

The Illinois estate tax is a progressive tax, meaning the tax rate increases as the value of the estate grows. As of 2023, the tax rates range from 0.8% to 16%, with exemptions and deductions available to reduce the taxable estate value. The state's exemption amount is currently set at $4 million, which is significantly higher than the federal exemption of $12.4 million.

Key Features of the Illinois Estate Tax

- Illinois utilizes a uniform state tax rate for all estates, regardless of the county in which the decedent resided.

- The taxable estate includes assets such as real estate, personal property, business interests, and investments located within Illinois.

- Estate planning techniques, such as gifting, trusts, and life insurance, can be employed to minimize the taxable estate and reduce the tax burden.

- The Illinois Inheritance Tax is separate from the estate tax and applies to beneficiaries receiving assets from the estate. However, there are exemptions and reduced rates for certain beneficiaries, such as spouses and lineal descendants.

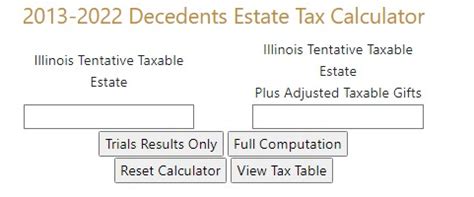

Illinois Estate Tax Calculator: A Comprehensive Tool

The Illinois Estate Tax Calculator is designed to assist individuals and professionals in estimating the potential estate tax liability for Illinois residents. This calculator takes into account various factors, including the value of the estate, exemptions, deductions, and applicable tax rates, to provide an accurate estimate of the tax due.

Key features of the calculator include:

- Estate Valuation: Users can input the estimated value of their assets, including real estate, personal property, and financial holdings.

- Exemptions and Deductions: The calculator automatically applies the current Illinois estate tax exemption and allows for additional deductions, such as charitable contributions and certain expenses.

- Progressive Tax Rates: The tool calculates the tax liability based on the progressive tax rate structure, ensuring an accurate representation of the tax owed.

- Tax Strategies: The calculator provides insights into potential tax-saving strategies, such as gifting or establishing trusts, to help users optimize their estate plan.

- Real-Time Updates: The Illinois Estate Tax Calculator is regularly updated to reflect any changes in tax laws and regulations, ensuring users have access to the most current information.

| Illinois Estate Tax Rates (2023) | Tax Rate |

|---|---|

| Taxable Estate Value up to $10,000 | 0.8% |

| $10,001 - $25,000 | 1% |

| $25,001 - $100,000 | 1.2% |

| $100,001 - $250,000 | 1.4% |

| $250,001 - $500,000 | 2% |

| $500,001 - $1,000,000 | 2.4% |

| $1,000,001 - $2,000,000 | 3.2% |

| $2,000,001 - $3,000,000 | 4% |

| $3,000,001 - $4,000,000 | 8% |

| Over $4,000,000 | 16% |

Strategies for Minimizing Estate Taxes

Estate planning is a dynamic process, and there are several strategies that can be employed to minimize the estate tax burden in Illinois. Here are some key approaches to consider:

Gifting

One effective strategy is to make gifts during one’s lifetime. Illinois, like the federal government, allows individuals to gift a certain amount annually without incurring gift taxes. By gifting assets to family members or charities, individuals can reduce the size of their taxable estate and potentially avoid higher tax brackets.

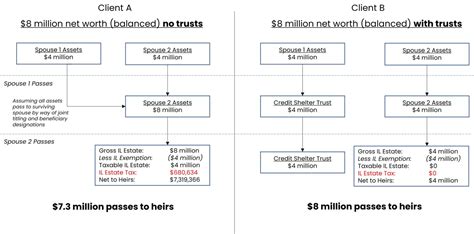

Establishing Trusts

Trusts are powerful estate planning tools that can help minimize taxes and provide asset protection. By establishing a trust, individuals can transfer assets to the trust, which can then be managed and distributed according to their wishes. Different types of trusts, such as revocable living trusts or irrevocable trusts, offer various benefits and tax advantages.

Life Insurance

Life insurance policies can be a valuable component of an estate plan. By purchasing a life insurance policy and naming the estate as the beneficiary, the death benefit can be used to pay estate taxes and other expenses. This strategy ensures that the assets in the estate are not depleted to cover tax liabilities.

Charitable Giving

Making charitable donations during one’s lifetime or through a will can provide tax benefits. Charitable gifts are typically exempt from estate taxes, and donors may also receive income tax deductions. This strategy not only reduces the taxable estate but also supports causes that are important to the individual.

The Importance of Professional Guidance

While the Illinois Estate Tax Calculator and the strategies outlined above provide a solid foundation for estate planning, it is crucial to seek professional advice tailored to individual circumstances. Estate planning is a complex process, and the tax laws and regulations can be intricate.

Engaging with a qualified estate planning attorney and a tax advisor can ensure that all aspects of estate planning are considered. These professionals can provide personalized guidance, taking into account factors such as family dynamics, business interests, and specific financial goals. They can also help navigate the legal and tax implications of different estate planning strategies, ensuring compliance with state and federal regulations.

Conclusion: Taking Control of Your Estate

Understanding and planning for the Illinois estate tax is a critical step in ensuring a smooth transition of your assets and minimizing tax liabilities. The Illinois Estate Tax Calculator offers a valuable tool to estimate tax obligations and explore potential tax-saving strategies. By employing a combination of gifting, trusts, life insurance, and charitable giving, individuals can effectively reduce their taxable estate and safeguard their legacy.

Remember, estate planning is an ongoing process, and regular reviews are essential to keep up with changing tax laws and personal circumstances. By taking a proactive approach and seeking professional guidance, individuals can navigate the complexities of estate taxes and create a comprehensive plan that aligns with their goals and values.

Frequently Asked Questions

What is the difference between the Illinois estate tax and the federal estate tax?

+

The Illinois estate tax and the federal estate tax are separate taxes with different exemptions and tax rates. The federal estate tax applies to estates with a value exceeding 12.4 million (as of 2023), while the Illinois estate tax has a lower exemption amount of 4 million. Additionally, the federal tax rates are generally higher than Illinois’ progressive tax rates.

Are there any exemptions or deductions available to reduce the Illinois estate tax liability?

+

Yes, Illinois offers an exemption amount of 4 million, which reduces the taxable estate value. Additionally, certain deductions are allowed, such as charitable contributions, mortgage debt, and certain expenses related to the administration of the estate. These deductions can further reduce the tax liability.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How often should I review and update my estate plan to ensure it aligns with changing tax laws and my personal circumstances?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>It is recommended to review your estate plan regularly, at least every 3-5 years. Major life events such as marriage, divorce, birth of a child, or significant changes in asset value should trigger a review. Additionally, changes in tax laws and regulations should be considered when updating your estate plan to ensure compliance and optimize tax strategies.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I avoid estate taxes altogether by gifting my assets during my lifetime?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Gifting assets during one's lifetime can effectively reduce the taxable estate and potentially avoid estate taxes. However, it's important to stay within the annual gift tax exclusion limits (16,000 as of 2023) to avoid gift taxes. Additionally, certain assets, such as real estate, may still be subject to estate taxes if not properly transferred.

What are the advantages of establishing a trust as part of my estate plan?

+

Establishing a trust offers several advantages, including asset protection, flexibility in distribution, and potential tax benefits. Trusts can be designed to minimize estate taxes, provide for specific needs of beneficiaries, and ensure privacy. There are various types of trusts, such as revocable living trusts or irrevocable trusts, each with its own benefits and considerations.