Florida Sales Tax Payment

In the Sunshine State, Florida, sales tax is an essential component of the state's revenue system, impacting businesses and consumers alike. Understanding the intricacies of sales tax payment is crucial for businesses operating in Florida, as it not only ensures compliance with state regulations but also helps manage financial obligations effectively. This article aims to provide an in-depth analysis of Florida sales tax payment, covering everything from registration and collection to payment methods and potential penalties, ensuring businesses are well-equipped to navigate this critical aspect of their financial operations.

Navigating the Sales Tax Landscape in Florida

Florida, with its diverse economy and thriving tourism industry, relies significantly on sales tax as a revenue stream. The state’s sales tax structure is relatively straightforward, with a uniform 6% state sales tax rate applicable across most goods and services. However, it’s important to note that certain counties and municipalities may impose additional local option taxes, resulting in a combined sales tax rate that can vary by location.

For businesses, particularly those new to the state or expanding their operations, comprehending the sales tax landscape is essential. This includes understanding the registration process, tax collection methods, and the frequency of sales tax payments. Let's delve deeper into each of these aspects to provide a comprehensive guide for businesses operating in Florida.

The Registration Process: Your First Step in Sales Tax Compliance

All businesses in Florida that engage in taxable sales, rentals, or leases are required to register with the Florida Department of Revenue (DOR). This registration process is a critical step towards compliance and ensures that businesses are authorized to collect and remit sales tax to the state.

The registration process can be initiated online through the DOR's website, which offers a user-friendly platform for businesses to provide the necessary information. This typically includes details such as the business's legal name, address, taxpayer identification number, and the types of products or services being offered. The DOR provides clear guidelines and resources to assist businesses throughout this process, ensuring a smooth and efficient registration.

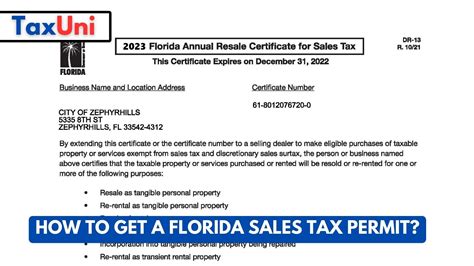

Upon successful registration, businesses are issued a unique identification number, often referred to as a tax registration number or sales tax permit. This number is crucial for identifying a business's sales tax obligations and should be prominently displayed at the point of sale to inform customers of the applicable tax rate.

It's worth noting that certain businesses, such as those primarily engaged in online sales or out-of-state retailers, may be subject to use tax obligations. Use tax is applicable when goods are purchased for use in Florida but are not subject to sales tax at the time of purchase. These businesses are also required to register with the DOR to ensure compliance with use tax regulations.

Collecting Sales Tax: Best Practices for Businesses

Once registered, businesses are responsible for collecting sales tax from customers at the point of sale. This process involves adding the applicable sales tax to the purchase price and ensuring accurate calculation and recording of tax amounts. Here are some best practices for businesses to ensure efficient and accurate sales tax collection:

- Point-of-Sale Systems: Invest in reliable point-of-sale (POS) systems that can automatically calculate sales tax based on the customer's location. These systems should be regularly updated to reflect any changes in tax rates or regulations.

- Training: Ensure that all staff members involved in sales transactions are trained on sales tax collection procedures. This includes understanding how to calculate sales tax, handle customer queries, and accurately record transactions.

- Regular Reviews: Conduct periodic reviews of sales tax calculations to ensure accuracy. This can be done by randomly selecting a sample of transactions and manually recalculating the tax amounts.

- Separate Accounts: Maintain separate accounts for sales tax collections to avoid commingling with other business funds. This ensures that the tax amount collected is readily available for remittance to the DOR.

- Clear Pricing: Display sales tax rates prominently on price tags, receipts, and online store platforms. This not only informs customers of the tax they are paying but also demonstrates transparency and compliance.

By implementing these practices, businesses can ensure that sales tax collection is accurate, efficient, and in line with Florida's regulations. This not only maintains compliance but also fosters trust and transparency with customers.

Payment Methods and Frequencies: Understanding Your Obligations

The frequency of sales tax payments in Florida depends on the volume of sales and the type of business. The DOR offers various payment methods and frequencies to accommodate different business needs. Here’s an overview of the payment methods and frequencies available:

- Electronic Payments: The DOR encourages electronic payments, which can be made through its secure online payment system. This method offers convenience, speed, and a paperless process. Electronic payments can be made using a credit card, debit card, or electronic check.

- Direct Debit: Businesses can set up direct debit arrangements with the DOR, allowing for automatic deductions from their bank accounts on the due date. This method ensures timely payments without the need for manual interventions.

- Mail-In Payments: For businesses preferring traditional methods, mail-in payments are an option. This involves sending a check or money order, along with the appropriate form, to the DOR's designated address. However, it's important to note that mail-in payments may take longer to process and may not be suitable for last-minute payments.

- Payment Frequency: The frequency of sales tax payments is determined by the business's sales volume. Generally, businesses with higher sales volumes are required to make more frequent payments. The DOR provides a sales and use tax schedule, which outlines the payment due dates based on the business's monthly or quarterly sales.

It's crucial for businesses to adhere to the payment schedule provided by the DOR to avoid late payment penalties and interest charges. Additionally, businesses should maintain accurate records of their sales tax payments, including payment dates, methods, and amounts, to facilitate future audits or reviews.

Potential Penalties and Interest: Understanding the Consequences

Non-compliance with sales tax regulations can result in penalties and interest charges, which can significantly impact a business’s financial health. It’s important for businesses to understand the potential consequences of non-compliance to ensure they take the necessary steps to avoid them.

Penalties for late payment or non-payment of sales tax can be substantial. The DOR may impose a penalty of up to 5% of the unpaid tax for each month the tax remains unpaid, with a maximum penalty of 25%. Additionally, the DOR may assess a negligence penalty of 5% of the tax due for failure to exercise ordinary care in the preparation of a tax return. In cases of willful neglect or fraud, the penalty can be as high as 100% of the tax due.

Interest charges are also applicable on unpaid sales tax. The DOR calculates interest based on the underpayment rate, which is determined by federal short-term interest rates. Interest accrues from the original due date of the tax until the date of payment.

To avoid penalties and interest, businesses should prioritize timely sales tax payments and ensure accurate record-keeping. In cases of temporary financial hardship, businesses can consider applying for a payment plan with the DOR. This allows businesses to pay their tax obligations in installments, provided they meet certain eligibility criteria and adhere to the agreed-upon payment schedule.

Expert Insights and Real-World Applications

Understanding the theoretical aspects of Florida sales tax payment is crucial, but real-world applications and expert insights can provide valuable context and practical guidance.

For instance, consider the case of a small business owner in Miami who expanded their operations to include online sales. This business owner, initially focused on local customers, may have overlooked the need to register for use tax. However, with the expansion of their online presence, they started selling goods to customers across the state, triggering use tax obligations. By staying informed and proactive, this business owner can ensure compliance and avoid potential penalties.

Another scenario involves a restaurant chain with multiple locations in Florida. Given the variability of sales tax rates across counties and municipalities, this chain must ensure that each location is accurately calculating and collecting the correct sales tax. By implementing centralized sales tax management systems and regular audits, they can maintain compliance and provide a consistent customer experience across all locations.

Conclusion: Empowering Businesses with Sales Tax Compliance

Florida’s sales tax regulations, while straightforward in structure, require careful attention and compliance to avoid penalties and interest charges. By understanding the registration process, adopting best practices for sales tax collection, and adhering to payment methods and frequencies, businesses can navigate the sales tax landscape with confidence.

As businesses operate and grow in Florida, staying informed about sales tax obligations is crucial. This includes staying updated with any changes in tax rates, regulations, or payment processes. By integrating sales tax compliance into their financial operations, businesses can contribute to the state's revenue system while maintaining a healthy financial standing.

Remember, compliance with sales tax regulations is not just a legal obligation but also a responsibility to the state and your customers. By understanding and embracing these obligations, businesses can thrive in Florida's dynamic economy while ensuring a fair and transparent tax system.

How often do I need to pay sales tax in Florida?

+The frequency of sales tax payments depends on your business’s sales volume. Generally, businesses with higher sales volumes are required to make more frequent payments. The DOR provides a sales and use tax schedule that outlines the payment due dates based on your monthly or quarterly sales.

What are the penalties for late payment of sales tax in Florida?

+Penalties for late payment or non-payment of sales tax can be substantial. The DOR may impose a penalty of up to 5% of the unpaid tax for each month the tax remains unpaid, with a maximum penalty of 25%. Additionally, negligence penalties and fraud penalties may apply, ranging from 5% to 100% of the tax due.

Can I set up a payment plan for my sales tax obligations in Florida?

+Yes, the DOR offers payment plans for businesses facing temporary financial hardship. These plans allow businesses to pay their tax obligations in installments. However, there are eligibility criteria, and businesses must adhere to the agreed-upon payment schedule to avoid penalties.

How can I stay updated with changes in Florida’s sales tax regulations and rates?

+It’s essential to stay informed about any changes in sales tax regulations and rates. The DOR provides resources and updates on its website. Additionally, engaging with tax professionals and subscribing to industry newsletters can ensure you receive timely updates and guidance on sales tax compliance.