Change Name On Federal Tax Id

In the world of business and finance, one crucial aspect that entrepreneurs and business owners must navigate is the process of changing their name on a federal tax ID. A federal tax ID, also known as an Employer Identification Number (EIN), is a unique number assigned by the Internal Revenue Service (IRS) to businesses for tax purposes. It is essential to understand the procedures and implications of modifying this critical identifier to ensure smooth tax operations and compliance.

An EIN is required for various reasons, such as opening a business bank account, hiring employees, and filing tax returns. When a business owner decides to change their name, whether due to personal reasons, a merger, or a rebranding strategy, it is imperative to update the associated federal tax ID to reflect the new identity accurately.

Understanding the Process of Changing a Name on a Federal Tax ID

Changing the name on a federal tax ID involves a series of steps that require careful attention to detail and compliance with IRS regulations. Here’s a comprehensive guide to help business owners navigate this process effectively:

Step 1: Determine the Need for a Name Change

Before initiating the name change process, it is crucial to assess whether a name change on the federal tax ID is necessary. The IRS provides guidelines on when a name change is required. Typically, a name change is necessary when there is a significant alteration to the business’s legal name, ownership structure, or operation type. For instance, if a sole proprietorship transitions into a partnership or corporation, a name change is warranted.

Step 2: Gather Necessary Documentation

To initiate the name change process, business owners must gather specific documentation. This may include legal documents, such as a certificate of incorporation or articles of amendment, reflecting the new business name. Additionally, the IRS may require proof of identity and authorization, such as a driver’s license or passport, to verify the individual’s authority to make the change.

Step 3: Complete the EIN Name Change Form

The IRS provides a dedicated form for businesses to request a name change on their federal tax ID. The form typically requires information about the current and new business names, the reason for the change, and details about the business’s structure and ownership. It is essential to complete the form accurately and provide all the required information to avoid delays in processing.

| Form Name | Description |

|---|---|

| IRS Form 8822-B | Change of Address or Responsible Party - Business |

| IRS Form 8821 | Tax Information Authorization |

| IRS Form SS-4 | Application for Employer Identification Number (EIN) |

Step 4: Submit the Name Change Request

Once the necessary documentation and forms are completed, business owners must submit the name change request to the IRS. The IRS provides multiple submission methods, including online submission, fax, or mail. Each method has specific requirements and processing times, so it is crucial to choose the most suitable option based on the business’s preferences and urgency.

Step 5: Wait for IRS Processing and Confirmation

After submitting the name change request, business owners must patiently await the IRS’s processing and confirmation. The IRS typically takes several weeks to process name change requests, and the timeline may vary depending on the submission method and the volume of applications. During this period, it is essential to keep track of the status of the request and address any potential issues promptly.

Step 6: Update Business Records and Notify Stakeholders

Once the IRS approves the name change, business owners must update their business records to reflect the new federal tax ID and name. This includes updating bank accounts, tax forms, contracts, and any other documents or systems that utilize the EIN. Additionally, it is crucial to notify stakeholders, such as employees, vendors, and clients, about the name change to ensure seamless operations and maintain trust and transparency.

Common Scenarios and Considerations

When changing a name on a federal tax ID, several scenarios and considerations may arise. Here are some common situations and insights to help business owners navigate the process effectively:

Scenario 1: Mergers and Acquisitions

In the event of a merger or acquisition, the new business entity may need to adopt a different name and structure. In such cases, the acquiring company or the newly formed entity must initiate the name change process for the federal tax ID. It is crucial to involve legal and tax professionals to ensure a smooth transition and compliance with relevant regulations.

Scenario 2: Rebranding Strategies

Businesses may undergo rebranding initiatives to align with their evolving identity or target audience. When a rebranding strategy involves a significant name change, it is essential to update the federal tax ID accordingly. This ensures consistency in tax operations and prevents potential confusion or compliance issues.

Scenario 3: Legal Name Changes

Business owners may decide to change their legal name for personal reasons. In such cases, the federal tax ID must be updated to reflect the new legal name. It is essential to provide the IRS with the necessary documentation, such as a court order or legal name change certificate, to support the name change request.

Consideration: Impact on Tax Returns

Changing the name on a federal tax ID may have implications for tax returns. It is crucial to ensure that tax returns filed under the old name are complete and accurate. Additionally, business owners must be aware of the potential need to amend tax returns or adjust accounting practices to reflect the new name and EIN.

Future Implications and Best Practices

Changing a name on a federal tax ID is a significant administrative task that requires careful planning and execution. Here are some future implications and best practices to consider:

Future Implications

- Consistent use of the new federal tax ID and name in all business operations to maintain compliance and avoid potential penalties.

- Regularly updating business records and systems to reflect the name change, ensuring seamless operations and minimizing disruptions.

- Notifying tax authorities and stakeholders about the name change to maintain transparency and avoid any adverse tax consequences.

Best Practices

- Planning and initiating the name change process well in advance to allow sufficient time for IRS processing and implementation.

- Maintaining open communication with tax professionals and legal advisors to address any legal or tax-related concerns during the name change process.

- Implementing robust record-keeping practices to ensure easy access to documentation and forms required for the name change request.

- Conducting a comprehensive review of all business records and systems to identify and update references to the old federal tax ID and name.

Conclusion

Changing a name on a federal tax ID is a critical process that requires careful attention to detail and compliance with IRS regulations. By understanding the steps involved, gathering necessary documentation, and seeking professional guidance when needed, business owners can navigate this process effectively. A well-executed name change ensures seamless tax operations, maintains compliance, and allows businesses to continue thriving under their new identity.

Can I change my federal tax ID name online?

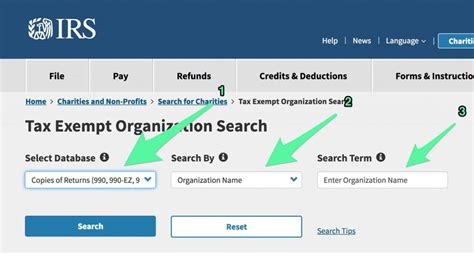

+Yes, the IRS provides an online platform for businesses to request a name change on their federal tax ID. This option offers convenience and a faster processing time compared to traditional mail or fax submissions.

How long does it take to process a federal tax ID name change request?

+The processing time for a federal tax ID name change request varies depending on the submission method and the IRS’s workload. Typically, it takes several weeks to process the request, but it can take longer during peak periods or if there are any issues with the application.

Do I need to notify the IRS if I change my business address along with the name change?

+Yes, if you change your business address along with the name change, you must notify the IRS. The IRS requires businesses to keep their address information up-to-date to ensure accurate communication and compliance. You can use the IRS Form 8822-B to update both the name and address information.