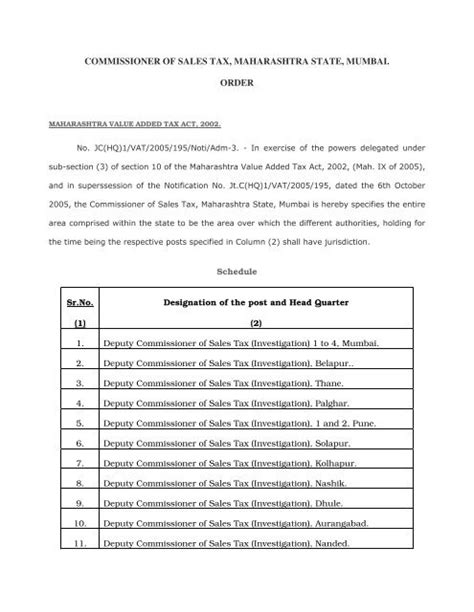

Commercial Tax Officer

The role of a Commercial Tax Officer is a crucial one in the field of taxation, serving as a vital link between businesses and government tax authorities. This position plays a pivotal role in ensuring that businesses comply with tax regulations, contributing significantly to the overall tax revenue collection process. In this article, we will delve into the responsibilities, qualifications, and the evolving nature of this profession, providing an in-depth analysis of the Commercial Tax Officer's role in modern tax systems.

The Scope of Responsibilities

A Commercial Tax Officer’s primary responsibility is to oversee the tax affairs of commercial entities, which can range from small businesses to large corporations. They are tasked with interpreting and applying tax laws, regulations, and policies accurately. This involves examining financial records, conducting audits, and assessing the tax liabilities of these businesses.

Furthermore, Commercial Tax Officers are responsible for educating businesses on their tax obligations and ensuring they understand the complex tax landscape. They provide guidance on tax planning, help identify tax incentives and credits, and assist in resolving tax-related disputes or issues.

In their day-to-day work, these officers might engage in field inspections, verify the accuracy of tax returns, and investigate potential tax evasion or fraud cases. They also collaborate with other government agencies and departments to ensure a coordinated approach to tax collection and compliance.

Qualifications and Skills Required

The role of a Commercial Tax Officer demands a unique skill set and specific qualifications. Firstly, a strong foundation in accounting and finance is essential, as officers need to understand financial statements, tax laws, and accounting principles.

Additionally, officers should possess excellent analytical skills to scrutinize financial data, identify patterns, and detect potential irregularities. Strong communication skills are vital for explaining complex tax concepts to businesses and resolving disputes amicably.

Given the technological advancements in tax systems, proficiency in using tax software and data analysis tools is becoming increasingly important. Commercial Tax Officers must stay updated with the latest tax laws and regulations, often requiring continuous professional development.

A bachelor's degree in accounting, finance, or a related field is typically a minimum requirement. However, many officers also pursue advanced certifications like the Chartered Tax Advisor (CTA) or Certified Public Accountant (CPA) to enhance their expertise and career prospects.

Evolution of the Profession

The profession of Commercial Tax Officer has evolved significantly over the years, adapting to the changing landscape of tax systems and technological advancements. With the digital transformation of tax administration, officers now have access to more sophisticated tools and data analytics platforms.

This evolution has led to more efficient tax collection processes, enhanced data-driven decision-making, and improved tax compliance. Officers can now identify potential tax issues or fraud more effectively, leveraging advanced data analytics and machine learning techniques.

Furthermore, the shift towards a more customer-centric approach in tax administration has also impacted the role. Commercial Tax Officers are now expected to provide more personalized services, offering tailored tax advice and support to businesses. This involves understanding the unique challenges and opportunities faced by different industries and businesses.

The increasing complexity of international tax regulations and cross-border transactions also presents new challenges for officers. They must stay abreast of global tax developments and ensure that businesses comply with international tax standards.

Impact and Future Outlook

The work of Commercial Tax Officers has a significant impact on the economy and society. By ensuring that businesses pay their fair share of taxes, they contribute to the funding of public services, infrastructure development, and social welfare programs.

Moreover, their efforts in educating businesses about tax compliance and incentives can stimulate economic growth and entrepreneurship. A well-informed business community can make more strategic financial decisions, leading to increased investment and job creation.

Looking ahead, the future of the Commercial Tax Officer profession is likely to be shaped by further technological advancements and changing tax landscapes. Officers will need to continue adapting to new digital tools and data analysis techniques.

Additionally, the rise of digital currencies and the gig economy presents new tax challenges that officers will need to address. They will play a crucial role in developing and implementing tax policies that keep pace with these evolving economic models.

In conclusion, the role of a Commercial Tax Officer is a dynamic and impactful profession, offering a unique opportunity to contribute to the efficient functioning of tax systems and the overall economy. As tax laws and technologies continue to evolve, the skills and expertise of Commercial Tax Officers will remain in high demand.

Frequently Asked Questions

What are the key responsibilities of a Commercial Tax Officer?

+Commercial Tax Officers are responsible for overseeing the tax affairs of businesses, interpreting tax laws, conducting audits, and ensuring tax compliance. They educate businesses on their tax obligations, offer tax planning advice, and assist in resolving tax disputes.

What qualifications are necessary to become a Commercial Tax Officer?

+A bachelor’s degree in accounting, finance, or a related field is often required. Advanced certifications like CTA or CPA are highly valued. Proficiency in tax software, data analytics, and strong communication skills are essential.

How has technology impacted the role of Commercial Tax Officers?

+Technology has transformed tax administration, offering more efficient processes and data-driven insights. Commercial Tax Officers now leverage advanced tools for tax collection, compliance, and fraud detection. They must stay updated with digital advancements.

What is the significance of Commercial Tax Officers in the economy?

+By ensuring tax compliance, Commercial Tax Officers contribute to the funding of public services and economic growth. They play a vital role in educating businesses about tax obligations and incentives, fostering a healthy business environment.

What are the future challenges for Commercial Tax Officers?

+The future holds challenges like adapting to digital currencies, the gig economy, and evolving tax landscapes. Commercial Tax Officers must stay ahead of these trends to provide effective tax guidance and ensure compliance.