Tax Break For Buying A House

In the pursuit of homeownership, one of the most significant financial considerations is the impact of taxes. The good news is that many countries and regions offer tax breaks to incentivize and support individuals in their journey to becoming homeowners. These incentives can significantly reduce the financial burden and make the dream of owning a home more achievable. This article will delve into the world of tax benefits associated with purchasing a house, exploring the various advantages and how they can benefit prospective homeowners.

Unveiling the Tax Advantages for Homebuyers

When it comes to buying a house, governments worldwide recognize the importance of encouraging homeownership. As a result, they often introduce tax policies that provide relief to those taking this significant step. These tax breaks can take several forms and offer substantial savings over the long term. Let’s explore some of the key tax advantages that homebuyers can leverage.

Mortgage Interest Deduction

One of the most prominent tax benefits for homeowners is the ability to deduct mortgage interest from their taxable income. This deduction applies to the interest paid on a primary residence’s mortgage loan. For instance, in the United States, homeowners can deduct the interest paid on a mortgage of up to 750,000</strong> for married couples filing jointly, and <strong>375,000 for single filers. This deduction can result in substantial tax savings, especially for individuals with higher-value homes and larger mortgage loans.

| Country | Mortgage Interest Deduction Limit |

|---|---|

| United States | $750,000 (married) / $375,000 (single) |

| Canada | Varies by province, up to $25,000 (Ontario) |

| United Kingdom | Not applicable; tax relief on mortgage interest for landlords |

💡 It's important to note that the mortgage interest deduction rules can vary greatly depending on the country and even the region within a country. For example, in Canada, the mortgage interest deduction limit can range from $10,000 to $25,000, depending on the province.

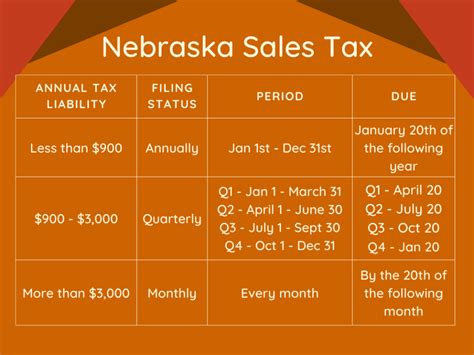

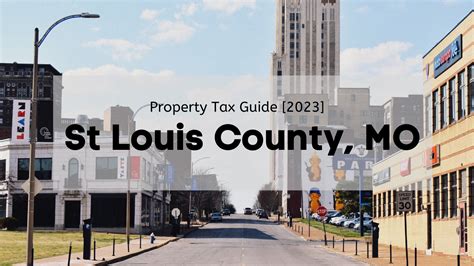

Property Tax Deductions and Credits

Property taxes are an ongoing expense for homeowners, but many countries offer deductions or credits to ease this burden. In the United States, for example, homeowners can deduct their property taxes from their federal income tax. Additionally, some states and local governments offer property tax credits or rebates to eligible homeowners.

First-Time Homebuyer Credits and Grants

Many governments understand the financial challenges first-time homebuyers face and offer incentives to make homeownership more accessible. These incentives can come in the form of tax credits, grants, or even forgivable loans. For instance, in Canada, the First-Time Home Buyer Incentive (FTHBI) program provides a shared equity mortgage of up to 10% of the purchase price, reducing the required down payment. This program aims to help buyers enter the housing market without incurring additional interest costs.

Energy-Efficient Home Improvements

Some governments promote energy efficiency and sustainability by offering tax credits for homeowners who make eco-friendly upgrades to their properties. These credits can apply to various improvements, such as installing solar panels, energy-efficient windows, or insulation. In the United States, the Nonbusiness Energy Property Tax Credits allow homeowners to claim a credit of up to $500 for certain energy-efficient upgrades.

Home Office Deductions

For homeowners who work from home, the ability to deduct expenses related to their home office can provide significant tax savings. This deduction applies to a portion of expenses like rent, utilities, and maintenance, based on the percentage of the home used for business purposes. However, it’s important to note that the rules for claiming a home office deduction can be complex and vary by country.

Maximizing Tax Benefits: A Strategic Approach

To make the most of the available tax breaks, homebuyers should adopt a strategic approach. This involves careful planning, understanding the specific tax laws in their region, and seeking professional advice when needed. Here are some key strategies to consider:

- Consult a Tax Professional: Navigating the complex world of tax laws can be challenging. Engaging the services of a qualified tax advisor can ensure that you take advantage of all eligible tax breaks and deductions.

- Understand Eligibility Criteria: Tax incentives often come with specific eligibility requirements. Ensure you meet these criteria to qualify for the benefits.

- Keep Detailed Records: Proper record-keeping is essential for claiming tax deductions. Save all relevant documents, including mortgage statements, property tax receipts, and records of home improvement expenses.

- Consider Long-Term Strategies: Some tax benefits, like the mortgage interest deduction, provide more significant savings over time. When planning your home purchase, consider the long-term financial implications and how these deductions can impact your overall tax liability.

Case Study: The Impact of Tax Breaks on Homeownership

Let’s consider a hypothetical case study to illustrate the potential impact of tax breaks on a homeowner’s financial situation. Meet Sarah, a first-time homebuyer in the United States.

Sarah purchases a home with a mortgage of $300,000 and an interest rate of 4%. She pays $1,200 in property taxes annually. By taking advantage of the mortgage interest deduction and property tax deduction, Sarah can reduce her taxable income by $10,800 in the first year. This results in a substantial tax savings of $2,700, assuming a 25% tax bracket.

Additionally, Sarah is eligible for a first-time homebuyer tax credit of $2,000. Over the course of five years, these tax benefits amount to a cumulative savings of $17,500. This significant financial relief can make a substantial difference in Sarah's journey to homeownership, helping her build equity and financial stability.

The Future of Tax Breaks for Homebuyers

As governments continue to recognize the importance of homeownership, tax incentives for homebuyers are likely to evolve and adapt. While some policies may change or be phased out, the overall trend suggests a continued focus on supporting individuals in their pursuit of owning a home. Stay informed about the latest tax laws and regulations to ensure you maximize the benefits available to you.

Conclusion

Tax breaks for buying a house are a powerful tool for individuals looking to achieve the dream of homeownership. By understanding and leveraging these incentives, homebuyers can reduce their financial burden and make their homes more affordable. With careful planning and a strategic approach, the tax advantages can significantly impact a homeowner’s financial journey.

Can I deduct the full amount of my mortgage interest from my taxes?

+

The deductibility of mortgage interest varies by country and often has limits. For instance, in the United States, the deduction is limited to interest paid on $750,000 of mortgage debt for married couples filing jointly.

Are there any tax benefits for homeowners who rent out a portion of their property?

+

Yes, homeowners who rent out a portion of their property may be eligible for tax deductions related to rental income and expenses. However, the rules can be complex, and it’s advisable to consult a tax professional.

Can I claim a tax deduction for the cost of my homeowner’s insurance?

+

In most cases, homeowner’s insurance premiums are not deductible for tax purposes. However, the cost of certain types of insurance, such as flood insurance, may be eligible for tax deductions under specific circumstances.