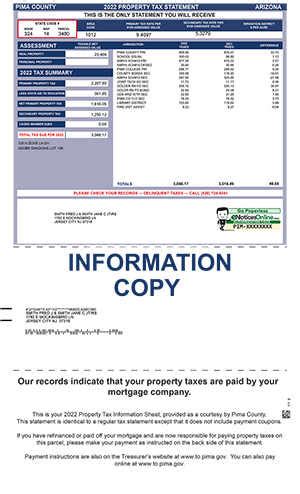

Pima County Tax Records

Welcome to this in-depth exploration of the Pima County Tax Records, a crucial aspect of property ownership and management in the vibrant region of Pima County, Arizona. This comprehensive guide aims to shed light on the intricacies of tax assessment, payment, and related processes, offering a detailed understanding of the system to both residents and investors alike.

Understanding Pima County Tax Records: A Comprehensive Guide

The world of property taxes can be complex, but breaking it down into manageable sections can provide a clear picture. This guide will navigate through the various aspects of Pima County Tax Records, offering a comprehensive understanding of the process.

The Basics: Property Assessment and Tax Rates

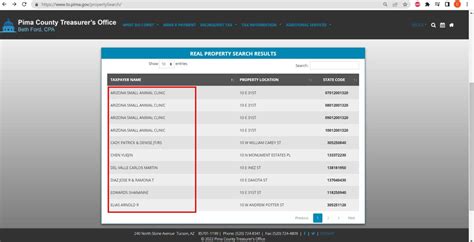

At the heart of the Pima County Tax Records system lies the process of property assessment. This critical step determines the taxable value of a property, which is the basis for calculating the taxes owed. The Pima County Assessor's Office is responsible for this evaluation, considering factors such as the property's size, location, and improvements.

Once the taxable value is determined, it is subjected to the tax rate, which is set by various government entities, including the state, county, and local municipalities. These rates can vary widely, impacting the final tax amount. For instance, in recent years, Pima County has seen a tax rate of approximately 1.25% of the property's full cash value, although this can fluctuate based on budgetary needs and other factors.

| Taxing Jurisdiction | Tax Rate (FY 2023) |

|---|---|

| Pima County | 0.8200% |

| City of Tucson | 0.2900% |

| Special Districts | Varies (e.g., 0.0250% for Flood Control District) |

It's important to note that these rates can change annually, so property owners should stay informed to understand their exact tax obligations.

Navigating the Tax Payment Process

Once the taxable value and tax rates are established, property owners in Pima County are responsible for timely tax payment. The Pima County Tax Collector plays a crucial role in this process, overseeing the collection of taxes and providing various payment options to accommodate different preferences and circumstances.

Pima County offers a variety of payment methods, ensuring convenience and accessibility for taxpayers. These include:

- Online Payments: A secure and convenient way to pay taxes using a credit or debit card. The Pima County Tax Collector's website provides a user-friendly platform for online transactions.

- In-Person Payments: Property owners can visit the Pima County Treasurer's Office to make payments in person. This option is ideal for those who prefer a more traditional approach or have specific inquiries that require face-to-face interaction.

- Mail-In Payments: For those who prefer to mail their payments, Pima County provides a secure address. This method is especially convenient for individuals who are out of town or prefer a more private transaction.

- Automated Payment Plans: To assist taxpayers with managing their tax obligations, Pima County offers automated payment plans. These plans allow for regular, automatic payments, ensuring that taxes are paid on time without the need for manual intervention.

It's crucial for property owners to be aware of the tax due dates to avoid late fees and penalties. Typically, taxes are due in two installments: the first by the end of September and the second by the end of January. However, these dates can vary, so it's advisable to check the official Pima County tax calendar for the most accurate information.

Exploring Tax Relief and Incentives

Pima County understands the financial commitments that come with property ownership, and as such, offers a range of tax relief programs and incentives to support its residents. These initiatives aim to ease the tax burden for eligible individuals and encourage specific activities or developments within the county.

One notable program is the Homeowner's Tax Relief Fund, which provides a credit to qualifying homeowners, helping to reduce their tax obligations. This fund is especially beneficial for senior citizens, the disabled, and those with limited incomes. To qualify, homeowners must meet certain criteria, such as having a primary residence in Pima County and meeting income thresholds.

Additionally, Pima County offers a Property Tax Exemption for Veterans, honoring the service and sacrifice of veterans by providing a tax exemption on their primary residences. This exemption can significantly reduce the tax burden for eligible veterans, making homeownership more affordable.

For those looking to develop or invest in Pima County, the county also provides tax incentives for economic development. These incentives, such as the Foreign Trade Zone designation, aim to attract businesses and promote economic growth. By offering tax breaks and other benefits, Pima County creates an environment conducive to business and investment, fostering a vibrant local economy.

The Future of Pima County Tax Records: Digital Transformation and Beyond

As technology continues to evolve, Pima County is embracing digital transformation to enhance its tax records system. The county is investing in innovative solutions to improve efficiency, accessibility, and transparency in tax management.

One key initiative is the development of a digital tax records platform, which aims to provide a centralized, user-friendly interface for taxpayers. This platform will enable property owners to access their tax records, view assessment details, and make payments online, all from the convenience of their homes or offices. It will also facilitate better communication between taxpayers and the county, allowing for quicker resolution of inquiries and issues.

Additionally, Pima County is exploring the use of blockchain technology to secure and streamline tax transactions. Blockchain's immutable ledger system can enhance transparency, reduce fraud, and improve the overall integrity of the tax records system. This technology could revolutionize how tax data is stored, shared, and verified, leading to a more efficient and secure process.

Looking ahead, Pima County's commitment to digital innovation and modernization will continue to shape the future of its tax records system. By leveraging technology, the county aims to create a more efficient, accessible, and transparent tax environment, benefiting both taxpayers and the local economy.

Frequently Asked Questions

What is the role of the Pima County Assessor's Office in tax records?

+The Pima County Assessor's Office is responsible for evaluating properties and determining their taxable value. This value is crucial as it forms the basis for calculating property taxes.

How often do tax rates change in Pima County?

+Tax rates can change annually, influenced by budgetary needs and other factors. Property owners should stay informed to understand their exact tax obligations for the current year.

Are there any tax relief programs available in Pima County?

+Yes, Pima County offers several tax relief programs, including the Homeowner's Tax Relief Fund and Property Tax Exemption for Veterans. These programs aim to reduce the tax burden for eligible individuals.

What are some of the tax incentives for economic development in Pima County?

+Pima County provides tax incentives such as the Foreign Trade Zone designation to attract businesses and promote economic growth. These incentives can significantly benefit investors and developers.

How is Pima County embracing digital transformation in its tax records system?

+Pima County is investing in a digital tax records platform and exploring blockchain technology to enhance efficiency, accessibility, and transparency in tax management.

The world of Pima County Tax Records is a fascinating blend of property assessment, tax rates, payment processes, and innovative initiatives. By understanding these intricacies, property owners and investors can navigate the system with confidence, ensuring they meet their tax obligations while taking advantage of available benefits and incentives.