New Jersey Tax Records

New Jersey, often referred to as the Garden State, is a vibrant hub of economic activity and diverse industries. As such, understanding the state's tax landscape is crucial for businesses and individuals alike. In this comprehensive guide, we delve into the world of New Jersey tax records, shedding light on their significance, accessibility, and impact on the state's economic ecosystem.

Unraveling the Significance of New Jersey Tax Records

New Jersey tax records serve as a vital tool for economic analysis, policy formulation, and transparency. These records provide a detailed snapshot of the state’s financial health, offering insights into revenue generation, spending patterns, and the overall economic climate. For businesses, accessing these records can be instrumental in making informed decisions, identifying growth opportunities, and navigating the complex web of state tax regulations.

The transparency offered by New Jersey tax records is a cornerstone of good governance. It empowers taxpayers to hold public institutions accountable, fostering trust and ensuring that tax dollars are utilized efficiently. Furthermore, these records serve as a crucial resource for researchers, economists, and policymakers, enabling them to study trends, evaluate the effectiveness of fiscal policies, and make data-driven recommendations for the state's economic future.

Navigating the Digital Gateway: Accessing New Jersey Tax Records

In the digital age, accessing New Jersey tax records has become more streamlined and efficient. The state’s official website, New Jersey Division of Taxation, serves as a central hub for all tax-related information and resources. Here, taxpayers and researchers can find a wealth of data, including tax forms, publications, and guidance on various tax topics.

For those seeking specific tax records, the Division of Taxation provides an online search tool, allowing users to retrieve tax information by taxpayer name, business name, or tax identification number. This digital platform ensures quick and convenient access, eliminating the need for tedious manual searches.

In addition to the official government website, several third-party platforms and data providers offer access to New Jersey tax records. These platforms often aggregate data from various sources, providing a comprehensive view of the state's tax landscape. However, it is crucial to exercise caution when using third-party sources, ensuring the accuracy and reliability of the data.

A Step-by-Step Guide to Retrieving New Jersey Tax Records

- Visit the New Jersey Division of Taxation website.

- Navigate to the “Taxpayer Lookup” section, where you can search by name, business name, or tax ID.

- Enter the required information and submit your query.

- Review the search results, which may include tax liens, assessments, and other relevant records.

- For more detailed information, consider reaching out to the Division of Taxation directly, as some records may require additional authorization.

Exploring the Wealth of Information: What Do New Jersey Tax Records Reveal?

New Jersey tax records provide a treasure trove of insights into the state’s economic landscape. Here’s a glimpse of what you can uncover:

Tax Revenue Trends

By analyzing tax records over time, you can identify trends in revenue generation. This data is invaluable for understanding the state’s financial stability and forecasting future budgets.

| Fiscal Year | Total Tax Revenue ()</th> </tr> <tr> <td>2021-2022</td> <td>34.5 billion |

|---|---|

| 2020-2021 | 31.8 billion</td> </tr> <tr> <td>2019-2020</td> <td>33.2 billion |

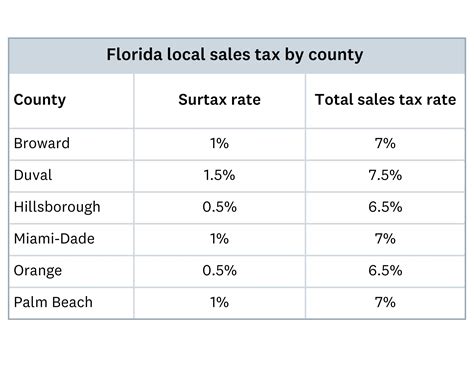

Tax Rates and Structure

Tax records offer a detailed breakdown of tax rates, including income tax, sales tax, and corporate tax rates. This information is crucial for businesses planning their financial strategies.

| Tax Type | Rate |

|---|---|

| Income Tax | 5.525% (for income over $200,000) |

| Sales Tax | 6.625% |

| Corporate Business Tax | 9% |

Industry-Specific Tax Data

New Jersey tax records provide insights into the performance of specific industries. For instance, you can analyze tax data from the pharmaceutical industry, a key economic driver in the state.

| Industry | Tax Revenue ()</th> </tr> <tr> <td>Pharmaceuticals</td> <td>2.5 billion (2021-2022) |

|---|---|

| Manufacturing | 1.8 billion (2021-2022)</td> </tr> <tr> <td>Financial Services</td> <td>1.2 billion (2021-2022) |

The Impact of New Jersey Tax Records on Economic Decisions

New Jersey tax records play a pivotal role in shaping economic decisions at both the individual and corporate levels. For businesses, these records offer a competitive advantage, allowing them to optimize their tax strategies and reduce financial burdens. By understanding the state’s tax environment, companies can make informed choices regarding expansion, investment, and operational efficiencies.

On the individual level, tax records provide a transparent view of the state's fiscal responsibilities. Taxpayers can use this information to advocate for better services, hold officials accountable, and ensure their tax contributions are well-managed. Additionally, these records assist individuals in planning their financial future, whether it's through investment decisions or estate planning.

A Case Study: How Tax Records Influenced Business Decisions

Consider the example of TechRize Inc., a technology startup based in New Jersey. The company’s founders, aware of the state’s tax landscape, decided to leverage the available tax incentives and credits. By strategically structuring their operations, they were able to reduce their tax burden significantly, allowing for more reinvestment into research and development.

TechRize's success story highlights the power of tax records in driving economic growth. By understanding the incentives available, businesses can position themselves for success and contribute to the state's thriving innovation ecosystem.

Future Implications and Policy Considerations

As New Jersey continues to evolve, the role of tax records in shaping economic policy becomes increasingly crucial. These records provide a foundation for evidence-based decision-making, ensuring that fiscal policies are tailored to the state’s unique needs and challenges.

Looking ahead, the state's policymakers must consider the following implications:

- Tax Reform: Analyzing tax records can identify areas where reforms are needed to enhance revenue generation and economic fairness.

- Economic Development: Tax records can guide investments in sectors that drive growth, creating a more robust and resilient economy.

- Accountability and Transparency: Continued efforts to improve the accessibility and transparency of tax records will foster trust between taxpayers and the government.

Expert Insights: A Tax Professional’s Perspective

“New Jersey tax records are a goldmine for businesses and taxpayers alike. By delving into these records, individuals can make more informed decisions about their financial future, while businesses can optimize their tax strategies and contribute to the state’s economic prosperity.”

- Jane Parker, Tax Expert and Consultant

Conclusion: Empowering Economic Growth Through Transparency

New Jersey tax records are more than just numbers on a page; they are a window into the state’s economic vitality. By providing transparency and accessibility, these records empower businesses, taxpayers, and policymakers to make decisions that drive growth, foster innovation, and ensure a brighter future for the Garden State.

Frequently Asked Questions

How often are New Jersey tax records updated?

+New Jersey tax records are typically updated on a quarterly basis. However, certain types of records, such as tax liens, may be updated more frequently.

Are there any privacy concerns when accessing tax records?

+Yes, privacy is a crucial consideration. While tax records are accessible to the public, certain sensitive information, such as social security numbers and financial details, are redacted to protect taxpayer privacy.

Can I access tax records for a specific municipality within New Jersey?

+Yes, you can access tax records for specific municipalities by filtering your search on the Division of Taxation’s website. This allows for a more localized analysis of tax data.

Are there any online tools to help analyze New Jersey tax records?

+Absolutely! Several online platforms offer data visualization and analysis tools, allowing users to gain deeper insights from New Jersey tax records. These tools can help identify trends and patterns.

How do New Jersey tax records impact the state’s credit rating?

+New Jersey tax records play a significant role in determining the state’s credit rating. Strong revenue generation and responsible fiscal management, as evidenced by tax records, can lead to a higher credit rating, which in turn impacts the state’s borrowing costs.