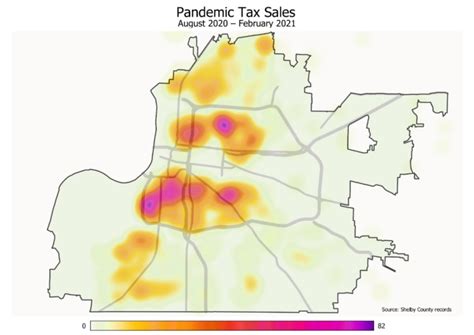

Shelby County Property Tax

Shelby County, Tennessee, is renowned for its vibrant urban landscapes, diverse communities, and thriving economic activities. Amidst this bustling setting, property taxes play a pivotal role in funding essential services and shaping the local economy. This comprehensive guide delves into the intricacies of Shelby County's property tax system, shedding light on its significance, the assessment process, payment methods, and the support systems in place to assist residents.

Understanding Shelby County's Property Tax Landscape

Property taxes are a fundamental source of revenue for local governments, including Shelby County. These taxes are integral to funding vital services such as education, emergency response, infrastructure development, and community programs. The Shelby County Assessor's Office oversees the assessment and collection of property taxes, ensuring a fair and equitable process.

The property tax rate in Shelby County is determined by a combination of factors, including the assessed value of the property, the tax rate set by the local government, and any applicable exemptions or credits. The assessed value is typically based on the property's market value, with adjustments made for factors like location, size, and condition.

For instance, consider a residential property located in downtown Memphis. The property's assessed value is determined by a comprehensive evaluation process, taking into account its proximity to cultural hubs, the availability of public transportation, and the overall real estate market trends in the area. This value then serves as the basis for calculating the property tax liability.

The Assessment Process: A Comprehensive Overview

The property assessment process in Shelby County is a meticulous undertaking, aimed at ensuring accuracy and fairness. The Shelby County Assessor's Office employs a team of highly trained professionals who conduct on-site visits and utilize advanced valuation methods to determine the fair market value of each property.

During the assessment, factors such as the property's physical characteristics, recent sales data, and local market conditions are taken into account. This process ensures that property owners are assessed fairly, based on the actual value of their holdings. For instance, a newly constructed home with modern amenities and energy-efficient features may be valued higher than an older property with similar square footage.

Property owners in Shelby County have the right to appeal their assessed values if they believe the assessment is inaccurate. The appeals process provides an opportunity for property owners to present evidence and arguments supporting their case. This ensures that the assessment process remains transparent and accountable.

Key Steps in the Assessment Process

- Data Collection: The assessor's office gathers comprehensive data on each property, including physical attributes, recent sales information, and other relevant factors.

- Market Analysis: Trained assessors analyze the local real estate market, considering trends, supply and demand, and other economic indicators.

- Valuation Methods: Various valuation techniques, such as the cost approach, sales comparison approach, and income approach, are employed to determine the property's fair market value.

- Notification: Property owners are notified of their assessed values, along with detailed information on how the assessment was determined.

- Appeal Process: Property owners have the right to appeal their assessments if they believe the value is incorrect. The appeals process is outlined by the Shelby County Assessor's Office, ensuring a fair and transparent review.

| Assessment Year | Total Assessed Value | Residential Properties | Commercial Properties |

|---|---|---|---|

| 2022 | $15.2 Billion | $12.1 Billion | $3.1 Billion |

| 2021 | $14.8 Billion | $11.5 Billion | $3.3 Billion |

| 2020 | $14.2 Billion | $11.0 Billion | $3.2 Billion |

Property Tax Payment: Options and Deadlines

Property tax payments in Shelby County are typically due twice a year, with payment deadlines falling on specific dates in the spring and fall. Property owners have several convenient payment options to choose from, including online payment portals, mail-in payments, and in-person payments at designated locations.

Payment Methods and Due Dates

- Online Payment: Property owners can make secure online payments through the Shelby County Trustee's Office website. This method offers the convenience of 24/7 access and provides a receipt for record-keeping.

- Mail-in Payment: Property owners can send their payments via mail to the Shelby County Trustee's Office. It's essential to include the correct property tax bill and ensure timely postage to avoid late fees.

- In-Person Payment: Property owners can visit the Shelby County Trustee's Office during business hours to make payments in person. This method allows for immediate confirmation and provides an opportunity to address any queries directly.

It's crucial for property owners to stay informed about their payment due dates to avoid late fees and potential penalties. The Shelby County Trustee's Office provides detailed information on payment deadlines and options on their official website.

Late Payment Penalties and Interest

Late payments of property taxes in Shelby County may incur penalties and interest charges. The specific penalties and interest rates are outlined by the Shelby County Trustee's Office and are subject to change. Property owners are advised to make timely payments to avoid these additional costs.

In cases where property owners face financial difficulties, the Shelby County Trustee's Office may offer payment plans or other assistance programs. It's advisable to reach out to the office for guidance and support in such situations.

Support and Resources for Property Owners

Shelby County recognizes the importance of supporting its property owners, especially during the tax assessment and payment processes. The Shelby County Assessor's Office and Trustee's Office provide a range of resources and services to assist residents.

Assessor's Office Support

The Shelby County Assessor's Office is committed to providing clear and concise information to property owners. They offer online resources, including assessment guides, frequently asked questions, and contact information for further assistance.

Property owners can reach out to the Assessor's Office with any queries or concerns regarding their property assessments. The office staff is trained to provide accurate and helpful information, ensuring that property owners understand the assessment process and their rights.

Trustee's Office Assistance

The Shelby County Trustee's Office plays a crucial role in property tax payments. They provide detailed information on payment deadlines, accepted payment methods, and any applicable discounts or exemptions. Their website serves as a comprehensive resource for property owners.

In addition to payment-related assistance, the Trustee's Office may offer support programs for eligible property owners. These programs can include payment plans, hardship exemptions, or other forms of financial relief. Property owners facing financial challenges are encouraged to contact the office for guidance.

Community Outreach and Education

Shelby County strives to educate its residents about property taxes and the assessment process. The Assessor's Office and Trustee's Office collaborate to organize community outreach events, workshops, and seminars. These initiatives aim to demystify the property tax system and empower residents with knowledge and understanding.

By participating in these educational programs, property owners can gain valuable insights into the assessment process, tax payment options, and available support services. This community engagement fosters a sense of transparency and trust between local government and residents.

Frequently Asked Questions (FAQ)

How often are property assessments conducted in Shelby County?

+Property assessments in Shelby County are conducted annually. The assessment process ensures that property values are accurately reflected and that tax liabilities are fair and equitable.

Can I appeal my property assessment if I believe it's inaccurate?

+Absolutely! Property owners have the right to appeal their assessments if they believe the value assigned to their property is incorrect. The Shelby County Assessor's Office provides a detailed appeals process, ensuring a fair and transparent review.

What happens if I miss the property tax payment deadline?

+Late payments of property taxes may result in penalties and interest charges. It's crucial to stay informed about payment deadlines to avoid these additional costs. The Shelby County Trustee's Office provides guidance on late payment procedures and potential options.

Are there any exemptions or discounts available for property taxes in Shelby County?

+Yes, Shelby County offers various exemptions and discounts to eligible property owners. These can include homestead exemptions, veteran's exemptions, and age-related discounts. It's advisable to consult the Shelby County Assessor's Office or Trustee's Office for detailed information on available benefits.

How can I stay informed about changes in property tax rates and assessments in Shelby County?

+The Shelby County Assessor's Office and Trustee's Office provide regular updates and notifications on their official websites. Property owners are encouraged to subscribe to their newsletters and follow their social media channels for the latest information on property tax-related matters.

Shelby County’s property tax system is designed to be fair, transparent, and supportive of its residents. By understanding the assessment process, payment options, and available resources, property owners can navigate the property tax landscape with confidence and contribute to the vibrant community of Shelby County.