Where To Find Agi On Tax Return

Navigating your tax return can be a complex task, especially when it comes to understanding and locating specific information. One such detail that often sparks curiosity is the Adjusted Gross Income (AGI). In this comprehensive guide, we will delve into the world of tax returns, exploring where you can find your AGI and why it holds significant importance. By the end of this article, you'll have a clear understanding of AGI's role and how to easily identify it on your tax documents.

Understanding Adjusted Gross Income (AGI)

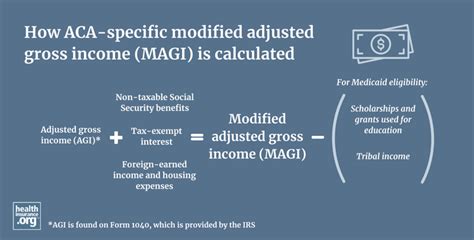

Adjusted Gross Income, or AGI, is a crucial metric in the realm of taxation. It represents your total income after certain deductions and adjustments have been applied. AGI serves as a starting point for calculating your taxable income and determining the appropriate tax rate applicable to your financial situation. In simpler terms, it provides a snapshot of your income adjusted for specific expenses, giving a more accurate picture of your financial standing.

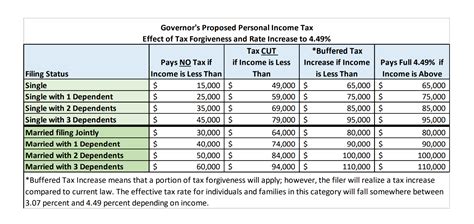

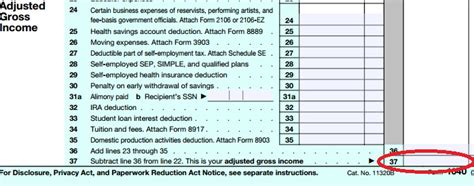

The calculation of AGI involves subtracting certain deductions from your gross income. These deductions can include items such as student loan interest, alimony payments, contributions to retirement accounts, and certain business expenses. By accounting for these adjustments, AGI provides a more nuanced view of your financial situation, taking into consideration various factors that impact your overall income.

AGI plays a pivotal role in the tax landscape as it is used to determine your eligibility for various tax credits, deductions, and benefits. It serves as a benchmark for assessing your financial standing and helps tax authorities and individuals alike make informed decisions regarding tax obligations and potential savings. Understanding AGI is essential for individuals seeking to optimize their tax strategies and ensure compliance with tax regulations.

Locating AGI on Your Tax Return

Finding your AGI on your tax return is a straightforward process, albeit one that may vary slightly depending on the tax form you’re using. Let’s explore the common places where you can locate your AGI, ensuring a smooth and efficient tax filing experience.

IRS Form 1040

If you’re using the standard IRS Form 1040, you’ll find your AGI conveniently displayed on the first page of the form. Look for the section titled “Tax and Credits” and within that, you’ll see a line specifically designated for “Adjusted Gross Income.” This line typically appears towards the top of the form, making it easily accessible and visible. Having your AGI readily available on the front page of the tax form simplifies the process of calculating your taxable income and facilitates a more streamlined tax filing experience.

Alternative Tax Forms

For those utilizing alternative tax forms, such as the 1040-NR (Non-Resident Alien) or 1040-SS (Self-Employment Tax), the location of AGI may differ slightly. In such cases, you’ll typically find your AGI on the final page of the respective tax form. While the placement may vary, the designation remains consistent, with a dedicated line clearly labeled as “Adjusted Gross Income.”

Electronic Tax Filing

In the digital age, many individuals opt for electronic tax filing through software or online platforms. When using these modern tax filing methods, your AGI is automatically calculated and displayed prominently within the software interface. This automated process ensures accuracy and convenience, allowing you to quickly locate and review your AGI without the need for manual calculations.

The Significance of AGI

AGI is more than just a numerical value on your tax return; it holds significant implications for your financial planning and tax strategy. Understanding the importance of AGI can empower you to make informed decisions and maximize your tax benefits.

Tax Credits and Deductions

AGI serves as a threshold for determining eligibility for various tax credits and deductions. For instance, certain tax credits, such as the Child Tax Credit or the Earned Income Tax Credit, have income limits tied to AGI. By knowing your AGI, you can assess your eligibility for these credits and potentially reduce your tax burden. Additionally, AGI is used to calculate itemized deductions, allowing you to claim expenses such as medical costs, charitable contributions, and state and local taxes, further optimizing your tax savings.

Phase-Out Limits

AGI also plays a role in phase-out limits, which are income thresholds beyond which certain tax benefits begin to decrease or phase out. For example, the Child Tax Credit has a phase-out limit based on AGI, meaning that as your AGI increases, the credit amount may decrease. Being aware of these phase-out limits allows you to strategize your financial planning and maximize the benefits you receive from various tax incentives.

Financial Aid and Eligibility

AGI extends its significance beyond tax calculations. It is often used as a key metric in determining financial aid eligibility for educational expenses. Many scholarship programs, grants, and student loan applications consider AGI as a primary factor in assessing an individual’s financial need. Understanding your AGI can help you navigate the financial aid process more effectively and access the support you may require for your educational pursuits.

AGI and Tax Planning Strategies

AGI provides a valuable insight into your financial position, allowing you to implement strategic tax planning measures. By analyzing your AGI, you can make informed decisions to optimize your tax liability and potentially reduce your tax burden.

Maximizing Deductions

One effective strategy is to maximize the deductions you claim on your tax return. AGI acts as a guide, helping you identify areas where deductions can be applied to lower your taxable income. For instance, if your AGI is on the higher end, considering contributions to retirement accounts or health savings accounts can provide significant tax benefits. By strategically planning your deductions, you can effectively reduce your AGI and, consequently, your taxable income.

Tax-Efficient Investment Strategies

AGI also influences your investment decisions and strategies. Certain investment vehicles, such as municipal bonds or tax-free investments, can provide tax advantages based on your AGI. By aligning your investment choices with your AGI, you can optimize your portfolio’s tax efficiency and potentially reduce the tax implications associated with your investments.

Tax-Efficient Retirement Planning

AGI plays a crucial role in retirement planning, especially when it comes to tax-efficient strategies. Understanding your AGI can help you determine the most advantageous retirement account contributions, such as traditional IRAs or Roth IRAs. By considering your AGI, you can optimize your retirement savings while minimizing the tax impact, ensuring a more prosperous financial future.

Future Implications and Considerations

As tax regulations and policies evolve, staying informed about AGI’s role becomes increasingly crucial. Here are some future implications and considerations to keep in mind when navigating your tax landscape.

Tax Reform and Policy Changes

Tax reforms and policy changes can impact the calculation and significance of AGI. It’s essential to stay updated on any legislative changes that may affect your tax obligations. By staying informed, you can adapt your tax planning strategies and ensure compliance with the latest tax regulations.

Long-Term Financial Planning

AGI serves as a foundational metric for long-term financial planning. By consistently tracking and analyzing your AGI over multiple tax years, you can identify trends and make informed decisions regarding your financial goals. This long-term perspective allows you to optimize your tax strategies, plan for retirement, and make strategic investments, ultimately enhancing your financial well-being.

Professional Guidance

While this guide provides a comprehensive understanding of AGI, seeking professional guidance from tax advisors or accountants can further enhance your tax planning efforts. Tax professionals can offer personalized advice based on your specific financial situation, ensuring that you maximize the benefits derived from your AGI and navigate the complex tax landscape with confidence.

How is AGI calculated on my tax return?

+AGI is calculated by subtracting specific deductions from your gross income. These deductions can include student loan interest, alimony payments, retirement account contributions, and certain business expenses. The resulting figure represents your AGI.

Why is AGI important for tax purposes?

+AGI is important as it determines your eligibility for various tax credits, deductions, and benefits. It serves as a benchmark for assessing your financial standing and helps in optimizing your tax strategy.

Can AGI be adjusted after filing my tax return?

+In certain circumstances, such as identifying errors or qualifying for additional deductions, you may be able to amend your tax return and adjust your AGI. However, it’s important to consult a tax professional to ensure compliance with tax regulations.