Utah State Income Tax

Utah's state income tax system is an integral part of its fiscal framework, contributing to the state's economic landscape and influencing the financial decisions of its residents and businesses. With a unique approach to taxation, Utah offers a tax structure that sets it apart from many other states in the U.S.

In this comprehensive guide, we will delve into the intricacies of Utah's state income tax, exploring its rates, deductions, and the overall impact it has on the state's economy and its citizens. By understanding the nuances of Utah's tax system, we can gain valuable insights into its effectiveness and the opportunities it presents.

Understanding Utah’s Income Tax Structure

Utah’s state income tax operates on a progressive rate structure, meaning that higher incomes are taxed at a higher rate. This approach aims to ensure that the tax burden is distributed fairly across different income levels.

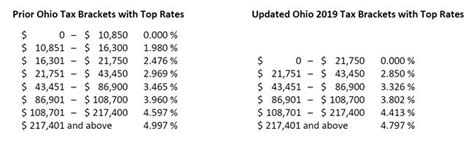

The tax rates in Utah are divided into five brackets, each with its own tax rate. These brackets are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| First $4,575 | 4.70% |

| $4,576 - $8,025 | 4.95% |

| $8,026 - $16,275 | 5.10% |

| $16,276 - $21,600 | 5.25% |

| Over $21,600 | 5.30% |

It's important to note that these tax rates are applicable to both individuals and married couples filing jointly. The rates are adjusted annually to account for inflation and cost-of-living changes.

One notable aspect of Utah's income tax is its single sales factor apportionment formula for businesses. This formula simplifies the process of calculating tax liabilities for businesses with operations in multiple states, making it a favorable environment for businesses to operate in Utah.

Deductions and Credits

Utah offers various deductions and credits to its residents, which can significantly reduce their overall tax liability. Some of the key deductions and credits include:

- Personal Exemption: Residents can claim a personal exemption, which reduces their taxable income. The exemption amount is adjusted annually and is currently set at $3,300.

- Standard Deduction: Utah provides a standard deduction for individuals and couples. The amount varies based on filing status, with single individuals receiving a higher deduction than married couples.

- Itemized Deductions: Residents have the option to itemize deductions, allowing them to reduce their taxable income by claiming expenses such as mortgage interest, state and local taxes, charitable contributions, and medical expenses.

- Tax Credits: Utah offers several tax credits, including the Working Family Tax Credit, the Child and Dependent Care Tax Credit, and the Low-Income Housing Tax Credit. These credits provide financial relief to eligible residents, helping to offset their tax liability.

Impact on Utah’s Economy

Utah’s state income tax plays a crucial role in shaping the state’s economy. By generating revenue through income taxes, the state is able to fund essential services and infrastructure projects that contribute to economic growth and development.

The progressive nature of Utah's income tax ensures that those with higher incomes contribute a larger share of their income to the state's revenue, promoting economic equality and providing support for social services and public programs.

Economic Growth and Business Environment

Utah’s favorable tax climate, including its single sales factor apportionment formula, has attracted numerous businesses to the state. The simplicity of the tax system and the absence of complex multi-state tax calculations make it easier for businesses to operate and expand in Utah.

Additionally, Utah's competitive tax rates compared to other states have contributed to its reputation as a business-friendly environment. This has led to increased job opportunities, investment, and economic growth, further enhancing the state's overall economic performance.

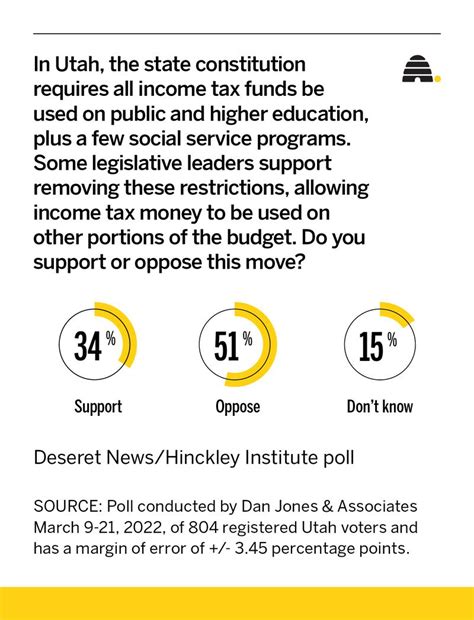

Social Programs and Infrastructure

The revenue generated from state income taxes is vital for funding various social programs and public services. Utah’s tax system ensures that resources are allocated to support education, healthcare, transportation, and other essential services that benefit its residents.

By investing in these areas, Utah is able to create a robust infrastructure and a high quality of life for its citizens, attracting new residents and businesses to the state.

Future Outlook and Considerations

As Utah continues to grow and evolve, its state income tax system will play a pivotal role in shaping its economic future. Several factors and considerations will influence the effectiveness and sustainability of the tax system in the coming years.

Economic Trends and Population Growth

Utah’s population is projected to continue growing at a rapid pace, which will have a direct impact on the state’s tax base. As the population expands, the demand for public services and infrastructure will increase, requiring a careful balance between revenue generation and spending.

Monitoring economic trends and ensuring that the tax system remains competitive and attractive to businesses will be crucial in sustaining Utah's economic growth and maintaining its position as a desirable place to live and work.

Tax Policy Reforms and Modernization

To adapt to changing economic conditions and technological advancements, Utah may consider tax policy reforms to ensure its tax system remains efficient and effective. This could involve exploring new tax incentives, streamlining tax processes, and embracing digital technologies to enhance taxpayer experiences.

By modernizing its tax system, Utah can attract innovative businesses, foster economic development, and maintain its competitive edge in the global marketplace.

Interplay with Federal Tax Policies

The state of Utah is closely intertwined with federal tax policies, and any changes at the federal level can have significant implications for the state’s tax system. Federal tax reforms, such as the Tax Cuts and Jobs Act of 2017, have already impacted state-level tax policies across the U.S.

Utah will need to carefully assess and adapt to any future federal tax reforms to ensure its tax system remains aligned with national trends and continues to serve the best interests of its residents and businesses.

International Tax Competition

In a globalized economy, Utah faces competition from other states and countries with different tax structures. To remain attractive and competitive, Utah must continuously evaluate its tax rates, deductions, and incentives to ensure it remains a desirable location for businesses and investors.

Staying abreast of international tax trends and benchmarking against other jurisdictions will be essential for Utah to maintain its position as a preferred destination for economic activity.

Frequently Asked Questions

What is the income tax rate for Utah residents?

+

Utah’s income tax rates are progressive and range from 4.70% to 5.30%, depending on the tax bracket an individual’s income falls into.

Are there any tax deductions available for Utah residents?

+

Yes, Utah offers various deductions, including a personal exemption, standard deductions, and the option to itemize deductions for expenses such as mortgage interest and charitable contributions.

How does Utah’s tax system benefit businesses?

+

Utah’s tax system is designed to be business-friendly, with a single sales factor apportionment formula that simplifies tax calculations for multi-state businesses. Its competitive tax rates and business incentives also make it an attractive location for companies.

What impact does state income tax have on Utah’s economy?

+

State income tax is a significant source of revenue for Utah, funding essential services, infrastructure projects, and social programs. It contributes to economic growth, job creation, and the overall prosperity of the state.

How does Utah’s tax system compare to other states?

+

Utah’s tax system is generally regarded as competitive and favorable for businesses and individuals. Its progressive income tax rates and business-friendly environment make it an attractive option compared to many other states.